Global Industrial Backhoe Loader Market

Market Size in USD Billion

CAGR :

%

USD

22.40 Billion

USD

37.63 Billion

2024

2032

USD

22.40 Billion

USD

37.63 Billion

2024

2032

| 2025 –2032 | |

| USD 22.40 Billion | |

| USD 37.63 Billion | |

|

|

|

|

Industrial Backhoe Loader Market Size

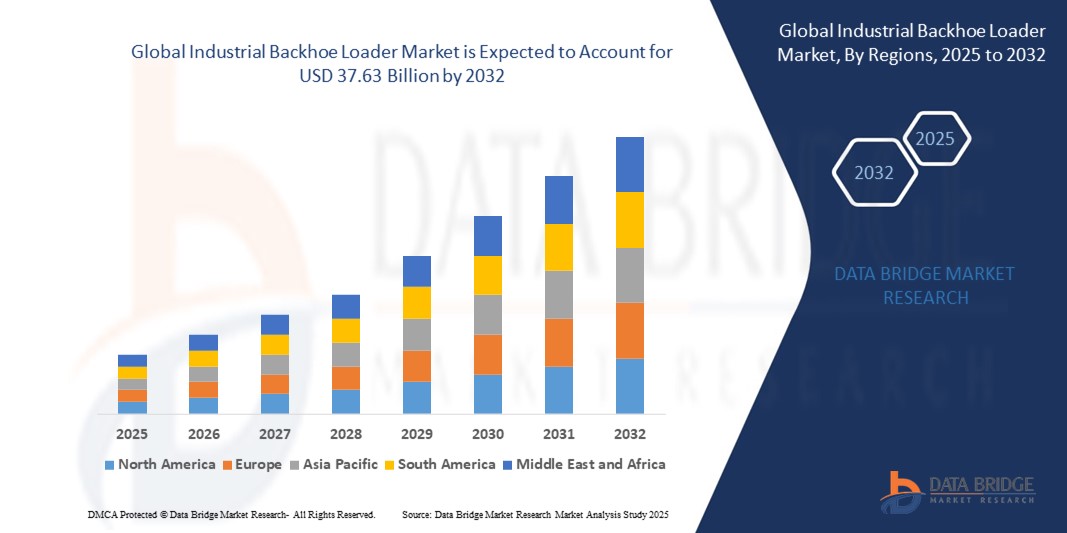

- The global industrial backhoe loader market size was valued at USD 22.40 billion in 2024 and is expected to reach USD 37.63 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is being driven by increasing demand for versatile, multi-purpose machinery in construction, mining, agriculture, and infrastructure development projects

- Rapid urbanization and large-scale infrastructure investments in emerging economies are creating significant opportunities for backhoe loader manufacturers and rental companies

Industrial Backhoe Loader Market Analysis

- The market is witnessing steady demand as contractors and municipalities increasingly opt for equipment that combines excavation, loading, and material handling capabilities in a single unit

- Manufacturers are innovating with hybrid and electric backhoe loader models, improved hydraulic systems, and telematics integration to enhance efficiency and reduce operational costs

- Asia-Pacific dominated the industrial backhoe loader market with the largest revenue share of 38.59% in 2024, supported by massive construction and infrastructure projects, rural development programs, and growing agricultural mechanization in countries such as China, India, and Southeast Asian nations

- North America is expected to be the fastest growing region during the forecast period, driven by increased investment in infrastructure rehabilitation, municipal utility works, and the adoption of advanced backhoe loaders with high productivity features

- The standard backhoe loader segment dominated the largest market revenue share of 43.9% in 2024, driven by its versatility, cost-effectiveness, and suitability for a wide range of construction, agricultural, and municipal applications. Standard models are widely adopted in emerging economies due to their ease of operation, lower maintenance costs, and ability to handle diverse tasks such as digging, trenching, and loading without requiring multiple machines

Report Scope and Industrial Backhoe Loader Market Segmentation

|

Attributes |

Industrial Backhoe Loader Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Industrial Backhoe Loader Market Trends

Increasing Integration of Advanced Telematics and Automation Technologies

- The global industrial backhoe loader market is experiencing a significant trend toward integrating advanced telematics and automation technologies to enhance operational efficiency and reduce downtime

- These technologies enable real-time equipment monitoring, predictive maintenance, and data-driven decision-making for fleet managers and construction companies

- Automated and semi-automated features are being incorporated to improve precision in tasks such as excavation, grading, and material handling, thereby reducing operator fatigue and increasing productivity

- For instance, several manufacturers are developing smart backhoe loaders with GPS-enabled telematics systems that provide insights on fuel consumption, idle time, and equipment usage patterns to optimize operations

- This trend is making backhoe loaders more appealing to industries seeking cost efficiency and higher returns on investment, particularly in large-scale infrastructure projects

- Advanced systems can monitor operator behavior, equipment strain, hydraulic pressure, and terrain conditions, enabling proactive maintenance and reducing unexpected breakdowns

Industrial Backhoe Loader Market Dynamics

Driver

Rising Infrastructure Development and Construction Activities

- The surge in global infrastructure projects, urbanization, and industrial development is a primary driver for the industrial backhoe loader market

- Backhoe loaders are highly versatile machines used for multiple applications such as excavation, loading, material handling, demolition, and grading, making them indispensable for construction projects

- Government investments in public infrastructure, such as road building, railway expansion, and smart city development, are fueling the demand for backhoe loaders

- The growing adoption of advanced hydraulics and fuel-efficient engines is further enhancing the performance and appeal of these machines in industrial applications

- The large-scale government infrastructure programs, and a booming construction sector, while North America is the fastest-growing market driven by technological adoption and replacement demand for outdated machinery

Restraint/Challenge

High Acquisition Cost and Operational Skill Requirements

- The high initial purchase cost of industrial backhoe loaders, along with expenses for regular maintenance and spare parts, can be a major barrier to adoption, especially for small and medium-sized contractors

- Operating modern backhoe loaders equipped with advanced technologies requires skilled personnel, and the shortage of trained operators can hinder market growth in some regions

- The integration of advanced telematics systems adds complexity and may require additional training and technical support

- Fuel price fluctuations and high operational costs can also deter potential buyers, particularly in cost-sensitive markets

- Safety regulations and varying environmental standards across countries create additional compliance challenges for global manufacturers and distributors

Industrial Backhoe Loader market Scope

The market is segmented on the basis of type, application, and sales channel.

- By Type

On the basis of type, the global industrial backhoe loader market is segmented into standard backhoe loaders, extendable dipper arm backhoe loaders, and others. The standard backhoe loader segment dominated the largest market revenue share of 43.9% in 2024, driven by its versatility, cost-effectiveness, and suitability for a wide range of construction, agricultural, and municipal applications. Standard models are widely adopted in emerging economies due to their ease of operation, lower maintenance costs, and ability to handle diverse tasks such as digging, trenching, and loading without requiring multiple machines. Their proven reliability and compatibility with various attachments have made them the preferred choice for contractors and small to mid-scale infrastructure projects.

The extendable dipper arm backhoe loader segment is expected to register the fastest growth rate from 2025 to 2032, as construction companies and large-scale projects increasingly demand enhanced digging depth and extended reach. Extendable dipper arms provide greater flexibility in accessing hard-to-reach areas, reducing the need for repositioning the machine and thereby improving operational efficiency. This segment is particularly gaining traction in urban infrastructure development, mining activities, and specialized tasks where deeper excavation or longer material handling capabilities are essential. Technological advancements in hydraulic systems and operator comfort features are further propelling adoption.

- By Application

On the basis of application, the global industrial backhoe loader market is categorized into excavation, material handling, demolition, grading, loading, and others. The excavation segment accounted for the highest revenue share in 2024, supported by the surge in road construction, pipeline installation, and residential development projects worldwide. Backhoe loaders are widely recognized for their ability to perform precise digging operations while offering the flexibility to switch between excavation and loading without the need for multiple machines.

The material handling segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the expansion of warehouse infrastructure, mining operations, and large-scale agricultural activities. Material handling applications benefit from backhoe loaders’ dual capability to load, transport, and unload materials efficiently, reducing downtime and operational costs. The growing trend toward multi-utility equipment in logistics and industrial operations is further boosting this segment’s demand.

- By Sales Channel

On the basis of sales channel, the global industrial backhoe loader market is segmented into direct and indirect sales. The direct sales segment held the largest revenue share in 2024, attributed to the preference of large construction firms and government agencies for purchasing directly from manufacturers to ensure customized configurations, aftersales support, and bulk procurement benefits. Direct sales channels also enable closer relationships between suppliers and end-users, ensuring machines are tailored to specific project needs.

The indirect sales segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing role of dealers, distributors, and rental service providers in reaching smaller contractors and rural markets. Indirect channels offer flexible purchasing options, easier access to equipment, and localized service networks, making them attractive for SMEs and seasonal operators.

Industrial Backhoe Loader Market Regional Analysis

- Asia-Pacific dominated the industrial backhoe loader market with the largest revenue share of 38.59% in 2024, supported by massive construction and infrastructure projects, rural development programs, and growing agricultural mechanization in countries such as China, India, and Southeast Asian nations

- Consumers and industries prioritize backhoe loaders for their multifunctionality, enabling excavation, material handling, and other tasks, particularly in regions with booming construction sectors

- Growth is supported by advancements in backhoe loader technology, such as telematics, fuel-efficient engines, and hybrid models, alongside rising adoption in both OEM and aftermarket segments

Japan Industrial Backhoe Loader Market Insight

Japan’s industrial backhoe loader market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced equipment that enhances productivity and safety. The presence of major manufacturers such as Komatsu and Hitachi, along with the integration of backhoe loaders in OEM construction projects, accelerates market penetration. Rising interest in aftermarket equipment customization also contributes to growth.

China Industrial Backhoe Loader Market Insight

China holds the largest share of the Asia-Pacific industrial backhoe loader market, propelled by rapid urbanization, rising construction activities, and increasing demand for versatile machinery. The country’s growing infrastructure projects, supported by initiatives such as the Belt and Road Initiative, drive adoption of backhoe loaders. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, making China a key player in the global market.

U.S. Industrial Backhoe Loader Market Insight

The U.S. industrial backhoe loader market is expected to witness significant growth, fueled by strong demand in construction and infrastructure projects, as well as growing awareness of equipment efficiency and operator safety. The trend towards smart machinery with GPS and automation features boosts market expansion. The integration of backhoe loaders in public infrastructure projects, supported by initiatives such as the Bipartisan Infrastructure Law, complements aftermarket demand, creating a robust market ecosystem.

Europe Industrial Backhoe Loader Market Insight

The Europe industrial backhoe loader market is expected to witness significant growth, supported by regulatory emphasis on sustainable construction practices and operator comfort. Consumers and contractors seek backhoe loaders that enhance productivity while meeting stringent emission standards. Growth is prominent in both new equipment sales and retrofit projects, with countries such as Germany and France showing significant uptake due to increasing infrastructure investments and urban development.

U.K. Industrial Backhoe Loader Market Insight

The U.K. market for industrial backhoe loaders is expected to witness rapid growth, driven by demand for efficient construction equipment in urban and suburban infrastructure projects. Increased focus on operator comfort, fuel efficiency, and environmental compliance encourages adoption. Evolving regulations promoting eco-friendly machinery influence consumer choices, balancing performance with sustainability requirements.

Germany Industrial Backhoe Loader Market Insight

Germany is expected to witness rapid growth in the industrial backhoe loader market, attributed to its advanced construction and manufacturing sectors and high consumer focus on equipment efficiency and sustainability. German contractors prefer technologically advanced backhoe loaders that reduce fuel consumption and enhance operational precision. The integration of these machines in large-scale infrastructure projects and aftermarket applications supports sustained market growth.

Industrial Backhoe Loader Market Share

The industrial backhoe loader industry is primarily led by well-established companies, including:

- Caterpillar (U.S.)

- J C Bamford Excavators Ltd. (U.K.)

- Komatsu (Japan)

- AB Volvo (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- Mahindra&Mahindra Ltd. (India)

- Terex Corporation (U.S.)

- Hyundai Construction Equipment Co., Ltd. (South Korea)

What are the Recent Developments in Global Industrial Backhoe Loader Market?

- In February 2025, New Holland Construction introduced the D Series Backhoe Loader, a new lineup focused on enhancing operator comfort, safety, and productivity. These machines feature a redesigned cab with 10% more space, improved visibility, and ergonomic controls. Powered by advanced FPT Industrial powertrain technology, they are equipped with F36 3.6-liter, 4-cylinder engines that meet Tier 4 Final emission standards. The D Series also offers versatile attachments and hydraulic systems for faster cycle times, making them ideal for a wide range of construction and agricultural tasks

- In November 2024, Case Construction Equipment launched its new SV Series backhoe loaders, including the 580SV, 590SV, and 695SV models. This series introduces a redesigned cab that enhances operator comfort with improved ergonomics, noise reduction, and expanded storage. The machines also feature upgraded controls, better visibility, and advanced FPT Stage V engines that reduce emissions while maintaining high performance. These enhancements aim to boost productivity, safety, and sustainability across construction and utility applications

- In June 2024, Escorts Kubota Limited introduced the BLX 75 backhoe loader, a "Made for India" machine tailored specifically for the country’s diverse terrain and operational demands. Engineered for high performance in heavy-duty construction and infrastructure projects, the BLX 75 features robust hydraulics, a fuel-efficient engine, and a compact design for maneuverability in tight spaces. Its launch underscores Escorts Kubota’s commitment to delivering durable, efficient, and locally optimized equipment to Indian contractors and builders

- In May 2022, Tata Hitachi launched the ZW225 5-tonne Wheel Loader from its Kharagpur plant, marking a significant addition to its construction equipment lineup. This model integrates innovative technologies aimed at maximizing customer earning potential while emphasizing operator comfort and convenience. The ZW225 features a powerful, fuel-efficient Cummins engine compliant with CEV-IV norms, advanced hydraulics for smoother operation, and a redesigned cab for enhanced visibility and ergonomics. It’s built to handle demanding applications across construction and mining sectors with reliability and efficiency

- In October 2022, JCB India launched the ecoXpert 3DX Backhoe Loader, a smart and fuel-efficient machine equipped with IntelliPerformance and IntelliDig technologies. These innovations provide real-time insights into machine performance and health, enabling better operational decisions. The 3DX ecoXpert offers up to 12% fuel savings and up to 22% reduction in maintenance costs, making it a cost-effective solution for construction and infrastructure projects. With enhanced operator comfort, safety features, and productivity-focused design, it sets a new benchmark in intelligent backhoe loaders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.