Global Industrial Diesel Turbocharger Market

Market Size in USD Billion

CAGR :

%

USD

5.53 Billion

USD

10.22 Billion

2025

2033

USD

5.53 Billion

USD

10.22 Billion

2025

2033

| 2026 –2033 | |

| USD 5.53 Billion | |

| USD 10.22 Billion | |

|

|

|

|

What is the Global Industrial Diesel Turbocharger Market Size and Growth Rate?

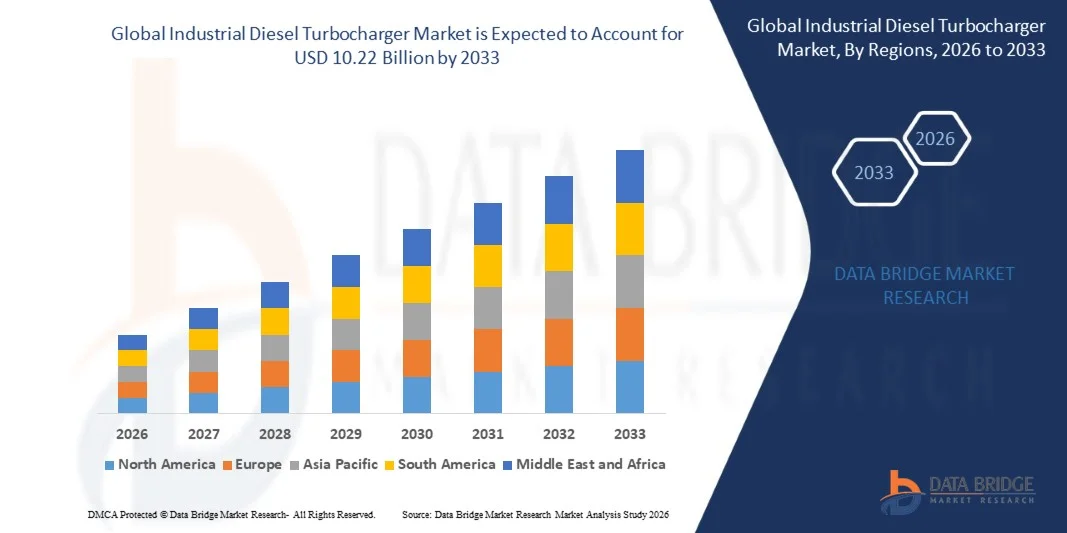

- The global industrial diesel turbocharger market size was valued at USD 5.53 billion in 2025 and is expected to reach USD 10.22 billion by 2033, at a CAGR of8.50% during the forecast period

- Rising government regulations is a crucial factor accelerating the market growth, also increase in engine downsizing to reduce vehicle weight, rising benefits of industrial turbocharger over the aspirated engine of identical power output, rising awareness among the people regarding the innovative technologies, and rising disposable income of consumers in advanced countries

What are the Major Takeaways of Industrial Diesel Turbocharger Market?

- Rising shift in the consumer trend towards green vehicle and rising demand for hybrid, variable geometry, and twin turbochargers and colossal investment by the automotive sector to incorporate fuel-efficient, low noise, and cleaner emission-quality in vehicles are the major factors among others boosting the industrial diesel turbocharger market

- Moreover, rising demand for fuel efficient engines and gasoline engines, increasing technological advancements and modernization in the production techniques and rising demand from the emerging economies will further create new opportunities for industrial diesel turbocharger market in the forecast period mentioned above

- Asia-Pacific dominated the industrial diesel turbocharger market with a 45.8% revenue share in 2025, driven by large-scale diesel engine production, rapid industrialization, and strong demand from construction, mining, agriculture, marine, and power generation sectors across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising investments in engine efficiency upgrades, emission-compliant diesel technologies, and modernization of industrial and marine fleets across the U.S. and Canada

- The Mining and Construction Equipment segment dominated the market with a 34.6% share in 2025, driven by extensive deployment of high-power diesel engines in excavators, loaders, haul trucks, and earthmoving machinery

Report Scope and Industrial Diesel Turbocharger Market Segmentation

|

Attributes |

Industrial Diesel Turbocharger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Diesel Turbocharger Market?

“Rising Adoption of High-Efficiency, Compact, and Advanced Turbocharging Technologies”

- The industrial diesel turbocharger market is witnessing a growing shift toward high-speed, compact, and high-pressure turbochargers designed to improve engine efficiency, power density, and fuel economy

- Manufacturers are introducing advanced materials, variable geometry turbochargers (VGT), and multi-stage turbocharging systems to support stringent emission regulations and higher engine performance

- Increasing demand for lightweight, durable, and thermally efficient turbochargers is driving adoption across power generation, construction equipment, mining, marine, and industrial engines

- For instance, companies such as Cummins, BorgWarner, ABB, Mitsubishi Heavy Industries, and Honeywell have launched next-generation turbochargers featuring improved aerodynamics, higher boost pressure, and enhanced durability

- Growing emphasis on reducing fuel consumption, lowering operational costs, and meeting global emission norms is accelerating the adoption of advanced industrial diesel turbochargers

- As industrial engines move toward higher efficiency and lower emissions, turbochargers will remain critical for optimizing performance, compliance, and lifecycle costs

What are the Key Drivers of Industrial Diesel Turbocharger Market?

- Rising demand for fuel-efficient and high-power diesel engines across industrial, marine, and power generation applications is driving turbocharger adoption

- For instance, in 2025, leading manufacturers such as Cummins, ABB, and BorgWarner expanded their industrial turbocharger portfolios to support lower emissions, higher efficiency, and extended service life

- Increasing industrialization, infrastructure development, and demand for reliable backup power systems are boosting turbocharger demand across the U.S., Europe, and Asia-Pacific

- Advancements in turbocharger design, including variable geometry systems, improved compressor materials, and advanced bearing technologies, are enhancing performance and durability

- Growing enforcement of emission standards such as EPA, Euro Stage V, and IMO regulations is pushing engine manufacturers to adopt advanced turbocharging solutions

- Supported by investments in engine modernization, energy efficiency, and industrial equipment upgrades, the Industrial Diesel Turbocharger market is expected to experience steady long-term growth

Which Factor is Challenging the Growth of the Industrial Diesel Turbocharger Market?

- High costs associated with advanced turbocharger technologies, premium materials, and precision manufacturing limit adoption among small and mid-sized engine manufacturers

- For instance, during 2024–2025, rising prices of specialty alloys, machining components, and logistics increased production and replacement costs for industrial turbochargers

- Complexity in integration, calibration, and maintenance of variable geometry and multi-stage turbochargers increases dependency on skilled technicians

- Limited awareness and technical expertise in emerging markets regarding advanced turbocharger benefits and maintenance practices slow adoption

- Competition from alternative efficiency-improvement technologies such as engine downsizing, hybrid power systems, and electrification creates substitution pressure

- To overcome these challenges, manufacturers are focusing on cost optimization, modular designs, service-friendly turbochargers, and aftermarket support to expand global adoption of industrial diesel turbochargers

How is the Industrial Diesel Turbocharger Market Segmented?

The market is segmented on the basis of end-user, sales channel, technology, application, and material.

- By End-User

On the basis of end-user, the industrial diesel turbocharger market is segmented into Mining and Construction Equipment, Agriculture Equipment, Oil and Gas Industry, Power Industry, and Marine Industry. The Mining and Construction Equipment segment dominated the market with a 34.6% share in 2025, driven by extensive deployment of high-power diesel engines in excavators, loaders, haul trucks, and earthmoving machinery. Turbochargers are critical in these applications to deliver high torque, improved fuel efficiency, and reliable performance under heavy-load and harsh operating conditions.

The Power Industry segment is expected to register the fastest CAGR from 2026 to 2033, supported by rising demand for diesel generator sets for backup power, grid stabilization, and remote power generation. Increasing infrastructure development, industrial expansion, and energy reliability requirements are accelerating turbocharger adoption across stationary diesel engines.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and Aftermarket. The OEM segment accounted for the largest market share of 61.3% in 2025, as turbochargers are increasingly integrated into new diesel engines to comply with emission norms, improve engine efficiency, and enhance power output. Strong demand for new industrial equipment, generators, marine vessels, and commercial vehicles supports OEM dominance.

The Aftermarket segment is projected to grow at the fastest CAGR during 2026–2033, driven by rising replacement demand, engine overhauls, and refurbishment of aging diesel fleets. Increasing focus on extending engine lifespan, improving performance, and reducing downtime is boosting demand for replacement and upgraded turbochargers across industrial and marine applications.

- By Technology

Based on technology, the industrial diesel turbocharger market is segmented into Twin-Turbo, Wastegate Technology, and Variable Geometry Technology (VGT). Wastegate Technology dominated the market with a 42.1% share in 2025, owing to its cost-effectiveness, mechanical simplicity, and widespread adoption across medium-duty industrial diesel engines. Wastegate turbochargers offer reliable boost control and are well-suited for applications with stable operating conditions.

Variable Geometry Technology is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to deliver superior fuel efficiency, reduced turbo lag, and better emission control across varying engine speeds. Increasing enforcement of emission regulations and demand for high-efficiency engines are accelerating VGT adoption.

- By Application

On the basis of application, the market is segmented into Light Commercial Vehicle, Heavy Commercial Vehicle, Ships & Aircrafts, Agriculture & Construction, and Locomotives. The Heavy Commercial Vehicle segment held the largest share of 38.7% in 2025, supported by extensive use of turbocharged diesel engines in trucks, buses, and heavy-duty transport vehicles requiring high torque and durability.

The Ships & Aircrafts segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by increasing marine trade, modernization of marine engines, and demand for fuel-efficient propulsion systems. Turbochargers play a vital role in enhancing marine engine efficiency, power output, and compliance with IMO emission standards.

- By Material

Based on material, the industrial diesel turbocharger market is segmented into Cast Iron and Aluminum. Cast Iron dominated the market with a 55.4% share in 2025, owing to its high strength, durability, and ability to withstand extreme temperatures and pressures in heavy-duty diesel engine applications. Cast iron turbochargers are widely used in industrial, marine, and construction equipment.

The Aluminum segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for lightweight turbochargers that improve fuel efficiency and reduce overall engine weight. Advancements in aluminum alloys and thermal resistance technologies are further supporting adoption in modern diesel engines.

Which Region Holds the Largest Share of the Industrial Diesel Turbocharger Market?

- Asia-Pacific dominated the industrial diesel turbocharger market with a 45.8% revenue share in 2025, driven by large-scale diesel engine production, rapid industrialization, and strong demand from construction, mining, agriculture, marine, and power generation sectors across China, Japan, India, South Korea, and Southeast Asia. High usage of heavy-duty diesel engines in infrastructure development, commercial transportation, and industrial machinery continues to fuel regional demand

- Leading manufacturers in Asia-Pacific are expanding production capacities, improving turbocharger efficiency, and adopting advanced materials and variable geometry technologies to meet rising performance and emission requirements

- Strong manufacturing ecosystems, cost-effective production, availability of skilled labor, and government-led infrastructure investments further reinforce Asia-Pacific’s leadership in the global industrial diesel turbocharger market

China Industrial Diesel Turbocharger Market Insight

China is the largest contributor within Asia-Pacific, supported by massive infrastructure projects, strong construction equipment manufacturing, and extensive use of diesel-powered machinery across mining, logistics, marine, and power generation sectors. Government-backed industrial development, expansion of heavy commercial vehicle production, and modernization of diesel engines to meet emission norms are driving sustained turbocharger demand. Strong domestic manufacturing capabilities and export-oriented production further enhance market growth.

Japan Industrial Diesel Turbocharger Market Insight

Japan shows steady growth, driven by advanced diesel engine engineering, strong marine and industrial equipment manufacturing, and focus on fuel-efficient and high-reliability turbocharger technologies. Adoption of variable geometry and high-performance turbochargers across marine engines, generators, and industrial machinery supports long-term market expansion.

India Industrial Diesel Turbocharger Market Insight

India is emerging as a high-growth market within Asia-Pacific, supported by rapid infrastructure development, expanding construction and mining activities, and rising demand for diesel generators and agricultural machinery. Government initiatives focused on manufacturing growth, transportation expansion, and power reliability continue to accelerate turbocharger adoption.

North America Industrial Diesel Turbocharger Market

North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising investments in engine efficiency upgrades, emission-compliant diesel technologies, and modernization of industrial and marine fleets across the U.S. and Canada. Increasing replacement demand, aftermarket expansion, and adoption of advanced turbocharger technologies such as variable geometry and twin-turbo systems support accelerated growth. Strong focus on fuel efficiency, durability, and regulatory compliance continues to strengthen regional market momentum

U.S. Industrial Diesel Turbocharger Market Insight

The U.S. leads North America, driven by strong demand from construction equipment, oil & gas operations, marine transportation, power generation, and heavy commercial vehicles. Replacement and retrofit demand for emission-compliant turbochargers, along with rising adoption of high-efficiency diesel engines, fuels market expansion.

Canada Industrial Diesel Turbocharger Market Insight

Canada contributes steadily, supported by diesel engine usage across mining, forestry, marine transport, and power generation. Investments in industrial modernization, equipment upgrades, and energy infrastructure support consistent turbocharger demand across the country.

Which are the Top Companies in Industrial Diesel Turbocharger Market?

The industrial diesel turbocharger industry is primarily led by well-established companies, including:

- Cummins Inc (U.S.)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- Napier Turbochargers Ltd (U.K.)

- MITSUBISHI HEAVY INDUSTRIES, LTD (Japan)

- Niitsu Turbo Industries (Japan)

- BorgWarner Inc (U.S.)

- Manipur Technical University (India)

- BMTS TECHNOLOGY (Germany)

- Liaoning RongLi Turbocharger Co., Ltd (China)

- Precision Turbo & Engine (U.S.)

- Comp Turbo Technology Inc. (U.S.)

- Rotomaster International (Canada)

- IHI Corporation (Japan)

What are the Recent Developments in Global Industrial Diesel Turbocharger Market?

- In March 2025, Cummins Inc., a global power and technology leader headquartered in Columbus, Indiana, announced a major upgrade to its iconic B-Series engine platform by unveiling the new Cummins B7.2 diesel engine at NTEA Work Truck Week in Indianapolis. The updated engine integrates advanced technologies and performance enhancements to strengthen durability, efficiency, and emissions compliance, reinforcing Cummins’ leadership in next-generation industrial diesel engine innovation

- In October 2024, engine manufacturer General Electric announced that its LM2500 marine engines were selected to power the Indian Navy’s Next Generation Missile Vessels (NGMV) being constructed by Cochin Shipyard Limited. GE Aerospace will also supply composite bases, enclosures, and a full range of gas turbine auxiliary systems, highlighting the growing role of high-performance propulsion and turbocharging technologies in advanced naval applications

- In September 2024, a Cummins-powered Ram truck showcased a 2,700 HP triple-turbo configuration during a high-performance demonstration, highlighting the exceptional power density, efficiency, and reliability of modern industrial diesel turbocharging systems. The display underscored Cummins’ expertise in pushing the performance limits of advanced turbocharger technologies

- In May 2023, Mitsubishi Heavy Industries introduced the MGS3100R turbocharger, designed to deliver higher efficiency in diesel engines while significantly improving fuel economy and reducing industrial emission levels. This launch marked a key technological milestone, supporting stricter emissions regulations and advancing sustainable diesel engine performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.