Global Indoor 5g Market

Market Size in USD Billion

CAGR :

%

USD

45.30 Billion

USD

196.08 Billion

2024

2032

USD

45.30 Billion

USD

196.08 Billion

2024

2032

| 2025 –2032 | |

| USD 45.30 Billion | |

| USD 196.08 Billion | |

|

|

|

|

Indoor 5G Market Size

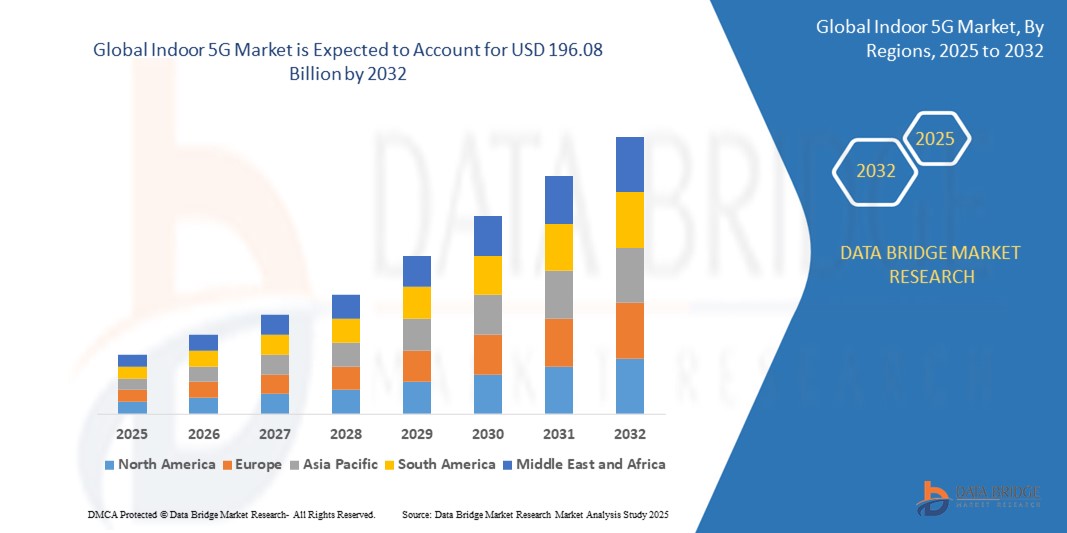

- The global indoor 5G market size was valued at USD 45.3 billion in 2024 and is expected to reach USD 196.08 billion by 2032, at a CAGR of 20.10% during the forecast period

- The market growth is largely fueled by increasing demand for high-speed, low-latency connectivity to support data-intensive applications across commercial, industrial, and institutional indoor environments

- Furthermore, the rising deployment of smart buildings, IoT devices, and edge computing solutions is driving the need for robust indoor 5G infrastructure, enabling seamless communication, automation, and real-time data processing within enclosed spaces. These converging factors are accelerating adoption of indoor 5G systems, thereby significantly boosting market expansion

Indoor 5G Market Analysis

- Indoor 5G networks, enabling ultra-fast and low-latency wireless connectivity within enclosed environments, are becoming essential components of modern enterprise infrastructure, smart buildings, and high-density public venues due to their ability to support real-time applications, IoT integration, and seamless user experiences

- The escalating demand for indoor 5G is primarily fueled by the rapid expansion of digital services, growing reliance on connected devices in commercial and industrial settings, and the need for uninterrupted, high-capacity coverage in places where traditional macro networks face limitations

- Asia-Pacific dominated the Indoor 5G market with a share of 39.5% in 2024, due to widespread 5G rollout initiatives, rapid urbanization, and the expansion of smart buildings across densely populated countries

- North America is expected to be the fastest growing region in the Indoor 5G market during the forecast period due to rising enterprise focus on digital transformation and high-bandwidth indoor applications across retail, healthcare, and education sectors

- Distributed Antenna Systems (DAS) segment dominated the market with a market share of 48.5% in 2024 due to its effectiveness in delivering strong, reliable 5G coverage in large, high-density indoor environments and its ability to support multiple carriers

Report Scope and Indoor 5G Market Segmentation

|

Attributes |

Indoor 5G Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Indoor 5G Market Trends

“Rising Deployment of Private 5G Networks”

- A significant and accelerating trend in the indoor 5G market is the rising deployment of private 5G networks by enterprises across industries such as manufacturing, healthcare, and logistics, enabling secure, low-latency, and high-capacity connectivity tailored to specific organizational needs

- For instance, companies such as Ericsson and Nokia are partnering with large manufacturers to implement private indoor 5G systems that support real-time automation, remote monitoring, and enhanced data security within factory floors

- Private 5G networks provide enterprises with dedicated spectrum access and customizable network management, allowing for improved reliability, network slicing, and seamless integration with existing IT infrastructure

- This trend is further driven by the need to support mission-critical applications such as augmented reality (AR), robotics, and IoT device connectivity in indoor environments, where traditional public networks may fall short in performance and security

- The growing preference for private 5G deployments is reshaping enterprise connectivity strategies, prompting telecom providers and system integrators to offer tailored indoor 5G solutions with end-to-end support

- As more organizations adopt private 5G networks, demand for scalable, flexible indoor 5G infrastructure is surging, making it a key growth driver for the indoor 5G market in both developed and emerging regions

Indoor 5G Market Dynamics

Driver

“Increasing Need for Fast and Reliable Connectivity”

- The increasing need for fast, reliable, and low-latency connectivity across commercial, industrial, and institutional spaces is a significant driver for the adoption of indoor 5G networks

- For instance, in February 2024, Verizon Business announced the expansion of its indoor 5G Ultra Wideband services across hospitals and large office campuses, aiming to enhance mission-critical connectivity and support real-time operations

- As businesses increasingly rely on cloud applications, IoT devices, and remote collaboration tools, traditional Wi-Fi and 4G networks often fall short in delivering consistent performance in dense indoor environments

- Indoor 5G provides high-capacity, interference-free connectivity that supports uninterrupted video conferencing, smart automation, and real-time data transfer, key requirements in sectors such as healthcare, manufacturing, retail, and education. Furthermore, the shift towards hybrid work models and digital-first business operations is amplifying the demand for resilient and scalable indoor wireless infrastructure

- The ability of indoor 5G to deliver enhanced user experiences, greater operational efficiency, and improved mobility across enclosed settings is propelling its adoption as a core enabler of next-generation indoor connectivity

Restraint/Challenge

“High Cost and Complexity of Infrastructure Deployment”

- The high cost and complexity of deploying indoor 5G infrastructure pose a significant challenge to widespread market adoption. Unlike traditional Wi-Fi setups, indoor 5G often requires specialized equipment such as small cells, Distributed Antenna Systems (DAS), and advanced backhaul solutions

- For instance, retrofitting older buildings or large venues such as airports and hospitals with indoor 5G often involves extensive planning, structural modifications, and integration with legacy systems, leading to increased capital and operational expenses

- These high upfront investments can be a barrier, particularly for small and mid-sized enterprises or organizations operating on limited budgets, slowing down deployment in sectors that could otherwise benefit from enhanced connectivity

- In addition, managing multiple technologies, coordinating with telecom providers, and ensuring consistent performance across various indoor zones adds to the operational complexity. While innovations in plug-and-play 5G solutions and open RAN architecture aim to reduce deployment costs, many indoor environments still face scalability and ROI concerns

- Overcoming this challenge will require continued advancements in cost-effective deployment models, simplified infrastructure solutions, and public-private collaboration to lower barriers for organizations seeking next-gen indoor connectivity

Indoor 5G Market Scope

The market is segmented on the basis of offering and business model.

- By Offering

On the basis of offering, the indoor 5G market is segmented into Distributed Antenna Systems (DAS), Small Cells, and Services. The Distributed Antenna Systems (DAS) segment accounted for the largest market revenue share of 48.5% in 2024, driven by its effectiveness in delivering strong, reliable 5G coverage in large, high-density indoor environments and its ability to support multiple carriers.

The services segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the rising demand for deployment, integration, and maintenance services as enterprises and service providers seek to optimize their indoor 5G infrastructure. The increasing reliance on expert-managed services to handle complex network requirements and ensure uninterrupted connectivity is fueling growth in this segment.

- By Business Model

On the basis of business model, the indoor 5G market is segmented into Service Providers, Enterprises, and Neutral Host Operators. The service providers segment dominated the market revenue share in 2024 due to their strong network infrastructure, established customer base, and ongoing investments in 5G deployments. These operators play a key role in bringing indoor 5G solutions to both urban and suburban commercial facilities through managed networks and partnerships.

The neutral host operators segment is expected to register the fastest growth rate from 2025 to 2032, supported by their cost-effective, shared infrastructure model that benefits multiple carriers within the same indoor environment. This model is gaining traction in large venues such as stadiums, shopping centers, and transportation hubs, where it minimizes redundancy and enhances connectivity across different service providers.

Indoor 5G Market Regional Analysis

- Asia-Pacific dominated the indoor 5G market with the largest revenue share of 39.5% in 2024, driven by widespread 5G rollout initiatives, rapid urbanization, and the expansion of smart buildings across densely populated countries

- The region’s strong investment in digital infrastructure, government-backed smart city programs, and rising enterprise demand for high-speed indoor connectivity are key contributors to market growth

- In addition, growing adoption of advanced technologies such as IoT, AI, and cloud computing within manufacturing, retail, and healthcare sectors is accelerating the deployment of indoor 5G networks

Japan Indoor 5G Market Insight

The Japan market is expanding steadily due to strong government focus on digital transformation, particularly in hospitals, offices, and transportation hubs. Demand for ultra-reliable, low-latency connectivity is driving investments in small cell and DAS installations, with telecom operators leading indoor 5G deployments across urban buildings and public facilities.

China Indoor 5G Market Insight

China held the largest share in the Asia-Pacific indoor 5G market in 2024, supported by aggressive 5G infrastructure expansion and smart city initiatives. Rapid digitalization of commercial spaces, increasing mobile data consumption, and large-scale enterprise adoption of private 5G networks are fueling demand. The government’s industrial digitalization push is further accelerating indoor 5G installations.

Europe Indoor 5G Market Insight

Europe indoor 5G market is projected to grow at a significant CAGR through 2032, fueled by strong regulatory support for digital connectivity, energy-efficient networks, and widespread enterprise digitization. Growth is supported by ongoing upgrades in commercial real estate and logistics hubs, where high-speed, secure, and low-latency connectivity is critical for automation and real-time applications. Advancements in in-building wireless systems and neutral host models are promoting scalable indoor 5G deployments across Western and Northern Europe

U.K. Indoor 5G Market Insight

The U.K. market is growing steadily due to high adoption of smart office and healthcare connectivity solutions. Government support for 5G testbeds and private network pilots is driving deployment in commercial and industrial facilities. Enterprises are increasingly leveraging indoor 5G to support hybrid work, IoT infrastructure, and real-time monitoring.

Germany Indoor 5G Market Insight

Germany’s indoor 5G market is expanding rapidly, driven by industrial automation, strong manufacturing base, and high enterprise demand for private 5G. Regulatory incentives for spectrum use, combined with adoption in automotive, logistics, and smart factories, are propelling growth. DAS and small cells are widely implemented across business parks and production facilities.

North America Indoor 5G Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising enterprise focus on digital transformation and high-bandwidth indoor applications across retail, healthcare, and education sectors. The region’s leadership in private 5G networks, cloud-based services, and advanced 5G infrastructure is driving demand for robust in-building connectivity. Adoption of indoor 5G is further supported by regulatory backing, strong telecom operator investments, and increasing need for secure, high-speed indoor coverage across commercial buildings,

U.S. Indoor 5G Market Insight

U.S. captured the largest share in North America’s indoor 5G market in 2024, driven by high deployment of small cells in shopping malls, offices, and entertainment venues. Rising demand for seamless 5G performance indoors, coupled with enterprise push for edge computing and private networks, is accelerating installations. Strong support from carriers and neutral host providers is further enhancing indoor 5G coverage and scalability.

Indoor 5G Market Share

The Indoor 5G industry is primarily led by well-established companies, including:

- Telefonaktiebolaget LM Ericsson (Sweden)

- Huawei Technologies Co., Ltd. (China)

- Nokia (Finland)

- SAMSUNG (South Korea)

- ZTE (China)

- CommScope (U.S.)

- Corning (U.S.)

- Comba Telecom (Hong Kong)

- AT&T (U.S.)

- Airspan (U.S.)

- SOLiD (U.S.)

- Dali Wireless (U.S.)

- Nextivity (U.S.)

- JMA Wireless (U.S.)

- Proptivity (Sweden)

- LitePoint (U.S.)

- ALCAN (Germany)

- Extenet Systems (U.S.)

- LITEON Technology (Taiwan)

- Mavenir (U.S.)

- Maven Wireless (Sweden)

- Boingo Wireless (U.S.)

Latest Developments in Global Indoor 5G Market

- In April 2025, Nokia and Bharti Airtel broadened their collaboration to strengthen Airtel’s 4G/5G network capabilities across India. Nokia will provide Packet Core and Fixed Wireless Access solutions to ensure smooth integration of 4G and 5G, along with expanded network capacity for home and enterprise connectivity. This initiative aims to boost service quality, automate operations via GenAI, lower operational costs, and drive Airtel’s transition to a standalone 5G architecture

- In April 2025, Airspan Networks Holdings LLC finalized the acquisition of Corning Incorporated’s wireless business, obtaining complete ownership of Corning’s 6000 and 6200 distributed antenna systems (DAS) and SpiderCloud’s 4G/5G small cell RAN solutions. This acquisition enhances Airspan’s indoor connectivity offerings, enabling a more comprehensive and integrated wireless solutions portfolio

- In September 2024, Huawei, in collaboration with du and Emirates Integrated Telecommunications Company (EITC), became the first to roll out Huawei’s 5G LampSite X ‘Digital Indoor Solution’ in the Middle East. Using Three Carrier Aggregation (3CC) Technology, the deployment achieved a peak data speed of 5.1 Gbps, significantly enhancing du’s position in the 5G user experience market

- In March 2024, Ericsson and Advanced Communications and Electronics Systems (ACES) signed a three-year strategic partnership to upgrade indoor 5G connectivity in Saudi Arabia. The agreement enables ACES to deploy Ericsson’s advanced indoor 5G technologies to a broad base of communication service providers (CSPs), addressing growing demand for robust indoor networks in the kingdom

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.