Global Industrial And Commercial Floor Scrubbers Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

6.20 Billion

2025

2033

USD

4.20 Billion

USD

6.20 Billion

2025

2033

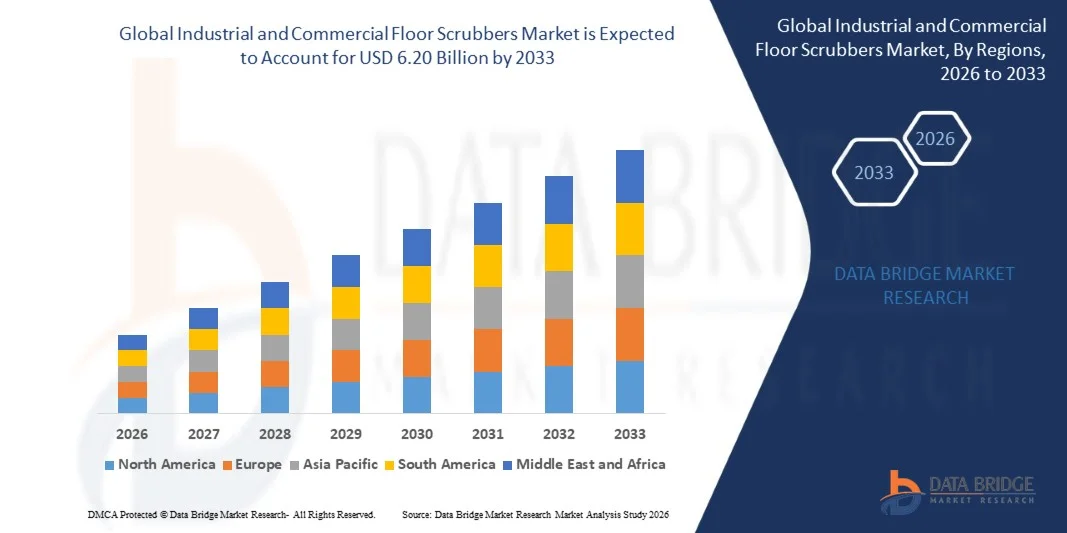

| 2026 –2033 | |

| USD 4.20 Billion | |

| USD 6.20 Billion | |

|

|

|

|

What is the Global Industrial and Commercial Floor Scrubbers Market Size and Growth Rate?

- The global industrial and commercial floor scrubbers market size was valued at USD 4.20 billion in 2025 and is expected to reach USD 6.20 billion by 2033, at a CAGR of5.00% during the forecast period

- Growing construction activities in commercial and residential sectors owing to the increasing population is a crucial factor accelerating the market growth, also rising rapid urbanization, increasing levels of consumer disposable income in developing countries, increasing modernization in the technology and design of industrial floor scrubbers with innovative features such as built-in GPS, Wi-Fi, performance data, maintenance alert among others and rising affordability, low maintenance cost and easy operation for small and confined spaces are the major factors among others boosting the industrial and commercial floor scrubbers market

What are the Major Takeaways of Industrial and Commercial Floor Scrubbers Market?

- Rising research and development activities in the market and rising emerging markets will further create new opportunities for industrial and commercial floor scrubbers market

- However, rising availability of low-cost manual labor in developing nations and floor scrubbers are interpreted to have an adverse impact on employment which acts as the major factors among others restraining the market growth, and will further challenge the industrial and commercial floor scrubbers market

- North America dominated the industrial and commercial floor scrubbers market with an estimated 35.9% revenue share in 2025, driven by widespread adoption of mechanized cleaning solutions across commercial buildings, warehouses, airports, healthcare facilities, and manufacturing plants in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by rapid urbanization, expansion of retail and commercial infrastructure, and rising investments in manufacturing and warehousing across China, India, Japan, South Korea, and Southeast Asia

- The Walk-Behind Scrubbers segment dominated the market with a 44.7% share in 2025, driven by their cost-effectiveness, compact design, and ease of operation across small to mid-sized commercial spaces

Report Scope and Industrial and Commercial Floor Scrubbers Market Segmentation

|

Attributes |

Industrial and Commercial Floor Scrubbers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial and Commercial Floor Scrubbers Market?

“Increasing Shift Toward Compact, High-Productivity, and Smart Industrial and Commercial Floor Scrubbers”

- The industrial and commercial floor scrubbers market is witnessing strong adoption of compact, battery-powered, and high-efficiency scrubbers designed to improve cleaning performance in space-constrained commercial and industrial environments

- Manufacturers are introducing high-speed, autonomous, and sensor-enabled scrubbers equipped with advanced navigation, adjustable brush pressure, and optimized water and detergent usage

- Growing demand for cost-efficient, lightweight, and easy-to-maneuver cleaning equipment is driving adoption across warehouses, retail stores, hospitals, airports, and manufacturing facilities

- For instance, companies such as Tennant Company, Kärcher, Hako, and Nilfisk have launched ride-on, walk-behind, and robotic scrubbers with improved runtime, intelligent controls, and data-driven cleaning insights

- Increasing focus on operational efficiency, reduced labor dependency, and consistent cleaning quality is accelerating the shift toward smart and automated floor scrubbers

- As facilities prioritize hygiene, productivity, and sustainability, Industrial and Commercial Floor Scrubbers will remain critical for large-scale, high-frequency cleaning operations

What are the Key Drivers of Industrial and Commercial Floor Scrubbers Market?

- Rising demand for efficient, time-saving, and labor-reducing cleaning solutions to maintain hygiene standards across commercial and industrial facilities

- For instance, in 2024–2025, leading manufacturers such as Tennant, Kärcher, and Fimap expanded their product portfolios with energy-efficient, low-noise, and autonomous floor scrubbers

- Growing expansion of warehousing, logistics centers, retail chains, healthcare facilities, and manufacturing plants across the U.S., Europe, and Asia-Pacific is boosting equipment demand

- Advancements in battery technology, brush systems, water recovery, and digital monitoring have improved scrubber performance, runtime, and ease of maintenance

- Rising emphasis on workplace safety, regulatory cleanliness standards, and sustainability goals is driving adoption of eco-friendly and low-water-consumption scrubbers

- Supported by infrastructure growth, automation trends, and rising facility management investments, the Industrial and Commercial Floor Scrubbers market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Industrial and Commercial Floor Scrubbers Market?

- High upfront costs associated with advanced, autonomous, and ride-on floor scrubbers limit adoption among small facilities and budget-constrained end users

- For instance, during 2024–2025, rising prices of batteries, electronic components, and raw materials increased manufacturing and procurement costs for several global vendors

- Complexity in operating, maintaining, and repairing technologically advanced scrubbers increases the need for skilled operators and technical support

- Limited awareness in emerging markets regarding automation benefits, total cost of ownership, and productivity gains slows adoption

- Competition from manual cleaning equipment and low-cost conventional scrubbers creates pricing pressure and impacts product differentiation

- To address these challenges, manufacturers are focusing on cost-optimized designs, operator training, modular components, and smart maintenance solutions to expand global adoption of industrial and commercial floor scrubbers

How is the Industrial and Commercial Floor Scrubbers Market Segmented?

The market is segmented on the basis of product type and end users.

- By Product Type

On the basis of product type, the industrial and commercial floor scrubbers market is segmented into Walk-Behind Scrubbers, Ride-On Scrubbers, and Robotic Scrubbers. The Walk-Behind Scrubbers segment dominated the market with a 44.7% share in 2025, driven by their cost-effectiveness, compact design, and ease of operation across small to mid-sized commercial spaces. These scrubbers are widely used in retail stores, hospitals, schools, and office buildings, as they offer efficient cleaning performance, lower upfront costs, and minimal operator training requirements. Their maneuverability and suitability for narrow aisles and congested areas further support strong adoption.

The Robotic Scrubbers segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing labor shortages, rising focus on automation, and demand for consistent cleaning quality. Autonomous navigation, sensor-based obstacle detection, and data-driven cleaning analytics are accelerating deployment of robotic scrubbers in airports, warehouses, and large commercial facilities.

- By End Users

On the basis of end users, the industrial and commercial floor scrubbers market is segmented into Transportation, Healthcare & Pharmaceuticals, Government, Education, Hospitality, Manufacturing & Warehousing, and Retail & Food. The Manufacturing & Warehousing segment dominated the market with a 38.2% share in 2025, supported by rapid expansion of industrial facilities, logistics hubs, and distribution centers. Large floor areas, high traffic intensity, and strict safety and cleanliness requirements drive consistent demand for high-capacity walk-behind and ride-on scrubbers in this segment. Continuous operations and frequent cleaning cycles further increase equipment utilization and replacement demand.

The Transportation segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing investments in airports, metro stations, railway terminals, and public transit infrastructure. Rising passenger volumes, regulatory hygiene standards, and demand for automated cleaning solutions are accelerating adoption of high-performance and robotic floor scrubbers across global transportation facilities.

Which Region Holds the Largest Share of the Industrial and Commercial Floor Scrubbers Market?

- North America dominated the industrial and commercial floor scrubbers market with an estimated 35.9% revenue share in 2025, driven by widespread adoption of mechanized cleaning solutions across commercial buildings, warehouses, airports, healthcare facilities, and manufacturing plants in the U.S. and Canada. High labor costs, strict workplace hygiene regulations, and strong preference for productivity-enhancing equipment continue to fuel demand

- Leading companies in North America are introducing battery-powered, ride-on, and autonomous floor scrubbers with improved runtime, smart diagnostics, and water-saving technologies, strengthening regional leadership

- Strong facility management ecosystems, high awareness of automated cleaning benefits, and sustained investment in commercial infrastructure further reinforce North America’s dominant market position

U.S. Industrial and Commercial Floor Scrubbers Market Insight

The U.S. is the largest contributor within North America, supported by extensive use of floor scrubbers across retail chains, logistics centers, hospitals, airports, and industrial facilities. Rising focus on labor efficiency, worker safety, and compliance with cleanliness standards is driving adoption of ride-on and robotic scrubbers. Presence of major manufacturers, strong aftermarket networks, and high replacement rates further support steady market growth.

Canada Industrial and Commercial Floor Scrubbers Market Insight

Canada contributes significantly to regional demand, driven by growing commercial construction, expansion of warehousing and logistics facilities, and increasing emphasis on hygienic public spaces. Preference for durable, low-noise, and cold-resistant equipment supports adoption across healthcare, education, and transportation facilities.

Asia-Pacific Industrial and Commercial Floor Scrubbers Market

Asia-Pacific is projected to register the fastest CAGR of 8.74% from 2026 to 2033, driven by rapid urbanization, expansion of retail and commercial infrastructure, and rising investments in manufacturing and warehousing across China, India, Japan, South Korea, and Southeast Asia. Growing awareness of automated cleaning solutions and increasing labor constraints are accelerating demand for efficient floor scrubbers.

China Industrial and Commercial Floor Scrubbers Market Insight

China leads Asia-Pacific growth due to massive industrial facilities, expanding logistics hubs, and strong demand from airports, shopping malls, and manufacturing plants. Domestic manufacturing capabilities and competitive pricing are accelerating adoption of walk-behind and ride-on scrubbers.

Japan Industrial and Commercial Floor Scrubbers Market Insight

Japan shows steady growth supported by advanced facility management practices, aging workforce concerns, and strong demand for high-quality, reliable cleaning equipment. Emphasis on automation and hygiene standards sustains long-term adoption.

India Industrial and Commercial Floor Scrubbers Market Insight

India is emerging as a high-growth market driven by expanding commercial real estate, healthcare infrastructure, airports, and organized retail. Rising labor costs, increasing hygiene awareness, and smart city initiatives are boosting adoption.

South Korea Industrial and Commercial Floor Scrubbers Market Insight

South Korea contributes steadily due to modern industrial facilities, strong retail infrastructure, and rising preference for automated and robotic cleaning solutions. Technological innovation and emphasis on operational efficiency support sustained market growth.

Which are the Top Companies in Industrial and Commercial Floor Scrubbers Market?

The industrial and commercial floor scrubbers industry is primarily led by well-established companies, including:

- Amano Corporation (Japan)

- Comac S.p.A (Italy)

- Conquest Equipment (Australia)

- Fimap S.p.A (Italy)

- Hako GmbH (Germany)

- Polivac International Pty Ltd (Australia)

- Tennant Company (U.S.)

- Numatic International (U.K.)

- Tornado Industries (U.S.)

- Alfred Kärcher SE & Co. KG (Germany)

- Bortek Industries, Inc. (U.S.)

- ECOVACS (China)

- Puresight Systems Pvt. Ltd. (India)

- Factory Cat (U.S.)

- Shanghai Bluesoul Environmental Technology CO., Ltd. (China)

- ContiOcean Environment Tech Co., Ltd. (China)

- Robert Bosch GmbH (Germany)

- Godrej (India)

What are the Recent Developments in Global Industrial and Commercial Floor Scrubbers Market?

- In April 2023, Tennant Company introduced two new battery-powered ride-on sweepers, the S680 and S880, designed for light- to medium-duty cleaning applications in both open and confined spaces, offering improved maneuverability, compact design, and higher productivity compared to earlier models, thereby enhancing operational efficiency in commercial and industrial facilities

- In August 2022, ONYX Systems, LLC, a technology-driven floor care equipment provider, launched the DX15 15-inch battery-powered floor scrubber, a lightweight, portable, and compact solution suited for small retail and commercial environments, delivering reliable performance and fast cleaning cycles, which strengthens its portfolio in cost-effective cleaning solutions

- In February 2022, Sam’s Club, a subsidiary of Walmart Inc., announced a strategic collaboration with Brain Corp. and Tennant Company to integrate inventory scanning capabilities into its robotic scrubber fleet, enabling real-time inventory data collection during cleaning operations and significantly improving operational visibility and efficiency

- In September 2020, Nilfisk unveiled the Liberty SC60, a high-performance autonomous ride-on robotic scrubber powered by BrainOS AI software, designed for large indoor facilities such as airports, warehouses, retail spaces, and light industrial environments, reinforcing Nilfisk’s position in advanced robotic cleaning and large-scale automation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.