Global Incretin Mimetics Market

Market Size in USD Billion

CAGR :

%

USD

14.15 Billion

USD

31.90 Billion

2024

2032

USD

14.15 Billion

USD

31.90 Billion

2024

2032

| 2025 –2032 | |

| USD 14.15 Billion | |

| USD 31.90 Billion | |

|

|

|

|

Incretin Mimetics Market Size

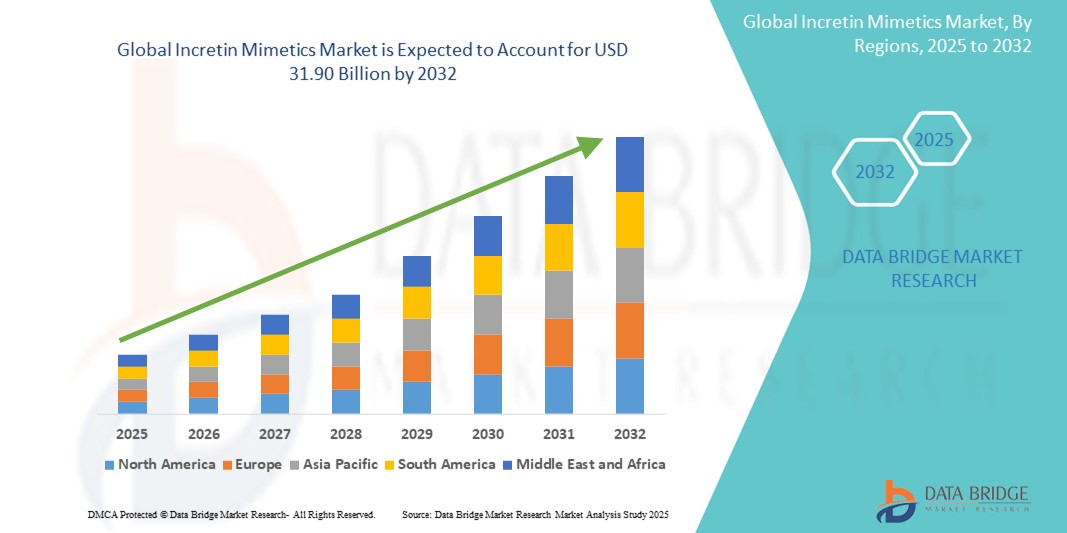

- The global incretin mimetics market size was valued at USD 14.15 billion in 2024 and is expected to reach USD 31.90 billion by 2032, at a CAGR of 10.69% during the forecast period

- The market growth is largely fueled by the rising prevalence of type 2 diabetes globally, alongside an increasing focus on innovative therapies that offer better glycemic control with reduced side effects. Incretin mimetics, such as GLP-1 receptor agonists, are gaining traction due to their dual benefit of glucose regulation and weight management

- Furthermore, growing healthcare expenditure, favorable reimbursement policies, and expanding clinical evidence supporting cardiovascular and renal benefits are positioning Incretin Mimetics as a preferred treatment option. These converging factors are accelerating the adoption of Incretin Mimetics solutions, thereby significantly boosting the industry's growth

Incretin Mimetics Market Analysis

- Incretin mimetics, a class of antidiabetic medications including GLP-1 receptor agonists and GIP/GLP-1 dual agonists, are increasingly becoming vital components in modern diabetes management due to their ability to regulate blood glucose levels, promote weight loss, and offer cardiovascular benefits. Their integration into treatment plans for type 2 diabetes reflects growing clinical confidence and patient acceptance

- The escalating demand for incretin mimetics is primarily driven by the rising global prevalence of type 2 diabetes, increasing awareness of metabolic health, and the shift toward combination therapies that improve patient outcomes while minimizing adverse effects

- North America dominated the incretin mimetics market with the largest revenue share of 39.70% in 2024, fueled by early adoption of novel diabetic treatments, robust healthcare infrastructure, favorable reimbursement policies, and high levels of obesity and diabetes incidence in the U.S. The region continues to witness strong growth, especially with the approval of advanced GLP-1/GIP dual receptor agonists

- Asia-Pacific is expected to be the fastest-growing region in the incretin mimetics market during the forecast period, with a projected CAGR of 12.5%, driven by increasing urbanization, rising disposable incomes, growing healthcare access, and a surge in diabetes prevalence in populous countries such as China and India

- The diabetes segment dominated the incretin mimetics market, capturing a market share of 81.5% in 2024, driven by the high global prevalence of type 2 diabetes and the proven efficacy of incretin-based therapies in glycemic control and weight management

Report Scope and Incretin Mimetics Market Segmentation

|

Attributes |

Incretin Mimetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Incretin Mimetics Market Trends

“Heightened Demand for Personalized and Convenient Therapeutics”

- A significant and accelerating trend in the global incretin mimetics market is the increasing preference for personalized, patient-centric diabetes care using next-generation GLP-1 receptor agonists and DPP-4 inhibitors. These therapies provide more targeted glycemic control with additional benefits such as weight management and cardiovascular risk reduction

- For instance, Novo Nordisk’s semaglutide-based solutions such as Ozempic and Rybelsus have shown strong global adoption due to their dual benefits in glycemic regulation and weight loss, especially in obese and overweight patients with type 2 diabetes. Similarly, Eli Lilly’s tirzepatide, which mimics both GIP and GLP-1, is gaining popularity for its enhanced metabolic outcomes

- The integration of digital health tools with Incretin Mimetics therapy allows for better treatment monitoring and adherence. Smart glucose monitors and mobile health applications help patients track their progress in real time, prompting clinicians to tailor therapies more effectively

- Moreover, the growing use of once-weekly or daily oral dosage forms has made these therapies more convenient, reducing the treatment burden associated with injectable-only regimens. For instance, the availability of oral semaglutide (Rybelsus) provides needle-free treatment options, improving compliance among patients who are hesitant to use injections

- This shift toward convenience and improved treatment experience is fundamentally reshaping expectations in diabetes care. As a result, pharmaceutical companies are investing in innovative delivery systems and combination therapies that align with evolving patient preferences

- The demand for user-friendly, efficacious, and multi-benefit diabetes treatments is expanding across both developed and emerging markets, as patients and providers asuch as seek comprehensive, long-term solutions for chronic disease management

Incretin Mimetics Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Type 2 Diabetes and Demand for Weight-Management Therapies”

- The increasing global prevalence of type 2 diabetes, coupled with the rising demand for therapies that offer glycemic control and weight reduction, is a significant driver of the incretin mimetics market. These agents, including GLP-1 receptor agonists and dual GIP/GLP-1 receptor agonists, are becoming the preferred treatment choices due to their multifaceted clinical benefits

- For instance, the widespread success of semaglutide (Ozempic, Wegovy) and tirzepatide (Mounjaro) reflects the market’s momentum, driven by clinical efficacy in both glycemic control and weight loss. These products are seeing increased adoption globally, including off-label usage for obesity management

- Incretin Mimetics not only help regulate blood glucose but also aid in reducing cardiovascular risks, making them attractive options for patients with multiple comorbidities

- Furthermore, the ease of use provided by once-weekly injections and the launch of oral formulations (such as Rybelsus) are making these therapies more accessible and appealing to patients, improving adherence and long-term outcomes

- The growing acceptance of preventive healthcare, rising awareness among diabetic populations, and the shift towards value-based care are also contributing to increased uptake. In addition, healthcare systems in developed countries are increasingly including these drugs in reimbursement policies, further fueling market expansion

Restraint/Challenge

“Cost of Therapy and Accessibility in Low-Income Regions”

- The high cost of incretin mimetics, especially branded formulations such as semaglutide and tirzepatide, poses a significant barrier to their adoption, particularly in low- and middle-income countries. Out-of-pocket costs remain substantial for uninsured or underinsured patients

- Despite their efficacy, limited access through public healthcare systems and lack of generic alternatives restricts patient reach in several emerging markets

- For instance, while North America and parts of Europe report robust growth due to strong insurance coverage and favorable healthcare policies, many patients in Asia, Africa, and Latin America still rely on older, more affordable therapies such as sulfonylureas or metformin due to cost constraints

- Further challenges include the need for refrigeration in some formulations, which may limit use in areas with inadequate cold chain infrastructure

- Addressing these issues through the introduction of low-cost generics, broader reimbursement programs, and improved healthcare access will be essential to unlocking the full market potential of Incretin Mimetics globally

Incretin Mimetics Market Scope

The incretin mimetics market is segmented on the basis of indication, drugs, route of administration, application, end-users, and distribution channel.

• By Indication

On the basis of indication, the incretin mimetics market is segmented into diabetes and others. The diabetes segment dominated the largest market revenue share of 81.5% in 2024, driven by the growing global burden of Type 2 diabetes and proven clinical outcomes of GLP-1 and DPP-4 drugs.

The others segment is anticipated to witness the fastest CAGR of 5.2% from 2025 to 2032, fueled by emerging applications in obesity management and cardiometabolic conditions, including heart failure and metabolic syndrome.

• By Drugs

On the basis of drugs, the market is segmented into exenatide, liraglutide, sitagliptin, saxagliptin, alogliptin, linagliptin, and others. The liraglutide segment held the highest market share of 24.5% in 2024, owing to its widespread use under the brands Victoza (diabetes) and Saxenda (obesity), supported by long-term data and dual-indication approval.

The exenatide segment is projected to register the fastest CAGR of 7.8% from 2025 to 2032, due to growing adoption of its once-weekly formulation and expanded global access, particularly in emerging markets.

• By Route of Administration

On the basis of route of administration, the incretin mimetics market is segmented into oral, parenteral, and others. The parenteral segment dominated the market with a revenue share of 68.4% in 2024, led by the strong adoption of GLP-1 receptor agonist injectables that offer robust glycemic control and weight reduction benefits.

The oral segment is expected to grow at the fastest CAGR of 8.3% during the forecast period, largely attributed to the increasing popularity of oral semaglutide (Rybelsus), which offers a non-invasive alternative to injectables.

• By Application

On the basis of application, the market is segmented into solid tumors and blood-related tumors. The solid tumors segment accounted for the largest share of 77.6% in 2024, backed by a growing number of preclinical and clinical studies investigating the potential anticancer effects of GLP-1 analogs in pancreatic, colorectal, and breast cancers.

The blood-related tumors segment is expected to witness steady growth with a moderate CAGR of 5.4% through 2032, as early-stage trials and academic research continue to explore hematologic applications.

• By End Users

On the basis of end users, the incretin mimetics market is segmented into hospitals, homecare, specialty clinics, and others. The hospital segment dominated the market with a share of 48.7% in 2024, reflecting institutional administration of injectable therapies and the initiation of treatment protocols in inpatient and outpatient settings.

The homecare segment is projected to be the fastest growing with a CAGR of 7.9% from 2025 to 2032, supported by rising patient self-administration, increased adoption of pen devices, and a shift towards personalized care at home.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment led the market with a 46.2% share in 2024, due to bulk purchasing practices, centralized drug management, and close alignment with institutional care settings.

The online pharmacy segment is expected to register the fastest CAGR of 8.6% from 2025 to 2032, driven by the growing trend of e-pharmacy adoption, telehealth integration, and increased patient preference for home delivery and subscription models.

Incretin Mimetics Market Regional Analysis

- North America dominated the incretin mimetics market with the largest revenue share of 39.70% in 2024, driven by the high prevalence of Type 2 diabetes, increasing adoption of GLP-1 and DPP-4 based therapies, and early availability of novel drugs such as oral semaglutide (Rybelsus)

- The presence of leading pharmaceutical companies such as Pfizer, Bristol-Myers Squibb, and Abbott, combined with favorable reimbursement policies and strong awareness among healthcare providers and patients, has significantly propelled market expansion

- In addition, the region benefits from advanced healthcare infrastructure, ongoing clinical trials for expanded indications (such as, obesity, cardiovascular risk reduction), and high investment in R&D, further reinforcing its leadership position in the global Incretin Mimetics market

U.S. Incretin Mimetics Market Insight

The U.S. incretin mimetics market captured the largest revenue share of 81.3% in 2024 within North America, fueled by the high prevalence of Type 2 diabetes, rising obesity rates, and strong adoption of GLP-1 receptor agonists such as semaglutide and liraglutide. Increasing physician awareness, widespread insurance coverage, and aggressive marketing by leading players such as Novo Nordisk and Eli Lilly further drive growth. Moreover, the growing off-label use of these drugs for weight management and cardiovascular benefits significantly contributes to the U.S. market’s dominance.

Europe Incretin Mimetics Market Insight

The Europe incretin mimetics market accounted for 27.5% of global revenue in 2024 and is projected to expand at a steady CAGR throughout the forecast period, driven by the rising burden of diabetes and obesity. The region benefits from favorable reimbursement policies, expanding geriatric population, and increased prescription of incretin-based therapies. Demand is supported by the growing acceptance of combination therapies, especially among patients intolerant to traditional antidiabetics.

U.K. Incretin Mimetics Market Insight

The U.K. incretin mimetics market is expected to grow at a CAGR of 10.6% from 2025 to 2032, bolstered by the NHS's proactive diabetes management programs and patient access to innovative GLP-1 drugs. The rising use of oral GLP-1 receptor agonists such as Rybelsus and continued focus on obesity-related metabolic conditions are propelling market expansion. In addition, initiatives around health awareness and digital health integration support prescription growth.

Germany Incretin Mimetics Market Insight

The Germany incretin mimetics market accounted for 21.3% of market revenue in 2024. The market is expected to grow steadily due to strong healthcare infrastructure, rising diabetes incidence, and robust physician engagement with newer GLP-1 and DPP-4 therapies. German consumers and healthcare professionals emphasize high-quality, clinically effective drugs, and the market is further supported by the uptake of dual-action incretin drugs for both glycemic and weight control.

Asia-Pacific Incretin Mimetics Market Insight

The Asia-Pacific incretin mimetics market is poised to grow at the fastest CAGR of 12.5% from 2025 to 2032, with increasing urbanization, growing middle-class income, and high diabetes prevalence acting as major catalysts. Countries such as China, India, and Japan are witnessing strong demand for oral and injectable GLP-1s as awareness and access improve. Multinational drugmakers and local pharma firms are investing heavily in market expansion, clinical trials, and affordability strategies.

Japan Incretin Mimetics Market Insight

The Japan incretin mimetics market captured 26.7% of the Asia-Pacific market revenue in 2024, reflecting a strong inclination toward evidence-based, long-term metabolic therapies. The Japanese market emphasizes precision medicine, and the widespread adoption of incretin mimetics is driven by an aging population, growing obesity-related comorbidities, and favorable drug approval timelines. The integration of advanced diagnostics and digital diabetes management tools is also accelerating drug uptake.

China Incretin Mimetics Market Insight

The China incretin mimetics market accounted for the largest revenue share of 34.9% in the Asia-Pacific Incretin Mimetics market in 2024. Key drivers include rapid urbanization, increasing sedentary lifestyles, and strong domestic pharmaceutical production. The Chinese government’s focus on chronic disease control, coupled with expanding health insurance coverage and the rising popularity of weight loss injections, is boosting demand. The availability of biosimilars and cost-effective local alternatives also fuels accessibility.

Incretin Mimetics Market Share

The incretin mimetics industry is primarily led by well-established companies, including:

- Pfizer Inc (U.S.)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Sun Pharmaceutical Industries Ltd (India)

- Novartis AG (Switzerland)

- Lupin (India)

- Cipla Inc (India)

- Fresenius SE & Co. KGaA (Germany)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

Latest Developments in Global Incretin Mimetics Market

- In June 2025, Novo Nordisk announced its plan to initiate Phase III clinical trials for Amycretin, a dual GLP-1 and amylin receptor agonist aimed at treating obesity and type 2 diabetes. Following highly promising mid-stage results, where patients experienced a 22% weight loss in 36 weeks with the injectable version, the company is advancing both oral and injectable formulations. This development reflects Novo Nordisk’s continued leadership in the incretin therapeutics space and its commitment to expanding patient-friendly treatment options

- In April 2025, Eli Lilly announced successful results from its Phase III ACHIEVE-1 trial for Orforglipron, an oral GLP-1 receptor agonist designed for type 2 diabetes and obesity treatment. The trial reported up to 1.6-point reductions in HbA1c and 8% average weight loss over 40 weeks. This milestone positions Orforglipron as a strong oral alternative to injectable GLP-1 therapies and showcases Eli Lilly’s focus on innovative, needle-free treatment modalities to enhance patient adherence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.