Global Incident Response Market

Market Size in USD Billion

CAGR :

%

USD

26.63 Billion

USD

358.49 Billion

2025

2033

USD

26.63 Billion

USD

358.49 Billion

2025

2033

| 2026 –2033 | |

| USD 26.63 Billion | |

| USD 358.49 Billion | |

|

|

|

|

Incident Response Market Size

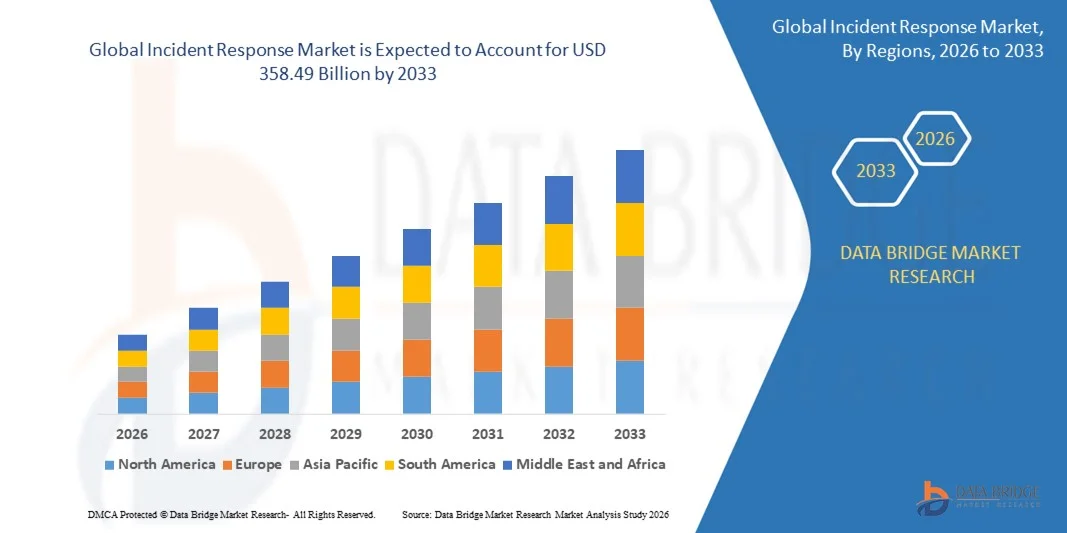

- The global incident response market size was valued at USD 26.63 billion in 2025 and is expected to reach USD 358.49 billion by 2033, at a CAGR of 38.40% during the forecast period

- The market growth is largely fuelled by the rising frequency and sophistication of cyberattacks such as ransomware, phishing, and advanced persistent threats

- In addition, increasing enterprise digitalisation and the growing adoption of cloud-based security solutions are accelerating market expansion

Incident Response Market Analysis

- The market is witnessing rapid adoption of automated incident response tools as organisations prioritise faster threat detection and remediation

- Growing awareness regarding the financial and reputational impact of cyber breaches is driving enterprises to strengthen their incident management frameworks

- North America dominated the incident response market with the largest revenue share in 2025, driven by the high frequency of cyberattacks, strong regulatory frameworks, and rapid adoption of advanced security technologies across enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global incident response market, driven by expanding digital infrastructure, increasing enterprise security spending, and a surge in cybersecurity threats across emerging economies

- The solution segment held the largest market revenue share in 2025 driven by the rising demand for automated detection, investigation, and coordinated response capabilities across digital ecosystems. Organisations increasingly prefer integrated platforms that consolidate alerts, streamline workflows, and reduce operational complexity

Report Scope and Incident Response Market Segmentation

|

Attributes |

Incident Response Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• VMware, Inc (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Incident Response Market Trends

Rise of AI-Integrated and Automated Incident Response Solutions

- The increasing integration of artificial intelligence and automation is transforming incident response by enabling faster threat detection, real-time triage, and autonomous remediation. These technologies reduce manual workloads and allow security teams to respond immediately to sophisticated cyberattacks, improving overall defence readiness across organisations

- The rising demand for intelligent platforms is accelerating the adoption of AI-powered analytics, automated playbooks, and machine learning–driven detection engines. These tools deliver high-speed decision-making in environments where security teams face alert fatigue or limited human resources, especially in large enterprises managing high data volumes

- The affordability and scalability of modern automated solutions are encouraging adoption among mid-sized companies, resulting in better threat visibility and reduced incident response time. Organisations benefit from consistent, repeatable actions without high operational overheads, strengthening their cybersecurity posture

- For instance, in 2024, several financial institutions reported a significant reduction in ransomware dwell time after deploying automated SOAR platforms from leading cybersecurity vendors. These systems enabled faster containment and mitigation, lowering financial losses and improving security workflow efficiency

- While AI-driven platforms are enhancing response capabilities, their success depends on continuous algorithm updates, skilled workforce training, and integration across existing IT systems. Vendors must prioritise customisable solutions and enterprise-wide compatibility to fully leverage the growing demand for automation

Incident Response Market Dynamics

Driver

Rising Frequency of Cyberattacks and Growing Enterprise Dependency on Digital Infrastructure

- The increasing prevalence of cyber threats such as ransomware, phishing, data breaches, and advanced persistent threats is compelling businesses and governments to strengthen incident response frameworks. The expanding digital footprint across cloud, IoT, and remote work environments has created more vulnerable entry points, pushing organisations to invest heavily in cybersecurity preparedness

- Enterprises are becoming more aware of the operational and financial consequences associated with delayed incident detection, including extended downtime, regulatory penalties, and reputational losses. This awareness is driving proactive use of incident response platforms across sectors such as BFSI, healthcare, and IT. The transition reflects a shift toward strategic risk mitigation and resilience

- Government initiatives, compliance mandates, and industry standards are reinforcing incident reporting, monitoring, and response mechanisms. From data protection regulations to national cybersecurity strategies, these frameworks are encouraging rapid adoption of response solutions across public and private sectors

- For instance, in 2023, multiple Asia-Pacific economies introduced compulsory breach notification rules, prompting enterprises to deploy automated monitoring tools and incident response systems to meet regulatory timelines

- While the rising cyber threat landscape is driving market expansion, organisations must continue strengthening skill development, response planning, and system integration to achieve consistent and long-term readiness

Restraint/Challenge

High Cost of Advanced Cybersecurity Tools and Shortage of Skilled Incident Response Professionals

- The high cost associated with advanced cybersecurity solutions such as SOAR platforms, endpoint detection systems, and AI-enabled response tools limits adoption among small and mid-sized organisations. Budget constraints often restrict investments to basic security controls, leaving gaps in rapid detection and effective mitigation

- A significant global shortage of skilled cybersecurity professionals further challenges market growth. Many organisations lack trained incident responders capable of managing complex breaches or operating sophisticated platforms. Skill gaps contribute to delayed threat identification and prolonged recovery time

- Market expansion is also hindered by integration complexities, as incident response tools require seamless compatibility with existing security infrastructure. Organisations without strong IT foundations face difficulties implementing automated response systems, resulting in incomplete workflows and inconsistent threat management

- For instance, in 2024, industry reports from regions such as Latin America highlighted that more than 60% of enterprises struggled to adopt advanced response technologies due to high upfront expenses and limited access to qualified cybersecurity personnel

- While technology continues to advance, overcoming cost barriers, closing workforce gaps, and improving system interoperability remain essential for scaling adoption of incident response solutions and ensuring sustained market growth

Incident Response Market Scope

The market is segmented on the basis of component, service, security type, deployment type, and industry vertical.

- By Component

On the basis of component, the incident response market is segmented into solution and service. The solution segment held the largest market revenue share in 2025 driven by the rising demand for automated detection, investigation, and coordinated response capabilities across digital ecosystems. Organisations increasingly prefer integrated platforms that consolidate alerts, streamline workflows, and reduce operational complexity.

The service segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing reliance on external cybersecurity experts for threat monitoring, incident handling, and strategic response planning. Service-based offerings are becoming essential for enterprises lacking in-house expertise, enabling faster recovery and more resilient security operations.

- By Service

On the basis of service, the incident response market is segmented into retainer, assessment and response, tabletop exercises, incident response planning and development, and advanced threat hunting. The retainer segment held the largest market revenue share in 2025 owing to the growing need for guaranteed access to expert responders during cybersecurity emergencies. Retainer agreements enable swift action, minimise downtime, and reduce breach impact.

The advanced threat hunting segment is expected to witness the highest growth rate from 2026 to 2033 as enterprises increasingly adopt proactive security approaches to identify hidden threats and eliminate potential intrusions before they escalate. Advanced hunting services are gaining traction due to rising APT activities and evolving attacker techniques.

- By Security Type

On the basis of security type, the incident response market is segmented into web security, endpoint security, database security, application security, and cloud security. The endpoint security segment held the largest market revenue share in 2025 driven by the surge in endpoint-generated threats such as ransomware, phishing payloads, and device-based intrusions. Organisations prioritise endpoint visibility due to growing hybrid work environments.

The cloud security segment is expected to witness the fastest growth rate from 2026 to 2033 due to accelerating cloud adoption, multi-cloud deployments, and the need for rapid breach containment in cloud-native environments. Cloud-focused incident response solutions support scalable protection, real-time monitoring, and compliance adherence.

- By Deployment Type

On the basis of deployment type, the incident response market is segmented into on-premises deployment and cloud deployment. The on-premises segment held the largest market revenue share in 2025 due to strong adoption among highly regulated industries requiring complete control over data and threat intelligence infrastructure. On-premises platforms remain preferred where data residency and internal governance are critical.

The cloud deployment segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for scalable, flexible, and cost-efficient response models. Cloud-delivered solutions enable rapid updates, remote access, and seamless integration with cloud-native applications, appealing to both large enterprises and SMEs.

- By Industry Vertical

On the basis of industry vertical, the incident response market is segmented into BFSI, government, healthcare and life sciences, retail and e-commerce, travel and hospitality, manufacturing, and IT and telecommunication. The BFSI segment held the largest market revenue share in 2025 due to the sector’s high exposure to financial fraud, data breaches, and regulatory scrutiny, driving strong investment in incident response capabilities.

The healthcare and life sciences segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising cyberattacks on digital health systems, electronic records, and connected medical devices. The urgent need to safeguard sensitive health information and ensure uninterrupted patient care is accelerating adoption across the sector

Incident Response Market Regional Analysis

- North America dominated the incident response market with the largest revenue share in 2025, driven by the high frequency of cyberattacks, strong regulatory frameworks, and rapid adoption of advanced security technologies across enterprises

- Organisations in the region place strong emphasis on proactive threat detection, rapid remediation, and seamless integration of incident response platforms with tools such as SIEM, EDR, and cloud security solutions

- This widespread adoption is further supported by high cybersecurity spending, a mature digital ecosystem, and the growing need for automated and AI-driven solutions to manage complex and evolving cyber threats

U.S. Incident Response Market Insight

The U.S. incident response market captured the largest revenue share in 2025 within North America, fuelled by the rapid rise of ransomware, data breaches, and targeted attacks on critical infrastructure. Enterprises are prioritising keyless, automated, and intelligence-driven response frameworks to minimise downtime and financial loss. The growing adoption of integrated platforms such as SOAR, coupled with increased utilisation of AI-assisted investigation tools, continues to propel the U.S. market. Moreover, strong regulatory pressures such as breach notification mandates support continuous expansion of incident response capabilities.

Europe Incident Response Market Insight

The Europe incident response market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent cybersecurity regulations such as GDPR and increasing cyber threats targeting financial services, manufacturing, and government sectors. Rising digitalisation across businesses, combined with heightened focus on data protection and operational resilience, is accelerating deployment of advanced response systems. The region is seeing expanding adoption across enterprises, SMEs, and public institutions, with growing investments in automation, cloud security, and real-time monitoring tools.

U.K. Incident Response Market Insight

The U.K. incident response market is expected to witness the fastest growth rate from 2026 to 2033, supported by rising cybercrime incidents and an increasing need for improved security and operational continuity. Concerns regarding data breaches, identity theft, and online fraud are encouraging both private and public sector organisations to adopt structured incident response frameworks. The U.K.’s strong focus on digital transformation, along with high adoption of cloud services and remote work environments, is further boosting market growth.

Germany Incident Response Market Insight

The Germany incident response market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising awareness of cybersecurity risks and a strong emphasis on data sovereignty and secure digital operations. Germany’s robust industrial base and rapid expansion of IoT-enabled infrastructure are encouraging adoption of advanced response systems. The increasing integration of incident response solutions with existing security architectures, along with a preference for privacy-centric tools, aligns with Germany’s strict compliance landscape and technology-driven environment.

Asia-Pacific Incident Response Market Insight

The Asia-Pacific incident response market is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding digital ecosystems, increasing cyberattacks, and rising cybersecurity investments across countries such as China, Japan, and India. Growing awareness among enterprises about the financial and operational impact of cyber incidents, combined with government initiatives promoting cybersecurity maturity, is supporting market adoption. The region’s position as a hub for IT services and technology manufacturing further enhances accessibility to advanced response solutions.

Japan Incident Response Market Insight

The Japan incident response market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech environment, rapid digital expansion, and growing demand for operational efficiency and security. Japanese enterprises prioritise precision, reliability, and automated protection solutions, which is fuelling adoption of AI-enabled incident response tools. The rising number of connected buildings, smart systems, and IoT deployments is further driving demand, while demographic shifts such as an aging workforce increase reliance on automated and user-friendly cybersecurity solutions.

China Incident Response Market Insight

The China incident response market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid digitalisation, expansion of cloud infrastructure, and strong government-led cybersecurity initiatives. China remains one of the largest adopters of digital platforms, and enterprises across manufacturing, e-commerce, and finance are increasingly deploying incident response solutions to mitigate growing cyber risks. The availability of locally developed cybersecurity technologies, competitive pricing, and the push toward smart city ecosystems are key factors driving the market’s expansion.

Incident Response Market Share

The Incident Response industry is primarily led by well-established companies, including:

• VMware, Inc (U.S.)

• Honeywell International Inc (U.S.)

• Schneider Electric (France)

• Cisco Systems (U.S.)

• Broadcom (U.S.)

• AO Kaspersky Lab (Russia)

• IBM (U.S.)

• NEC Corporation (Japan)

• Hexagon AB (Sweden)

• R1 RCM, Inc (U.S.)

• Eccentex (U.S.)

• The Response Group (U.S.)

• Haystax Technology (U.S.)

• Alert Technologies (U.S.)

• Crisisworks (U.K.)

• EmerGeo (U.S.)

• Veoci (U.S.)

• MissionMode (U.S.)

• Accenture (Ireland/U.S.)

• General Electric (U.S.)

• Rockwell Automation (U.S.)

• PAS Global LLC (U.S.)

• Fortinet, Inc (U.S.)

• Palo Alto Networks (U.S.)

• Darktrace (U.K.)

• Forescout Technologies Inc (U.S.)

Latest Developments in Global Incident Response Market

- In June 2024, Cyera introduced its new incident response service, offered on a retainer basis, which leverages the company’s advanced data security platform to help incident responders address breaches more rapidly. This development is expected to enhance organizations’ ability to access critical data insights, strengthen incident containment, and improve overall cyber resilience, thereby contributing to the growth of the incident response market

- In March 2024, International Business Machines Corporation launched the IBM X-Force Cyber Range in Washington, U.S., designed to support federal agencies in improving their preparedness against rising cyber threats. This initiative aims to bolster national cyber defense capabilities, enhance training environments for government teams, and elevate demand for sophisticated incident response solutions across the market

- In January 2024, Check Point Software Technologies Ltd. rolled out the first generation of its Infinity AI Copilot, an AI-powered cybersecurity assistant built to streamline security operations. This launch is intended to address the global cybersecurity talent shortage, improve security policy management, and accelerate threat mitigation, ultimately strengthening the adoption of AI-driven incident response technologies in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.