Global Industrial Communication Market

Market Size in USD Billion

CAGR :

%

USD

23.68 Billion

USD

44.31 Billion

2024

2032

USD

23.68 Billion

USD

44.31 Billion

2024

2032

| 2025 –2032 | |

| USD 23.68 Billion | |

| USD 44.31 Billion | |

|

|

|

|

Industrial Communication Market Size

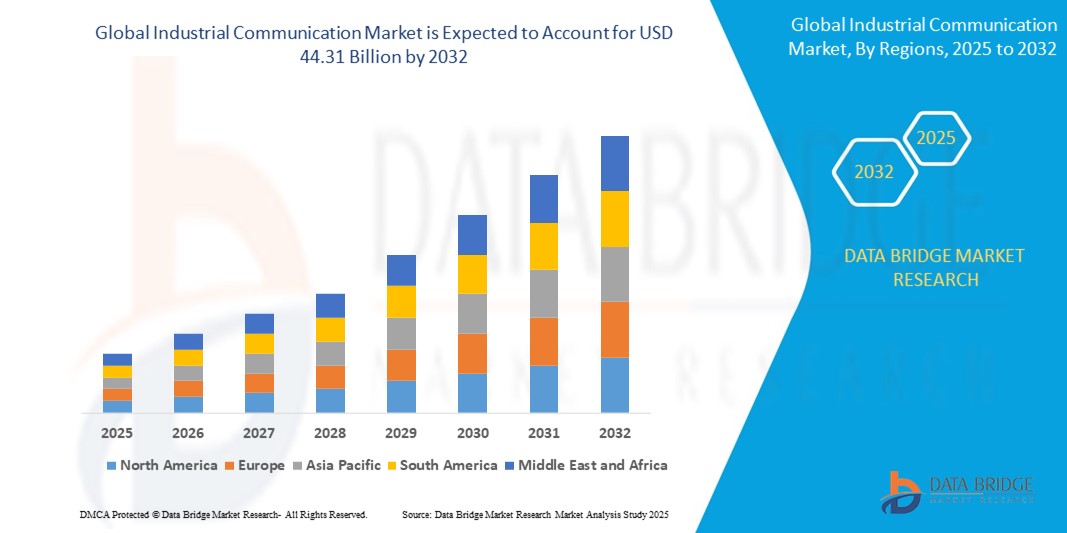

- The global industrial communication market was valued at USD 23.68 billion in 2024 and is expected to reach USD 44.31 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.15%, primarily driven by the increasing adoption of Industrial IoT (IIoT) solutions and advancements in communication technologies

- This growth is driven by factors such as the increasing need for automation, the rise of smart factories, and the growing demand for real-time data transmission and communication in industrial operations

Industrial Communication Market Analysis

- Industrial communication systems are essential for enabling seamless data exchange, control, and monitoring across various industrial processes, including manufacturing, automation, and control systems. These systems ensure reliable communication in real-time, which is crucial for improving efficiency, safety, and productivity

- The demand for industrial communication solutions is significantly driven by the increasing adoption of Industry 4.0 technologies, including automation, smart factories, and the Industrial Internet of Things (IIoT). The demand for robust communication infrastructure is particularly high in industries such as automotive, oil & gas, and energy

- North America and Europe are prominent regions in the industrial communication market due to their strong industrial base and continuous investments in automation and digital transformation initiatives. The U.S. and Germany, in particular, lead the way with their high adoption of advanced industrial communication technologies

- Globally, industrial communication systems are considered one of the key enablers of modern industrial operations, ranking just behind automation systems and control systems in terms of importance, as they support the core functions that drive operational efficiency and digital transformation in industries

Report Scope and Industrial Communication Market Segmentation

|

Attributes |

Industrial Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Communication Market Trends

“Growing Adoption of Industrial IoT and Automation Systems”

- One prominent trend in the global industrial communication market is the increasing adoption of Industrial Internet of Things (IIoT) and automation systems

- These advancements enable real-time data collection, monitoring, and control across manufacturing processes, enhancing operational efficiency and decision-making

- For instance, IIoT platforms allow for seamless communication between machines, sensors, and controllers, enabling predictive maintenance, remote diagnostics, and real-time performance optimization

- The integration of automation systems further boosts this trend by reducing human intervention, increasing production rates, and ensuring consistent quality control, thus driving demand for robust and scalable communication solutions

- This trend is transforming industries like manufacturing, energy, and logistics, improving productivity and efficiency, and spurring the need for advanced industrial communication technologies

Industrial Communication Market Dynamics

Driver

“Rising Demand for Real-Time Data and Connectivity”

- The growing need for real-time data acquisition, processing, and seamless communication across industrial operations is significantly driving the demand for advanced industrial communication solutions

- Industries like manufacturing, energy, and transportation increasingly rely on efficient, high-speed communication networks to enable real-time monitoring, predictive maintenance, and optimized workflow automation

- With the rise of connected devices and automation technologies, there is a higher demand for robust communication networks that support continuous and secure data exchange across various systems and locations

- Advanced industrial communication systems facilitate faster decision-making and reduce operational downtime, ensuring higher productivity and enhanced safety in critical environments

- As industries adopt Industry 4.0 and smart factory concepts, the demand for integrated communication networks that enable data sharing, machine-to-machine communication, and remote operations continues to rise

For instance,

- In October 2022, a study by the Industrial Internet Consortium revealed that companies adopting IIoT solutions saw a 20% improvement in operational efficiency, underscoring the importance of efficient and seamless industrial communication systems to enhance production and process management

Opportunity

“Leveraging Artificial Intelligence for Enhanced Industrial Communication”

- AI-powered industrial communication solutions can optimize network management, improve predictive maintenance, and enable real-time decision-making, enhancing operational efficiency and reliability

- AI algorithms can analyze vast amounts of data generated by industrial machines and communication networks, identifying patterns and anomalies to predict potential failures or areas for improvement

- Additionally, AI-driven systems can automate network configurations, troubleshoot issues, and improve security by detecting vulnerabilities in industrial communication networks

For instance,

- In September 2023, a case study from Siemens highlighted how AI-enabled communication systems enhanced data flow between factory machines, reducing energy consumption by 15% and improving overall system performance

- The integration of AI in industrial communication networks allows for more effective monitoring, faster response times, and better resource allocation, ultimately leading to higher productivity and cost savings across industries

Restraint/Challenge

“High Infrastructure and Deployment Costs Hindering Market Expansion”

- The high cost of deploying and maintaining industrial communication systems remains a significant challenge for the market, especially for small and medium-sized enterprises (SMEs) and industries in developing regions

- These systems, which are essential for ensuring reliable communication in industrial settings, often involve substantial investments in hardware, software, and network infrastructure, which can be prohibitively expensive

- The financial barrier can deter companies with limited budgets from upgrading their legacy systems or adopting cutting-edge industrial communication solutions, leading to a reliance on outdated technologies

- As a result, these limitations can create disparities in operational efficiency and technology adoption, ultimately hindering the broader growth and transformation of industries reliant on advanced communication systems

Industrial Communication Market Scope

The market is segmented on the basis of offerings, communication protocol, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Offerings |

|

|

By Communication Protocol |

|

|

By End User |

|

Industrial Communication Market Regional Analysis

“North America is the Dominant Region in the Industrial Communication Market”

- North America holds a dominant position in the global industrial communication market, driven by its well-established industrial base, advanced technology adoption, and high demand for real-time communication solutions across various industries

- The U.S. leads the market due to the presence of key market players, robust infrastructure, and the growing demand for automation and IoT integration in manufacturing, oil & gas, automotive, and other sectors

- The availability of government initiatives promoting industrial digitalization and significant investments in Industry 4.0 technologies further strengthens the market in the region

- In addition, the increasing trend of smart factories and automation is further propelling the adoption of industrial communication technologies, which is boosting market growth across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the industrial communication market, driven by rapid industrialization, technological advancements, and rising demand for real-time communication solutions

- Countries such as China, India, and Japan are key contributors due to the expansion of manufacturing industries, increasing demand for automation, and significant investments in smart factories and IoT-enabled technologies

- Japan, with its highly developed manufacturing sector and adoption of cutting-edge industrial communication solutions, remains a crucial market. The country continues to innovate in automation, leading to greater demand for reliable communication systems

- China and India, with their large industrial sectors and ongoing investments in modern manufacturing technologies, are witnessing increased demand for industrial communication systems to improve operational efficiency and connectivity. Additionally, the growing presence of global industrial communication providers is further fueling market growth in the region

Industrial Communication Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens AG (Germany)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric SE (France)

- Mitsubishi Electric Corporation (Japan)

- ABB Ltd. (Switzerland)

- Honeywell International Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Siemens Digital Industries Software (U.S.)

- Bosch Rexroth AG (Germany)

- Emerson Electric Co. (U.S.)

Latest Developments in Global Industrial Communication Market

- In February 2023, Cisco Systems, Inc. introduced Meraki's inaugural 5G Cellular Gateways for Fixed Wireless Access (FWA). The Cisco Meraki MG51 and MG51E cellular gateways offer a 5G-powered, cloud-first solution for Wide Area Networking (WAN), enhancing connectivity and network performance

- In April 2023, Siemens expanded its Simatic portfolio with the introduction of the Simatic S7-1500V, designed to meet specific market needs, including the virtual hosting of PLC computing

- In December 2022, Rockwell Automation introduced FactoryTalk Logix Echo, an advanced emulator that simplifies the process by enabling users to directly download to FactoryTalk Logix Echo without the need for adjustments. The solution delivers enhanced system performance, large capacity, and optimized productivity essential for control systems

- In October 2022, OMRON Corporation unveiled its IoT Gateways in the United States for the first time. These gateways efficiently capture accurate data, ensure reliable cloud connectivity, and facilitate the development of solutions that enhance automation in everyday life

- In October 2022, Moxa, Inc. introduced the EDR-G9010 Series, a secure router equipped with a firewall, NAT, VPN, and a switch. Enhanced with IDS/IPS functionality, the EDR-G9010 Series evolves into an industrial-grade next-generation firewall, offering comprehensive risk detection and prevention capabilities to safeguard critical infrastructure against cybersecurity threats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Communication Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Communication Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Communication Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.