Global Industrial Electronics Packaging Market

Market Size in USD Billion

CAGR :

%

USD

1.82 Billion

USD

2.52 Billion

2021

2029

USD

1.82 Billion

USD

2.52 Billion

2021

2029

| 2022 –2029 | |

| USD 1.82 Billion | |

| USD 2.52 Billion | |

|

|

|

|

Market Analysis and Size

The technology relates to establishing electrical interconnections and appropriate housing for electrical circuitry. The industrial electronic packages provide four major functions: distribution of electrical energy (that is, power) for circuit function, interconnection of electrical signals, mechanical protection of circuits, and dissipation of heat generated by circuit function. Industrial electronics packaging is widely used to prevent the product from radio frequency noise emission, cooling, mechanical damage, electrostatic discharge and physical damage.

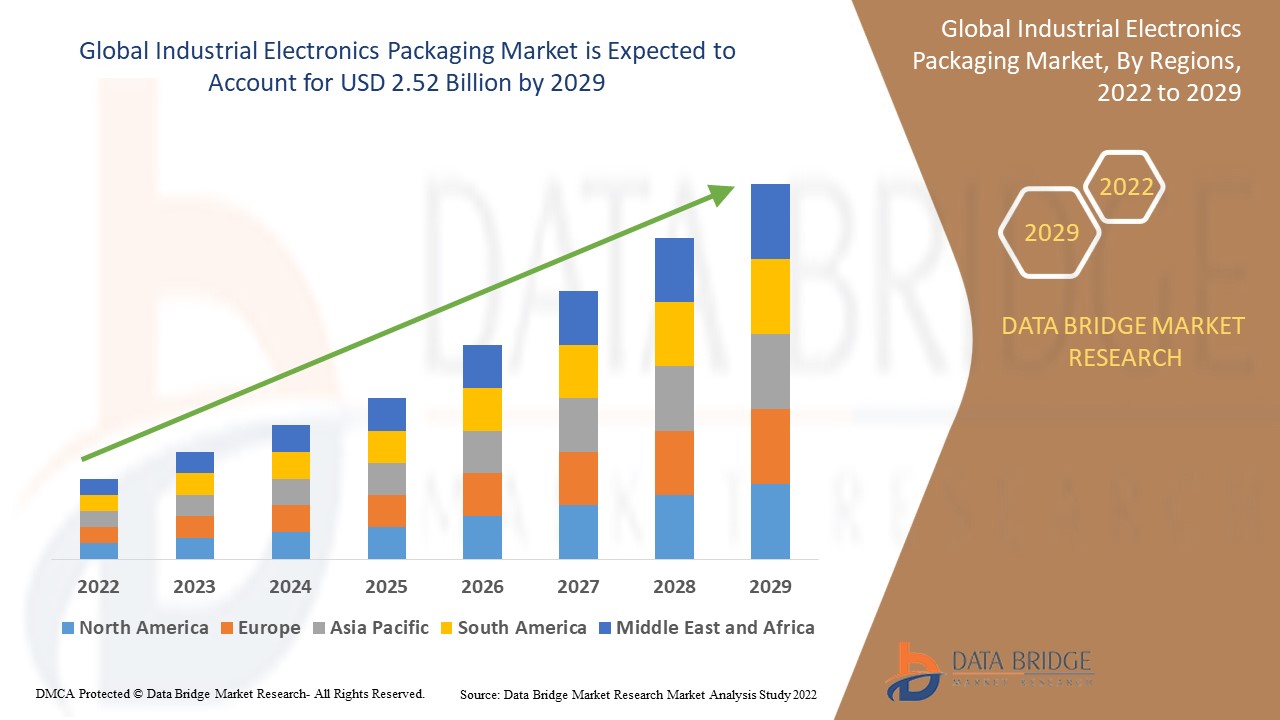

Data Bridge Market Research analyses that the industrial electronics packaging market was valued at USD 1.82 billion in 2021 and is expected to reach USD 2.52 billion by 2029, registering a CAGR of 4.13 % during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Testing and Measuring Equipment, Process Control Equipment, Industrial Controls, Power Electronics, Industrial Automation Equipment, Others), Material (Plastic, Paper and Paperboard), Packaging Type (Rigid, Flexible), Application (Semiconductor and Integrated Circuit, Printed Circuit Board, Others), End User (Consumer Electronics, Aerospace and Defence, Automotive, Telecommunication, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

DS Smith (U.K.), Mondi (U.K.), International Paper (U.S.), Sonoco Products Company(U.S.), Sealed Air (U.S.), Huhtamaki (Finland), Smurfit Kappa (Ireland), WestRock Company (U.S.), UFP Technologies Inc. (U.S.), Stora Enso (Finland), Pregis LLC (U.S.), Shenzhen Hoichow Packing Manufacturing Ltd. (China), Dordan Manufacturing Company (U.S.), Hangzhou Xunda Packaging Co. (China), Dunapack Packaging Group (Austria), Universal Protective Packaging Inc. (U.S.), Parksons Packaging Ltd. (India), Neenah Paper and Packaging (U.S.), Plastic Ingenuity (U.S.), JJX Packaging (U.S.) |

|

Market Opportunities |

|

Market Definition

Industrial electronic packaging refers to the production and design of enclosures for electronic devices ranging from specific semiconductor devices to complete systems such as a mainframe computer. An electronic system's packaging must consider radio frequency noise emission, mechanical damage, cooling, and electrostatic discharge. Industrial electronic equipment made in small quantities may use standardized commercially available enclosures such as prefabricated boxes or card cages.

Industrial Electronics Packaging Market Dynamics

Drivers

- Rise the demand of paper and paperboard packaging

Paper and paperboard is a material which is extensively used for the packaging of computer and mobile phones. Computers and Mobile phones are electronic products that are breakable in nature, so they require packaging that offers complete safety for the product. Paper and paperboard offer both strength and rigidity for the product. Other features of paper and paperboard such as soft superb printability, and polished finish make it more popular among electronics appliances companies.

- Growing digitalization

The increasing digitization is growing the demand for Internet of Things (IOT) in the market, which is driving the global need for effective packaging and industrial electronics product. The global industrial electronic market needs for electronics packaging which are increased by the rising adoption of smart computing devices such as smart computing, tablets, laptops mobile phones e-readers and smartphones in several developed and underdeveloped economies which are anticipated to increase the growth of the industrial electronics packaging market.

- Demand of sustainable packaging

Many e-commerce industries are aiming to use the sustainable packaging solutions such as paper based packaging to decrease the use of the plastic wastes and moving towards the use of paper-based packaging for the packaging of electronic products. This trend is also projected to hit the industrial electronics packaging market, which is sensitive to exterior impacts with better designing to make packaging more stronger.

Opportunities

- Technological advancement

Technology development is embedded into packages, making a convincing business case for industrial electronics products with the potential to increase profits and reduce costs. Technological advancement in electronics packaging are forcing to electronic packaging industries because the electronics packaging design is evolving at a speedy rate. As technology increases, the demands of the electronic packaging also goes up and changes accordingly, creating beneficial opportunity for the revenue growth of thw market.

- Photonics development

Photonics development is automatically integrated with the multiple levels of media interconnections which has connected to custom electronic packaging. This is the major factor which is pushing electronic product major companies to alter and adapt electronic packaging’s functions with packaging designs.

Restraints/ Challenges

However, the industrial sector is anticipated to witness large manufacturing disruptions. This disruptions in the manufacturing sector are anticipated to lead the brand reputation and losses in the market share of the manufactured electronics products. A shift in dynamics in the economics of production, customized demand of products and value chain can lead to disruptions in manufacturing which will act as a market restraint that will obstruct the market's growth rate

Moreover, lack of skilled professionals with high cost of technology and equipment will likely obstruct the growth of the industrial electronics packaging market during the forecast period. Also, the Harmful effects of plastic will become the major challenge for the market's growth.

This industrial electronics packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the industrial electronics packaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Industrial Electronics Packaging Market

The outbreak of Covid-19 pandemic had an adverse impact on the sales of packaging industries globally, along with industrial electronics packaging. The computer, mobile phones and other electronic sector drive the demand for the industrial electronics packaging. Even during this epidemic, the product production in these industries did not considerably affect the market. This is slightly affected due to a disruptions in supply chains, close in production and a scarcity of raw materials.

Moreover, strict lockdowns and shutdowns overall affected the initial demands for the electronic devices. Also, the Schools started to operate in online mode and Offices started working from home so, these factors are significantly increased the demand for electronics devices which giving stimulus to the industrial electronic packaging solutions. On a broader level, during the peak of Covid-19 pandemic the sales and demand of industrial electronics packaging increases considerably.

Recent Development

- In May 2020, KLA Corporation has declared its new business group which will be totally focused on its packaging, electronics and components (EPC) businesses. With the development of technologies such as machine learning, IoT, and others, this new business aims to cater to the changing landscape of the electronics industry.

- In October 2020, Smurfit Kappa Group of company has announced that it had accomplished the acquisition of Verzuolo for a cost of € 360 Mn. in Northern Italy, This new acquisition adds a 600,000-tonne containerboard mill group’s assets, and is anticipated to contribute to the sustainability aims of the company.

Global Industrial Electronics Packaging Market Scope

The industrial electronics packaging market is segmented on the basis of products, material, packaging type, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Testing and Measuring Equipment

- Process Control Equipment

- Industrial Controls

- Power Electronics

- Industrial Automation Equipment

- Others

Material

- Plastic

- Paper and Paperboard

Packaging Type

- Rigid

- Flexible

Application

- Semiconductor and Integrated Circuit

- Printed Circuit Board

- Others

End User

- Consumer Electronics

- Aerospace and Defence

- Automotive

- Telecommunication

- Others

Industrial Electronics Packaging Market Regional Analysis/Insights

The industrial electronics packaging market is analysed and market size insights and trends are provided by country, products, material, packaging type, application and end-user as referenced above.

The countries covered in the industrial electronics packaging market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa.

North America dominates the industrial electronics packaging market in terms of market share during the forecast period. This is due to the growing demand for industrial electronics packaging in this region. North America region leads the industrial electronics packaging market, with U.S leading the way in terms of growing production of the electronics product along with increasing demand of cost efficient, durable and impact resistant.

During the estimated period, Asia-Pacific is expected to be the fastest developing region due to the growth of the electronics industry in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Industrial Electronics Packaging Market Share Analysis

The industrial electronics packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to industrial electronics packaging market.

Some of the major players operating in the industrial electronics packaging market are:

- DS Smith (U.K.)

- Mondi (U.K.)

- International Paper (U.S.)

- Sonoco Products Company (U.S.)

- Sealed Air (U.S.)

- Huhtamaki (Finland)

- Smurfit Kappa (Ireland)

- WestRock Company (U.S.)

- UFP Technologies Inc. (U.S.)

- Stora Enso (Finland)

- Pregis LLC (U.S.)

- Shenzhen Hoichow Packing Manufacturing Ltd. (China)

- Dordan Manufacturing Company (U.S.)

- Hangzhou Xunda Packaging Co. (China)

- Dunapack Packaging Group (Austria)

- Universal Protective Packaging Inc. (U.S.)

- Parksons Packaging Ltd. (India)

- Neenah Paper and Packaging (U.S.)

- Plastic Ingenuity (U.S.)

- JJX Packaging (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 IMPORT DATA

2.13 EXPORT DATA

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

5.8 CONSUMER PREFERNCES & BEHAVIOUR

5.9 CONSUMER BUYING FACTORS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TESTING & MEASURING EQUIPMENT

8.3 PROCESS CONTROL EQUIPMENT

8.4 INDUSTRIAL CONTROLS

8.5 POWER ELECTRONICS

8.6 INDUSTRIAL AUTOMATION EQUIPMENT

8.7 OTHERS

9 PLASTIC GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , BY MATERIAL

9.1 OVERVIEW

9.2 PLASTIC

9.2.1 POLYETHYLENE (PE)

9.2.2 POLYETHYLENE TEREPHTHALATE (PET)

9.2.3 POLYPROPYLENE (PP)

9.2.4 POLYSTYRENE (PS)

9.2.5 POLY VINYL CHLORIDE (PVC)

9.2.6 POLYETHYLENE TEREPHTHALATE (PETE)

9.2.7 ACRYLONITRILE-BUTADIENE-STRYRENE (ABS)

9.2.8 POLYCARBONATE

9.2.9 OTHERS

9.3 PAPER & PAPERBOARD

9.4 METALS

9.4.1 COPPER LEADFRAMES

9.4.2 COPPER TRACES

9.4.3 TUNGSTEN

9.4.4 OTHERS

9.5 CERAMICS

9.5.1 ALUMINUM OXIDE SUBTRATES MODIFIED WITH BAO

9.5.2 ALUMINUM OXIDE SUBTRATES MODIFIED WITH SIO2

9.5.3 ALUMINUM OXIDE SUBTRATES MODIFIED WITH CUO

9.5.4 SIN DIELECTRICS

9.5.5 OTHERS

9.6 POLYMERS

9.6.1 EPOXIES

9.6.2 FILLED EPOXIES

9.6.3 SILICA-FILLED ANHYDRIDE

9.6.4 RESIN

9.6.5 CONDUCTIVE ADHESIVES

9.6.6 POLYAMIDE DIELECTRIC

9.6.7 BENZOCLOBUTENE

9.6.8 SILICONES

9.6.9 PHOTOSENSITIVE POLYMERS

9.6.10 OTHERS

9.7 GLASSES

9.7.1 SILICON DIOXIDE

9.7.2 SILICATE GLASSES

9.7.3 BOROSILICATE GLASS SUBSTRATE

9.7.4 GLASS FIBERS

9.7.5 OTHERS

9.8 WOOD

9.9 FIBER

9.1 OTHERS

10 PLASTIC GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , BY PACKAGING TYPE

10.1 OVERVIEW

10.2 RIGID

10.2.1 CORRUGATED BOXES

10.2.1.1. SINGLE-PHASE CORRUGATED BOX

10.2.1.2. SINGLE WALL CORRUGATED BOX

10.2.1.3. DOUBLE-WALL CORRUGATED BOX

10.2.1.4. TRIPLE WALL CORRUGATED BOX

10.2.1.5. OTHERS

10.2.2 CONTAINERS & SHIPPERS

10.2.2.1. BINS

10.2.2.2. TOTES

10.2.2.2.1. NESTABLE

10.2.2.2.2. STACKABLE

10.2.2.2.3. STACK AND NEST

10.2.2.2.4. OTHERS

10.2.2.3. BULK CONTAINER

10.2.2.4. OTHERS

10.2.3 PROTECTIVE PACKAGING

10.2.3.1. TRAYS

10.2.3.2. CLAMSHELLS

10.2.3.3. UNITIZER

10.2.3.3.1. STRETCH FILM

10.2.3.3.2. SHRINK WRAP

10.2.3.3.3. STRAPPING

10.2.3.3.4. OTHERS

10.2.3.4. OTHERS

10.2.4 OTHERS

10.3 FLEXIBLE

10.3.1 BAGS & POUCHES

10.3.2 TAPES & LABELS

10.3.3 FILMS & OTHERS

11 PLASTIC GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , BY TECHNOLOGY

11.1 OVERVIEW

11.2 SURFACE-MOUNT TECHNOLOGY (SMD)

11.3 CHIP SCALE PACKAGES (CSP)

11.4 THROUGH (THRU) HOLE MOUNTING

11.5 BOX-IN-BOX PACKAGING

11.6 OTHERS

12 PLASTIC GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , BY APPLICATION

12.1 OVERVIEW

12.2 ELECTRONIC COMPONENTS

12.2.1 INTEGRATED CIRCUITS

12.2.2 MICROCONTROLLER

12.2.3 TRANSFORMER

12.2.4 BATTERY

12.2.5 FUSE

12.2.6 RELAYS

12.2.7 SWITCHES

12.2.8 MOTORS

12.2.9 CIRCUIT BREAKERS

12.2.10 CIRCUIT CARDS

12.2.11 RESISTORS

12.2.12 CAPACITORS

12.2.13 DIODES

12.2.14 TRANSISTORS

12.2.15 INDUCTORS

12.2.16 OTHERS

12.3 ELECTRONIC DEVICES

12.3.1 THYRISTORS

12.3.2 ELECTRONIC SWITCHING DEVICES

12.3.3 DIGITAL ELECTRONIC SYSTEMS

12.3.4 OPTOELECTRONIC SYSTEMS

12.3.5 THERMAL SYSTEMS

12.3.6 MOTION CONTROL

12.3.7 INDUSTRIAL ROBOTS

12.3.8 OPERATIONAL AMPLIFIERS

12.3.9 DIGITAL ELECTRONIC SYSTEMS

12.3.10 OTHERS

13 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET, BY GEOGRAPHY

13.1 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 OVERVIEW

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 ITALY

13.4.4 FRANCE

13.4.5 SPAIN

13.4.6 SWITZERLAND

13.4.7 RUSSIA

13.4.8 TURKEY

13.4.9 BELGIUM

13.4.10 NETHERLANDS

13.4.11 REST OF EUROPE

13.5 ASIA-PACIFIC

13.5.1 JAPAN

13.5.2 CHINA

13.5.3 SOUTH KOREA

13.5.4 INDIA

13.5.5 SINGAPORE

13.5.6 THAILAND

13.5.7 INDONESIA

13.5.8 MALAYSIA

13.5.9 PHILIPPINES

13.5.10 AUSTRALIA AND NEW ZEALAND

13.5.11 HONG KONG

13.5.12 TAIWAN

13.5.13 REST OF ASIA-PACIFIC

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

13.7 MIDDLE EAST AND AFRICA

13.7.1 SOUTH AFRICA

13.7.2 EGYPT

13.7.3 SAUDI ARABIA

13.7.4 UNITED ARAB EMIRATES

13.7.5 ISRAEL

13.7.6 REST OF MIDDLE EAST AND AMERICA

14 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL INDUSTRIAL ELECTRONICS PACKAGING MARKET , COMPANY PROFILE

15.1 DS SMITH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 SMURFIT KAPPA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 SEALED AIR

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 AMETEK.INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 DORDAN MANUFACTURING COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 DUPONT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 GY PACKAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 KIVA CONTAINER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 PRIMEX DESIGN & FABRICATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 QUALITY FOAM PACKAGING, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 UFP TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 ACHILLES USA

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 DESCO INDUSTRIES INC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 ORLANDO PRODUCTS INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 DELPHON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 PROTECTIVE PACKAGING CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 DOU YEE ENTERPRISES

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 GWP GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 ENGINEERED MATERIALS, INC

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 CREOPACK

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

16 RELATED REPORTS

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Global Industrial Electronics Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Electronics Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Electronics Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.