Global Inductor Market

Market Size in USD Billion

CAGR :

%

USD

4.68 Billion

USD

6.35 Billion

2024

2032

USD

4.68 Billion

USD

6.35 Billion

2024

2032

| 2025 –2032 | |

| USD 4.68 Billion | |

| USD 6.35 Billion | |

|

|

|

|

Inductor Market Size

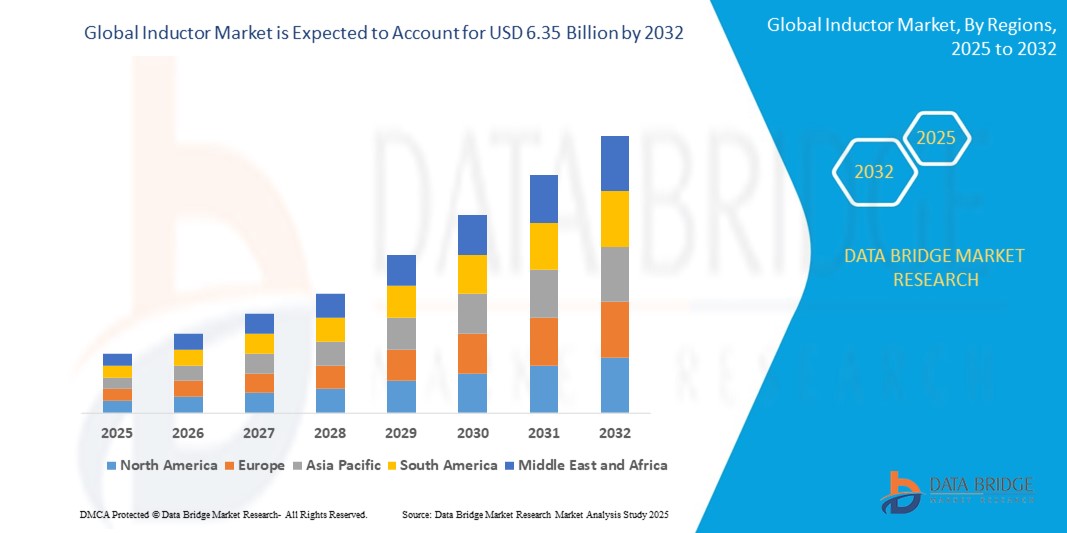

- The global Inductor market size was valued at USD 4.68 billion in 2024 and is expected to reach USD 6.35 billion by 2032, at a CAGR of 3.90% during the forecast period

- This growth is driven by the increasing demand for consumer electronics, the rise of electric vehicles (EVs), and the expansion of 5G and IoT applications requiring efficient power management solutions

Inductor Market Analysis

- The Inductor market encompasses passive electronic components that store energy in a magnetic field, used in power management, signal filtering, and energy storage across applications like consumer electronics, automotive systems, and telecommunications.

- The demand for inductors is significantly driven by the proliferation of consumer electronics, with global smartphone shipments reaching 1.4 billion units in 2024, and the growth of EVs, with 6.6 million units sold globally in 2021, doubling from the previous year.

- Asia-Pacific is expected to dominate the Inductor market due to its robust electronics manufacturing sector, holding a 37.0% market share in 2023.

- North America is expected to be the second-largest market, driven by industrial automation and high adoption of smartphones and tablets, with a 28.9% share in 2023.

- The Consumer Electronics segment is expected to dominate the market with a market share of 36.5% in 2025 due to the critical role of inductors in power regulation and signal filtering in devices like smartphones and wearables.

Report Scope and Inductor Market Segmentation

|

Attributes |

Inductor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Inductor Market Trends

“Adoption of Multilayer Inductors in Miniaturized Electronics”

- A prominent trend in the Inductor market is the increasing adoption of multilayer inductors, which are projected to reach USD 3.2 billion by 2032, driven by their compact size, high inductance, and suitability for surface-mount technology in smartphones and wearables.

- These inductors support the trend toward miniaturization, with 60% of consumer electronics manufacturers adopting multilayer inductors for compact circuit designs by 2024.

- For instance, in January 2024, TDK Corporation launched the KLZ2012-A series of multilayer inductors for automotive audio bus applications, offering high durability and inductance tolerance.

- This trend is driving demand for high-performance, space-efficient inductors in advanced communication systems and RF modules.

Inductor Market Dynamics

“Rising Demand for Consumer Electronics and Electric Vehicles”

- The increasing adoption of consumer electronics, with global online sales projected to reach USD 540 billion by 2027, and the continued surge in EV demand—electric vehicle sales surpassed 14 million units globally in 2023 (up from 6.6 million in 2021)—are significantly contributing to the growth of the inductor market.

- Inductors play a critical role in power regulation, voltage conversion, and signal filtering, improving device and system efficiency by up to 15% in automotive and high-performance consumer electronics.

-

For instance, in March 2024, TDK Corporation launched a new series of automotive-grade power inductors (CLT32 series) designed for ADAS and battery management systems, supporting high current and low DC resistance for compact EV designs.

-

- As global consumer demand increases for smartphones, wearables, EVs, and power electronics, the need for advanced inductors is projected to grow significantly, ensuring efficient power distribution and energy-saving capabilities.

Opportunity

“Expansion of 5G Networks and IoT Devices”

- The ongoing global rollout of 5G—with 675 million connections expected by 2025—and the rapid growth of the Internet of Things (IoT), projected to reach 18.8 billion connected devices by 2025, is creating vast opportunities for high-frequency, low-loss RF and power inductors.

- These inductors are crucial for high-speed data transmission, EMI suppression, and efficient power management in 5G infrastructure and compact IoT sensors.

- For example, in October 2023, Murata Manufacturing Co., Ltd. partnered with a major Asian telecom operator to provide miniaturized RF inductors for next-generation 5G base stations and edge devices.

- This trend is enabling the development of compact and energy-efficient inductive components that support scalable 5G deployments and low-power IoT ecosystems, boosting market growth across telecom and industrial segments.

Restraint / Challenge

“Raw Material Price Volatility and Miniaturization Complexity”

- The inductor market faces challenges due to fluctuating raw material prices—copper prices rose by over 20% in 2024, with 40% of manufacturers citing material costs as a key concern. Additionally, the trend toward miniaturization creates engineering complexity, particularly in maintaining thermal stability and inductance accuracy in compact designs.

-

For instance, Taiyo Yuden reported in 2024 that over 35% of their R&D efforts were focused on overcoming challenges related to compact multilayer inductor fabrication for ultra-thin consumer devices.

-

- Moreover, a 2024 industry survey revealed that 30% of small and medium-sized enterprises (SMEs) struggled with dimensional tolerances and performance degradation during the miniaturization process, impacting production efficiency and cost.

- These constraints demand significant investment in advanced materials, nano-fabrication, and design simulation technologies, potentially increasing product costs and slowing adoption in cost-sensitive markets.

Inductor Market Scope

The market is segmented on the basis type, core type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Core Type |

|

|

By Application |

|

In 2025, the Consumer Electronics segment is projected to dominate the market with the largest share in the application segment.

The Consumer Electronics segment is expected to dominate the Inductor market with the largest share of 56.22% in 2025 due to rising demand for smartphones, tablets, laptops, and wearables. Inductors are essential in these devices for filtering, power management, and energy storage. Rapid technological advancements, growing disposable income, and global 5G deployment are driving consumption of compact and high-efficiency electronic devices. For instance, the increasing integration of power inductors in fast-charging modules and wireless devices is further accelerating segment growth.

The Fixed Inductors segment is expected to account for the largest share during the forecast period in the type segment.

In 2025, the Fixed Inductors segment is expected to dominate the market with the largest market share of 51.31%, owing to their widespread use in power supplies, RF circuits, and signal processing across various industries. Fixed inductors offer high reliability, cost-effectiveness, and stability, making them ideal for consumer electronics, automotive systems, and industrial applications. The demand for miniaturized, surface-mount fixed inductors is growing as manufacturers aim to reduce board space while maintaining performance, particularly in mobile devices and wearables.

Inductor Market Regional Analysis

“North America Holds the Largest Share in the Inductor Market"

- North America dominates the Inductor market, driven by strong demand from consumer electronics, automotive, and defense industries, as well as a robust presence of key market players such as Vishay Intertechnology, Coilcraft, and TDK Corporation.

- The U.S. holds a significant share owing to the widespread use of inductors in smartphones, wearables, EVs, medical devices, and aerospace systems. High R&D investment and early adoption of new technologies such as 5G and electric mobility further contribute to market expansion.

- Government initiatives supporting advanced manufacturing and electronic component production, alongside collaborations between OEMs and component manufacturers, continue to strengthen the region’s position in the global inductor market.

- Additionally, the rising integration of high-frequency inductors in power electronics and signal processing systems is propelling regional demand across both consumer and industrial sectors.

“Asia-Pacific is Projected to Register the Highest CAGR in the Inductor Market”

- The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, driven by expanding consumer electronics production, increasing EV penetration, and large-scale adoption of 5G and IoT infrastructure.

- Countries like China, Japan, South Korea, and India are key markets due to their well-established electronics manufacturing ecosystems and increasing domestic demand.

- Japan and South Korea continue to lead in innovation and miniaturization of inductive components, with companies such as Murata, Taiyo Yuden, and Samsung Electro-Mechanics investing in next-generation inductor technologies.

- China and India are experiencing rapid growth due to government-backed initiatives such as “Make in India” and China’s 14th Five-Year Plan, which prioritize local production of electronic components and renewable energy systems—both major end-use areas for inductors.

Inductor Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TDK Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Vishay Intertechnology, Inc. (U.S.)

- Taiyo Yuden Co., Ltd. (Japan)

- Coilcraft, Inc. (U.S.)

- Delta Electronics, Inc. (Taiwan)

- Panasonic Corporation (Japan)

- Pulse Electronics (Yageo Corporation) (U.S.)

- Sumida Corporation (Japan)

- KYOCERA AVX Components Corporation (U.S.)

Latest Developments in Global Inductor Market

- In March 2025, TDK Corporation announced the launch of its CLT32 series power inductors, optimized for automotive applications including Advanced Driver-Assistance Systems (ADAS) and power management in Electric Vehicles (EVs). These inductors offer high current capability and compact design, ideal for space-constrained automotive environments.

- In January 2025, Murata Manufacturing Co., Ltd. introduced a new series of multilayer chip inductors (LQG series) for 5G and Wi-Fi 6E applications, designed to meet growing demand for compact, high-frequency components in next-generation wireless communication devices

- In November 2024, Vishay Intertechnology expanded its IHLE® series of low-profile, high-current inductors with integrated e-shields to reduce EMI. These are targeted at automotive under-the-hood applications, improving reliability and performance in harsh environments.

- In October 2024, Coilcraft Inc. unveiled the XAL7050 Series, a family of high-performance shielded power inductors for DC-DC converters in high-frequency applications such as laptops, gaming consoles, and industrial control units. These components offer a low DCR and high saturation current.

- In September 2024, Taiyo Yuden Co., Ltd. announced the expansion of its MCOIL™ line of metal power inductors, introducing ultra-compact models to meet rising demand for slim, high-performance mobile devices and wearables. The new inductors deliver stable performance even under high currents and temperatures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inductor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inductor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inductor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.