Global Industrial Fabric Market

Market Size in USD Billion

CAGR :

%

USD

139.79 Billion

USD

232.93 Billion

2024

2032

USD

139.79 Billion

USD

232.93 Billion

2024

2032

| 2025 –2032 | |

| USD 139.79 Billion | |

| USD 232.93 Billion | |

|

|

|

|

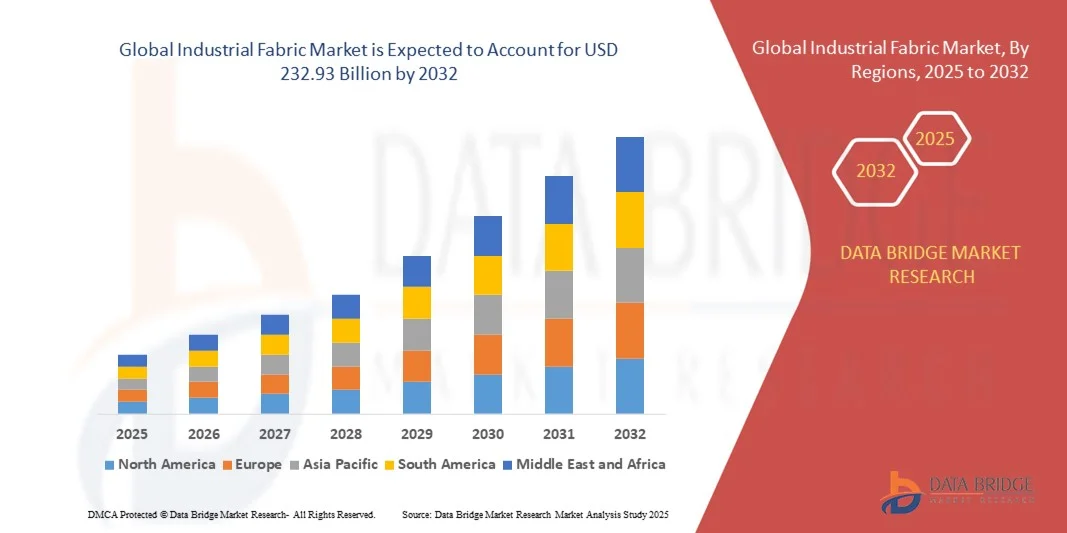

What is the Global Industrial Fabric Market Size and Growth Rate?

- The global industrial fabric market size was valued at USD 139.79 billion in 2024 and is expected to reach USD 232.93 billion by 2032, at a CAGR of 6.59% during the forecast period

- Major factors that expected to boost the growth industrial fabric market in the forecast period are the rise larger characterises provided by the industrial fabric. Furthermore, the rise in the use of industrial fabric in the increasing of the automotive industry is further anticipated to propel the growth of the industrial fabric market

- On the other hand, the strict government guidelines, and the decrease in the declining industrial activities because of the COVID-19 which in turn is further projected to impede the growth of the industrial fabric market in the timeline period

What are the Major Takeaways of Industrial Fabric Market?

- The advantageous development in the filtration application and the advancing countries will further provide potential opportunities for the growth of the industrial fabric market in the coming years. However, the decrease in the expenses of the industrial fabric might further challenge the growth of the industrial fabric market in the near future

- North America dominated the Industrial Fabric market with the largest revenue share of 34.49% in 2024, driven by rising demand across automotive, aerospace, and construction sectors

- The Asia-Pacific (APAC) industrial fabric market is set to grow at the fastest CAGR of 9.34% from 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and expanding automotive and construction industries in China, India, and Southeast Asia

- The polyester segment dominated the market with a revenue share of 41.5% in 2024, driven by its high durability, cost-effectiveness, and wide applicability across automotive, conveyor belts, and protective clothing

Report Scope and Industrial Fabric Market Segmentation

|

Attributes |

Industrial Fabric Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Fabric Market?

Sustainability and Smart Material Innovation

- A significant and accelerating trend in the global industrial fabric market is the growing emphasis on eco-friendly production, recycling, and smart material technologies. Manufacturers are increasingly focusing on sustainable raw materials, biodegradable fibers, and reduced carbon footprint processes

- For instance, Toray Industries has introduced advanced polyester fabrics derived from recycled PET bottles, significantly lowering environmental impact in automotive and industrial applications

- Smart fabric innovation is also reshaping the market, with developments in high-strength, lightweight composites that enhance durability, energy efficiency, and safety across industries such as construction, aerospace, and automotive

- The use of digital textile technologies such as nanocoatings, fire-retardant treatments, and antimicrobial finishes is boosting demand for specialized fabrics tailored to industry-specific needs

- This trend toward sustainable and intelligent fabrics is setting new benchmarks in performance, compliance, and environmental responsibility. As a result, companies such as Freudenberg Group and Berry Global are heavily investing in R&D to expand product offerings that align with regulatory pressures and customer sustainability goals

- The demand for eco-friendly and high-performance industrial fabrics is rapidly growing, driven by rising sustainability mandates and the need for advanced functionality across multiple sectors

What are the Key Drivers of Industrial Fabric Market?

- The surge in demand across automotive, construction, filtration, and protective clothing industries is a major driver fueling the industrial fabric market

- For instance, in March 2024, Ahlstrom-Munksjö expanded its industrial filtration fabric production in the U.S. to meet rising demand from the energy and transportation sectors

- As industries increasingly require lightweight, durable, and cost-efficient materials, industrial fabrics are replacing conventional alternatives such as metal and plastics, offering better performance and sustainability

- Rapid growth in infrastructure development, rising automotive production, and emphasis on worker safety is expanding the usage of coated, nonwoven, and composite fabrics

- Moreover, government initiatives for green manufacturing and stricter environmental regulations are accelerating the adoption of recyclable and bio-based industrial fabrics

- The need for high-strength, versatile, and functional materials across multiple applications ensures strong and consistent growth opportunities for the industrial fabric market

Which Factor is Challenging the Growth of the Industrial Fabric Market?

- Volatility in raw material prices, particularly petroleum-based fibers such as polyester and nylon, is a significant challenge impacting profitability and cost management for manufacturers

- For instance, global fluctuations in crude oil prices during 2023–2024 created supply chain disruptions, affecting companies such as Habasit and Beaulieu Technical Textiles that rely heavily on synthetic fiber inputs

- Environmental concerns and stricter waste disposal regulations pose additional hurdles, especially for companies with limited recycling infrastructure

- Another major barrier is intense competition from low-cost regional players, particularly in Asia, which pressures established global manufacturers to reduce prices while maintaining quality

- In addition, the need for high capital investments in advanced machinery, R&D, and compliance certifications can restrain smaller players from scaling up operations

- Overcoming these challenges requires companies to diversify raw material sourcing, adopt circular economy practices, and invest in innovation, ensuring long-term resilience and competitiveness in the industrial fabric market

How is the Industrial Fabric Market Segmented?

The market is segmented on the basis of fiber, application, type, and end users.

- By Fiber

On the basis of fiber, the industrial fabric market is segmented into polyamide, polyester, aramid, composite, and others. The polyester segment dominated the market with a revenue share of 41.5% in 2024, driven by its high durability, cost-effectiveness, and wide applicability across automotive, conveyor belts, and protective clothing. Polyester’s resistance to stretching, abrasion, and harsh weather makes it the most preferred choice in heavy-duty industries.

The aramid segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, fueled by rising demand in protective apparel and flame-resistant applications. Aramid’s exceptional heat resistance, strength-to-weight ratio, and use in aerospace and defense industries contribute significantly to its growth. In addition, composites are increasingly being explored for advanced, lightweight applications, further diversifying the market. The growing demand for high-performance materials in challenging environments is expected to keep fiber innovation at the forefront of market expansion.

- By Application

On the basis of application, the industrial fabric market is segmented into conveyor belt, transmission belt, protective apparel, automotive carpet, flame-resistant apparel, and others. The conveyor belt segment accounted for the largest market share of 36.8% in 2024, owing to rapid expansion in mining, construction, and logistics industries. Industrial fabrics used in conveyor systems ensure strength, reliability, and resistance to abrasion, making them indispensable for material handling operations.

The protective apparel segment is projected to record the fastest CAGR of 9.2% from 2025 to 2032, driven by increasing safety regulations and the demand for flame-resistant, chemical-resistant, and cut-proof fabrics across oil & gas, construction, and defense sectors. Automotive carpets are also emerging as a strong sub-segment due to rising vehicle production and consumer preference for comfort and durability. With industrial fabrics playing a vital role in both safety and performance, applications are expanding rapidly across diverse industries.

- By Type

On the basis of type, the industrial fabric market is segmented into fiberglass, aramid, carbon, vinyl, and others. The fiberglass segment led the market with a revenue share of 39.4% in 2024, supported by its widespread use in construction, filtration, and transportation due to its heat resistance, lightweight properties, and cost-effectiveness. Fiberglass fabrics are also integral in composite applications, where strength and corrosion resistance are critical.

The carbon fiber segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by rising adoption in aerospace, automotive, and wind energy industries. Carbon fabrics provide exceptional stiffness and strength while reducing overall weight, making them vital in performance-driven sectors. Vinyl fabrics, favored in automotive interiors and industrial covers, also contribute to steady demand. With industries increasingly prioritizing efficiency and durability, advanced fabric types are reshaping industrial standards and expanding growth opportunities.

- By End Users

On the basis of end users, the industrial fabric market is segmented into automotive, construction, aerospace, transportation, and others. The automotive segment dominated with a market share of 34.7% in 2024, driven by extensive usage in seat belts, airbags, carpets, and reinforced components. Growing vehicle production and consumer preference for safety and comfort continue to sustain strong demand for industrial fabrics in this segment.

The aerospace segment is expected to grow at the fastest CAGR of 9.6% from 2025 to 2032, fueled by the rising adoption of lightweight composite fabrics for aircraft interiors, insulation, and structural applications. Construction also remains a major consumer, utilizing fabrics in roofing, reinforcement, and geotextiles. Transportation sectors, particularly rail and marine, are adopting industrial fabrics for safety and durability improvements. The increasing reliance on high-performance materials across industries highlights industrial fabrics as a critical enabler of safety, efficiency, and sustainability.

Which Region Holds the Largest Share of the Industrial Fabric Market?

- North America dominated the industrial fabric market with the largest revenue share of 34.49% in 2024, driven by rising demand across automotive, aerospace, and construction sectors. The region’s strong industrial base, combined with high adoption of advanced materials for performance, safety, and sustainability, makes it a key hub for industrial fabric consumption

- Manufacturers in North America are investing heavily in high-strength polyester, aramid, and composite fabrics to meet the requirements of diverse industries ranging from protective apparel to filtration systems

- The growth is further supported by stringent safety regulations, strong R&D infrastructure, and the presence of global market leaders. The push toward lightweight and eco-friendly materials in automotive and aerospace continues to boost demand, securing North America’s position as the leading market

U.S. Industrial Fabric Market Insight

The U.S. dominated the North American industrial fabric market in 2024, underpinned by its robust automotive industry, infrastructure projects, and rapid adoption of technical textiles. Industrial fabrics are widely used in airbags, seat belts, conveyor belts, and filtration applications, driven by regulatory compliance and performance needs. The U.S. market is also witnessing strong demand for flame-retardant and protective fabrics in oil & gas and defense sectors. Sustainability trends, coupled with innovation in recycled polyester and bio-based fabrics, are shaping industry strategies. The dominance of global players such as DuPont and Johns Manville, combined with government initiatives to strengthen domestic manufacturing, ensures long-term growth opportunities in the U.S.

Europe Industrial Fabric Market Insight

The Europe industrial fabric market is projected to expand at a substantial CAGR during the forecast period, driven by the region’s emphasis on sustainability, worker safety, and innovation in lightweight composites. Industrial fabrics are gaining traction in construction, geotextiles, and protective clothing, especially under strict EU safety and environmental regulations. The demand is also supported by growth in automotive manufacturing hubs in Germany and Eastern Europe, where lightweight, durable fabrics are vital for safety and efficiency. Investments in recycling and circular economy initiatives are further boosting adoption. Europe’s combination of regulatory push and industrial diversity makes it a strong growth region.

U.K. Industrial Fabric Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, fueled by infrastructure development, automotive innovation, and growing adoption of flame-resistant and protective textiles. Rising construction activity and demand for durable, weather-resistant fabrics in roofing and reinforcement applications are supporting growth. In addition, the U.K.’s strong textile R&D sector and focus on eco-friendly materials align with global sustainability trends. Increasing demand for advanced industrial fabrics across both public and private projects ensures steady market expansion in the region.

Germany Industrial Fabric Market Insight

The Germany industrial fabric market is forecast to expand at a considerable CAGR, supported by its leading role in automotive and aerospace manufacturing. Germany’s engineering expertise and innovation in high-performance fibers, such as aramid and carbon, are driving adoption in airbags, filtration, and flame-retardant apparel. Furthermore, sustainability-driven policies and consumer preference for eco-conscious solutions are pushing German manufacturers to adopt recycling and advanced fabric technologies. The integration of industrial fabrics into smart construction materials and lightweight composites further strengthens growth prospects, positioning Germany as a key driver within the European market.

Which Region is the Fastest Growing in the Industrial Fabric Market?

The Asia-Pacific (APAC) industrial fabric market is set to grow at the fastest CAGR of 9.34% from 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and expanding automotive and construction industries in China, India, and Southeast Asia. The region’s position as a global manufacturing hub for textiles and raw materials makes industrial fabrics highly accessible and affordable. Government initiatives promoting smart manufacturing, infrastructure development, and safety regulations are accelerating adoption across multiple industries. In addition, APAC’s growing role in automotive exports, renewable energy, and urban construction is fueling demand for advanced fabrics, cementing its status as the fastest-growing region.

Japan Industrial Fabric Market Insight

The Japan industrial fabric market is growing steadily, driven by its high-tech manufacturing culture and demand for lightweight, high-performance materials. Industrial fabrics are being widely adopted in automotive interiors, aerospace components, and protective textiles. Japan’s aging workforce is also driving demand for ergonomic, durable, and easy-to-use protective apparel. Moreover, the country’s focus on eco-friendly and recyclable materials aligns with global sustainability goals, supporting future market expansion.

China Industrial Fabric Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by its dominant textile manufacturing industry, rapid urbanization, and increasing middle-class consumption. Industrial fabrics are extensively used in construction, automotive, and industrial belts, with demand also rising in protective clothing. The country’s strong base of domestic manufacturers and government-backed smart city and infrastructure initiatives are accelerating adoption. China’s ability to produce cost-effective yet high-quality industrial fabrics positions it as a leading market in the region, with continued dominance expected through 2032

Which are the Top Companies in Industrial Fabric Market?

The industrial fabric industry is primarily led by well-established companies, including:

- Forbo Flooring India Private Limited (India)

- Ahlstrom-Munksjö (Finland)

- Habasit (Switzerland)

- TORAY INDUSTRIES, INC. (Japan)

- ContiTech AG (Germany)

- Cerex Advanced Fabrics, Inc (U.S.)

- W. Barnet GmbH & Co. KG (Germany)

- DuPont (U.S.)

- Johns Manville (U.S.)

- Fitesa (Brazil)

- G & R Henderson & Co (U.K.)

- Berry Global Inc. (U.S.)

- Kimberly-Clark (U.S.)

- Freudenberg Group (Germany)

- Beaulieu Technical Textiles (Belgium)

- THE YOKOHAMA RUBBER CO., LTD (Japan)

- CBC INDIA (India)

- Bridgestone Corporation (Japan)

- ZENITH RUBBER (India)

- Wovlene Tec Fab India (India)

- Parishudh Fibres (India)

- Sage Automotive Interiors (U.S.)

- ACME (India)

What are the Recent Developments in Global Industrial Fabric Market?

- In July 2022, DuPont, a prominent manufacturer of industrial fabrics, introduced a specialized flame-resistant (FR) fabric enhanced with a bio-based chemical-repellent finish, designed to make protective clothing more sustainable while improving worker safety. DuPont Nomex Comfort with EcoForce technology offers superior flame resistance and chemical protection, effectively addressing growing environmental concerns related to personal protective equipment (PPE). This launch highlights DuPont’s commitment to combining innovation with sustainability in protective apparel

- In June 2021, chemical manufacturer DuPont unveiled a new fabric collection developed in collaboration with Jayashree Textiles, a division of the Aditya Birla Group, using DuPont Biomaterials Sorona, a sustainable and partially bio-based polymer. The initiative aimed to promote the future of sustainable textiles, providing brands and retailers with eco-friendly options for casual and fashion wear. This development reinforced DuPont’s leadership in advancing sustainable fabric solutions for diverse industries

- In April 2020, Bridgestone Americas announced plans to resume operations at its North American commercial tire plants along with its subsidiaries producing industrial products, fibers, textiles, and building materials. The move was intended to strengthen the company’s production capabilities and ensure timely supply across key markets. This step emphasized Bridgestone’s resilience and focus on maintaining market stability during challenging conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Fabric Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Fabric Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Fabric Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.