Global Industrial Bulk And Transport Packaging Market

Market Size in USD Billion

CAGR :

%

USD

17.57 Billion

USD

24.04 Billion

2025

2033

USD

17.57 Billion

USD

24.04 Billion

2025

2033

| 2026 –2033 | |

| USD 17.57 Billion | |

| USD 24.04 Billion | |

|

|

|

|

Industrial Bulk and Transport Packaging Market Size

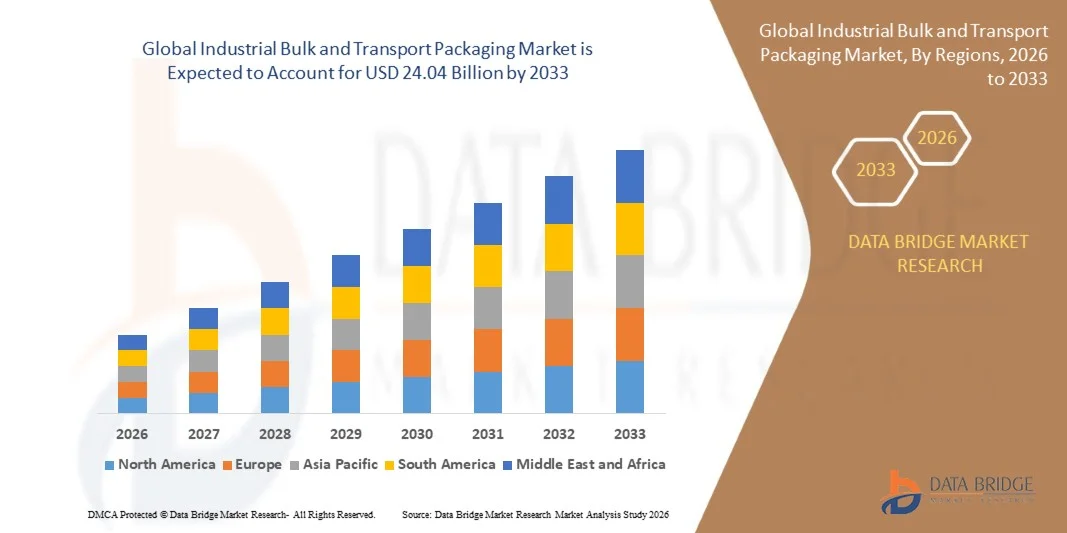

- The global industrial bulk and transport packaging market size was valued at USD 17.57 billion in 2025 and is expected to reach USD 24.04 billion by 2033, at a CAGR of 4.00% during the forecast period

- The market growth is primarily driven by increasing demand for durable, efficient, and large-capacity packaging solutions across industries such as chemicals, food and beverage, pharmaceuticals, and manufacturing, where bulk transportation reliability and compliance remain essential

- In addition, rising global logistics activities, expanding international trade volumes, and the growing emphasis on cost-effective long-distance transportation are strengthening market adoption of industrial packaging formats such as drums, IBCs, crates, and bulk bags, contributing to strong industry expansion

Industrial Bulk and Transport Packaging Market Analysis

- Industrial bulk and transport packaging, designed for the secure handling, storage, and movement of large-volume materials, continues to gain traction due to its ability to reduce product loss, optimize shipping efficiency, and support automated logistics handling across sectors such as chemicals, construction, agriculture, and pharmaceuticals

- The increasing adoption of reusable and sustainable packaging formats, combined with the rise of globalized supply chains and stringent safety regulations, is accelerating demand for robust, compliant, and performance-focused bulk transport packaging solutions, reinforcing its integral role in modern industrial logistics systems

- North America dominated the industrial bulk and transport packaging market with a share of over 40% in 2025, due to strong industrial manufacturing output, expanding e-commerce shipments, and increasing reliance on durable containers for heavy-duty applications

- Asia-Pacific is expected to be the fastest growing region in the industrial bulk and transport packaging market during the forecast period due to rapid industrialization, manufacturing scale-up, and increasing import-export activities across China, India, and Southeast Asian economies

- Drums segment dominated the market with a market share of 48.7% in 2025, due to expanding chemical and lubricant supply chains across emerging industrial economies. Drums are widely adopted due to their durability, recyclability, and availability in steel, plastic, and composite configurations that suit varying transport conditions. Their role in hazardous and volatile substance transport continues to increase as businesses prioritize safety, leakage prevention, and compliance with international transport regulations. In addition, advancements such as RFID-enabled drum tracking and improved sealing systems support operational efficiency across global supply networks

Report Scope and Industrial Bulk and Transport Packaging Market Segmentation

|

Attributes |

Industrial Bulk and Transport Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Bulk and Transport Packaging Market Trends

Rising Adoption of Reusable and Sustainable Industrial Packaging Solutions

- The industrial bulk and transport packaging market is witnessing a strong shift toward reusable, recyclable, and eco-efficient packaging formats as sustainability initiatives become central to global industrial logistics strategies. Industries such as chemicals, food processing, construction, and pharmaceuticals are increasingly transitioning from single-use bulk packaging to long-cycle solutions designed for multiple handling and transportation cycles, supporting waste reduction and long-term operational cost efficiency

- For instance, Schoeller Allibert has expanded its reusable bulk container and pallet portfolio focusing on returnable packaging systems that support repeated industrial circulation and reduce waste generation throughout supply chain operations

- Reusable packaging adoption is also being reinforced by advancements in material engineering, where manufacturers are developing high-strength and lightweight polymers optimized for repeated industrial use, extended durability, and improved load-bearing capabilities. The availability of collapsible bulk bins, returnable IBCs, and reusable transport crates is reshaping handling efficiency across warehouses, automated facilities, and international shipping environments

- Industries focused on hazardous and food-grade applications are also accelerating the adoption of reusable formats that ensure contamination control, regulatory compliance, and storage safety while maintaining structural performance under standard and extreme conditions. Digitalization through RFID tagging, barcode tracking, and asset monitoring is further enhancing the lifecycle value and internal traceability of reusable bulk packaging assets

- Regulatory frameworks emphasizing waste reduction, industrial material recovery, and circular economy compliance are strengthening organizational focus on reusable packaging infrastructures, especially in regions promoting sustainable industrial supply chains. Companies are increasingly incorporating reusable packaging as part of long-term logistics planning to reduce disposal-related expenditure, improve traceability, and align with environmental policies

- As sustainability performance becomes a procurement requirement for global industries, reusable and circular-focused bulk transport packaging systems are expected to establish a long-term presence in industrial logistics frameworks, marking a transition toward durable, environmentally aligned, and lifecycle-optimized packaging solutions

Industrial Bulk and Transport Packaging Market Dynamics

Driver

Growing Demand from Chemical, Pharmaceutical, and Manufacturing Logistics

- The industrial bulk and transport packaging market is being driven by increasing requirements for efficient, large-volume, and compliance-ready packaging formats within chemical, pharmaceutical, and manufacturing logistics. These sectors require safe transport and storage solutions capable of handling corrosive fluids, powders, temperature-sensitive materials, and heavy-density industrial commodities while reducing material loss during long-distance or high-frequency movement

- For instance, Greif continues strengthening its intermediate bulk container and drum offerings to support expanding logistics demands for chemicals and industrial goods across both domestic and international supply networks

- Industries handling hazardous fluids and regulated substances are relying on bulk packaging formats that offer structural durability, spill resistance, and compatibility with automated handling systems used across warehouses, chemical storage hubs, and port distribution facilities. The rising volume of international trade and increasing complexity of supply chains are further accelerating demand for standardized and high-capacity packaging formats suitable for containerized logistics

- The expansion of pharmaceutical cold-chain operations and stringent handling standards are increasing usage of insulated bulk solutions engineered to maintain product integrity across geographically dispersed supply points. Manufacturing sectors are also adopting drum systems, bulk crate formats, and IBCs to reduce packaging costs per shipment, optimize warehouse density, and support scalable logistics operations

- As industrial activity continues expanding across regions with increasing export flows and large manufacturing footprints, demand for reliable, safe, and transport-efficient bulk packaging solutions is expected to remain strong, reinforcing its essential role in industrial distribution networks and long-term logistics planning

Restraint/Challenge

Regulatory Compliance and High Material Handling Standards

- A significant challenge affecting the industrial bulk and transport packaging market is the need to comply with strict regulatory frameworks governing packaging structural safety, hazardous material handling, contamination prevention, and global transport certification. Manufacturers and end users must ensure packaging meets chemical compatibility standards, load compliance, impact resistance, and hazardous substance transport regulations, which increases operational and certification-related complexity

- For instance, companies managing chemical drums and intermediate bulk containers are required to comply with UN and ISO transportation regulations before these assets can be approved for industrial shipping and warehouse handling

- The presence of multiple sector-specific compliance requirements creates barriers for organizations managing cross-regional or multi-industry supply chains, where packaging must meet food-grade, pharmaceutical, or hazardous chemical standards depending on application. Meeting these requirements often requires specialized materials, validated production processes, and repeated compliance testing, which increases lead time and capital investment

- High handling standards also require bulk packaging to withstand operational environments involving mechanical lifting, stacking, exposure to chemicals, and repeat circulation within automated handling systems. Failure to meet these standards may result in product leakage, contamination, or operational disruption, increasing replacement and compliance risks

- As regulatory expectations continue strengthening across hazardous material, food safety, and pharmaceutical logistics frameworks, the requirement for certified, high-performance industrial bulk packaging is expected to remain a structural challenge. Ensuring compliance while maintaining cost-efficiency and operational reliability will be critical for manufacturers and logistics operators managing large-scale transport environments

Industrial Bulk and Transport Packaging Market Scope

The market is segmented on the basis of packaging type, material type, and end user.

- By Packaging Type

On the basis of packaging type, the industrial bulk and transport packaging market is segmented into cartons, wooden crates, containers, drums, pails, corrugated boxes, barrels, IBCs, strapping, and others. The drums segment dominated the market in 2025 with the largest revenue share of 48.7% due to expanding chemical and lubricant supply chains across emerging industrial economies. Drums are widely adopted due to their durability, recyclability, and availability in steel, plastic, and composite configurations that suit varying transport conditions. Their role in hazardous and volatile substance transport continues to increase as businesses prioritize safety, leakage prevention, and compliance with international transport regulations. In addition, advancements such as RFID-enabled drum tracking and improved sealing systems support operational efficiency across global supply networks.

The IBCs segment is expected to witness the fastest growth rate from 2026 to 2033 driven by their high capacity, stackability, and suitability for liquid and semi-solid materials across heavy industries. Businesses prefer IBCs for their cost efficiency per unit volume, reduced material handling effort, and reusability, which align with sustainability goals and regulatory waste reduction policies. Their compatibility with hazardous material transport standards and adoption across chemicals, oil and lubricants, and pharmaceuticals further strengthens their market hold. The demand remains strong as manufacturers continue integrating smart tracking systems and tamper-evident features for secure long-haul logistics environments.

- By Material Type

On the basis of material type, the market is segmented into plastic, paper and paperboard, metal, wood, and others. The plastic segment dominated the market in 2025 with the highest revenue share attributed to its versatility, lighter weight, corrosion resistance, and adaptability for manufacturing bulk packaging formats such as IBCs, pails, and drums. Industries prefer plastic packaging due to its durability in demanding environments, especially in chemical handling, liquid food transport, and lubricants storage. The growing availability of recycled and bio-based plastics also supports adoption as companies work toward eco-friendly and regulatory-compliant packaging strategies in large-scale transport systems. Plastic remains favored due to its cost efficiency and ability to meet strict hygiene, safety, and reuse standards.

The paper and paperboard segment is projected to witness the fastest CAGR from 2026 to 2033 due to rising emphasis on biodegradable and recyclable packaging solutions in food, electronics, and agriculture logistics. Lightweight corrugated formats allow lower transportation costs and reduced carbon emissions, making them appealing options for sustainable supply chains. Regulatory pressure against single-use plastics and growth of e-commerce-driven bulk shipping further reinforce segment momentum. The ongoing innovation in high-strength fiber materials and moisture-resistant coatings is improving load-bearing capacities, enabling wider industrial adoption while supporting companies’ environmental targets.

- By End User

On the basis of end user, the market is segmented into agriculture, automotive, building and construction, chemicals and pharmaceuticals, food and beverages, metallurgical, oil and lubricants, electrical and electronics, and others. The chemicals and pharmaceuticals segment dominated the market in 2025 owing to the critical requirement for secure, regulated, and contamination-resistant transport packaging solutions. Industries handling hazardous, reactive, and temperature-sensitive materials rely on drums, IBCs, and reinforced containers engineered to comply with international regulatory frameworks. The sector experiences sustained demand driven by expanding global manufacturing and trade networks, particularly in specialty chemicals and life sciences logistics. This segment maintains leadership due to its dependency on certified high-performance packaging to ensure safety, purity, and controlled distribution across long-distance transport lanes.

The food and beverages segment is expected to witness the fastest growth rate from 2026 to 2033 supported by rising global food trade volumes, cold chain expansion, and the increasing use of hygienic and reusable packaging formats. Bulk packaging solutions such as corrugated boxes, plastic containers, and drums play a vital role in preventing contamination and spoilage throughout transport. Growth in processed food exports, dairy distribution, and beverage concentrates transportation fuels notable investment in durable and traceable packaging formats. Sustainability trends, reusable packaging adoption, and compliance with evolving food safety regulations are accelerating this segment’s expansion across both regional and international transport channels.

Industrial Bulk and Transport Packaging Market Regional Analysis

- North America dominated the industrial bulk and transport packaging market with the largest revenue share of over 40% in 2025, driven by strong industrial manufacturing output, expanding e-commerce shipments, and increasing reliance on durable containers for heavy-duty applications

- Industries in the region value high-performance packaging solutions that support chemical resistance, high load-bearing capacity, and compliance with safety and environmental standards such as those for hazardous material movement

- The growth is supported by the presence of well-established logistics and warehousing infrastructure, strong demand from sectors such as food and beverage, chemicals, pharmaceuticals, and oil and gas, and an increasing shift toward reusable and sustainable packaging models

U.S. Industrial Bulk and Transport Packaging Market Insight

The U.S. industrial bulk and transport packaging market secured the largest revenue share within North America in 2025, driven by strong manufacturing and export activities. The rising reliance on bulk packaging formats including IBCs, metal drums, tank containers, and rigid plastics is supporting market expansion across chemicals, agriculture, and pharmaceuticals. The increasing penetration of reusable and recyclable packaging solutions and the rising implementation of supply chain automation such as RFID-based tracking and smart containers are further strengthening market development. The growing emphasis on sustainable logistics, supported by regulatory frameworks and corporate sustainability commitments, continues to accelerate the adoption of advanced and durable packaging systems.

Europe Industrial Bulk and Transport Packaging Market Insight

The Europe industrial bulk and transport packaging market is projected to grow at a substantial CAGR through the forecast period, supported by stringent environmental regulations and strong adoption of reusable industrial packaging formats. Rising trade activity, advanced logistics frameworks, and increasing demand from automotive, chemical, and food processing industries are reinforcing the need for high-strength packaging solutions. The region is witnessing increasing use of pallet containers, bulk bags, and hybrid lightweight transport designs to improve efficiency and minimize waste. The shift toward automation in warehouse handling and transport systems is further supporting the market’s adoption of standardized and modular packaging formats suitable for mechanized movement

U.K. Industrial Bulk and Transport Packaging Market Insight

The U.K. industrial bulk and transport packaging market is expected to expand at a notable CAGR during the forecast period, driven by increasing exports, growing adoption of palletized cargo systems, and rising need for protective transport solutions across pharmaceuticals and chemicals. The rise of e-commerce fulfillment hubs and automated warehouses is further accelerating the demand for bulk packaging systems that support stacking strength and efficient shipment consolidation. Sustainability mandates and the shift toward closed-loop reusable packaging ecosystems are expected to contribute to continuous market growth.

Germany Industrial Bulk and Transport Packaging Market Insight

The Germany industrial bulk and transport packaging market is anticipated to grow at a significant CAGR due to high industrial activity, a strong automotive ecosystem, and strict regulatory requirements surrounding safe transport of materials. The market benefits from a well-developed manufacturing base and a high focus on engineered, safe, and reusable packaging materials for hazardous and high-value products. The increased implementation of smart logistics systems and Industry 4.0-enabled warehousing is driving adoption of standardized, durable, and automation-friendly transport packaging solutions across industries.

Asia-Pacific Industrial Bulk and Transport Packaging Market Insight

The Asia-Pacific industrial bulk and transport packaging market is expected to expand at the fastest CAGR during 2026 to 2033, driven by rapid industrialization, manufacturing scale-up, and increasing import-export activities across China, India, and Southeast Asian economies. The high production volume of chemicals, construction materials, agricultural goods, and pharmaceuticals is supporting demand for flexible and rigid bulk packaging formats. Increasing infrastructure investments, digital logistics advancements, and the growth of third-party logistics providers are accelerating the adoption of industrial transport packaging across the region.

Japan Industrial Bulk and Transport Packaging Market Insight

The Japan industrial bulk and transport packaging market is growing steadily due to advanced manufacturing operations, strong export dependency, and increased focus on safety and high material integrity in logistics. Growing automation in warehousing and the use of robotics for material handling are driving the demand for standardized and precision-engineered industrial packaging formats. The country’s focus on reusable, lightweight, and recyclable packaging solutions is also supporting market acceleration across food, chemical, and electronics industries.

China Industrial Bulk and Transport Packaging Market Insight

The China industrial bulk and transport packaging market accounted for the largest share in Asia-Pacific in 2025, supported by extensive manufacturing operations, strong export-oriented production, and rising investments in logistics and supply chain modernization. Rapid growth in chemicals, agriculture, construction, and pharmaceuticals industries is increasing demand for bulk bags, crates, steel drums, and IBCs. The availability of cost-effective materials, a large domestic manufacturing ecosystem, and rising adoption of reusable industrial packaging systems for cost optimization and regulatory compliance continue to propel market expansion.

Industrial Bulk and Transport Packaging Market Share

The industrial bulk and transport packaging industry is primarily led by well-established companies, including:

- NEFAB Group (Sweden)

- Greif (U.S.)

- Rehrig Pacific Company (U.S.)

- Del-Tec Packaging (U.S.)

- Kuehne + Nagel (Switzerland)

- DS Smith (U.K.)

- Eltete TPM Ltd. (Finland)

- Sonoco Products Company (U.S.)

- Berry Global Inc. (U.S.)

- Amcor plc (Switzerland)

- Mondi (Austria)

- International Paper (U.S.)

- WestRock Company (U.S.)

- Snyder Industries (U.S.)

- Sigma Plastics Group (U.S.)

- Lamar Packaging Systems (U.S.)

- SSI SCHAEFER (Germany)

- Schoeller Allibert (Netherlands)

- Ven Pack (India)

- BWAY Corporation (U.S.)

- Orora Packaging Solutions (Australia)

Latest Developments in Global Industrial Bulk and Transport Packaging Market

- In November 2025, Mondi Group expanded its product offering by launching an extended corrugated and solid-board packaging portfolio following its acquisition of Schumacher Packaging. This development is expected to strengthen Mondi’s competitive position in the industrial bulk and transport packaging sector by broadening its sustainable materials portfolio and enhancing supply capabilities across the food and logistics industries. The move reinforces the growing shift toward recyclable, fiber-based packaging solutions and is projected to boost demand for alternative bulk packaging formats among environmentally regulated markets

- In July 2025, SCHÜTZ Container Systems announced a USD 31 million capacity expansion at its U.S. facility in St. Joseph, Missouri. This investment is expected to significantly increase production scale, support faster delivery timelines, and strengthen the domestic supply chain for intermediate bulk containers (IBCs) and industrial transport packaging. The integration of fully electric, automated equipment in the expansion also aligns with rising demand for energy-efficient and industry-compliant packaging solutions across the North American market

- In January 2025, SCHÜTZ GmbH & Co. KGaA entered into a strategic licensing agreement with National Plastic Factory Company (NPF) to begin local production of ECOBULK IBCs in Saudi Arabia. This partnership is expected to accelerate regional manufacturing localization, improve supply accessibility across the GCC industrial ecosystem, and reduce reliance on imports. The move positions the company to tap into rising demand from oil and gas, chemical, and food sectors requiring compliant and durable bulk liquid transport solutions

- In August 2024, Mauser Packaging Solutions strengthened its global footprint by acquiring a South African plastic-drum manufacturing business. This acquisition is expected to enhance the company’s regional production capabilities and accelerate access to emerging industrial markets in Africa. The expanded presence supports the rising need for reusable, compliant, and heavy-duty bulk containers as industrialization, export-focused manufacturing, and regulated chemical logistics continue to scale across the region

- In February 2024, Mauser Packaging Solutions acquired the assets of Consolidated Container Company, LLC, expanding its industrial container and reconditioning services across the U.S. Midwest. This move is projected to strengthen the company’s domestic supply chain resilience, extend service coverage for high-volume industrial users, and support the transition toward circular packaging systems. With increasing regulatory focus on waste reduction and reusable industrial packaging, this acquisition strategically positions the firm for long-term market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Bulk And Transport Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Bulk And Transport Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Bulk And Transport Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.