Global Inductively Coupled Plasma Mass Spectroscopy Market

Market Size in USD Million

CAGR :

%

USD

447.91 Million

USD

684.29 Million

2025

2033

USD

447.91 Million

USD

684.29 Million

2025

2033

| 2026 –2033 | |

| USD 447.91 Million | |

| USD 684.29 Million | |

|

|

|

|

Inductively Coupled Plasma Mass Spectroscopy Market Size

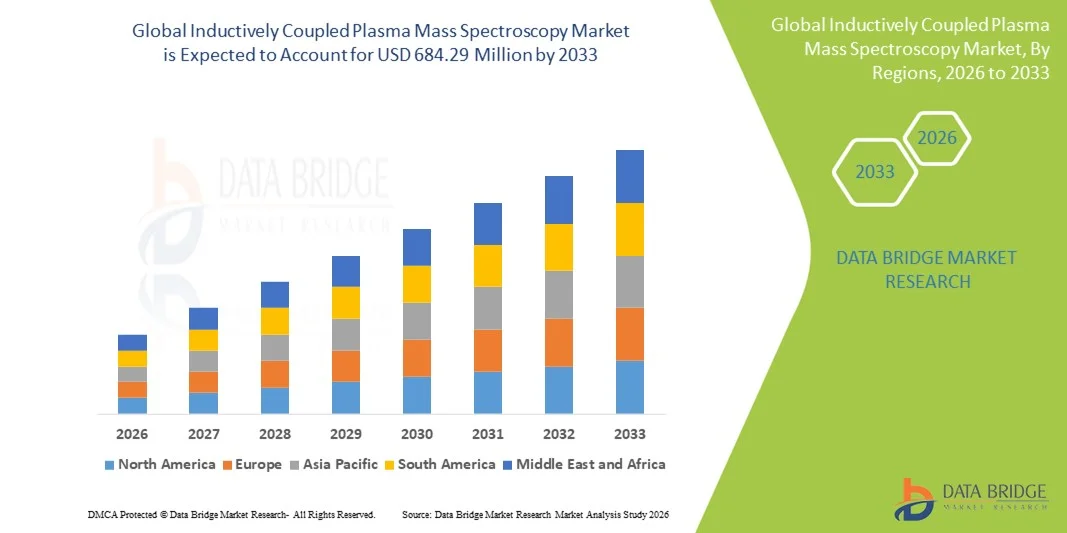

- The global inductively coupled plasma mass spectroscopy market size was valued at USD 447.91 million in 2025 and is expected to reach USD 684.29 million by 2033, at a CAGR of 5.44% during the forecast period

- The market growth is largely fueled by the rising utilization of high-precision elemental analysis across sectors such as environmental testing, pharmaceuticals, food safety, and semiconductor manufacturing, supported by advancements in analytical instrumentation and automation technologies

- Furthermore, the growing demand for sensitive, reliable, and ultra-trace detection solutions in compliance-driven industries is establishing ICP-MS as a preferred analytical technique worldwide. These converging factors are accelerating the adoption of ICP-MS systems, thereby significantly boosting the industry’s growth

Inductively Coupled Plasma Mass Spectroscopy Market Analysis

- Inductively coupled plasma mass spectroscopy, a high-precision analytical technique for ultra-trace elemental and isotopic detection, is becoming a critical tool across environmental testing, pharmaceuticals, food safety, and semiconductor manufacturing due to its exceptional sensitivity, accuracy, and ability to analyze complex samples

- The escalating demand for inductively coupled plasma mass spectroscopy is primarily fueled by stringent regulatory standards for contaminant monitoring, increasing adoption of robust quality-control processes across industrial sectors, and a rising preference for rapid, highly sensitive analytical solutions driven by technological advancements in spectroscopy instrumentation

- North America dominated the inductively coupled plasma mass spectroscopy market with the largest revenue share of 38.7% in 2025, supported by strong investments in environmental compliance testing, advanced pharmaceutical R&D activities, and the presence of leading analytical instrument manufacturers, with the U.S. showing substantial adoption across water testing labs, semiconductor facilities, and biopharma research centers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to expanding industrialization, growing environmental pollution monitoring programs, and increased government funding for laboratory infrastructure and scientific research

- The Single Quadrupole ICP-MS Spectrometer segment dominated the inductively coupled plasma mass spectroscopy market with a market share of 46.5% in 2025, driven by its cost-effectiveness, versatility, and widespread use in routine elemental analysis across environmental laboratories, food quality agencies, and academic institutions

Report Scope and Inductively Coupled Plasma Mass Spectroscopy Market Segmentation

|

Attributes |

Inductively Coupled Plasma Mass Spectroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Inductively Coupled Plasma Mass Spectroscopy Market Trends

Advancement in AI-Driven Data Processing and Workflow Automation

- A significant and accelerating trend in the global inductively coupled plasma mass spectroscopy market is the increasing integration of AI-based data analytics and automated workflow solutions, enhancing precision, throughput, and efficiency across laboratories engaged in elemental and isotopic analysis

- For instance, leading analytical instrument providers are incorporating automated sample introduction systems and AI-enhanced calibration tools that minimize human error and streamline complex testing workflows in high-volume environmental and pharmaceutical laboratories

- AI integration in inductively coupled plasma mass spectroscopy enables capabilities such as automated interference correction, improved signal stability prediction, and intelligent diagnostic alerts. For instance, some advanced ICP-MS platforms use machine learning algorithms to optimize plasma conditions and detect abnormal instrument behavior before performance issues arise

- The seamless combination of ICP-MS instruments with laboratory information management systems (LIMS) and automated sample preparation robots enables centralized control of analytical workflows. Through a single digital interface, labs can manage sample tracking, data validation, and result reporting, significantly improving operational efficiency

- This trend toward more intelligent, intuitive, and fully automated analytical systems is reshaping expectations for laboratory performance. Consequently, companies such as Agilent Technologies and Thermo Fisher Scientific are developing AI-enabled ICP-MS systems with automated method setup and enhanced self-diagnostic capabilities

- The demand for inductively coupled plasma mass spectroscopy systems featuring advanced automation, AI-supported data interpretation, and integrated digital connectivity is growing rapidly across environmental, semiconductor, and pharmaceutical sectors seeking high-throughput and reliable trace analysis

Inductively Coupled Plasma Mass Spectroscopy Market Dynamics

Driver

Rising Global Demand for Ultra-Trace Analysis Across Regulated Industries

- The increasing prevalence of strict regulatory standards across environmental, pharmaceutical, food safety, and semiconductor industries is a major driver accelerating the demand for inductively coupled plasma mass spectroscopy systems

- For instance, in 2025, several environmental monitoring agencies strengthened guidelines for heavy metal and PFAS detection in water and soil, prompting laboratories to adopt high-sensitivity ICP-MS instruments capable of meeting ultra-low detection limits

- As industries face growing pressure to comply with contaminant monitoring and quality assurance requirements, ICP-MS offers advanced features such as multi-element detection, isotopic ratio analysis, and rapid sample throughput, providing a superior alternative to conventional analytical methods

- Furthermore, the rising need for accurate elemental testing in pharmaceutical impurity profiling and semiconductor manufacturing is making ICP-MS an essential component of analytical workflows across global laboratories

- The convenience of automated sample handling, remote instrument monitoring, and streamlined data management through software platforms are key factors propelling the adoption of ICP-MS systems across academic, industrial, and governmental sectors. The shift toward digital laboratories and the availability of user-friendly automated ICP-MS solutions also support market expansion

Restraint/Challenge

High Instrument Costs and Strict Calibration & Regulatory Compliance Requirements

- The high upfront cost of advanced ICP-MS instruments and the ongoing expenses associated with consumables, maintenance, and calibration present a significant challenge to broader adoption, particularly for small laboratories and institutions with limited budgets

- For instance, regulatory frameworks governing pharmaceutical elemental impurity testing and environmental contamination analysis require frequent validation, calibration, and documentation, increasing operational burden and complexity for laboratories using ICP-MS

- In addition, concerns surrounding complex instrument operation, matrix interferences, and the need for skilled personnel may hinder adoption in labs lacking specialized analytical expertise. Some facilities remain hesitant due to the technical challenges associated with maintaining consistent performance

- Addressing these issues through user-friendly software interfaces, robust interference-removal technologies, and simplified calibration workflows is crucial for enhancing accessibility. Companies such as PerkinElmer and Shimadzu are developing ICP-MS systems with automated tuning and stability optimization to support less experienced operators

- While technological advancements are reducing operational complexity, the perceived premium investment required for ICP-MS continues to limit adoption among cost-sensitive laboratories, especially in developing regions or small academic institutions

- Overcoming these challenges through affordable models, advanced automation, and improved regulatory support tools will be essential for accelerating global uptake of inductively coupled plasma mass spectroscopy systems

Inductively Coupled Plasma Mass Spectroscopy Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the inductively coupled plasma mass spectroscopy market is segmented into single quadrupole ICP-MS spectrometer, triple quadrupole ICP-MS spectrometer, and others. The single quadrupole ICP-MS spectrometer segment dominated the market with the largest market revenue share of 46.5% in 2025, driven by its cost-effective nature and suitability for routine multi-element analysis across environmental, academic, and food testing laboratories. Single quadrupole systems remain the preferred choice for laboratories seeking reliable detection capability without the higher investment required for advanced multi-quadrupole platforms. Their established performance, ease of operation, and compatibility with a wide range of sample types continue to strengthen adoption. The market also witnesses strong demand for single quadrupole ICP-MS due to advancements in interference-reduction technologies and automated analytical workflows that enhance both accuracy and efficiency. Furthermore, their broad applicability in regulatory testing environments contributes significantly to this segment’s dominance.

The triple quadrupole ICP-MS spectrometer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its exceptional selectivity, sensitivity, and ability to handle complex sample matrices with minimal spectral interference. These systems are increasingly adopted in semiconductor fabrication, pharmaceutical impurity profiling, and advanced environmental monitoring where ultra-trace detection is critical. Their growing popularity is supported by the rise in global regulatory requirements that demand higher analytical precision and method reliability. Furthermore, triple quadrupole systems offer enhanced analytical flexibility, making them ideal for specialized isotopic studies and high-purity material testing. The segment's growth is also driven by expanding R&D investments and increasing automation in testing laboratories worldwide.

- By Application

On the basis of application, the inductively coupled plasma mass spectroscopy market is segmented into pharmaceutical industry, environmental analysis, metallurgical, semiconductor, and others. The environmental analysis segment dominated the market with the largest revenue share in 2025, driven by stringent global regulations for water quality, air particulate analysis, and soil contamination monitoring. ICP-MS is widely adopted for its ability to detect ultra-trace levels of toxic metals such as arsenic, lead, and mercury with high precision and reliability. Increasing industrial pollution and expanding government surveillance programs have further intensified the need for advanced analytical technologies. The segment benefits from global investments aimed at enhancing environmental testing infrastructure across both developed and developing regions. Moreover, rising focus on emerging contaminants such as PFAS has strengthened the role of ICP-MS as the preferred analytical tool for environmental compliance.

The semiconductor segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the rising need for ultra-trace metal analysis in advanced chip manufacturing processes. Semiconductor fabrication requires detection of impurities at ppt and sub-ppt levels, making ICP-MS an indispensable instrument for process chemicals, ultrapure water, and materials quality analysis. Growing expansion of semiconductor production in the U.S., Taiwan, South Korea, and Japan is significantly increasing demand for high-performance ICP-MS systems. In addition, the shift toward 5 nm and smaller technology nodes is accelerating adoption of triple quadrupole ICP-MS for interference-free quantification. Increasing investment in electric vehicles, renewable energy systems, and wide-bandgap semiconductor materials is also contributing to rapid segment growth.

Inductively Coupled Plasma Mass Spectroscopy Market Regional Analysis

- North America dominated the inductively coupled plasma mass spectroscopy market with the largest revenue share of 38.7% in 2025, supported by strong investments in environmental compliance testing, advanced pharmaceutical R&D activities, and the presence of leading analytical instrument manufacturers

- Laboratories in the region prioritize accuracy, high sensitivity, and ultra-trace detection capabilities, making ICP-MS the preferred analytical tool for regulatory compliance, quality control, and research applications

- This widespread adoption is further supported by the presence of leading analytical instrument manufacturers, well-established research infrastructure, and a technologically advanced scientific community, establishing ICP-MS systems as a critical solution across environmental, semiconductor, and pharmaceutical sectors

U.S. Inductively Coupled Plasma Mass Spectroscopy Market Insight

The U.S. ICP-MS market captured the largest revenue share of 79% in 2025 within North America, fueled by significant investments in environmental monitoring, pharmaceutical R&D, and semiconductor fabrication. Laboratories are increasingly prioritizing high-sensitivity, ultra-trace elemental analysis for regulatory compliance and quality control. The growing adoption of automated workflows, AI-based data processing, and integration with laboratory information management systems further propels the ICP-MS market. Moreover, the expansion of high-tech manufacturing, stringent regulatory requirements, and the presence of leading analytical instrument manufacturers significantly contribute to market growth.

Europe Inductively Coupled Plasma Mass Spectroscopy Market Insight

The Europe ICP-MS market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations for environmental testing, food safety, and pharmaceutical quality assurance. Rising urbanization, increasing laboratory infrastructure investments, and the growing focus on advanced research are fostering the adoption of ICP-MS systems. European laboratories are also attracted to the high precision, multi-element detection capabilities, and automation features offered by modern ICP-MS instruments. The market sees significant growth across environmental, pharmaceutical, and semiconductor applications, with instruments being incorporated into both new laboratory setups and renovation projects.

U.K. Inductively Coupled Plasma Mass Spectroscopy Market Insight

The U.K. ICP-MS market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of advanced analytical instrumentation and a focus on ultra-trace elemental testing in regulatory and research environments. Concerns regarding environmental compliance, pharmaceutical quality, and industrial contamination are encouraging laboratories to invest in ICP-MS technology. The U.K.’s well-established research infrastructure, high laboratory automation adoption, and emphasis on technological advancement are expected to continue to stimulate market growth.

Germany Inductively Coupled Plasma Mass Spectroscopy Market Insight

The Germany ICP-MS market is expected to expand at a considerable CAGR during the forecast period, fueled by strong government support for research and development, growing environmental monitoring initiatives, and rising demand for precision analytical solutions. Germany’s focus on innovation and sustainability promotes the adoption of ICP-MS instruments, particularly in pharmaceutical, environmental, and semiconductor laboratories. The integration of automation, AI-assisted data processing, and high-throughput workflows is becoming increasingly prevalent, with laboratories favoring robust, accurate, and compliance-ready ICP-MS systems.

Asia-Pacific Inductively Coupled Plasma Mass Spectroscopy Market Insight

The Asia-Pacific ICP-MS market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by rapid industrialization, increasing laboratory infrastructure, and growing demand for high-sensitivity elemental analysis in countries such as China, Japan, and India. Government initiatives promoting research, quality assurance, and environmental monitoring are accelerating ICP-MS adoption. Furthermore, the region is emerging as a hub for ICP-MS instrument manufacturing and assembly, making systems more accessible and affordable to a wider laboratory base.

Japan Inductively Coupled Plasma Mass Spectroscopy Market Insight

The Japan ICP-MS market is gaining momentum due to the country’s strong focus on advanced manufacturing, semiconductor quality control, and pharmaceutical research. Japanese laboratories emphasize precision, reliability, and high-throughput analysis, driving the adoption of ICP-MS systems. The integration of instruments with laboratory automation, data analytics, and IoT-based monitoring enhances productivity and ensures compliance with regulatory standards. Moreover, increasing government research funding and the growing number of specialized analytical laboratories are supporting market expansion.

India Inductively Coupled Plasma Mass Spectroscopy Market Insight

The India ICP-MS market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding research and industrial base, rapid urbanization, and increasing adoption of advanced analytical techniques. India is witnessing significant growth in environmental testing, pharmaceutical quality control, and semiconductor process monitoring. The development of smart laboratories, availability of cost-effective ICP-MS instruments, and strong domestic manufacturing support are key factors propelling the market in India.

Inductively Coupled Plasma Mass Spectroscopy Market Share

The Inductively Coupled Plasma Mass Spectroscopy industry is primarily led by well-established companies, including:

- Agilent Technologies (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- Shimadzu Corporation (Japan)

- Elemental Scientific Inc. (U.S.)

- Analytik Jena GmbH+Co. KG (Germany)

- Bruker Corporation (U.S.)

- GBC Scientific Equipment Pty Ltd (Australia)

- Nu Instruments Ltd (U.K.)

- Spectro Analytical Instruments GmbH (Germany)

- Skyray Instrument Inc. (China)

- HORIBA, Ltd. (Japan)

- JEOL Ltd. (Japan)

- Teledyne Leeman Labs (U.S.)

- Rigaku Corporation (Japan)

- Advion, Inc. (U.S.)

- Hitachi High‑Technologies Corporation (Japan)

- Aurora Biomed (Canada)

- Expec Technology (FPI) (China)

What are the Recent Developments in Global Inductively Coupled Plasma Mass Spectroscopy Market?

- In July 2025, SPECTRO Analytical Instruments launched the SPECTROGREEN MS a new quadrupole ICP‑MS spectrometer built for high‑performance, routine trace‑level elemental analysis across environmental, pharmaceutical, food safety, and industrial labs. The instrument boasts a high-matrix interface, advanced collision/reaction cell technology, robust interference control, and streamlined workflows, aiming to deliver strong sensitivity and stability even with complex samples

- In October 2024, Thermo Fisher Scientific launched the new Thermo Scientific iCAP MX Series ICP-MS, which includes a single‑quadrupole (iCAP MSX) and a triple‑quadrupole (iCAP MTX) ICP‑MS. The new series is designed to simplify trace‑element analysis and improve analytic performance even for challenging high‑matrix samples expanding capabilities for environmental, food safety, industrial and research labs globally

- In April 2024, PerkinElmer introduced the NexION 1100 ICP-MS at Analytica 2024. The NexION 1100 offers a “single‑analyzer three‑quad” design with simplified interference removal, lower maintenance requirements, and modernized user workflow, aimed at improving ease-of-use and operational uptime for labs conducting trace-elemental analysis

- In September 2022, Agilent Technologies released a significant software upgrade ICP‑MS MassHunter 5.2 enhancing nanoparticle (NP) analysis capabilities by allowing acquisition of virtually unlimited elements in a single visit to the sample vial. This expanded the analytical versatility of single‑ and triple‑quadrupole ICP‑MS systems, enabling more comprehensive multi‑element detection

- In March 2021, Agilent introduced the Agilent 7850 ICP-MS system, designed to streamline workflow and reduce common “time traps” in ICP‑MS analysis. The 7850 ICP‑MS combines robust performance with smart software tools for easier method setup, sample prep, interference correction, and data review making ICP‑MS more accessible even to less experienced labs and helping to increase throughput

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.