Global Industrial Centrifuges Market

Market Size in USD Billion

CAGR :

%

USD

2.73 Billion

USD

3.91 Billion

2024

2032

USD

2.73 Billion

USD

3.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.73 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Industrial Centrifuge Market Size

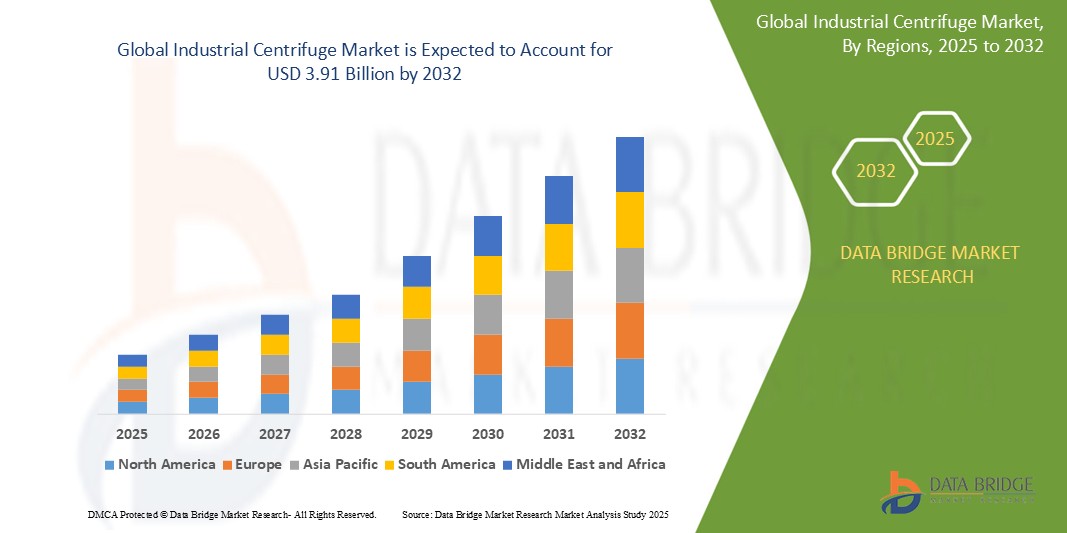

- The global industrial centrifuge market size was valued at USD 2.73 billion in 2024 and is expected to reach USD 3.91 billion by 2032, at a CAGR of 4.60% during the forecast period

- This growth is driven by factors such as the increasing demand for efficient separation processes across various industries, stringent environmental regulations, advancements in centrifuge technology, and the rising need for wastewater treatment solutions

Industrial Centrifuge Market Analysis

- Centrifuges are machines that separate substances with different densities, remove moisture, and promote gravitational effects by using centrifugal force

- Solid-liquid separation, liquid-liquid separation, and liquid-liquid-solid separation are all done with industrial centrifuges

- North America is expected to dominate the industrial centrifuges market with 36.9% due to robust sectors such as pharmaceuticals, food and beverage, chemical processing, and wastewater treatment

- Asia-Pacific is expected to be the fastest growing region in the industrial centrifuge market during the forecast period due to chemical, petrochemical, pharmaceutical, and biotechnology industries are expanding, driving the need for advanced separation equipment

- Sedimentation centrifuge segment is expected to dominate the market with a market share due to its effective in separating solids from liquids in a variety of applications, making them a common choice for industrial processes

Report Scope and Industrial Centrifuge Market Segmentation

|

Attributes |

Industrial Centrifuge Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Centrifuge Market Trends

“Technological Advancements and Automation”

- Modern industrial centrifuges are increasingly incorporating automation technologies, such as IoT connectivity and AI-based monitoring systems. This integration allows for real-time performance tracking, predictive maintenance, and enhanced operational efficiency

- There is a growing emphasis on developing energy-efficient centrifuge models to reduce operational costs and align with global sustainability goals. Manufacturers are focusing on optimizing designs to minimize energy consumption without compromising performance

- Centrifuge manufacturers are offering customized solutions tailored to the unique requirements of various industries, including pharmaceuticals, food processing, and wastewater treatment. This trend is driven by the need for specialized equipment that meets stringent industry standards

- The use of corrosion-resistant and lightweight materials in centrifuge construction is on the rise. These materials enhance the durability and longevity of the equipment, reducing maintenance needs and extending service life

- To accommodate space constraints in modern industrial facilities, there is a shift towards more compact and modular centrifuge designs. These designs offer flexibility and ease of integration into existing production lines

Industrial Centrifuge Market Dynamics

Driver

“Increasing Demand across Process Industries”

- The chemical industry utilizes centrifuges for separating solids from liquids, purifying chemicals, and recovering valuable by-products. The growing chemical production activities globally are driving the demand for efficient separation technologies

- In the food sector, centrifuges are employed for clarifying juices, separating cream from milk, and producing edible oils. The rising demand for processed and packaged food products is fueling the need for advanced centrifuge systems

- The pharmaceutical industry relies on centrifuges for cell harvesting, protein purification, and vaccine production. The expansion of the biopharmaceutical sector, especially in emerging markets, is significantly contributing to market growth

- With increasing environmental concerns, industrial centrifuges are extensively used in wastewater treatment plants to dewater sludge, facilitating efficient waste management and compliance with environmental regulations

- Centrifuges are used in the mining industry for separating valuable minerals from ore, enhancing resource recovery and operational efficiency. The growth in mining activities is positively impacting the centrifuge market

Opportunity

“Expansion in Emerging Economies”

- Rapid urbanization and industrialization in countries such as China, India, and Brazil are leading to increased investments in infrastructure, including wastewater treatment facilities and food processing plants, thereby boosting the demand for industrial centrifuges

- Governments in emerging economies are implementing policies to promote industrial growth and environmental sustainability. These initiatives often include subsidies or incentives for adopting advanced technologies, such as industrial centrifuges

- Establishing local manufacturing units or partnerships in emerging markets can reduce costs and improve supply chain efficiency, presenting significant opportunities for market players to expand their presence

- Adapting centrifuge designs to meet the specific requirements and conditions of emerging markets can enhance product acceptance and market penetration

- Providing training programs and after-sales support can build customer loyalty and ensure the effective use of centrifuge equipment in emerging economies

Restraint/Challenge

“High Capital Investment and Operational Complexities”

- The significant capital investment required for purchasing industrial centrifuges can be a barrier for small and medium-sized enterprises, limiting their ability to adopt advanced separation technologies

- Centrifuges require regular maintenance and skilled operators, leading to ongoing operational costs. The complexity of these machines may also result in increased downtime during repairs or maintenance

- There is a shortage of trained professionals capable of operating and maintaining advanced centrifuge systems, particularly in developing regions, which can hinder the effective utilization of the equipment

- Strict environmental and safety regulations necessitate compliance, which can involve additional costs and administrative efforts for industries utilizing centrifuge technologies

- Economic downturns or fluctuations in commodity prices can impact the budgets of industries investing in capital-intensive equipment such as centrifuges, affecting market growth

Industrial Centrifuge Market Scope

The market is segmented on the basis of equipment type, mode of operation, design, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Equipment Type |

|

|

By Mode of Operation |

|

|

By Design |

|

|

By End-User |

|

|

By Distribution Channel |

|

In 2025, the sedimentation centrifuge is projected to dominate the market with a largest share in equipment type segment

The sedimentation centrifuge segment is expected to dominate the industrial centrifuge market with the largest share of 56.22% in 2025 due to its effective in separating solids from liquids in a variety of applications, making them a common choice for industrial processes. The high versatility and efficiency in separating particles with different densities contribute to their dominance in the market.

The horizontal centrifuge is expected to account for the largest share during the forecast period in design market

In 2025, the horizontal centrifuge segment is expected to dominate the market with the largest market share due to its higher efficiency in separating solids from liquids. They are particularly beneficial in large-scale operations, such as wastewater treatment plants and mining operations, where continuous and high-throughput separation is essential. The horizontal design ensures even distribution of materials and improves the overall separation process, contributing to its dominance.

Industrial Centrifuge Market Regional Analysis

“North America Holds the Largest Share in the Industrial Centrifuge Market”

- North America holds the largest revenue share in the global industrial centrifuge market with 36.9%, primarily driven by the U.S.

- The demand is bolstered by robust sectors such as pharmaceuticals, food and beverage, chemical processing, and wastewater treatment

- Continuous innovation and adoption of advanced centrifuge technologies contribute to the region's market dominance

- Stringent environmental and safety regulations in the U.S. necessitate the use of efficient separation technologies, further propelling market growth

- Established infrastructure and significant investments in industrial processes solidify North America's leading position in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Industrial Centrifuge Market”

- Countries such as China and India are experiencing significant industrial growth, increasing the demand for industrial centrifuges

- The chemical, petrochemical, pharmaceutical, and biotechnology industries are expanding, driving the need for advanced separation equipment

- Policies promoting infrastructure development and foreign investments are accelerating market growth in the region

- Rising environmental concerns and the need for effective wastewater treatment solutions are boosting the adoption of industrial centrifuges

- The Asia Pacific region is expected to witness the highest compound annual growth rate (CAGR) in the coming years, reflecting its dynamic market expansion

Industrial Centrifuge Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ANDRITZ (Austria)

- ALFA LAVAL (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- Mitsubishi Kakoki Kaisha, Ltd. (Japan)

- Thomas Broadbent & Sons Ltd (U.K.)

- FLSmidth (Denmark)

- Schlumberger Limited (U.S.)

- Ferrum Ltd. (Switzerland)

- Flottweg SE (Germany)

- SIEBTECHNIK TEMA GmbH (Germany)

- HEINKEL Process Technology GmbH (Germany)

- Gruppo Pieralisi - MAIP S.p.A. (Italy)

- SPX Flow Inc. (U.S.)

- HAUS Centrifuge Technologies (Turkey)

- Elgin Power and Separation Solutions (U.S.)

- Dedert Corporation (U.S.)

- US Centrifuge Systems (U.S.)

- B&P Littleford (U.S.)

Latest Developments in Global Industrial Centrifuge Market

- In July 2024, The Hettich Group, a third-generation family-owned life science equipment company renowned for its laboratory centrifuges, has announced a strategic growth partnership with Bregal Unternehmerkapital GmbH. This collaboration aims to bolster Hettich's market presence and drive innovation in the laboratory equipment sector

- In January 2024, GEA unveiled X Control, a fresh centrifuge control system. The introduction of X Control sets the stage for incorporating Artificial Intelligence (AI), promising quicker and simpler data collection and analysis and self-optimization of the entire system in the future. The heightened computing capabilities will also enhance integration with SCADA (Supervisory Control and Data Acquisition) systems

- In September 2023, The U.S. Army Engineer Research and Development Center (ERDC) completed the upgrade of beam centrifuges, giving modernized functionality to one of the most innovative pieces of technology. The centrifuge within the Geotechnical and Structures Laboratory's (GSL) Geotechnical Engineering and Geosciences Branch (GEGB) was upgraded with improvements to its electrical and hydraulic systems and significant renovations to the control building

- In April 2023, Eppendorf, a prominent life science company, has unveiled the Centrifuge 5427 R, marking its debut in the microcentrifuge segment equipped with hydrocarbon cooling. This innovation aims to enhance sustainability in laboratory environments by offering a refrigerated device that utilizes a natural cooling agent with a Global Warming Potential (GWP) nearly zero

- In February 2023, the globally operating Eppendorf Group announced an expansion of its manufacturing presence within the Chinese market. The company finalized an agreement for a new production facility in the Shanghai metropolitan area. This facility will focus on producing Eppendorf centrifuges specifically for the local market. The establishment of this new site is expected to catalyze further growth for the life science company's centrifuge business

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Centrifuges Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Centrifuges Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Centrifuges Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.