Global Industrial Boilers Market

Market Size in USD Billion

CAGR :

%

USD

16.70 Billion

USD

21.65 Billion

2024

2032

USD

16.70 Billion

USD

21.65 Billion

2024

2032

| 2025 –2032 | |

| USD 16.70 Billion | |

| USD 21.65 Billion | |

|

|

|

|

Industrial Boilers Market Size

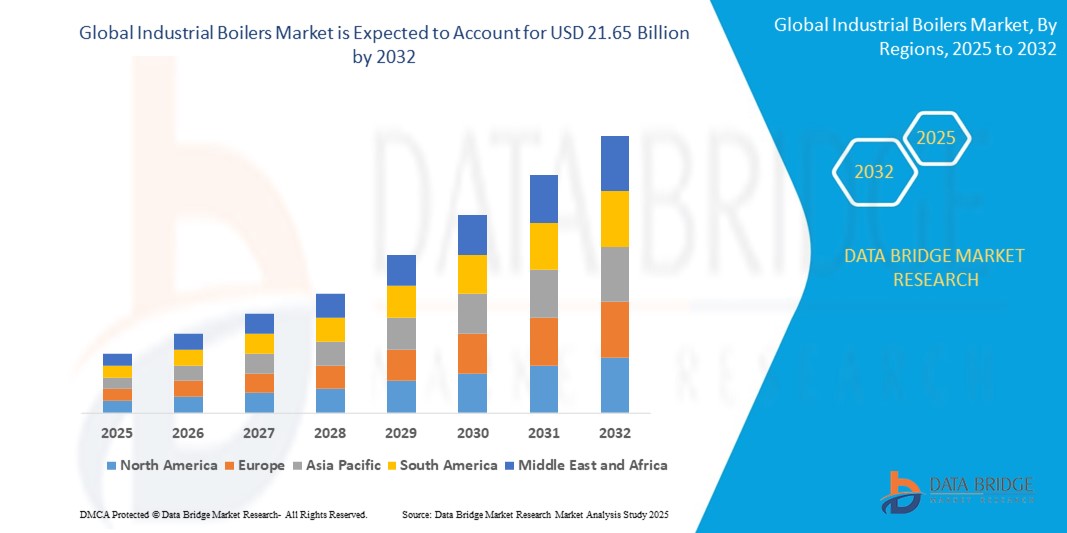

- The global industrial boilers market size was valued at USD 16.70 billion in 2024 and is expected to reach USD 21.65 billion by 2032, at a CAGR of 3.30% during the forecast period

- This growth is driven by factors such as the increasing demand for energy across manufacturing industries, rising adoption of clean and efficient fuel technologies, and ongoing industrial expansion in emerging economies

Industrial Boilers Market Analysis

- Industrial boilers are essential equipment used across various sectors such as chemical, food & beverage, paper & pulp, and power generation, providing steam and heat for diverse industrial processes

- The demand for industrial boilers is significantly driven by the increasing need for energy efficiency, strict emission regulations, and the ongoing transition toward clean energy and renewable integration in industrial operations

- North America dominates the global industrial boilers market, accounting for approximately 41.91% of the market share in 2024, the forecast period, attributed to rapid industrialization, expansion of manufacturing sectors, and government initiatives promoting industrial development, especially in China, India, and Southeast Asia

- North America is expected to hold a significant share of the industrial boilers market due to modernization of legacy power and heating infrastructure and rising demand for cleaner fuel technologies

- The natural gas-fired boiler segment is projected to dominate the global industrial boilers market, holding approximately 25% of the total market share. This dominance is attributed to natural gas being a cleaner and more efficient fuel source compared to oil or coal, resulting in lower carbon emissions and operational costs

Report Scope and Industrial Boilers Market Segmentation

|

Attributes |

Industrial Boilers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Boilers Market Trends

“Integration of Low-Emission Technologies & Smart Boiler Systems”

- One prominent trend in the industrial boilers market is the increasing adoption of low-emission and energy-efficient boiler systems to comply with stringent environmental regulations and reduce carbon footprints

- These innovations enhance operational efficiency and sustainability by incorporating advanced control systems, real-time monitoring, and automation, thereby minimizing fuel consumption and emissions

- For instance, In October 2023, Cleaver-Brooks introduced a new line of low NOx firetube boilers with integrated smart control systems, enabling real-time optimization and compliance with upcoming EPA standards in the U.S.

- These advancements are transforming industrial energy systems, boosting demand for intelligent, eco-friendly boiler solutions, and supporting industries in achieving decarbonization and operational cost savings

Industrial Boilers Market Dynamics

Driver

“Growing Demand from Expanding Industrial and Manufacturing Sectors”

- The rising energy demands from rapidly expanding industrial and manufacturing sectors, including chemicals, food & beverage, pharmaceuticals, pulp & paper, and power generation, are significantly contributing to the increased adoption of industrial boilers

- As economies industrialize—particularly in developing regions—the need for reliable and efficient steam and heat generation systems continues to grow to support uninterrupted production and process operations

- Industries are also increasingly seeking customized, fuel-flexible, and energy-efficient boiler solutions to meet both productivity targets and regulatory requirements

For instance,

- In February 2024, Thermax Limited announced a major project in Southeast Asia to supply energy-efficient biomass-fired industrial boilers to a large agro-processing company, supporting sustainability goals and production efficiency

- As a result of the industrial expansion and demand for more efficient energy solutions, global demand for industrial boilers is witnessing consistent growth, especially in emerging economies with strong manufacturing activity

Opportunity

“Integration of Smart Technologies & IoT for Predictive Maintenance”

- Smart boilers integrated with IoT (Internet of Things) and AI-based predictive maintenance technologies offer a significant opportunity to enhance operational efficiency, reduce downtime, and minimize repair costs

- These advanced systems can continuously monitor boiler performance, detect early signs of wear and tear, and predict maintenance needs, thus avoiding unplanned failures and ensuring seamless operations

- The ability to automate maintenance schedules based on real-time data is expected to drive demand for more reliable and cost-effective boiler solutions across industries

For instance,

- In March 2024, Siemens launched an AI-powered smart boiler system that utilizes real-time data to predict maintenance requirements and improve energy efficiency, helping industries reduce operational costs and extend the lifespan of their boilers

- The integration of smart technologies is expected to enhance productivity and sustainability in industrial processes, leading to greater adoption of IoT-enabled boilers and significantly improving long-term cost savings and energy management

Restraint/Challenge

“High Initial Investment and Operating Costs”

- The high initial investment and operating costs associated with industrial boilers pose a significant challenge to market growth, particularly for small and medium-sized enterprises (SMEs) in emerging markets

- Industrial boilers, especially those that are energy-efficient, can require a substantial capital expenditure, with prices often ranging from tens of thousands to several million dollars depending on size, capacity, and technology

- The ongoing operational costs, including fuel consumption, maintenance, and compliance with environmental regulations, can also be a financial burden for industries with tight budget

For instance,

- In February 2024, a report by Frost & Sullivan highlighted that small manufacturers in Southeast Asia face difficulties in adopting the latest energy-efficient boilers due to the significant upfront investment and operational expenses associated with newer technologies

- These financial barriers may deter companies from upgrading their boiler systems or adopting advanced technologies, resulting in continued reliance on older, less efficient models, which can ultimately hinder long-term market growth

Industrial Boilers Market Scope

The market is segmented on the basis tubing methods, steam pressure, stream usage, furnace position, shell axis, tubes in boilers, water and steam circulation in boilers, fuel type, product type, boiler horsepower, and industry.

|

Segmentation |

Sub-Segmentation |

|

By Tubing Methods |

|

|

By Steam Pressure |

|

|

By Stream Usage |

|

|

By Furnace Position |

|

|

By Shell Axis |

|

|

By Tubes in Boilers |

|

|

By Water and Steam Circulation in Boilers |

|

|

By Fuel Type |

|

|

By Product Type |

|

|

By Boiler Horsepower |

|

|

By Industry |

|

In 2025, the natural gas-fired boiler segment is projected to dominate the industrial boilers market with the largest share in the fuel type segment.

The natural gas-fired boiler segment is projected to dominate the global industrial boilers market, holding approximately 25% of the total market share. This dominance is attributed to natural gas being a cleaner and more efficient fuel source compared to oil or coal, resulting in lower carbon emissions and operational costs. Natural gas boilers offer high efficiency and reliability, making them a preferred choice for both residential and commercial heating applications. In addition, the widespread availability and infrastructure support for natural gas further enhance their adoption across various industries

The horizontal boilers is expected to account for the largest share during the forecast period in shell axis segments

The horizontal boilers segment is expected to dominate the market with the largest market share of 55% in 2025, due to their widespread use in various industries, including manufacturing, chemicals, and food processing. Horizontal boilers are preferred for their larger capacity, ease of maintenance, and space efficiency, making them ideal for industrial applications requiring high steam output. The demand for horizontal boilers continues to grow as industries look for reliable, efficient, and cost-effective solutions to meet energy needs. In addition, horizontal boilers are more adaptable to fluctuating energy demands, contributing to their market dominance

Industrial Boilers Market Regional Analysis

“North America Holds the Largest Share in the Industrial Boilers Market”

- North America dominates the global industrial boilers market, accounting for approximately 41.91% of the market share in 2024

- The U.S. holds a significant share due to increased demand for high-precision industrial processes, rising energy requirements, and continuous advancements in boiler technologies

- The availability of well-established regulatory frameworks and growing investments in research & development by leading boiler manufacturers further strengthen the market

- In addition, the increasing focus on energy optimization, reduction in operational costs, and the adoption of cleaner energy sources are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Industrial Boilers Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the industrial boilers market, driven by rapid industrialization, growing manufacturing output, and increasing demand for energy-efficient solutions

- Countries such as China, India, and Japan are emerging as key markets due to their expanding industrial base, rising energy consumption, and increasing infrastructure development

- China, with its large manufacturing sector and significant investments in power generation and industrial applications, is driving substantial demand for industrial boilers. The country is also focusing on environmental sustainability, further propelling the adoption of cleaner and more efficient boiler technologies

- India, with its burgeoning industrial activities, including in sectors like textiles, chemicals, and food processing, is experiencing rapid adoption of industrial boilers to meet growing energy needs. Increased government support and private sector investments in infrastructure are further contributing to the market growth

Industrial Boilers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- RSA Security LLC (U.S.)

- Genpact (U.S.)

- MetricStream (U.S.)

- KPMG Česká republika, s.r.o. (Netherlands)

- BitSight Technologies, Inc. (U.S.)

- Ernst & Young Global Limited (U.K.)

- PwC (U.K.)

- ProcessUnity, Inc. (U.S.)

- Venminder, Inc. (U.S.)

- Resolver Inc. (Canada)

- NAVEX Global, Inc. (U.S.)

- Riskpro (India)

- SAI Global Pty Limited (U.S.)

- Rapid Ratings International Inc. (U.S.)

- Optiv Security Inc. (U.S.)

- Aravo Solutions, Inc. (U.S.)

- OneTrust, LLC. (U.S.)

- Prevalent, Inc. (U.S.)

Latest Developments in Global Industrial Boilers Market

- In February 2024, Miura Co. Ltd. introduced the Miura Care Program, a comprehensive preventative boiler maintenance initiative in collaboration with Hartford Steam Boiler (HSB). This program is designed to ensure maximum safety, reliability, and efficiency for boiler systems while offering unmatched peace of mind to customers. Miura Care integrates Internet of Things (IoT) technology for predictive maintenance, minimizing downtime and optimizing performance. It also includes an industry-exclusive Boiler Availability Guarantee, reinforcing Miura’s commitment to uninterrupted system operation

- In December 2022, Bharat Heavy Electricals Limited (BHEL) entered into a Technology License Agreement (TLA) with Sumitomo SHI FW (SFW) of Finland to advance Circulating Fluidized Bed Combustion (CFBC) boiler technology. This agreement enables BHEL to engineer, design, manufacture, erect, commission, and sell both supercritical and subcritical CFBC boilers in India and select overseas territories. CFBC technology offers fuel flexibility, improved operational efficiency, and reduced SOx & NOx emissions, eliminating the need for additional emission control systems. In addition, it supports biomass co-firing, promoting sustainable energy solutions

- In November 2022, Babcock & Wilcox (B&W) secured a $24 million contract to supply advanced control technologies, two industrial package boilers, and auxiliary equipment for a North American petroleum refinery. This agreement highlights B&W’s expertise in steam generation and emissions control, ensuring high efficiency and reliability in industrial operations. The package boilers feature low emissions, simple operation, and flexible fuel options, while selective catalytic reduction (SCR) systems help minimize nitrogen oxide (NOx) emissions. B&W continues to lead in clean power production technology

- In August 2022, Thermax unveiled its multi-fuel boiler solution, designed to help industrial users transition from traditional to green energy. This innovative system, introduced by Thermax Babcock & Wilcox Energy Solutions, provides fuel flexibility, allowing seamless switching between municipal solid waste, bagasse, biomass, and coal. The FlexiSource boiler addresses challenges related to fuel availability, geopolitical shifts, and environmental concerns, ensuring continuous energy production. With growing interest in biomass energy, Thermax has already secured multiple orders, reinforcing its commitment to sustainable industrial solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Boilers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Boilers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Boilers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.