Global Individual Quick Freezing Market

Market Size in USD Billion

CAGR :

%

USD

22.44 Billion

USD

36.91 Billion

2024

2032

USD

22.44 Billion

USD

36.91 Billion

2024

2032

| 2025 –2032 | |

| USD 22.44 Billion | |

| USD 36.91 Billion | |

|

|

|

|

Individual Quick Freezing Market Size

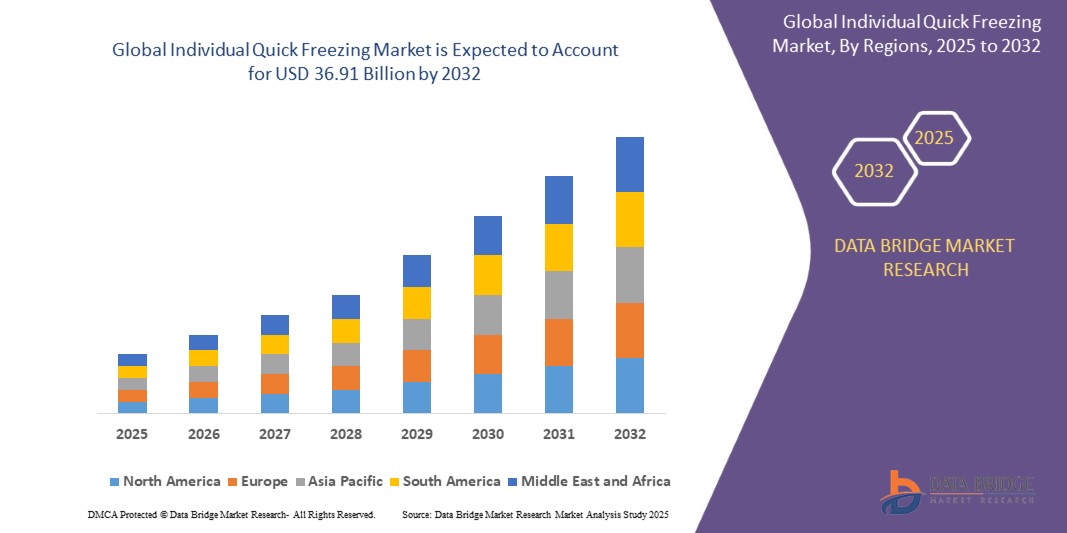

- The global individual quick freezing market size was valued at USD 22.44 billion in 2024 and is expected to reach USD 36.91 billion by 2032, at a CAGR of 5.3% during the forecast period

- Increasing consumer demand for frozen food products that retain natural texture, flavor, and nutritional content is a significant growth driver.

- Rising adoption of IQF technology in food processing due to its efficiency, product quality preservation, and extended shelf life propels market growth.

- Growth in frozen food retail, foodservice, and cold-chain logistics globally supports expanded IQF technology utilization.

Individual Quick Freezing Market Analysis

- IQF technology enables rapid freezing of individual food pieces, preventing clumping and preserving quality, making it preferred for fruits, vegetables, seafood, and meat products.

- Spiral and tunnel freezers dominate due to their high throughput, energy efficiency, and suitability for continuous freezing processes.

- Cryogenic freezing is gaining traction owing to faster freezing times and ability to freeze delicate products.

- The expanding convenience food market and demand for healthier, preservative-free options are increasing IQF application in ready meals and snacks.

Report Scope and Individual Quick Freezing Market Segmentation

|

Attributes |

Individual Quick Freezing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Individual Quick Freezing Market Trends

Rising Demand for Convenience and Quality Preservation

- Expanding retail and foodservice sectors stimulate demand for premium frozen foods with fresh-like qualities achievable through IQF technology.

- Ongoing innovation aims at energy-efficient, automated, and space-optimized IQF systems.

- Increased focus on reducing food wastage and extending product shelf life is encouraging IQF adoption.

- Integration with digital monitoring and control systems enhances process efficiency and product consistency.

Individual Quick Freezing Market Dynamics

Driver

Growth in Frozen Food Consumption and Technological Advancements

- The rapid growth in consumer preference for convenient, ready-to-cook, and preserved food products is a primary driver for the individual quick freezing (IQF) market. IQF technology allows for the freezing of individual food pieces rapidly, preserving the texture, flavor, and nutritional value of perishable items such as fruits, vegetables, seafood, and meat. These quality attributes are increasingly sought by health-conscious and busy consumers worldwide.

- Technological advancements, including automation and digitalization of IQF equipment, have enhanced freezing efficiency, reduced operational costs, and improved product throughput. Innovations such as AI-driven process controls, energy-efficient spiral and tunnel freezers, and cryogenic freezing systems provide processors with greater reliability and sustainability.

- Expansion of cold chain logistics and food retail infrastructure, especially in emerging economies, improves the accessibility and distribution of frozen food products, creating additional demand for IQF processing.

- Foodservice and catering industries are increasingly relying on IQF products to ensure consistent quality and food safety, further propelling market growth.

Restraint/Challenge

High Capital Investment and Energy Consumption

- The high initial investment cost for modern IQF equipment, coupled with substantial energy consumption during operation, limits adoption among small and medium-sized food processors, especially in developing regions. This financial barrier may hamper widespread market penetration in these markets.

- Maintaining operational efficiency requires skilled labor and technical expertise for equipment handling, maintenance, and troubleshooting. Shortages of adequately trained personnel in some regions present operational challenges for manufacturers and processors.

- Variability in cold storage infrastructure and logistics capabilities across different geographies creates uneven growth and limits market expansion in underdeveloped areas.

- Competition from alternative freezing methods such as blast freezing and cryogenic freezing, which may offer certain advantages for specific applications, can restrict IQF market share in price-sensitive segments.

Individual Quick Freezing Market Scope

The market is segmented on the basis of equipment type, processing stage, product type, and technology.

- By Equipment Type

On the basis of equipment type, the individual quick freezing market is segmented into spiral freezers, tunnel freezers, box freezers, and others. The spiral freezer segment dominates the largest market revenue share in 2024, primarily due to its high efficiency, space optimization, and suitability for continuous freezing processes in large-scale food manufacturing. Tunnel freezers are also widely used for their ability to handle diverse product forms and high throughput capabilities, particularly in seafood and meat freezing applications.

- By Product Type

On the basis of product type, the market is segmented into fruits & vegetables, seafood, meat & poultry, dairy products, convenience food, and others. The fruits & vegetables segment held the largest share in 2024, attributed to increasing consumer demand for fresh-like frozen produce and expanding frozen food retail channels. Seafood and meat & poultry segments are also significant due to their perishability and the need for high-quality preservation.

- By Technology

On the basis of technology, the market is categorized into mechanical individual quick freezing and cryogenic individual quick freezing. Mechanical IQF dominates the market share due to its established infrastructure, lower operating costs, and widespread application across food processing industries. Cryogenic IQF is anticipated to witness the fastest growth rate from 2025 to 2034, supported by advantages such as ultra-rapid freezing and suitability for delicate or premium products.

Individual Quick Freezing Market Regional Analysis

- North America dominates the individual quick freezing market with the largest revenue share of approximately 35% in 2024, driven by its advanced frozen food industry, significant presence of IQF equipment manufacturers, and widespread consumer acceptance of frozen convenience foods in countries like the U.S. and Canada.

- The region’s growth is supported by robust cold chain logistics infrastructure, stringent food safety regulations, and continuous innovation in freezing technologies, which enhance product quality and operational efficiency.

- Increasing demand from retail and foodservice sectors for high-quality frozen products further fuels market expansion, alongside strong investments in automated and energy-efficient IQF solutions.

- Additionally, North America’s established food processing industry and growing trend toward clean-label, preservative-free frozen foods emphasize IQF adoption for maintaining freshness and nutritional integrity.

U.S. Individual Quick Freezing Market Insight

The U.S. dominates the North American individual quick freezing (IQF) market in 2024, driven by advanced frozen food processing infrastructure, stringent food safety regulations, and strong consumer demand for convenient, fresh-like frozen products. Adoption of automated and energy-efficient IQF equipment by food manufacturers supports high product quality and operational efficiency across meat, seafood, fruits, and vegetables segments.

Europe Individual Quick Freezing Market Insight

Europe’s individual quick freezing market is poised for robust growth, propelled by increasing frozen food consumption, regulatory emphasis on food safety, and growing consumer preference for preserved nutrition and texture. Countries including Germany, France, and the U.K. are key contributors, with investments in sustainable freezing technologies and cold chain infrastructure accelerating market expansion.

U.K. Individual Quick Freezing Market Insight

The U.K. market is witnessing notable growth fueled by rising demand for ready-to-eat frozen meals and convenience foods. Enhanced focus on product quality and reduced food waste drives implementation of IQF technology among food producers and retailers. Innovation in freezing and packaging technologies supports the evolving consumer preferences in both retail and foodservice sectors.

Germany Individual Quick Freezing Market Insight

Germany benefits from a strong food processing industry coupled with regulatory frameworks encouraging sustainable food preservation technologies. The country’s demand for high-quality frozen products in retail and foodservice channels fosters growth in IQF adoption, especially in meat, dairy, and vegetable product segments.

Asia-Pacific Individual Quick Freezing Market Insight

Asia-Pacific holds a significant share in the global IQF market, driven by rapid urbanization, increasing frozen food consumption, and infrastructure development in countries such as China, India, Japan, and South Korea. Government initiatives supporting cold chain logistics and modernized food processing facilities accelerate IQF technology uptake, meeting rising demand for convenience and long shelf life.

India Individual Quick Freezing Market Insight

India is projected to experience rapid growth, spurred by expanding organized retail, increased consumer preference for convenience foods, and expanding cold storage infrastructure. Government programs promoting food safety and minimizing post-harvest losses further support the adoption of IQF technologies in fruit, vegetable, and seafood processing.

China Individual Quick Freezing Market Insight

China leads the Asia-Pacific IQF market in both revenue and growth, supported by a vast frozen food processing industry and investments in freezing technology upgrades. Rising consumer demand for premium frozen products and growth in exports of frozen goods enhance IQF technology implementation across meat, seafood, and produce sectors.

Individual Quick Freezing Market Share

The Individual Quick Freezing industry is primarily led by well-established companies, including:

- Marel hf (Iceland)

- GEA Group AG (Germany)

- JBT Corporation (United States)

- Air Liquide (France)

- Linde Group (Ireland)

- Messer Group (Germany)

- Scanico (Denmark)

- OctoFrost (Sweden)

- Patkol (Thailand)

- Starfrost (United Kingdom)

- Cryogenic Systems Equipment (United States)

- FPS Food Process Solutions (Canada)

- RMF Freezers (United States)

- Frigoscandia (Sweden)

- Teknotherm (Norway)

- Mycom (Japan)

Latest Developments in Global Individual Quick Freezing Market

- In January 2025: Marel hf launched an advanced spiral freezer system featuring AI-driven process optimization to improve energy efficiency and product consistency.

- In September 2024: GEA Group AG expanded its cryogenic IQF product line with a focus on sustainable refrigerant use and faster freezing cycles.

- In June 2024: JBT Corporation introduced a modular tunnel freezer designed for small to medium-scale processors emphasizing minimal footprint and automation.

- In March 2023: Air Liquide invested in new cryogenic freezing facilities targeting the expanding seafood processing market in North America.

- In November 2022: Messer Group partnered with leading food processors to supply integrated IQF solutions combining freezing and packaging technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.