Global Industrial And Commercial Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

62.63 Billion

USD

274.72 Billion

2024

2032

USD

62.63 Billion

USD

274.72 Billion

2024

2032

| 2025 –2032 | |

| USD 62.63 Billion | |

| USD 274.72 Billion | |

|

|

|

|

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Size

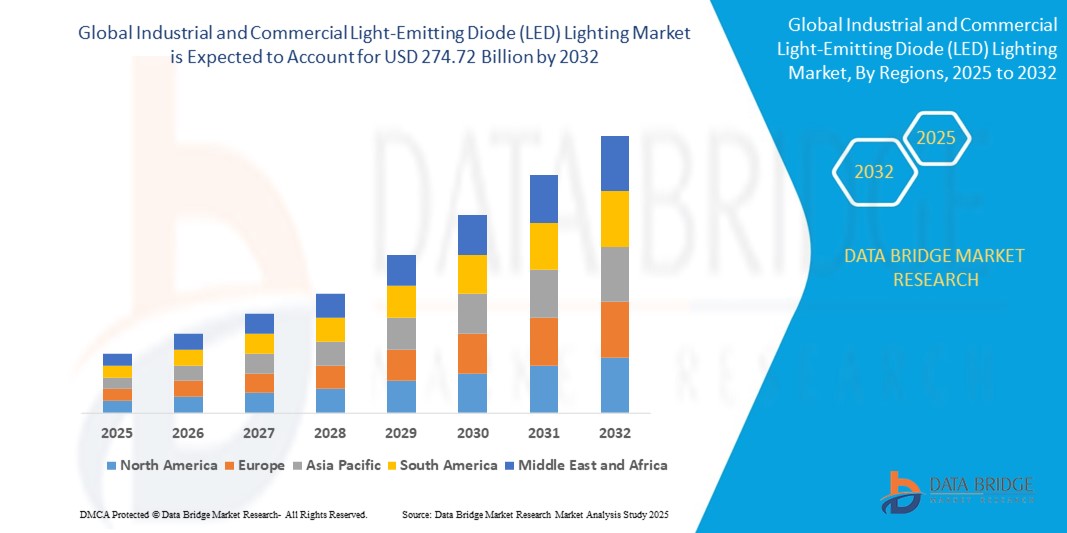

- The global industrial and commercial light-emitting diode (LED) lighting market size was valued at USD 62.63 billion in 2024 and is expected to reach USD 274.72 billion by 2032, at a CAGR of 20.30% during the forecast period

- The market growth is primarily driven by increasing demand for energy-efficient lighting solutions, government initiatives promoting sustainable technologies, and advancements in LED technology enhancing performance and affordability

- Rising awareness of environmental sustainability and the need for cost-effective lighting solutions in industrial and commercial sectors are further accelerating the adoption of LED lighting systems, significantly boosting market expansion

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Analysis

- LED lighting solutions, known for their energy efficiency, durability, and versatility, are critical components in modern industrial and commercial facilities, offering superior illumination, reduced energy consumption, and integration with smart lighting system

- The growing demand for LED lighting is fueled by stringent energy regulations, the shift toward green building practices, and the increasing preference for smart and connected lighting solutions

- North America dominated the industrial and commercial LED lighting market with the largest revenue share of 38.75% in 2024, driven by early adoption of energy-efficient technologies, high investment in infrastructure, and the presence of leading market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, rising industrial activities, and supportive government policies promoting energy-efficient lighting solutions

- The LED fixtures segment dominated the largest market revenue share of 62.3% in 2024, driven by their widespread adoption in industrial and commercial settings due to their durability, energy efficiency, and seamless integration into existing infrastructure

Report Scope and Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Segmentation

|

Attributes |

Industrial and Commercial Light-Emitting Diode (LED) Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Trends

“Increasing Integration of IoT and Smart Lighting Solutions”

- The Global Industrial and Commercial LED Lighting Market is experiencing a significant trend of integrating Internet of Things (IoT) and smart lighting technologies

- These technologies enable advanced control, monitoring, and automation of lighting systems, providing deeper insights into energy consumption, occupancy patterns, and maintenance needs

- IoT-enabled LED lighting solutions allow for proactive energy management, identifying opportunities for optimization before they lead to inefficiencies or high operational costs

- For instance, several companies are developing smart lighting platforms that adjust brightness based on real-time occupancy data or integrate with building management systems to optimize energy usage in industrial and commercial facilities

- This trend is enhancing the value proposition of LED lighting systems, making them more attractive to facility managers, industrial operators, and commercial property owners

- Smart lighting algorithms can analyze a wide range of environmental factors, including daylight availability, occupancy levels, and operational schedules, to deliver tailored lighting solutions

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Lighting Solutions”

- The increasing demand for energy-efficient lighting, driven by rising energy costs and sustainability goals, is a major driver for the Global Industrial and Commercial LED Lighting Market

- LED lighting systems enhance energy savings by offering superior efficiency, longer lifespans, and reduced maintenance costs compared to traditional lighting technologies

- Government regulations and incentives, particularly in regions such as North America, which is the dominating region, are contributing to the widespread adoption of LED lighting

- The proliferation of smart city initiatives and the development of advanced connectivity technologies, such as 5G, are further enabling the expansion of LED lighting applications, offering seamless integration with IoT ecosystems for more sophisticated lighting services

- Manufacturers are increasingly offering advanced LED lamps and fixtures as standard or customizable solutions to meet the expectations of industrial and commercial end-users and enhance facility value

Restraint/Challenge

“High Initial Costs and Integration Complexities”

- The substantial initial investment required for LED lighting hardware, smart control systems, and integration can be a significant barrier to adoption, especially in cost-sensitive markets such as parts of Asia-Pacific, despite it being the fastest-growing region

- Retrofitting LED lighting systems into existing industrial or commercial facilities can be complex and costly

- In addition, concerns about system compatibility and cybersecurity pose major challenges. Smart LED lighting systems collect and transmit data for monitoring and control, raising concerns about potential vulnerabilities, data breaches, and compliance with cybersecurity regulations

- The fragmented regulatory landscape across different countries regarding energy efficiency standards, data usage, and smart system integration further complicates operations for international manufacturers and service providers

- These factors can deter potential buyers and limit market expansion, particularly in regions where awareness of cybersecurity risks is high or where budget constraints are a significant factor

Industrial and Commercial Light-Emitting Diode (LED) Lighting market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the global industrial and commercial LED lighting market is segmented into LED lamps and LED fixtures. The LED fixtures segment dominated the largest market revenue share of 62.3% in 2024, driven by their widespread adoption in industrial and commercial settings due to their durability, energy efficiency, and seamless integration into existing infrastructure. LED fixtures are increasingly favored for their ability to provide uniform lighting and long-term cost savings.

The LED lamps segment is anticipated to witness the fastest growth rate of 15.8% from 2025 to 2032, fueled by rising demand for retrofit solutions and the replacement of traditional lighting systems with energy-efficient LED lamps. Their compatibility with existing sockets and growing consumer awareness of energy conservation further accelerate adoption.

- By Application

On the basis of application, the global industrial and commercial LED lighting market is segmented into indoor lighting and outdoor lighting. The indoor lighting segment is expected to dominate with a market revenue share of 68.7% in 2024, driven by the extensive use of LED lighting in offices, warehouses, factories, and retail spaces. The energy efficiency, improved illumination quality, and reduced maintenance costs of LED solutions make them ideal for indoor applications.

The outdoor lighting segment is projected to experience the fastest growth rate of 16.4% from 2025 to 2032. The increasing adoption of LED lighting for streetlights, parking lots, and building exteriors, coupled with smart lighting solutions integrated with IoT for enhanced control and energy savings, is driving this growth.

- By End User

On the basis of end user, the global industrial and commercial LED lighting market is segmented into industrial and commercial. The commercial segment is expected to hold the largest market revenue share of 73.2% in 2024, owing to the high demand for LED lighting in offices, retail stores, hospitality, and healthcare facilities. The focus on energy efficiency, aesthetic appeal, and compliance with green building standards drives the adoption of LED lighting in commercial spaces.

The industrial segment is anticipated to witness rapid growth of 18.1% from 2025 to 2032, fueled by the increasing use of LED lighting in manufacturing facilities, warehouses, and logistics centers. The durability of LED solutions in harsh industrial environments, coupled with their ability to reduce energy costs and enhance worker productivity, supports this growth.

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Regional Analysis

- North America dominated the industrial and commercial LED lighting market with the largest revenue share of 38.75% in 2024, driven by early adoption of energy-efficient technologies, high investment in infrastructure, and the presence of leading market players

- Consumers and businesses prioritize LED lighting for its energy savings, long lifespan, and enhanced illumination quality, particularly in regions with diverse industrial and commercial applications

- Growth is supported by advancements in LED technology, including smart lighting systems and high-efficiency fixtures, alongside rising adoption in both new installations and retrofit projects

U.S. Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

The U.S. industrial and commercial light-emitting diode (LED) lighting market captured the largest revenue share of 77.8% in 2024 within North America, fueled by strong demand for energy-efficient lighting in industrial facilities and commercial spaces. Growing awareness of cost savings and environmental benefits, coupled with government incentives for sustainable practices, drives market expansion. The trend toward smart lighting integration and increasing regulations promoting energy efficiency further boost adoption in both industrial and commercial sectors.

Europe Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

The Europe industrial and commercial LED lighting market is expected to witness significant growth, supported by stringent regulations on energy efficiency and sustainability. Businesses seek LED solutions that enhance workplace safety, improve visibility, and reduce energy consumption. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing substantial uptake due to environmental concerns and urban development.

U.K. Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

The U.K. market for industrial and commercial LED lighting is expected to witness rapid growth, driven by demand for energy-efficient and high-quality lighting in commercial offices and industrial facilities. Increased focus on reducing carbon footprints and improving workplace aesthetics encourages adoption. Evolving energy regulations and government incentives for sustainable lighting solutions influence business choices, balancing performance with compliance.

Germany Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

Germany is expected to witness rapid growth in the industrial and commercial LED lighting market, attributed to its advanced manufacturing sector and strong emphasis on energy efficiency. German businesses prefer technologically advanced LED systems that reduce operational costs and contribute to sustainability goals. The integration of smart LED lighting in premium industrial facilities and commercial spaces supports sustained market growth.

Asia-Pacific Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of energy efficiency, cost savings, and enhanced lighting quality boosts demand for LED lamps and fixtures. Government initiatives promoting sustainable infrastructure and smart cities further encourage the adoption of advanced LED lighting solutions.

Japan Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

Japan’s industrial and commercial LED lighting market is expected to witness rapid growth due to strong consumer and business preference for high-quality, energy-efficient LED lighting solutions that enhance workplace safety and productivity. The presence of major electronics manufacturers and the integration of LED lighting in new industrial and commercial projects accelerate market penetration. Rising interest in smart lighting systems also contributes to growth.

China Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Insight

China holds the largest share of the Asia-Pacific industrial and commercial LED lighting market, propelled by rapid urbanization, expanding industrial sectors, and increasing demand for energy-efficient lighting solutions. The country’s growing focus on smart cities and sustainable development supports the adoption of advanced LED lamps and fixtures. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Industrial and Commercial Light-Emitting Diode (LED) Lighting Market Share

The industrial and commercial light-emitting diode (LED) lighting industry is primarily led by well-established companies, including:

- Zumtobel Group (Austria)

- Eaton (Ireland)

- Dialight (U.K.)

- Advanced Lighting Technologies, LLC (U.S.)

- AIXTRON (Germany)

- OSRAM SYLVANIA Inc (U.S.)

- TOYODA GOSEI Co., Ltd. (Japan)

- Digital Lumens, Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Signify Holding. (Netherlands)

- GENERAL ELECTRIC (U.S.)

- Schneider Electric (France)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Hubbell (U.S.)

- Ushio America, Inc. (U.S.)

- Litetronics International, Inc. (U.S.)

- Cree Lighting. (U.S.)

- LG INNOTEK. (South Korea)

- Leviton Manufacturing Co., Inc. (U.S.)

What are the Recent Developments in Global Industrial and Commercial Light-Emitting Diode (LED) Lighting Market?

- In March 2025, Signify Holding and Dixon Technologies (India) Ltd. unveiled a 50:50 joint venture to bolster domestic manufacturing of lighting products in India. This strategic alliance aims to deliver innovative, high-quality, and cost-effective LED lighting solutions for leading brands in the Indian market. The venture will focus on producing a diverse portfolio of products, including LED bulbs, downlights, spotlights, battens, rope lights, strips, and other LED accessories. Aligned with the “Make in India” initiative, the collaboration leverages Signify’s lighting expertise and Dixon’s manufacturing strength to enhance local production capabilities

- In February 2025, Kichler Lighting LLC announced a recall of its Ellerbeck Wall Sconces due to a potential electric shock hazard. These sconces, featuring articulating jointed arms and offered in finishes such as black, natural brass, polished nickel, and classic pewter, were found to have a defect where electrical wires could become damaged at the adjustable joints. This issue arises when the sconces are installed as plug-in fixtures without an electrical box. The recall applies to units manufactured on or after June 16, 2023. Consumers are urged to stop using the affected products and request a free replacement

- In October 2023, YEELIGHT introduced the Yeelight Beam, a sleek tabletop-style LED light that doubles as a headphone stand. Designed for modern smart homes, it offers seamless integration with Apple HomeKit, Amazon Alexa, and Google Assistant, allowing users to control lighting with voice commands or smart devices. The Yeelight Beam is part of the brand’s push toward multifunctional, Matter-compatible lighting solutions that blend utility with aesthetic appeal, enhancing both workspace and ambiance

- In October 2023, Halonix Technologies introduced the UP-DOWN GLOW LED bulb in India, designed to elevate home lighting with a vibrant and customizable experience. This innovative bulb features three switch-enabled modes, allowing users to alternate between lighting effects. Both the dome (upper section) and the stem (lower section) emit multicolored glows, creating dynamic ambiance tailored to different moods and settings. The product blends functionality with decorative appeal, making it ideal for modern interiors seeking both style and versatility

- In September 2023, US LED launched the Right Choice Series, a new line of outdoor LED luminaires engineered to elevate site lighting performance and ease of installation. Tailored for contractors, the series includes versatile mounting options such as trunnion mounts, direct pole mounts, and adjustable slip fitters. These features streamline setup while ensuring adaptability across various outdoor applications. With a sleek, modern design and selectable color temperatures, the luminaires offer both aesthetic appeal and functional flexibility. The Right Choice Series reflects US LED’s commitment to ultra-long-life lighting and energy-efficient solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial And Commercial Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial And Commercial Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial And Commercial Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.