Global Incident Detection Video Content Analytics Market

Market Size in USD Billion

CAGR :

%

USD

11.69 Billion

USD

50.62 Billion

2025

2033

USD

11.69 Billion

USD

50.62 Billion

2025

2033

| 2026 –2033 | |

| USD 11.69 Billion | |

| USD 50.62 Billion | |

|

|

|

|

Incident Detection Video Content Analytics Market Size

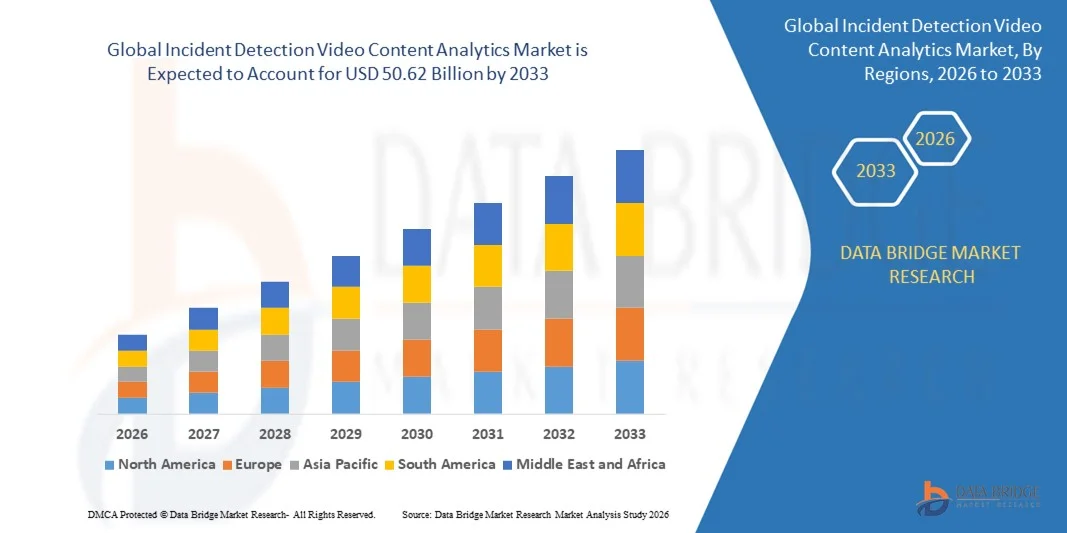

- The global incident detection video content analytics market size was valued at USD 11.69 billion in 2025 and is expected to reach USD 50.62 billion by 2033, at a CAGR of 20.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of AI-driven surveillance solutions, increasing demand for real-time threat detection, and the expansion of smart city projects worldwide

- Growing need for automated monitoring across transportation, commercial infrastructure, and public safety environments is further accelerating market adoption

Incident Detection Video Content Analytics Market Analysis

- The market is experiencing strong momentum due to increasing security threats and the demand for proactive incident response across highly monitored environments such as traffic systems, critical facilities, and retail spaces

- Continuous innovation in computer vision technologies and the integration of analytics with existing surveillance networks are strengthening operational efficiency and reducing reliance on manual monitoring

- North America dominated the incident detection video content analytics market with the largest revenue share in 2025, driven by widespread adoption of AI-powered surveillance systems and increasing investments in advanced security infrastructure across public and private sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global incident detection video content analytics market, driven by rising urbanization, growing infrastructure development, increasing awareness of security solutions, and government initiatives promoting digital surveillance and smart city projects

- The edge-based segment held the largest market share in 2025 owing to its ability to process video data locally, reduce latency, and enable real-time incident detection without relying heavily on centralized infrastructure. This approach enhances system responsiveness and reduces bandwidth costs, making it highly suitable for smart city and critical surveillance applications

Report Scope and Incident Detection Video Content Analytics Market Segmentation

|

Attributes |

Incident Detection Video Content Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Incident Detection Video Content Analytics Market Trends

Rise of AI-Driven Real-Time Incident Detection

- The rapid adoption of AI-powered surveillance analytics is reshaping the incident detection landscape by enabling real-time monitoring and automated threat identification. These systems allow immediate response to anomalies such as unauthorized access, traffic violations, or crowd disturbances, improving overall security efficiency across high-footfall environments. The ability to process large volumes of video data within seconds is pushing organizations to replace traditional monitoring with intelligent automation

- Demand for real-time analytics is rising in locations such as transportation hubs, commercial complexes, and public infrastructure where immediate situational awareness is essential. Increasing deployment of smart surveillance cameras with embedded analytics is reducing manual workload and improving operational accuracy. This shift is also enhancing incident visibility and supporting faster decision cycles for security teams

- The growing preference for intelligent video solutions is supported by advancements in deep learning models that enhance detection accuracy and reduce false alarms. Organizations benefit from improved incident verification and faster decision-making without relying heavily on human operators. Continuous AI training and algorithm optimization are further improving system reliability across diverse environments

- For instance, in 2023, several metropolitan traffic departments reported reduced response times after integrating AI-based video analytics for detecting road accidents and traffic rule violations. These systems enabled quicker dispatch and improved traffic flow management. The adoption resulted in fewer traffic bottlenecks and enhanced road safety measures across multiple cities

- While AI-driven video analytics expand real-time monitoring capabilities, success depends on continuous algorithm enhancement, seamless integration with existing systems, and user training to ensure optimal functionality. Proper system calibration and performance tuning are vital for maintaining accuracy. Organizations must also invest in employee readiness to maximize operational benefits

Incident Detection Video Content Analytics Market Dynamics

Driver

Increasing Need for Proactive Security and Automated Surveillance

- Rising security threats across public and private environments are driving organizations to adopt automated incident detection systems. These solutions facilitate early identification of suspicious activities such as intrusion, object abandonment, or aggressive behavior, helping prevent potential risks. The transition from reactive to proactive monitoring is becoming essential for modern security strategies

- The shift toward enhanced security compliance and the financial implications of undetected security breaches are compelling businesses to implement intelligent video analytics. Growing awareness about operational efficiency and safety is increasing the adoption of automated monitoring tools. Companies benefit from reduced human error and improved incident resolution timelines

- Government initiatives and institutional frameworks supporting smart city development and digital surveillance infrastructure are further strengthening market growth. Investments in AI-enabled monitoring systems are enabling authorities to improve emergency response and safety standards. Enhanced connectivity and sensor integration are also boosting system effectiveness

- For instance, in 2022, multiple city authorities across Europe introduced mandatory integration of intelligent analytics into public surveillance networks to enhance real-time monitoring and reduce manual intervention. These initiatives aimed to standardize security protocols across urban centers. The move accelerated adoption among transport, utilities, and municipal service providers

- While rising security demands are boosting adoption, the market requires ongoing innovation, robust system calibration, and effective user management practices to sustain long-term utilization. Stakeholders must prioritize system scalability and adaptability. Stronger governance and training frameworks are essential to ensure accuracy and reliability

Restraint/Challenge

High Deployment Cost and Limited Technical Expertise Across End-User Environments

- The high upfront cost of advanced video analytics platforms, such as AI servers, GPU-based processing units, and integrated VMS solutions, limits adoption among smaller enterprises. Budget constraints often restrict deployment to large organizations or government bodies with established surveillance infrastructure. This financial barrier slows the transition to intelligent monitoring in cost-sensitive markets

- Many end-users in developing regions lack the technical expertise required to install, manage, and optimize AI-driven video analytics systems. Challenges such as system configuration, algorithm training, and maintenance reduce operational efficiency and hinder widespread usage. Inadequate training resources and skills shortages also contribute to inconsistent system performance

- Market expansion is further limited by connectivity and storage constraints in remote or resource-limited areas. These regions often rely on basic surveillance solutions without advanced analytics capability, reducing detection accuracy and response effectiveness. Limited access to robust network infrastructure affects processing speed and data reliability

- For instance, in 2023, several security agencies in Southeast Asia highlighted that over 60% of small-scale establishments lacked access to high-performance video analytics tools due to cost and technical limitations. This gap forced many businesses to continue using manual monitoring practices. As a result, response times and incident reporting accuracy remained low

- While industry innovation continues to broaden capability, addressing affordability, infrastructure gaps, and workforce training remains essential to unlocking full market potential. Scalable and low-cost analytics solutions are required for wider penetration. Building local service ecosystems will also be critical for long-term adoption and operational sustainability

Incident Detection Video Content Analytics Market Scope

The market is segmented on the basis of type, component, deployment mode, and vertical.

- By Type

On the basis of type, the incident detection video content analytics market is segmented into edge-based and server-based solutions. The edge-based segment held the largest market share in 2025 owing to its ability to process video data locally, reduce latency, and enable real-time incident detection without relying heavily on centralized infrastructure. This approach enhances system responsiveness and reduces bandwidth costs, making it highly suitable for smart city and critical surveillance applications.

The server-based segment is expected to witness steady growth from 2026 to 2033, supported by the rising adoption of centralized analytics platforms. These systems allow large-scale video data consolidation and advanced analysis, making them ideal for organizations that require deep learning model training, high-capacity storage, and large operational surveillance networks.

- By Component

On the basis of component, the market is segmented into services and software. The software segment accounted for the largest revenue share in 2025 due to the increasing deployment of AI-powered analytics engines capable of detecting anomalies, classifying events, and generating actionable insights in real time. Continuous enhancements in algorithm accuracy and integration features further strengthen software adoption among end users.

The services segment is projected to grow significantly during 2026–2033, driven by rising demand for installation, maintenance, system integration, and training services. As organizations adopt more complex analytics solutions, the need for expert support and managed services is increasing to ensure system performance and reliability.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into on-premises and cloud. The on-premises segment led the market in 2025 as many enterprises and government agencies prioritize data security, regulatory compliance, and local control over surveillance infrastructure. On-premises systems are commonly deployed in high-security environments such as defense, critical infrastructure, and traffic management centers.

The cloud segment is expected to record the fastest growth from 2026 to 2033, fuelled by scalability, cost efficiency, and remote accessibility. Cloud-based analytics enable organizations to manage large video data volumes, deploy updates seamlessly, and integrate AI models without significant hardware investments.

- By Vertical

On the basis of vertical, the incident detection video content analytics market is segmented into banking, financial services and insurance (BFSI), city surveillance, critical infrastructure, education, hospitality and entertainment, manufacturing, defense and border security, retail, traffic management, transportation and logistics, and others. The city surveillance segment accounted for the largest market share in 2025, driven by increasing adoption of intelligent analytics for monitoring public spaces, reducing crime, and supporting smart city initiatives.

The traffic management segment is expected to witness steady growth from 2026 to 2033 as AI-powered video analytics are increasingly deployed to detect accidents, monitor traffic flow, identify congestion, and support automated violation enforcement. Other verticals such as retail and manufacturing are also adopting analytics to enhance safety, improve operational visibility, and strengthen incident response mechanisms.

Incident Detection Video Content Analytics Market Regional Analysis

- North America dominated the incident detection video content analytics market with the largest revenue share in 2025, driven by widespread adoption of AI-powered surveillance systems and increasing investments in advanced security infrastructure across public and private sectors

- Organizations in the region prioritize intelligent monitoring, real-time analytics, and seamless system integration, supporting rapid deployment of video analytics technologies across applications such as traffic management, city surveillance, and critical infrastructure

- This strong adoption is further supported by high technology readiness, substantial cybersecurity awareness, and a growing emphasis on proactive threat detection, positioning North America as a leading hub for intelligent video analytics solutions

U.S. Incident Detection Video Content Analytics Market Insight

The U.S. incident detection video content analytics market captured the largest revenue share in 2025 within North America, fuelled by rapid advancements in AI, machine learning, and video processing technologies. The country is witnessing strong demand for automated surveillance solutions across sectors including transportation, retail, law enforcement, and urban safety. Growing reliance on real-time analytics, remote monitoring, and integrated command-and-control platforms continues to accelerate adoption. In addition, the expansion of smart city programs and federal investments in public security infrastructure are further driving market growth.

Europe Incident Detection Video Content Analytics Market Insight

The Europe incident detection video content analytics market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict regulatory frameworks, rising safety requirements, and increasing focus on intelligent surveillance in both public and private environments. Growing urban development, expansion of transportation networks, and the need for automated monitoring are boosting deployment across the region. Europe is also experiencing heightened adoption of AI-powered incident detection in commercial buildings, industrial facilities, and municipal surveillance systems as part of broader modernization initiatives.

U.K. Incident Detection Video Content Analytics Market Insight

The U.K. incident detection video content analytics market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s strong commitment to digital transformation and advanced security systems. Rising concerns over public safety, crime prevention, and infrastructure protection are driving the integration of real-time analytics within surveillance networks. The proliferation of smart city projects, combined with a growing preference for cloud-based monitoring platforms and AI-enabled video solutions, is expected to further strengthen market expansion.

Germany Incident Detection Video Content Analytics Market Insight

The Germany incident detection video content analytics market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising adoption of intelligent security technologies and strong emphasis on data privacy and system reliability. Germany’s advanced industrial base and focus on innovation are accelerating deployment of AI-based analytics across manufacturing sites, transport systems, and critical infrastructure. Increasing integration with automated building systems and IoT platforms is further enhancing the demand for high-performance, privacy-conscious video analytics solutions.

Asia-Pacific Incident Detection Video Content Analytics Market Insight

The Asia-Pacific incident detection video content analytics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising security concerns, and expanding smart city investments across countries such as China, Japan, and India. Growing awareness of real-time incident detection and the need for scalable, cost-efficient surveillance solutions are accelerating adoption. The region’s strong manufacturing capabilities, increasing digitalization, and government-led smart infrastructure initiatives are further boosting the penetration of video analytics systems.

Japan Incident Detection Video Content Analytics Market Insight

The Japan incident detection video content analytics market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced technology ecosystem, high urban density, and increasing focus on public safety automation. Japanese cities are rapidly adopting intelligent surveillance systems integrated with IoT devices, enabling unified monitoring of public spaces and transportation networks. The country’s aging population is also driving demand for automated, user-friendly security analytics to ensure safer living and working environments.

China Incident Detection Video Content Analytics Market Insight

The China incident detection video content analytics market accounted for the largest market revenue share in Asia Pacific in 2025, driven by massive smart city expansion, high adoption of AI technologies, and significant investments in public security infrastructure. China leads in the deployment of intelligent surveillance systems across residential complexes, commercial facilities, and government projects. Strong domestic manufacturing, affordability of AI-powered solutions, and robust integration of analytics with large-scale urban monitoring platforms are key factors propelling market growth in the country.

Incident Detection Video Content Analytics Market Share

The Incident Detection Video Content Analytics industry is primarily led by well-established companies, including:

- Avigilon Corporation (U.S.)

- Cisco (U.S.)

- Axis Communications AB (Sweden)

- Honeywell International Inc. (U.S.)

- Agent Video Intelligence Ltd. (Israel)

- AllGoVision Technologies Pvt. Ltd (India)

- Aventura Technologies, Inc. (U.S.)

- Genetec Inc. (Canada)

- IntelliVision (U.S.)

- intuVision, Inc. (U.S.)

- PureTech Systems (U.S.)

- IBM Corporation (U.S.)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Dahua Technology Co., Ltd. (China)

- iOmniscient (Australia)

- Huawei Technologies Co., Ltd. (China)

- Gorilla Technology Group (Taiwan)

- ISS, Inc. (U.S.)

- Viseum (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.