Global Industrial Bags Market

Market Size in USD Billion

CAGR :

%

USD

69.16 Billion

USD

89.67 Billion

2025

2033

USD

69.16 Billion

USD

89.67 Billion

2025

2033

| 2026 –2033 | |

| USD 69.16 Billion | |

| USD 89.67 Billion | |

|

|

|

|

What is the Global Industrial Bags Market Size and Growth Rate?

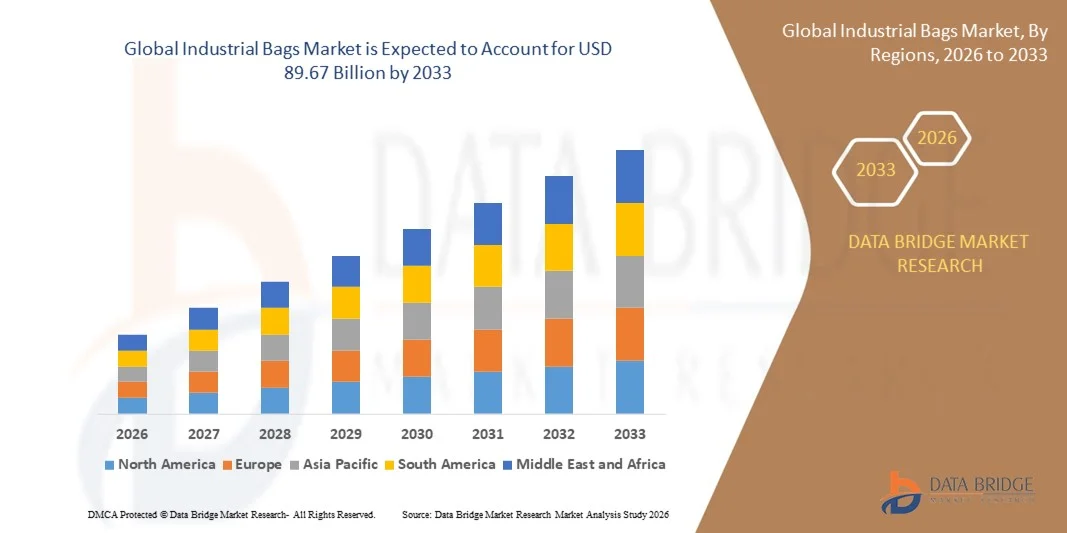

- The global industrial bags market size was valued at USD 69.16 billion in 2025 and is expected to reach USD 89.67 billion by 2033, at a CAGR of3.3% during the forecast period

- The rise in demand for food and beverages, grocery, dairy products acts as one of the major factors driving the growth of industrial bags market. The growing traction of industrial plastic bags in humid regions with the purpose of providing protection against rain, moisture and other liquid contents and increase in adoption owning to its abrasion resistance accelerate the industrial bags market growth

What are the Major Takeaways of Industrial Bags Market?

- The increase in demand for the bags because of its barrier properties, easy to open and pack feature and efficiency and the growth in their popularity due to their recyclable and reusable nature further influences the industrial bags market

- In addition, rapid industrialization, increase in retail outlets, rise in demand of consumer goods and increase in demand from healthcare and pharmaceutical sectors positively affect the industrial bags market. Furthermore, product development and innovations due to the shift consumer preference in towards bio-degradable industrial plastic bags extends profitable opportunities to the industrial bags market

- Asia-Pacific dominated the industrial bags market with a 37.91% revenue share in 2025, driven by high-volume manufacturing, robust packaging infrastructure, and rapid industrialization across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rising industrial packaging needs, e-commerce growth, and demand for advanced, durable, and eco-friendly industrial bags in the U.S. and Canada

- The Gusseted Bags segment dominated the market with a 44.2% share in 2025, owing to its versatility, enhanced load-bearing capacity, and ability to store bulk powders, grains, chemicals, and liquids efficiently

Report Scope and Industrial Bags Market Segmentation

|

Attributes |

Industrial Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Bags Market?

Growing Adoption of Sustainable, High-Strength, and Multi-Purpose Industrial Bags

- The industrial bags market is witnessing increasing demand for lightweight, durable, and reusable bags designed for bulk storage, transportation, and industrial logistics

- Manufacturers are introducing multi-layered, moisture-resistant, and UV-stabilized bags that provide enhanced strength, longer shelf life, and compatibility with automated handling systems

- Rising focus on sustainability and recyclability is driving development of biodegradable and recyclable industrial bag materials suitable for chemicals, food, and agricultural products

- For instance, companies such as Mondi, Amcor, Smurfit Kappa, Dana Poly, and Inteplast Group are expanding their product lines with reinforced, reusable, and eco-friendly industrial bags

- Increasing demand for standardized, versatile bags capable of withstanding harsh industrial environments is accelerating adoption across manufacturing, logistics, and agricultural sectors

- As industries prioritize efficiency, durability, and sustainability, Industrial Bags will remain essential for safe storage, transportation, and regulatory compliance

What are the Key Drivers of Industrial Bags Market?

- Rising demand for durable, high-capacity bags to store bulk powders, liquids, and granular materials efficiently across industries

- For instance, in 2025, leading companies such as Mondi, Amcor, Smurfit Kappa, Dana Poly, and Inteplast Group introduced multi-layered and reinforced bag designs with higher load-bearing capacity

- Expanding industrial production, warehousing, and global trade is boosting the need for industrial bags across U.S., Europe, and Asia-Pacific

- Adoption of automated packaging, robotic handling, and smart logistics is driving demand for standardized, strong, and lightweight industrial bags

- Rising focus on sustainability and regulatory compliance is encouraging the use of recyclable, biodegradable, and chemical-resistant bag materials

- Supported by growth in manufacturing, agriculture, chemicals, and food industries, the Industrial Bags market is poised for long-term expansion

Which Factor is Challenging the Growth of the Industrial Bags Market?

- High costs associated with premium, multi-layered, or specialized industrial bags limit adoption among small and mid-sized enterprises

- For instance, during 2024–2025, fluctuations in raw material prices, such as polyethylene and polypropylene, increased production costs for several global vendors

- Complex handling requirements for heavy, high-capacity bags increase operational challenges and require training for proper use

- Limited awareness in emerging markets regarding high-strength, reusable, and eco-friendly industrial bags slows adoption

- Competition from alternative packaging solutions, including bulk containers, drums, and reusable crates, creates pricing pressure

- To address these challenges, companies are focusing on cost-optimized, eco-friendly designs, technical support, and value-added services to boost global adoption of Industrial Bags

How is the Industrial Bags Market Segmented?

The market is segmented on the basis of product type, material, and end use.

- By Product

On the basis of product, the industrial bags market is segmented into Gusseted Bags, Sewn Open Mouth Bags, and Others. The Gusseted Bags segment dominated the market with a 44.2% share in 2025, owing to its versatility, enhanced load-bearing capacity, and ability to store bulk powders, grains, chemicals, and liquids efficiently. These bags are widely adopted in manufacturing, logistics, and agricultural sectors for their superior stability, stacking ability, and easy handling.

The Sewn Open Mouth Bags segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for robust, customizable, and high-capacity bags in industrial, pharmaceutical, and food processing applications. Increasing mechanization in packaging lines and need for multi-purpose storage solutions further accelerate adoption of sewn open mouth bags.

- By Material

On the basis of material, the market is segmented into Bio-Degradable and Non-Biodegradable bags. The Non-Biodegradable segment dominated the market with a 61.5% share in 2025, supported by superior strength, durability, and cost-effectiveness across industries such as chemicals, food processing, and logistics. Non-biodegradable bags are widely used for long-term storage, transport of heavy goods, and protection against moisture and environmental factors.

The Bio-Degradable segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing environmental regulations, sustainability initiatives, and growing adoption in food, agriculture, and pharmaceutical sectors. Rising consumer and corporate focus on eco-friendly packaging is driving long-term growth of biodegradable industrial bags.

- By End Use

On the basis of end use, the industrial bags market is segmented into Food and Beverages, Pharmaceuticals, Electricals and Electronics, Agriculture, and Others. The Food and Beverages segment dominated the market with a 38.7% share in 2025, driven by high-volume bulk storage, transport of grains, powders, and liquid ingredients, and strict regulatory compliance requirements.

The Agriculture segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by the expanding need for seed storage, fertilizer transport, and pesticide packaging. Growth in mechanized farming, rising agricultural exports, and adoption of durable, reusable bags support increasing demand across the sector.

Which Region Holds the Largest Share of the Industrial Bags Market?

- Asia-Pacific dominated the industrial bags market with a 37.91% revenue share in 2025, driven by high-volume manufacturing, robust packaging infrastructure, and rapid industrialization across China, India, Japan, South Korea, and Southeast Asia. Rising demand for bulk storage, agricultural packaging, and food & beverage transport fuels market adoption, supported by government initiatives for industrial growth and sustainability. Expansion of FMCG, pharmaceuticals, and agricultural exports further strengthens regional demand for durable, high-capacity industrial bags

- Leading companies in Asia-Pacific are investing in automation, advanced bagging technologies, biodegradable materials, and high-strength polymers, enhancing production efficiency and product quality. Rising focus on sustainable, reusable, and multi-purpose industrial bags reinforces the region’s leadership in innovation and capacity

- Growing industrial clusters, skilled workforce, and cost-effective manufacturing contribute to Asia-Pacific maintaining its dominant position

China Industrial Bags Market Insight

China is the largest contributor to the Asia-Pacific market due to extensive industrial growth, world-leading packaging and manufacturing infrastructure, and government support for sustainable and high-capacity industrial bags. Adoption of bio-degradable, multi-layered, and bulk packaging solutions for chemicals, grains, and industrial goods drives strong domestic and export market penetration.

India Industrial Bags Market Insight

India is emerging as a major growth hub, driven by expanding manufacturing units, government-backed packaging initiatives, and rising agricultural and FMCG exports. Increasing adoption of durable industrial bags in logistics, storage, and bulk transport applications accelerates market growth.

Japan Industrial Bags Market Insight

Japan shows steady growth with strong focus on high-quality manufacturing, industrial automation, and innovative packaging materials. Demand for reusable, high-strength, and precision-engineered industrial bags supports consistent market expansion.

South Korea Industrial Bags Market Insight

South Korea contributes significantly through adoption in electronics, automotive, and chemical industries. Demand for high-capacity, durable, and recyclable industrial bags drives regional growth, supported by advanced manufacturing and sustainability initiatives.

North America Industrial Bags Market

North America is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by rising industrial packaging needs, e-commerce growth, and demand for advanced, durable, and eco-friendly industrial bags in the U.S. and Canada. Expansion of food processing, pharmaceuticals, and chemical industries supports high-volume adoption. Leading companies in the region focus on biodegradable materials, smart packaging solutions, and automation in bag production, strengthening technological competitiveness. High innovation, investment in sustainable materials, and strong logistics networks further reinforce North America’s rapid growth trajectory.

U.S. Industrial Bags Market Insight

The U.S. is the largest contributor in North America, with high demand from food & beverage, agriculture, and chemical sectors. Adoption of advanced, reusable, and bio-based bags is increasing to meet regulatory and sustainability standards.

Canada Industrial Bags Market Insight

Canada supports regional growth through industrial expansion, government initiatives promoting sustainability, and rising use of high-capacity and eco-friendly industrial bags in agriculture, chemicals, and logistics sectors.

Which are the Top Companies in Industrial Bags Market?

The industrial bags industry is primarily led by well-established companies, including:

- Mondi (U.K.)

- ProAmpac (U.S.)

- Inteplast Group (U.S.)

- Dana Poly, Inc. (U.S.)

- Raj Packaging Industries Ltd (India)

- Rutan Poly Industries, Inc. (U.S.)

- New York Packaging & RediBagUSA (U.S.)

- PitchBook (U.S.)

- Amcor plc (Switzerland)

- AmeriGlobe L.L.C. (U.S.)

- BAG Corp. (U.S.)

- Bemis Company, Inc. (U.S.)

- Cascades Inc. (Canada)

- Greif (U.S.)

- International Paper (U.S.)

- BWAY Corporation (U.S.)

- NEFAB GROUP (Sweden)

- Orora Packaging Australia Pty Ltd (Australia)

- SCHÜTZ GmbH & Co. KGaA (Germany)

- Sigma Plastics Group (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco Products Company (U.S.)

- WestRock Company (U.S.)

- Industrial Packaging (U.S.)

- DuPont (U.S.)

What are the Recent Developments in Global Industrial Bags Market?

- In January 2024, Greif and IonKraft partnered to develop the first reusable plastic jerrycan coatings, enhancing sustainability and addressing recycling challenges, marking a significant step toward greener and more environmentally friendly packaging solutions. This collaboration aims to transform packaging practices for a sustainable future

- In November 2023, Yara signed a contract with a supplier in Brazil to produce a new bag made from 100% recycled PET (rPET), advancing sustainable packaging in the agriculture sector. This initiative aims to reduce the environmental impact of packaging and promote circular economy practices

- In July 2023, UltraTech Cement Limited introduced innovative cement bags containing 50% recycled polypropylene (rPP), reducing the use of virgin plastic by 43% per bag and fostering sustainability in the circular economy. This move strengthens the company’s commitment to environmentally responsible packaging

- In May 2022, Smurfit Kappa announced an investment of EUR 35 million to construct a new packaging plant in Morocco, aimed at expanding production capacity and supporting sustainable packaging initiatives in the region. This investment underlines the company’s focus on growth and environmental responsibility

- In May 2022, Berry Global Inc. launched a line of high-strength refuse sacks made from recycled plastics, enhancing durability while promoting circular economy practices. This product development emphasizes the company’s commitment to sustainable material use in packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Bags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Bags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Bags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.