Global Indoor Cabinet Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.34 Billion

2024

2032

USD

1.68 Billion

USD

2.34 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 2.34 Billion | |

|

|

|

|

Indoor Cabinet Market Size

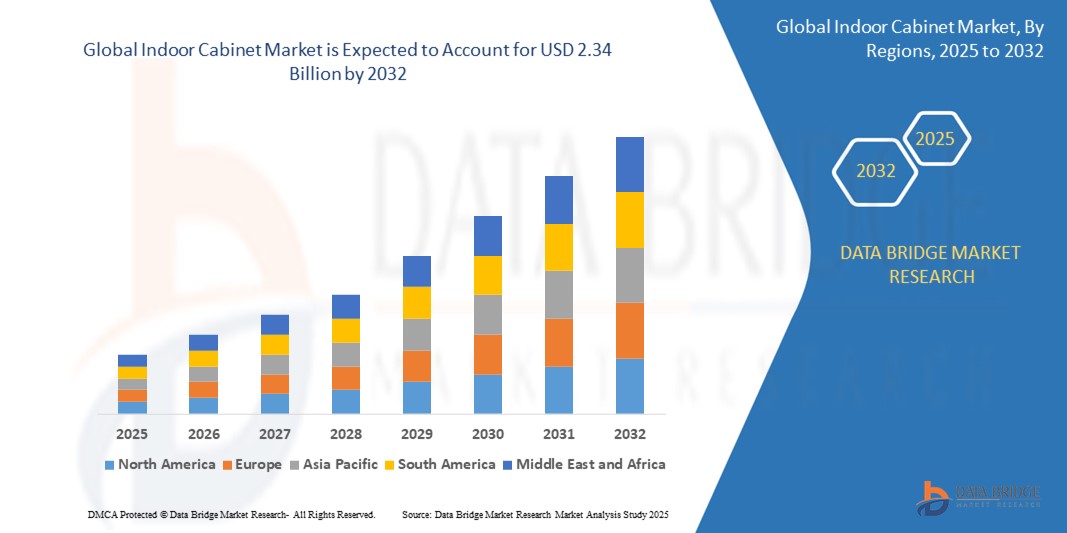

- The global indoor cabinet market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 2.34 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the rising demand for space optimization in residential and commercial interiors, increasing urbanization, and evolving aesthetic preferences

- Growth in smart home setups and modular furniture trends is also contributing to the adoption of multifunctional indoor cabinets

Indoor Cabinet Market Analysis

- Increasing consumer focus on organized living spaces and premium home décor is driving demand for customized and ready-to-assemble indoor cabinet solutions

- Manufacturers are expanding product lines with eco-friendly materials, minimalist designs, and technologically integrated features to align with evolving consumer lifestyles

- North America dominated the global indoor cabinet market with the largest revenue share of 38.4% in 2024, driven by a surge in home renovation projects and increasing investments in modular furniture solutions for residential and commercial spaces

- Asia-Pacific region is expected to witness the highest growth rate in the global indoor cabinet market, driven by rapid urbanization, rising middle-class population, and increasing demand for space-saving and modular furniture solutions across residential and commercial sectors

- The server cabinet segment dominated the market with the largest revenue share in 2024, driven by the rising demand for secure and organized storage of IT infrastructure in both residential and commercial environments. With the growing number of connected devices and data transfer requirements, server cabinets offer critical support for space efficiency, cable management, and system protection. Their use is especially prominent in residential smart setups and private office networks, where data security and system stability are essential

Report Scope and Indoor Cabinet Market Segmentation

|

Attributes |

Indoor Cabinet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Smart and Modular Cabinet Solutions • Expansion of E-Commerce Channels for Furniture Distribution |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Indoor Cabinet Market Trends

“Rising Demand for Modular and Multi-Functional Storage Solutions”

• Consumers are increasingly opting for modular cabinets that offer flexible configurations and efficient space utilization in compact urban homes

• Multi-functional designs, such as cabinets with foldable desks, built-in drawers, and lighting, are gaining popularity for maximizing utility

• Young homeowners prefer customizable cabinet systems that align with minimalistic and tech-savvy lifestyle preferences

• Modular cabinet lines from global brands are enabling customers to assemble and expand storage based on evolving needs

• For instance, IKEA’s PLATSA series allows users to customize storage layouts for bedrooms, entryways, or home offices, enhancing utility across different spaces

Indoor Cabinet Market Dynamics

Driver

“Growth in Urbanization and Interior Renovation Activities”

• Rising urban populations and shrinking living spaces are driving the demand for space-saving, modern cabinet designs

• Renovation projects in residential and commercial properties are boosting indoor cabinet installations for aesthetics and functionality

• Open-plan layouts and multi-zone interiors require storage units that can serve more than one purpose

• Increasing awareness of home improvement trends and access to e-commerce platforms is accelerating cabinet purchases

• For instance, the growth of smart apartments and real estate developments in cities such as Singapore has increased demand for sleek, customizable indoor cabinets in both rental and owned spaces

Restraint/Challenge

“High Cost of Premium Customization and Raw Materials”

• Customization features and premium hardware significantly raise the overall price of indoor cabinet systems

• Materials such as solid wood, imported laminates, and designer finishes contribute to higher production and retail costs

• Consumers in price-sensitive markets often opt for basic or semi-modular storage solutions over high-end alternatives

• Volatility in raw material costs, especially engineered wood and metal components, impacts manufacturer pricing and affordability

- For instance, in markets such as Indonesia and Vietnam, many homeowners choose MDF-based indoor cabinets as a cost-effective alternative to expensive hardwood designs

Indoor Cabinet Market Scope

The market is segmented on the basis of product, shape type, applications, and end-user

• By Product

On the basis of product, the indoor cabinet market is segmented into server cabinet, router cabinet, switch cabinet, base station cabinet, data center cabinet, electromagnetic shielding cabinet, and others. The server cabinet segment dominated the market with the largest revenue share in 2024, driven by the rising demand for secure and organized storage of IT infrastructure in both residential and commercial environments. With the growing number of connected devices and data transfer requirements, server cabinets offer critical support for space efficiency, cable management, and system protection. Their use is especially prominent in residential smart setups and private office networks, where data security and system stability are essential.

The data center cabinet segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rapid expansion of cloud services and the rising number of hyper-scale data centers. These cabinets are specifically designed for high-density equipment and airflow optimization, making them ideal for large-scale deployments in the telecommunications and power sectors. The shift toward 5G infrastructure and edge computing is further accelerating demand for this segment.

• By Shape Type

On the basis of shape type, the indoor cabinet market is segmented into transverse-shaped cabinet and L-shaped cabinet. The transverse-shaped cabinet segment accounted for the largest revenue share in 2024 due to its versatility and compact structure, which allows for efficient use of floor space in small to mid-sized facilities. These cabinets are often selected for setups that require frequent component access, especially in server rooms and retail offices.

The L-shaped cabinet segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to optimize corner space and accommodate complex wiring layouts. These cabinets are increasingly preferred in modern, high-performance environments such as telecommunications centers, where floor plan efficiency is crucial.

• By Applications

On the basis of applications, the indoor cabinet market is segmented into residential, restaurants, and others. The residential segment dominated the market in 2024, supported by the growing adoption of indoor cabinets for personal networking, security systems, and entertainment equipment organization. Homeowners are increasingly investing in compact, aesthetically designed cabinets that blend with interior décor while offering functional storage.

The restaurant segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increased demand for organized and secured placement of networking hardware, point-of-sale systems, and surveillance equipment in foodservice environments. As the industry shifts toward smart kitchens and digitized front-end operations, the need for efficient cabinet storage has become more pronounced.

• By End-User

On the basis of end-user, the indoor cabinet market is segmented into telecommunication and power supply. The telecommunication segment held the largest revenue share in 2024, driven by the growing installation of networking hardware across urban and remote areas. The rise of 5G networks and fiber-optic infrastructure is generating consistent demand for specialized indoor cabinets to house switches, routers, and servers securely.

The power supply segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing investments in renewable energy facilities, smart grids, and control room automation. Cabinets used in power environments are designed to protect sensitive components from electromagnetic interference and physical damage, ensuring long-term reliability and safety.

Indoor Cabinet Market Regional Analysis

• North America dominated the global indoor cabinet market with the largest revenue share of 38.4% in 2024, driven by a surge in home renovation projects and increasing investments in modular furniture solutions for residential and commercial spaces

• The demand is supported by consumer preference for aesthetic, functional storage systems and the rising popularity of organized living. In addition, the prevalence of DIY culture and growing awareness of space optimization has further fueled the demand for indoor cabinets across urban households

• Technological advancements, such as smart cabinets with built-in lighting and automated access, also contribute to the growing appeal of indoor cabinets in North America

U.S. Indoor Cabinet Market Insight

The U.S. indoor cabinet market accounted for the largest revenue share of 79.2% in 2024 within North America, supported by a well-established housing sector and the growing trend of customized interiors. Rising consumer expenditure on home furnishings and increasing adoption of smart storage solutions have propelled the demand. Furthermore, innovations in cabinet materials and finishes, along with the availability of eco-friendly and durable options, are influencing purchase decisions across residential and commercial applications

Europe Indoor Cabinet Market Insight

The Europe indoor cabinet market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the region’s emphasis on sustainable construction and eco-friendly furniture. Urbanization, space constraints, and consumer inclination toward minimalistic interior designs are key drivers. Moreover, the integration of high-quality storage solutions in modular kitchens, living rooms, and offices is enhancing market traction across the region

U.K. Indoor Cabinet Market Insight

The U.K. indoor cabinet market is expected to witness the fastest growth rate from 2025 to 2032, due to the growing preference for compact and multi-functional furniture solutions. Rising housing development, increased focus on home aesthetics, and evolving consumer lifestyles are driving the adoption of modular indoor cabinets. E-commerce platforms and design customization services are also playing a pivotal role in market expansion across the country

Germany Indoor Cabinet Market Insight

The Germany indoor cabinet market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's focus on sustainable housing and energy-efficient interior solutions. The strong presence of premium furniture manufacturers, combined with consumer demand for sleek, durable, and customizable cabinet systems, is boosting market growth. German consumers also value advanced functionality and ergonomic design, leading to increased adoption of smart storage technologies in home and office settings

Asia-Pacific Indoor Cabinet Market Insight

The Asia-Pacific indoor cabinet market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increased disposable income, and a booming real estate sector. Countries such as China, India, and Japan are witnessing a rise in demand for modular interiors and compact furniture, aligning with the growing number of urban households. The expanding middle-class population and the increasing popularity of home improvement projects are further encouraging the adoption of modern indoor cabinet systems

Japan Indoor Cabinet Market Insight

The Japan indoor cabinet market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's compact living spaces and high emphasis on efficient space utilization. The integration of traditional design with modern, functional storage solutions is gaining popularity. Moreover, the aging population and the demand for ergonomic, accessible cabinets are contributing to the market’s evolution, especially in residential and assisted living settings

China Indoor Cabinet Market Insight

The China indoor cabinet market held the largest revenue share in Asia Pacific in 2024, driven by rapid urban development, expansion of the housing sector, and the rising demand for modern, space-saving furniture. The availability of affordable, customizable cabinets, along with increasing consumer spending on home improvement, has propelled market growth. Strong domestic manufacturing capabilities and government support for smart and green housing solutions further enhance the market potential in China

Indoor Cabinet Market Share

The Indoor Cabinet industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Eaton (Ireland)

- ELBA (Italy)

- Siemens (Germany)

- Zanardo Spa (Italy)

- Oracle (U.S.)

- C.C. Power, LLC. (U.S.)

- Dell Inc. (U.S.)

- ZAKLAD PRODUKCJI AUTOMATYKI SIECIOWEJ SA (Poland)

- Huawei Technologies Co., Ltd. (China)

- AFL. (India)

- The Wiedemann Company (U.S.)

- MERZ GmbH (Germany)

- Xiamen Hongfa Electroacoustic Co.,Ltd. (China)

- Sleeve Seal. (U.S.)

- Lucy Group Ltd. (Thailand)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDOOR CABINET MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INDOOR CABINET MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL INDOOR CABINET MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HAZARD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 MARKET TREND SCENARIO_ELECTRICAL INDOOR CABINET INDUSTRY

9.1 U.S.

9.2 GERMANY

10 CLIMATE CHANGE SCENARIO

10.1 ENVIRONMENTAL CONCERNS

10.2 INDUSTRY RESPONSE

10.3 GOVERNMENT’S ROLE

10.4 ANALYST RECOMMENDATIONS

11 GLOBAL INDOOR CABINET MARKET, BY TYPE, 2018-2032 (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 WALL-MOUNTED CABINETS

11.3 FREESTANDING CABINETS

11.4 OVERHEAD CABINETS

11.5 CORNER CABINETS

11.6 BASE CABINETS

11.7 OTHERS

12 GLOBAL INDOOR CABINET MARKET, BY CATEGORY, 2018-2032 (USD MILLION) (MILLION UNITS)

12.1 OVERVIEW

12.2 ELECTRICAL

12.2.1 BY CATEGORY

12.2.1.1. WALL-MOUNT CABINETS

12.2.1.2. FREE-STANDING CABINETS

12.2.1.3. NEMA-RATED CABINETS

12.2.1.4. OTHERS

12.3 NON-ELECTRICAL

13 GLOBAL INDOOR CABINET MARKET, BY SHAPE, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 TRANSVERSE-SHAPED CABINET

13.3 L-SHAPED CABINET

14 GLOBAL INDOOR CABINET MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 WOOD

14.2.1 SOLID WOOD

14.2.2 ENGINEERED WOOD

14.2.2.1. PLYWOOD

14.2.2.2. MDF

14.2.2.3. OTHERS

14.3 METAL

14.3.1 STAINLESS STEEL

14.3.2 ALUMINUM

14.3.3 OTHERS

14.4 GLASS

14.5 PLASTIC/POLYMER

14.6 STONE

14.7 COMPOSITE MATERIALS

14.8 OTHERS

15 GLOBAL INDOOR CABINET MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 RESIDENTIAL

15.2.1 LIVING ROOM

15.2.2 KITCHEN

15.2.3 BEDROOM

15.2.4 BATHROOM

15.2.5 OTHERS

15.3 COMMERCIAL

15.3.1 OFFICES

15.3.2 RETAIL SPACES

15.3.3 HOSPITALITY

15.3.3.1. HOTELS

15.3.3.2. RESTAURANTS

15.3.3.3. BARS AND CLUBS

15.3.3.4. OTHERS

15.3.4 HEALTHCARE FACILITIES

15.3.5 OTHERS

15.4 INDUSTRIAL

16 GLOBAL INDOOR CABINET MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 DIRECT SALES

16.3 INDIRECT SALES

16.3.1 ONLINE

16.3.1.1. E-COMMERCE PLATFORMS

16.3.1.2. COMPANY WEBSITES

16.3.2 OFFLINE

16.3.2.1. SPECIALTY STORES

16.3.2.2. FURNITURE SHOWROOMS

16.3.2.3. HOME IMPROVEMENT STORES

16.3.2.4. OTHERS

17 GLOBAL INDOOR CABINET MARKET, BY REGION, 2018-2032 (USD MILLION) (MILLION UNITS)

GLOBAL INDOOR CABINET MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 SWITZERLAND

17.2.7 NETHERLANDS

17.2.8 BELGIUM

17.2.9 RUSSIA

17.2.10 DENMARK

17.2.11 SWEDEN

17.2.12 POLAND

17.2.13 TURKEY

17.2.14 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 SINGAPORE

17.3.7 THAILAND

17.3.8 INDONESIA

17.3.9 MALAYSIA

17.3.10 PHILIPPINES

17.3.11 NEW ZEALAND

17.3.12 VIETNAM

17.3.13 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 UAE

17.5.3 SAUDI ARABIA

17.5.4 OMAN

17.5.5 QATAR

17.5.6 KUWAIT

17.5.7 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL INDOOR CABINET MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18.6 MERGERS & ACQUISITIONS

18.7 NEW PRODUCT DEVELOPMENT & APPROVALS

18.8 EXPANSIONS & PARTNERSHIP

18.9 REGULATORY CHANGES

19 GLOBAL ELECTRICAL INDOOR CABINET MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: U.S.

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: GERMANY

19.5 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.6 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

19.7 MERGERS & ACQUISITIONS

19.8 NEW PRODUCT DEVELOPMENT & APPROVALS

19.9 EXPANSIONS & PARTNERSHIP

19.1 REGULATORY CHANGES

20 GLOBAL INDOOR CABINET MARKET, SWOT ANALYSIS

21 GLOBAL INDOOR CABINET MARKET, COMPANY PROFILES

21.1 IKEA

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 HÄFELE AMERICA CO.

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 HETTICH HOLDING GMBH & CO. OHG

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 MASTERBRAND CABINETS, LLC

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 AMERICAN WOODMARK CORPORATION

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 MASCO CORPORATION

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 FABUWOOD CABINETRY CORP.

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 OPPEIN HOME GROUP

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CABINETWORKS GROUP

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 NOBILIA KITCHENS

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 POGGENPOHL

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 SCAVOLINI S.P.A.

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 GODREJ INTERIO

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENTS

21.14 SYMPHONY GROUP

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 EUROMOBIL GROUP

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENTS

21.16 HANWHA L&C

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT DEVELOPMENTS

21.17 CANADEL

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT DEVELOPMENTS

21.18 WREN KITCHENS

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENTS

21.19 HOWDENS JOINERY

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT DEVELOPMENTS

21.2 SLEEK INTERNATIONAL

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 GLOBAL ELECTRICAL INDOOR CABINET MARKET, COMPANY PROFILES

22.1 EQUIPTO ELECTRONICS CORPORATION

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 MAYSTEEL

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 HUBBELL

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENTS

22.4 BULL METAL PRODUCTS

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENTS

22.5 MIER PRODUCTS, INC.

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENTS

22.6 APX COMPANY

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT DEVELOPMENTS

22.7 NJ SULLIVAN

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENTS

22.8 E-ABEL

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 PRODUCT PORTFOLIO

22.8.4 RECENT DEVELOPMENTS

22.9 STARECO GMBH

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENTS

22.1 EUROSOFT - CONTROL S.R.O.

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 PRODUCT PORTFOLIO

22.10.4 RECENT DEVELOPMENTS

23 RELATED REPORTS

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.