Global Industrial Bakeware Market

Market Size in USD Billion

CAGR :

%

USD

7.24 Billion

USD

10.78 Billion

2024

2032

USD

7.24 Billion

USD

10.78 Billion

2024

2032

| 2025 –2032 | |

| USD 7.24 Billion | |

| USD 10.78 Billion | |

|

|

|

|

What is the Global Industrial Bakeware Market Size and Growth Rate?

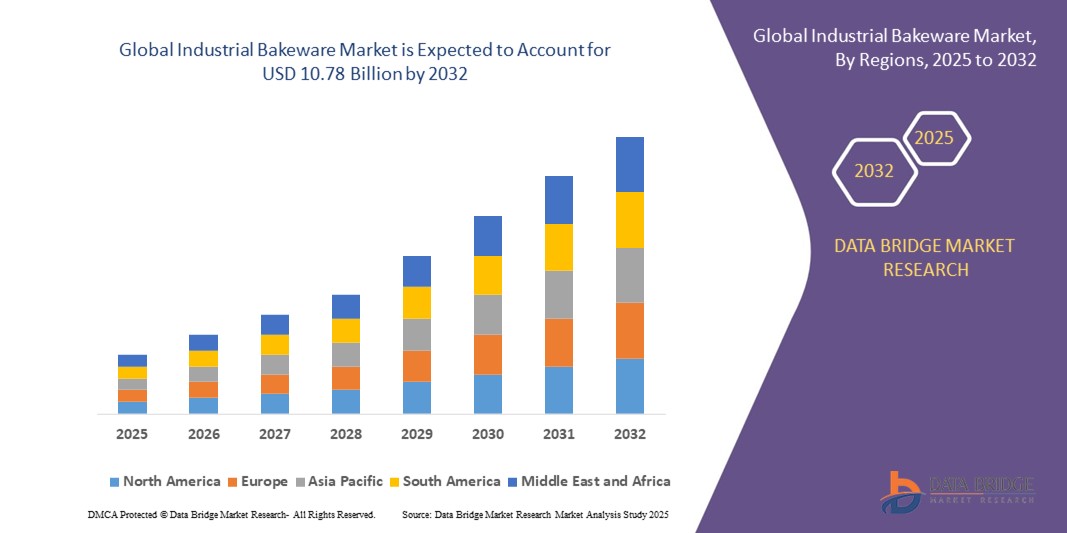

- The global industrial bakeware market size was valued at USD 7.24 billion in 2024 and is expected to reach USD 10.78 billion by 2032, at a CAGR of 5.10% during the forecast period

- The industrial bakeware market is experiencing steady growth, driven by increasing demand from commercial bakeries and large-scale food production facilities. Advancements in non-stick and durable materials, along with a shift towards eco-friendly options, are key trends shaping the market

- The rise in home baking during recent years has also fueled demand, particularly through online retail channels. However, fluctuations in raw material prices and the need for sustainable manufacturing practices present challenges. Regional growth is notable in Asia-Pacific, where urbanization and expanding food industries are key drivers

What are the Major Takeaways of Industrial Bakeware Market?

- The escalating global consumption of baked goods is a critical driver for the industrial bakeware market, fueled by the increasing popularity of convenience foods and on-the-go snacks. This demand surge is particularly pronounced in urban areas, where lifestyle shifts toward quick meal options are evident

- In addition, the growth of artisanal and specialty bakery segments is pushing the need for advanced bakeware solutions, enabling manufacturers to scale production while maintaining product quality and consistency. For instance, in August 2024, according to the article published in ETHospitalityWorld, the bakery sector is experiencing a revolution due to the integration of culinary technology and traditional baking processes, driven by a growing demand for healthier, sustainable, and creative food alternatives

- North America dominated the industrial bakeware market with the largest revenue share of 36.14% in 2024, driven by rising consumer interest in home baking, bakery cafés, and artisanal baked goods

- Asia-Pacific industrial bakeware market is poised to grow at the fastest CAGR of 6.39% during 2025–2032, supported by urbanization, rising disposable incomes, and changing dietary habits

- The tins and trays segment dominated the market with the largest revenue share of 38.6% in 2024, primarily due to their wide use in large-scale bakeries, confectioneries, and food processing plants

Report Scope and Industrial Bakeware Market Segmentation

|

Attributes |

Industrial Bakeware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Bakeware Market?

Rising Demand for Non-Stick, Sustainable, and Customized Bakeware

- A significant and accelerating trend in the global industrial bakeware market is the adoption of non-stick coatings and sustainable materials such as silicone, aluminized steel, and recyclable composites, aimed at improving durability, energy efficiency, and easy food release

- Manufacturers are increasingly focusing on customized and specialty bakeware designed for commercial bakeries, hotels, and large-scale food production to meet diverse consumer preferences.

- For instance, in 2024, SEB Group and Meyer Corporation expanded their industrial bakeware product lines with eco-friendly materials and high-performance coatings to cater to both environmental concerns and efficiency in mass baking

- This trend is reshaping industrial baking by aligning with sustainability goals, enhancing production efficiency, and catering to the growing demand for specialized bakery products

What are the Key Drivers of Industrial Bakeware Market?

- Growing bakery and confectionery industry worldwide, driven by increasing consumption of bread, cakes, pastries, and biscuits, is a major factor fueling demand for industrial bakeware

- For instance, in March 2024, Wilton Brands LLC introduced professional-grade bakeware lines designed for high-volume bakeries, highlighting how innovation in bakeware supports industrial demand

- Rising demand for energy-efficient ovens and durable bakeware is encouraging bakeries to replace conventional equipment with advanced, long-lasting bakeware solutions

- Shift toward non-stick and easy-to-clean products reduces operational downtime in commercial baking facilities, making them more attractive to professional users

- The global trend of urbanization and increased consumption of ready-to-eat baked goods continues to propel industrial bakeware adoption across supermarkets, quick-service restaurants, and packaged food industries

Which Factor is Challenging the Growth of the Industrial Bakeware Market?

- High raw material costs, particularly for premium non-stick coatings, aluminized steel, and eco-friendly alternatives, remain a challenge for manufacturers to balance quality and affordability

- For instance, rising prices of aluminum and stainless steel in 2024 increased production costs for companies such as Chicago Metallic Bakeware and Nordic Ware, impacting profit margins

- Short product replacement cycles in industrial setups, due to wear and tear in high-volume baking, can limit long-term cost efficiency for bakeries

- Intense competition from low-cost local manufacturers, especially in Asia-Pacific, challenges global brands in terms of pricing and product differentiation

- Addressing these challenges through cost-effective innovation, sustainable material sourcing, and durability enhancements will be critical for manufacturers to stay competitive in the global market

How is the Industrial Bakeware Market Segmented?

The market is segmented on the basis of product type, material, application, and distribution channel.

- By Product Type

On the basis of product type, the industrial bakeware market is segmented into tins and trays, cups, molds, pans and dishes, rolling pins, and others. The tins and trays segment dominated the market with the largest revenue share of 38.6% in 2024, primarily due to their wide use in large-scale bakeries, confectioneries, and food processing plants. Their versatility for bread, pastries, cakes, and cookies makes them an essential tool in both automated and manual baking lines. The demand for durable, reusable, and standardized tins and trays has further driven adoption in industrial production units.

The molds segment is projected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by growing demand for customized and premium bakery products, especially in decorative cakes and confectionery. The trend toward innovation in bakery designs and consumer preferences for artisanal products supports mold adoption in industrial setups.

- By Material

On the basis of material, the industrial bakeware market is segmented into metal, silicone, glass, ceramic, composite materials, and others. The metal segment held the largest revenue share of 52.4% in 2024, driven by its superior heat conduction, durability, and suitability for high-volume baking in commercial and industrial facilities. Stainless steel and aluminum remain the preferred choices due to their resilience and efficiency in maintaining uniform baking quality.

The silicone segment is expected to register the fastest CAGR of 22.1% from 2025 to 2032, driven by increasing adoption of non-stick, lightweight, and flexible bakeware solutions. Silicone bakeware is gaining favor for industrial applications and in specialty baking where easy demolding and intricate designs are required. In addition, sustainability considerations and consumer inclination toward BPA-free, food-safe materials are such asly to further boost the silicone bakeware segment in the forecast period.

- By Application

On the basis of application, the industrial bakeware market is segmented into commercial, industrial, and household. The commercial segment dominated the market with the largest revenue share of 41.7% in 2024, supported by the growing number of bakery chains, cafes, and quick-service restaurants worldwide. Demand is driven by consistent need for standardized baking equipment that enhances efficiency, maintains quality, and supports mass production of popular baked goods.

The industrial segment is projected to grow at the fastest CAGR of 18.9% from 2025 to 2032, propelled by rising investments in large-scale automated baking facilities. Increasing demand for packaged bakery products in supermarkets and convenience stores further supports industrial adoption. The household segment, though smaller, also contributes to market growth, driven by the popularity of home baking trends, especially post-pandemic, and the rising sales of smaller bakeware products through retail and e-commerce channels.

- By Distribution Channel

On the basis of distribution channel, the industrial bakeware market is segmented into direct sales, retail, online/e-commerce, and others. The direct sales segment accounted for the largest revenue share of 36.9% in 2024, as manufacturers directly supply bulk quantities of bakeware to commercial and industrial clients. This model ensures reliability, customization, and cost efficiency, making it the preferred choice for bakeries and foodservice operators.

The online/e-commerce segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by the rapid growth of digital platforms and changing buyer preferences. Online channels offer a wide variety of bakeware options, competitive pricing, and ease of doorstep delivery, which is attracting both small bakeries and household consumers. Retail outlets also remain important, especially for household bakeware, while other channels such as distributors and wholesalers cater to specialized regional markets.

Which Region Holds the Largest Share of the Industrial Bakeware Market?

- North America dominated the industrial bakeware market with the largest revenue share of 36.14% in 2024, driven by rising consumer interest in home baking, bakery cafés, and artisanal baked goods

- Demand in the region is further fueled by the strong presence of commercial bakeries, quick-service restaurants, and growing sales of ready-to-eat baked products

- The market also benefits from higher disposable incomes, an expanding health-conscious population seeking premium bakeware solutions, and the influence of baking culture through digital media, cooking shows, and social platforms

U.S. Industrial Bakeware Market Insight

U.S. industrial bakeware market captured the largest revenue share in 2024 within North America, led by robust demand from commercial bakeries, foodservice chains, and rising home baking trends. Increasing popularity of bakeware products designed for healthier cooking, such as non-stick and silicone molds, has further accelerated adoption. The surge in online retailing, coupled with a rising culture of DIY home baking during festive and seasonal periods, continues to propel the market forward.

Europe Industrial Bakeware Market Insight

Europe industrial bakeware market is projected to expand at a substantial CAGR throughout the forecast period, supported by a strong tradition of bakery consumption and rising innovation in bakeware designs. Growing demand for artisan bread, pastries, and healthier bakery alternatives is boosting the requirement for durable, high-quality bakeware products. Europe’s strict food safety standards and increasing investments by commercial bakeries in modern baking equipment are also contributing to strong growth.

U.K. Industrial Bakeware Market Insight

U.K. industrial bakeware market is anticipated to grow at a noteworthy CAGR, fueled by the popularity of café culture, patisseries, and a strong emphasis on artisanal baked products. The increasing demand for eco-friendly and sustainable bakeware solutions, alongside growth in online bakery businesses, is shaping market expansion. Strong retail distribution networks and consumer preference for convenience further support adoption in the country.

Germany Industrial Bakeware Market Insight

Germany industrial bakeware market is expected to expand at a considerable CAGR, driven by a culture of bread and bakery consumption and a shift toward premium, long-lasting bakeware. The nation’s emphasis on energy efficiency, precision engineering, and eco-conscious materials is also influencing the adoption of innovative bakeware solutions. The growing number of artisanal bakeries, combined with modernized production facilities, reinforces Germany’s position in the European market.

Which Region is the Fastest Growing in the Industrial Bakeware Market?

Asia-Pacific industrial bakeware market is poised to grow at the fastest CAGR of 6.39% during 2025–2032, supported by urbanization, rising disposable incomes, and changing dietary habits. Growing bakery culture, particularly in China, Japan, and India, is driving strong demand for bakeware across both residential and commercial segments. Increasing presence of global bakery brands, rapid expansion of cafés and quick-service restaurants, and domestic manufacturing strength are making APAC the most dynamic region in this industry.

Japan Industrial Bakeware Market Insight

Japan industrial bakeware market is gaining traction due to a growing interest in Western-style bakery products and premium patisserie culture. Compact, innovative bakeware solutions that align with Japan’s urban lifestyle are highly sought after. In addition, the emphasis on quality, precision, and multifunctional products is propelling market growth, particularly in commercial baking and foodservice applications.

China Industrial Bakeware Market Insight

China industrial bakeware market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rising urban middle-class populations, expanding café chains, and growing popularity of Western-style baked goods. Affordable bakeware products, strong domestic production, and the expansion of e-commerce channels are fueling demand. China’s bakery sector is also benefiting from government initiatives supporting the foodservice industry, making it a leading market for bakeware adoption.

Which are the Top Companies in Industrial Bakeware Market?

The industrial bakeware industry is primarily led by well-established companies, including:

- Wilton Brands LLC (U.S.)

- Nordic Ware (U.S.)

- Chicago Metallic Bakeware (U.S.)

- Lodge Manufacturing Company (U.S.)

- Fat Daddio's (U.S.)

- SEB Group (France)

- De Buyer Industries SAS (France)

- Gobel France (France)

- USA Pan (U.S.)

- Meyer Corporation (U.S.)

- Paderno World Cuisine (Canada)

- Vollrath Company, LLC (U.S.)

- Matfer Bourgeat International (France)

- Sasa Demarle Inc. (France)

- Vollum Inc. (U.S.)

- Conair Corporation (U.S.)

- Helen of Troy Limited (U.S.)

- Le Creuset (France)

- TableCraft Products Company (U.S.)

What are the Recent Developments in Global Industrial Bakeware Market?

- In February 2023, Meyer Corporation unveiled its Anolon Pro Bakeware collection, designed with commercial-grade uncoated aluminized steel for superior heat conductivity, durability, and even baking performance. The pans are oven and broiler-safe, catering to a variety of sweet and savory recipes, and feature continuous wire-rolled rims for added strength. This launch strengthened Meyer’s positioning in the premium bakeware category

- In February 2023, Guardini, in collaboration with ArcelorMittal, Cooper Coated Coil, and ILAG, introduced the XBake sustainable bakeware line, manufactured using ArcelorMittal's XCarb green steel certificates and coated with PFAS-free, non-stick material applied to steel coils by CCC. This innovation reinforced Guardini’s commitment to eco-friendly and health-conscious bakeware solutions

- In October 2021, Caraway, a non-toxic cookware brand, entered the bakeware segment by launching a collection in five modern colors. These non-stick items are made from non-toxic materials with ceramic coatings, ensuring they are free from harmful heavy metals. This expansion highlighted Caraway’s mission to combine aesthetics with safe, sustainable bakeware

- In April 2021, Made In, a premium D2C cookware supplier, partnered with renowned baker Nancy Silverton to release a range of porcelain baking dishes in various shapes and sizes. The collection, crafted in France, offered exotic designs with high-quality performance. This collaboration elevated Made In’s brand appeal through association with a celebrated culinary figure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.