Global Industrial Absorbents Market

Market Size in USD Billion

CAGR :

%

USD

4.63 Billion

USD

8.39 Billion

2024

2032

USD

4.63 Billion

USD

8.39 Billion

2024

2032

| 2025 –2032 | |

| USD 4.63 Billion | |

| USD 8.39 Billion | |

|

|

|

|

Industrial Absorbents Market Size

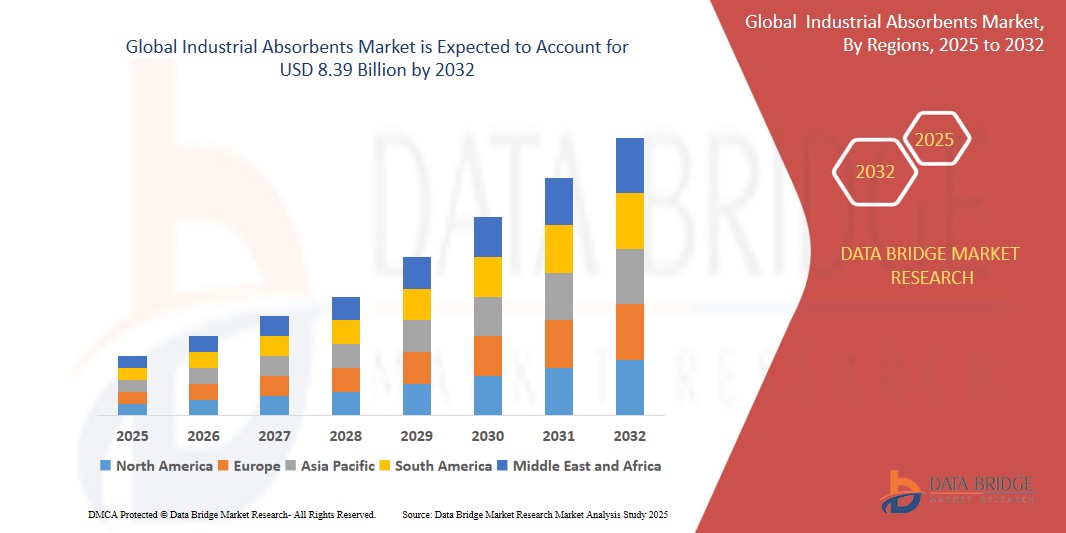

- The global industrial absorbents market size was valued at USD 4.63 billion in 2024 and is expected to reach USD 8.39 billion by 2032, at a CAGR of 7.72% during the forecast period

- This growth is driven by factors such as stringent environmental regulations, rapid industrialization, and increased awareness of environmental protection

Industrial Absorbents Market Analysis

- Industrial absorbents are products used to manage and contain spills, especially liquids such as oil, chemicals, and water-based substances. They play a vital role in ensuring workplace safety, protecting the environment, and complying with regulatory standards across various industries

- The market is experiencing steady growth, driven by increasing industrial activities, stringent environmental regulations, advancements in absorbent technologies, and growing awareness of environmental sustainability and spill management

- North America is expected to dominate the industrial absorbents market due to its established industries, advanced spill management technologies, and strong regulatory frameworks supporting environmental protection

- Asia-Pacific is expected to be the fastest growing region in the industrial absorbents market during the forecast period due to rapid industrialization, increasing demand for spill management solutions, and the growing awareness of environmental sustainability

- Synthetic segment is expected to dominate the market due to its high fluid absorption capacity, non-flammability, durability, and water repellency. These properties make synthetic materials ideal for industries such as oil & gas, chemical, and food processing, driving their growing demand for efficient spill management solutions

Report Scope and Industrial Absorbents Market Segmentation

|

Attributes |

Industrial Absorbents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Absorbents Market Trends

“Increasing Adoption of Synthetic Absorbent Materials”

- One prominent trend in the global industrial absorbents market is the increasing adoption of synthetic absorbent materials

- This trend is driven by the need for more efficient, durable, and versatile absorbents capable of handling a wide range of industrial spills, including oil, chemicals, and hazardous substances

- For instance, industries across North America and Asia-Pacific are increasingly utilizing polypropylene-based absorbents due to their high absorption capacity, water repellency, and non-flammability

- The shift toward synthetic materials is also driving innovation in absorbent design, leading to lighter, more cost-effective, and environmentally friendly products

- As industries prioritize rapid spill response, environmental compliance, and workplace safety, the growing use of synthetic absorbents is expected to play a key role in market expansion from 2025 to 2032

Industrial Absorbents Market Dynamics

Driver

“Growing Environmental Concerns and Regulations”

- The tightening of global environmental regulations is a major driver for the industrial absorbents market, as industries face increasing pressure to prevent and manage spills effectively

- This shift is especially evident in sectors such as oil & gas, chemicals, and manufacturing, where compliance with pollution control standards is essential for operations

- Rising awareness of the environmental impact of industrial spills is prompting companies to adopt advanced absorbent materials that ensure faster, safer, and more efficient containment

- In response, manufacturers are introducing eco-friendly and high-performance absorbents, particularly synthetic variants, that meet both regulatory requirements and sustainability goals

- The growing emphasis on corporate social responsibility and environmental sustainability is further pushing companies to proactively invest in effective spill control solutions

For instance,

- U.S. Environmental Protection Agency (EPA) enforces the Clean Water Act, which mandates proper spill control measures, driving demand for industrial absorbents across American industries

- In Europe, REACH and other environmental directives require strict chemical handling protocols, pushing industries to invest in reliable absorbent solutions for compliance and safety

- As governments strengthen environmental enforcement and companies prioritize sustainable operations, regulatory pressure and environmental responsibility will remain key growth drivers in the industrial absorbents market

Opportunity

“Emergence of Biodegradable Industrial Absorbents”

- Growing environmental awareness and regulatory pressures are encouraging the shift toward sustainable spill control solutions, driving interest in biodegradable industrial absorbents

- Manufacturers are exploring plant-based and recycled materials that offer effective absorption while minimizing environmental impact and disposal issues

- These eco-friendly products align with corporate sustainability goals and appeal to industries aiming to enhance their green credentials and meet evolving compliance standards

For instance,

- Companies such as New Pig and EcoSolutions are developing biodegradable absorbent lines made from cellulose and recycled fibers, targeting industries focused on green operations

- Startups in Europe are innovating with agricultural waste-based absorbents, combining spill control effectiveness with compostable, zero-waste solutions

- As environmental priorities gain momentum, the emergence of biodegradable industrial absorbents is expected to create strong growth potential and reshape product strategies across the market

Restraint/Challenge

“Reducing Large Oil Spills”

- The declining frequency of large-scale oil spill incidents, due to improved safety protocols and advanced prevention technologies, poses a challenge for the industrial absorbents market

- With fewer major spills occurring, the demand for bulk absorbent materials in the oil & gas sector is diminishing, affecting overall market volume and growth potential

- This challenge is especially relevant in regions with strict spill prevention regulations, where investment is shifting from reactive cleanup solutions to proactive spill avoidance technologies

For instance,

- The International Maritime Organization (IMO) mandates strict oil pollution prevention measures under MARPOL, encouraging operators to adopt prevention-first approaches over absorbent-based cleanup strategies

- As the industry focuses more on spill prevention than post-incident response, the reduced occurrence of large oil spills may slow market expansion in certain high-volume segments

Industrial Absorbents Market Scope

The market is segmented on the basis of material type, product, type, and end-use industry.

|

Segmentation |

Sub-Segmentation |

|

By Material Type |

|

|

By Product |

|

|

By Type |

|

|

By End-Use Industry

|

|

In 2025, the synthetic is projected to dominate the market with a largest share in material type segment

The synthetic segment is expected to dominate the industrial absorbents market in 2025 due to its high fluid absorption capacity, non-flammability, durability, and water repellency. These properties make synthetic materials ideal for industries such as oil & gas, chemical, and food processing, driving their growing demand for efficient spill management solutions.

The pads is expected to account for the largest share during the forecast period in product market

In 2025, the pads segment is expected to dominate the market due to their versatility, ease of use, and effectiveness in absorbing a wide range of liquids, including oils, chemicals, and water-based substances. Pads are widely used across industries such as oil & gas, chemical, and food processing, making them the go-to solution for spill control and cleanup.

Industrial Absorbents Market Regional Analysis

“North America Holds the Largest Share in the Industrial absorbents Market”

- North America dominates the industrial absorbents market, driven by the its established industries, advanced spill management technologies, and strong regulatory frameworks supporting environmental protection

- U.S. holds a significant share due to its large oil & gas, chemical, and manufacturing sectors, which rely heavily on effective absorbent solutions for spill containment and cleanup

- The region benefits from a robust network of manufacturers, suppliers, and research institutions that drive innovation, particularly in synthetic and eco-friendly absorbent solutions

- As North America continues to adopt advanced, high-performance absorbents for various industries, it is poised to maintain its dominant position in the market throughout the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Industrial absorbents Market”

- Asia-Pacific is expected to witness the highest growth rate in the industrial absorbents market, driven by rapid industrialization, increasing demand for spill management solutions, and the growing awareness of environmental sustainability

- China holds a significant share due to its expanding manufacturing, oil & gas, and chemical sectors, which are boosting the demand for absorbents in industries requiring efficient spill control measures

- The rise in industrial activities, coupled with government initiatives to enhance environmental protection and safety standards, is accelerating the adoption of advanced absorbent products across the region

- With improvements in local manufacturing capabilities, rising industrialization, and increasing investments in environmental protection, Asia-Pacific is set to emerge as the fastest-growing region in the industrial absorbents market from 2025 to 2032

Industrial Absorbents Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Ansell Ltd. (Australia)

- Johnson Matthey plc (U.K.)

- TOLSA (Spain)

- SHARE CORPORATION (U.S.)

- Brady Corporation (U.S.)

- Decorus Europe Ltd. (U.K.)

- New Pig Corporation (U.S.)

- Oil-Dri Corporation of America (U.S.)

- Meltblown Technologies Inc. (U.S.)

- Monarch Green, Inc. (U.S.)

Latest Developments in Global Industrial Absorbents Market

- In January 2024, Finite Fiber, a global leader in fiber and precision-cut fiber technology, launched PurAbsorb Industrial Super Absorbent, a breakthrough in 100% natural, high-absorption spill cleanup solutions. This innovation is expected to significantly influence the industrial absorbents market by driving demand for sustainable, high-performance products and reinforcing the industry's shift toward eco-friendly spill management technologies

- In September 2023, EarthSafe launched a new line of high-efficiency absorbents, a move set to enhance the industrial absorbents market by offering advanced solutions that improve spill containment and cleanup efficiency. This introduction is likely to drive market growth by addressing the increasing demand for more effective, environmentally friendly absorbent products across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Absorbents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Absorbents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Absorbents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.