Global Induction Motors Market

Market Size in USD Billion

CAGR :

%

USD

26.42 Billion

USD

46.09 Billion

2024

2032

USD

26.42 Billion

USD

46.09 Billion

2024

2032

| 2025 –2032 | |

| USD 26.42 Billion | |

| USD 46.09 Billion | |

|

|

|

|

Induction Motors Market Size

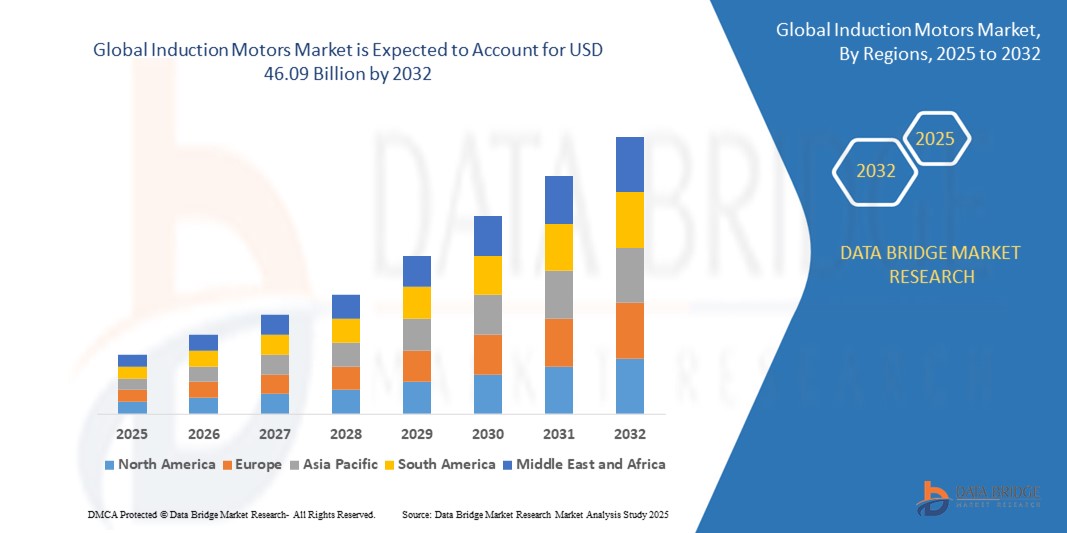

- The global induction motors market size was valued at USD 26.42 billion in 2024 and is expected to reach USD 46.09 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is driven by increasing industrial automation, rising demand for energy-efficient motors, and advancements in motor design and control technologies

- Growing emphasis on sustainable energy solutions and the replacement of outdated motor systems with high-efficiency induction motors are further propelling market expansion

Induction Motors Market Analysis

- Induction motors, known for their reliability, efficiency, and low maintenance, are critical components in various industrial and commercial applications, including pumps, fans, compressors, and conveyor systems

- The surge in demand for induction motors is fueled by rapid industrialization, growing adoption of electric vehicles, and increasing investments in renewable energy projects

- North America dominated the induction motors market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, high adoption of automation technologies, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing industrial output, and rising investments in infrastructure development in countries such as China and India

- The three-phase induction motors segment dominated the largest market revenue share of 68.5% in 2024, driven by their widespread use in industrial applications due to high efficiency, robustness, and low maintenance requirements

Report Scope and Induction Motors Market Segmentation

|

Attributes |

Induction Motors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Induction Motors Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global induction motors market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced monitoring and analysis of motor performance, operational efficiency, and predictive maintenance needs

- AI-powered solutions facilitate proactive maintenance by identifying potential motor failures before they result in costly downtime or equipment damage

- For instance, companies such as ABB and Siemens are developing AI-driven platforms that analyze motor operational data to optimize energy efficiency, predict maintenance schedules, and enhance industrial automation processes

- This trend enhances the value of induction motors by improving reliability and reducing operational costs, making them more appealing to industrial and commercial users

- AI algorithms can analyze a wide range of motor performance metrics, such as vibration, temperature, and energy consumption, to optimize performance and extend motor lifespan

Induction Motors Market Dynamics

Driver

“Rising Demand for Energy-Efficient Motors and Industrial Automation”

- The growing emphasis on energy efficiency and sustainability is a major driver for the global induction motors market, with increasing adoption of high-efficiency motors

- Induction motors are widely used in industrial automation, powering equipment such as pumps, compressors, conveyors, and fans, driven by the expansion of manufacturing and infrastructure sectors

- Government regulations, particularly in North America and Europe, mandate the use of energy-efficient motors, boosting market demand

- The rise of electric vehicles (EVs), especially in North America and Asia-Pacific, is increasing the use of three-phase induction motors due to their durability, reliability, and low maintenance

- The proliferation of IoT and advancements in 5G technology enable real-time motor monitoring and control, further driving the adoption of smart induction motors in industrial applications

- Major automakers and industrial manufacturers are integrating induction motors as standard components to meet energy efficiency goals and enhance operational performance

Restraint/Challenge

“High Installation Costs and Raw Material Price Volatility”

- The high initial costs associated with manufacturing, installing, and integrating advanced induction motors, particularly those with IoT and AI capabilities, pose a significant barrier, especially in cost-sensitive emerging markets

- Retrofitting existing systems with high-efficiency induction motors can be complex and expensive, limiting adoption in older industrial facilities

- Data security and privacy concerns arise with IoT-enabled motors, as they collect and transmit sensitive operational data, raising risks of breaches or misuse, particularly in regions with stringent data protection regulations

- The fragmented regulatory landscape across countries regarding energy efficiency standards and data handling complicates compliance for global manufacturers

- Price volatility of raw materials, such as copper and steel, used in motor production can increase costs and impact market growth, especially for smaller manufacturers

- These challenges may deter adoption in regions with high cost sensitivity or limited awareness of advanced motor technologies, hindering market expansion

Induction Motors market Scope

The market is segmented on the basis of type, voltage, application, and end-user industry.

- By Type

On the basis of type, the global induction motors market is segmented into single-phase induction motors, three-phase induction motors, squirrel cage motors, slip ring motors, and others. The three-phase induction motors segment dominated the largest market revenue share of 68.5% in 2024, driven by their widespread use in industrial applications due to high efficiency, robustness, and low maintenance requirements. These motors are ideal for heavy-duty applications such as pumps, compressors, and conveyors in manufacturing and oil & gas industries.

The squirrel cage motors segment is expected to witness the fastest growth rate of 8.4% from 2025 to 2032, owing to their simplicity, durability, and cost-effectiveness. Their increasing adoption in electric vehicles and automation systems, particularly in Asia-Pacific, further accelerates market growth.

- By Voltage

On the basis of voltage, the global induction motors market is segmented into low voltage, medium voltage, and high voltage. The low voltage segment accounted for the largest market revenue share of 62.3% in 2024, driven by its extensive use in residential, commercial, and small-scale industrial applications, such as HVAC systems, pumps, and household appliances. The affordability and compatibility of low voltage motors with standard electrical systems fuel their demand.

The medium voltage segment is anticipated to experience the fastest growth rate of 7.9% from 2025 to 2032, propelled by rising demand in heavy industries such as manufacturing, mining, and power generation, where medium voltage motors offer high power output and efficiency for demanding applications.

- By Application

On the basis of application, the global induction motors market is segmented into industrial, commercial, residential, HVAC systems, automotive, and others. The industrial segment dominated with a market revenue share of 55.7% in 2024, driven by the extensive use of induction motors in manufacturing processes, heavy machinery, and automation systems. Their reliability and low maintenance make them critical for continuous, high-demand operations.

The automotive segment is projected to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by the rising adoption of induction motors in electric vehicles (EVs) due to their high efficiency, good speed regulation, and absence of commutators. Government incentives and increasing EV production globally are key growth drivers.

- By End-User Industry

On the basis of end-user industry, the global induction motors market is segmented into manufacturing, oil & gas, energy & power, automotive, agriculture, and others. The manufacturing segment held the largest market revenue share of 48.2% in 2024, driven by the widespread use of induction motors in processes such as material handling, machining, and automation. The sector’s focus on energy efficiency and productivity enhances motor adoption.

The automotive end-user industry is expected to grow at the fastest rate of 10.1% from 2025 to 2032, propelled by the global shift toward electric vehicles and the integration of three-phase induction motors in EV drivetrains. Supportive government policies and technological advancements in motor efficiency further boost this segment.

Induction Motors Market Regional Analysis

- North America dominated the induction motors market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, high adoption of automation technologies, and the presence of major industry players

- Consumers prioritize induction motors for their reliability, low maintenance, and high efficiency, particularly in industrial applications such as manufacturing, oil & gas, and HVAC systems.

- Growth is supported by advancements in motor technology, including high-efficiency IE3/IE4-class motors and integration with variable frequency drives (VFDs), alongside rising adoption in both OEM and aftermarket segments

U.S. Induction Motors Market Insight

The U.S. induction motors market captured the largest revenue share of 77.3% in 2024 within North America, fueled by strong demand in industrial automation, automotive, and energy & power sectors. The trend towards energy efficiency, driven by regulations such as the U.S. Department of Energy’s efficiency standards and tax incentives for retrofitting, boosts the replacement of older motors with advanced models. The growing incorporation of induction motors in electric vehicles (EVs) and smart manufacturing systems further enhances market expansion.

Europe Induction Motors Market Insight

The Europe induction motors market is expected to witness steady growth, supported by regulatory emphasis on energy efficiency and sustainability, such as the EU’s Ecodesign Directive mandating IE3 motors. Consumers seek motors that offer high efficiency and reliability for industrial and commercial applications, including HVAC systems and automotive manufacturing. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to advanced industrial bases and environmental concerns.

U.K. Induction Motors Market Insight

The U.K. market for induction motors is expected to experience steady growth, driven by demand for energy-efficient solutions in industrial and commercial settings. Increased focus on reducing energy consumption and greenhouse gas emissions encourages the adoption of high-efficiency motors. Evolving regulations balancing motor performance with environmental standards influence consumer choices, particularly in HVAC systems and manufacturing applications.

Germany Induction Motors Market Insight

Germany is expected to witness strong growth in the induction motors market, attributed to its advanced manufacturing sector and high consumer focus on energy efficiency. German industries prefer technologically advanced motors, such as squirrel cage and three-phase models, that reduce energy consumption and enhance operational efficiency. The integration of these motors in premium industrial equipment and aftermarket solutions supports sustained market growth.

Asia-Pacific Induction Motors Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and rising demand for electric vehicles in countries such as China, India, and Japan. Increasing awareness of energy efficiency, coupled with government initiatives promoting sustainable industrial practices, boosts demand for induction motors. Applications in automotive, manufacturing, and HVAC systems, supported by strong domestic production, enhance market growth.

Japan Induction Motors Market Insight

Japan’s induction motors market is expected to witness rapid growth due to strong consumer preference for high-efficiency, technologically advanced motors that enhance operational reliability and safety. The presence of major automotive and electronics manufacturers, along with the integration of induction motors in OEM vehicles and robotics, accelerates market penetration. Rising interest in smart manufacturing and aftermarket applications also contributes to growth.

China Induction Motors Market Insight

China holds the largest share of the Asia-Pacific induction motors market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for energy-efficient solutions in manufacturing and automotive sectors. The country’s growing industrial base and focus on smart manufacturing support the adoption of advanced three-phase and squirrel cage motors. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Induction Motors Market Share

The induction motors industry is primarily led by well-established companies, including:

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- WEG S.A. (Brazil)

- Nidec Corporation (Japan)

- General Electric (U.S.)

- Toshiba Corporation (Japan)

- Regal Beloit Corporation (U.S.)

- Emerson Electric Co. (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- Rockwell Automation (U.S.)

- Teco Electric & Machinery Co., Ltd. (Taiwan)

- Hitachi, Ltd. (Japan)

- Baldor Electric Company (U.S.)

- Danfoss A/S (Denmark)

- Leroy-Somer (France)

- Marathon Electric (U.S.)

What are the Recent Developments in Global Induction Motors Market?

- In February 2024, ABB launched the world’s first liquid-cooled IE5 SynRM motor, marking a major leap in industrial motor technology. This next-generation synchronous reluctance motor integrates ultra-premium IE5 energy efficiency with advanced liquid cooling—previously exclusive to induction motors. The innovation sets a new benchmark for power density and reliability, especially in space-constrained, high-demand environments such as marine, plastics, and food processing. With 40% lower energy losses than IE3 motors, it significantly reduces operating costs and environmental impact. Its compact, fanless design also minimizes noise and maintenance, making it ideal for modern, sustainable industrial applications

- In July 2023, Ideal Electric made a strategic move by acquiring the Louis Allis Large Synchronous Machines and Large Induction Motors product lines. This acquisition, though undisclosed in financial terms, significantly broadens Ideal’s portfolio and strengthens its presence in the large motor segment. Alongside the product lines, Ideal also gained rights to intellectual property from legacy brands such as Beloit Power Systems, Fairbanks Morse, and Colt Industries. The deal enhances Ideal’s ability to serve industrial and government clients with new machines, upgrades, and support—reinforcing its role as a key player in the U.S. electric machinery market

- In June 2023, ABB introduced the AMI 5800 NEMA modular induction motor, a next-generation solution engineered for high-demand industrial applications such as pumps, compressors, fans, extruders, conveyors, and crushers. Designed specifically for the North American market, it combines exceptional energy efficiency with robust reliability. The motor features a high-strength welded steel frame to reduce stress and vibration, ensuring a long service life even in harsh environments. Its modular design allows for flexible customization, making it ideal for both new installations and upgrades. The AMI 5800 meets or exceeds NEMA standards, offering a compact, high-performance solution for critical operations

- In August 2022, WEG acquired the Motion Control Business Unit of Gefran S.p.A. for approximately €23 million. This strategic move included subsidiaries and operations in Italy, Germany, China, and India, significantly expanding WEG’s global manufacturing footprint and product offerings. The acquisition enhances WEG’s capabilities in variable frequency drives, DC converters, and servo drives, aligning with its goal to strengthen its presence in the European market and accelerate international growth. For Gefran, the sale supports a renewed focus on its core businesses in sensors and automation components

- In June 2022, Nidec Corporation launched SynRA, a groundbreaking synchronous reluctance motor with an aluminum cage rotor, tailored for the U.S. market. This innovative motor merges the high efficiency of SR motors with the simplicity and robustness of cage-type induction motors. Certified to achieve IE5 efficiency, SynRA operates with minimal energy loss and requires only a basic V/F open-loop control—unlike traditional SR motors that demand complex vector control. Its design eliminates the need for magnets, reducing cost and temperature sensitivity, while offering plug-and-play compatibility with existing systems. SynRA is ideal for fans, pumps, compressors, and other industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.