Global Industrial Film Market

Market Size in USD Billion

CAGR :

%

USD

77.82 Billion

USD

108.98 Billion

2024

2032

USD

77.82 Billion

USD

108.98 Billion

2024

2032

| 2025 –2032 | |

| USD 77.82 Billion | |

| USD 108.98 Billion | |

|

|

|

|

Industrial Film Market Size

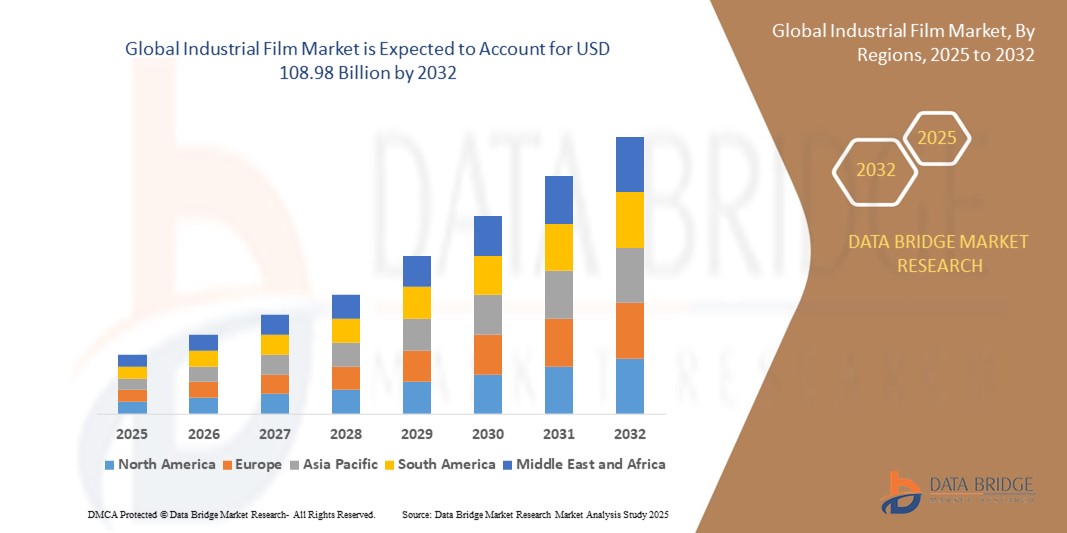

- The global industrial film market size was valued at USD 77.82 billion in 2024 and is expected to reach USD 108.98 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing demand for sustainable packaging solutions, advancements in polymer technology, and the growing need for protective films across various industries such as construction, transportation, and agriculture

- In addition, rising industrialization, particularly in emerging economies, and the shift toward lightweight, durable, and eco-friendly materials are accelerating the adoption of industrial films, significantly boosting market expansion

Industrial Film Market Analysis

- Industrial films, known for their durability, flexibility, and protective properties, are critical components in packaging, construction, agriculture, and other industrial applications due to their ability to provide barrier protection, enhance product longevity, and support sustainable practices

- The surge in demand for industrial films is fueled by the rapid growth of the packaging industry, increasing construction activities, and the rising adoption of advanced agricultural practices requiring films for greenhouse and mulching applications

- Asia-Pacific dominated the industrial film market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, a booming packaging sector, and significant manufacturing capabilities in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period due to increasing investments in sustainable materials, stringent environmental regulations, and growing demand for high-performance films in construction and automotive industries

- The linear low-density polyethylene segment held the largest market revenue share of 38% in 2024, driven by its flexibility, high tensile strength, and puncture resistance, making it ideal for packaging and agricultural applications. Its recyclability and cost-effectiveness further bolster its dominance

Report Scope and Industrial Film Market Segmentation

|

Attributes |

Industrial Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Film Market Trends

“Increasing Integration of Advanced Materials and Automation”

- The global industrial film market is experiencing a notable trend toward the integration of advanced materials and automation in production processes

- Advanced materials, such as high-performance polymers and biodegradable films, enable enhanced durability, flexibility, and sustainability, meeting diverse industry needs

- Automation in film manufacturing, including smart production lines and real-time quality monitoring, improves efficiency, reduces waste, and ensures consistent film quality

- For instance, companies are leveraging automated extrusion and coating technologies to produce multi-layer films with superior barrier properties for packaging and agricultural application

- This trend enhances the appeal of industrial films for industries such as packaging, agriculture, and construction, driving innovation and market growth

- Advanced materials also allow for tailored film properties, such as improved puncture resistance, UV stability, and recyclability, aligning with evolving consumer and regulatory demands

Industrial Film Market Dynamics

Driver

“Rising Demand for Sustainable Packaging and Infrastructure Development”

- Growing consumer and regulatory demand for sustainable packaging solutions, such as recyclable and biodegradable films, is a key driver for the global industrial film market

- Industrial films enhance product protection and shelf life in applications such as food packaging, construction, and agriculture, boosting their adoption

- Government initiatives promoting green packaging and stricter environmental regulations, particularly in Europe, are accelerating the shift toward eco-friendly films

- Rapid urbanization and infrastructure development in emerging economies, especially in Asia-Pacific, are increasing demand for films used in construction, such as vapor barriers and protective coatings

- Manufacturers are increasingly offering films with enhanced properties, such as moisture resistance and strength, to meet the needs of modern construction and packaging industries

Restraint/Challenge

“High Production Costs and Regulatory Restrictions on Plastics”

- The high cost of producing advanced industrial films, particularly those incorporating biodegradable or high-performance materials, can be a barrier to widespread adoption, especially in cost-sensitive markets

- Complex manufacturing processes, such as multi-layer film extrusion, require significant investment in equipment and technology, increasing overall costs

- Regulatory restrictions on single-use plastics and non-recyclable materials, particularly in Europe and North America, pose challenges for manufacturers, necessitating costly reformulations and compliance measures

- Environmental concerns about plastic waste and varying regulations across regions create operational complexities for global manufacturers and suppliers

- These factors can limit market growth in regions with stringent regulations or where cost considerations heavily influence purchasing decisions

Industrial Film market Scope

The market is segmented on the basis of type and end user.

- By Type

On the basis of type, the global industrial film market is segmented into linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), High-Density Polyethylene (HDPE), polyethylene terephthalate/bi-axially oriented polyethylene terephthalate (PET/BOPET), polypropylene/bi-axially oriented polypropylene (PP/BOPP), cast polypropylene (CPP), polyvinyl chloride (PVC), polyamide/bi-axially oriented polyamide (BOPA), and others. The linear low-density polyethylene segment held the largest market revenue share of 38% in 2024, driven by its flexibility, high tensile strength, and puncture resistance, making it ideal for packaging and agricultural applications. Its recyclability and cost-effectiveness further bolster its dominance.

The polypropylene/bi-axially oriented polypropylene segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent clarity, printability, and moisture barrier properties, which are highly valued in food packaging and labeling applications. The rising demand for sustainable and lightweight packaging solutions, coupled with advancements in film processing technologies, accelerates its adoption.

- By End User

On the basis of end user, the global industrial film market is segmented into transportation, construction, industrial packaging, agriculture, medical, and others. The industrial packaging segment dominated the market with a revenue share of 40% in 2024, driven by the surge in e-commerce and the need for durable, protective packaging solutions. The widespread use of films such as LLDPE and HDPE for stretch and shrink films in logistics and warehousing supports this dominance.

The agriculture segment is anticipated to experience the fastest growth rate of 6.2% from 2025 to 2032. The increasing adoption of industrial films for greenhouse farming, soil protection, and mulching applications, particularly in emerging economies, drives this growth. Films such as LDPE and LLDPE offer benefits such as UV resistance, temperature control, and weed prevention, enhancing crop yield and sustainability.

Industrial Film Market Regional Analysis

- Asia-Pacific dominated the industrial film market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, a booming packaging sector, and significant manufacturing capabilities in countries such as China and India

- End users prioritize industrial films for their durability, flexibility, and cost-effectiveness, particularly in applications such as packaging, construction, and agriculture in regions with rapid industrialization

- Market growth is fueled by advancements in polymer technologies, including high-performance films such as BOPET and BOPP, alongside rising adoption across transportation, medical, and industrial packaging segments

U.S. Industrial Film Market Insight

The U.S. industrial film market is expected to witness significant growth fueled strong demand in industrial packaging and construction sectors. Growing awareness of sustainable packaging solutions and the adoption of advanced films such as HDPE and BOPET drive market expansion. The trend toward lightweight materials in transportation and regulatory support for eco-friendly films further bolster growth.

Europe Industrial Film Market Insight

Europe is expected to witness the fastest growth rate in the global industrial film market, driven by stringent environmental regulations and a focus on sustainable packaging solutions. Demand for films such as BOPP and BOPET is rising in industrial packaging and agriculture due to their recyclability and performance. Countries such as Germany and the U.K. lead adoption, supported by advanced manufacturing and green initiatives.

U.K. Industrial Film Market Insight

The U.K. market for industrial films is expected to grow rapidly, fueled by increasing demand for sustainable packaging in industrial and agricultural applications. Consumer preference for high-quality, recyclable films such as PP/BOPP and PET/BOPET drives market growth. Evolving regulations promoting circular economy practices and the rise of e-commerce packaging needs further accelerate adoption.

Germany Industrial Film Market Insight

Germany is expected to witness the fastest growth rate in Europe’s industrial film market, attributed to its advanced manufacturing sector and emphasis on energy-efficient, sustainable materials. German industries favor high-performance films such as BOPA and HDPE for packaging and construction, contributing to reduced material waste and enhanced durability. The integration of these films in premium applications supports sustained market growth.

Asia-Pacific Industrial Film Market Insight

Asia-Pacific dominates the industrial film market, driven by rapid industrialization, expanding manufacturing capabilities, and rising demand in countries such as China, India, and Japan. Increasing adoption of LLDPE and LDPE films in agriculture and packaging, coupled with government initiatives promoting sustainable materials, boosts market growth. Rising disposable incomes and urbanization further enhance demand.

Japan Industrial Film Market Insight

Japan’s industrial film market is expected to grow rapidly, driven by strong demand for high-quality films such as BOPET and BOPP in packaging and medical applications. The presence of major manufacturers and the integration of advanced films in industrial processes accelerate market penetration. Growing interest in sustainable and lightweight materials also contributes to market expansion.

China Industrial Film Market Insight

China holds the largest share of the Asia-Pacific industrial film market, propelled by rapid urbanization, booming e-commerce, and increasing demand for packaging solutions. The country’s growing manufacturing sector and focus on cost-effective films such as LDPE and PVC support widespread adoption. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Industrial Film Market Share

The industrial film industry is primarily led by well-established companies, including:

- Vecom (India)

- Vishakha Polyfab Pvt Ltd (India)

- Klöckner Pentaplast (Germany)

- Dow (U.S.)

- Soretrac (U.K.)

- Hypac Packaging Pte Ltd. (Singapore)

- Peiyu Plastics Corporation (Taiwan)

- AVI Global Plast (India)

- Verstraete IML (Belgium)

- Berry Global Inc. (U.S.)

- Jindal Poly Films (India)

- Mitsui Chemicals, Inc. (Japan)

- PLASTIC SUPPLIERS, INC. (U.S.)

- WINPAK LTD. (Canada)

- Polifilm GmbH (Germany)

- Avery Dennison (U.S.)

- DIC CORPORATION (Japan)

What are the Recent Developments in Global Industrial Film Market?

- In October 2024, Eastman, a U.S.-based specialty materials leader, acquired Dalian Ai-Red Technology (Dalian) Co., Ltd., a manufacturer of paint protection and window films for automotive and architectural applications across the Asia-Pacific region. This strategic move enhances Eastman’s advanced coatings and performance films capabilities, expanding its production capacity and innovation potential to meet growing global demand. The acquisition aligns with Eastman’s goal to deliver high-performance, value-added solutions in the industrial film market, particularly in automotive and architectural aftermarket films

- In September 2024, Brookfield Asset Management completed a strategic investment in Castlelake L.P., acquiring a 51% stake in its fee-related earnings and committing capital to Castlelake’s private credit strategies. Castlelake, a global alternative investment firm, specializes in asset-based private credit, including aviation and specialty finance. While not directly tied to industrial films, this move reflects a broader trend of capital flows into infrastructure and industrial assets, which can indirectly boost demand for industrial films used in construction, packaging, and logistics

- In April 2024, Cosmo Films introduced seven innovative specialty films for the U.S. market at Label Expo Americas 2024, showcasing its commitment to product diversification and industry-specific innovation. The new lineup includes PVC-free graphic films for signage, high shrink label films (PETG and Crystalline PET), CPP extrusion lamination films, Teplo R heat-resistant films, 92-micron white and clear label films, Flexi Premere non-tear elongation films, and primer-coated films for enhanced printability. These launches reflect Cosmo’s focus on sustainability, print performance, and application versatility across packaging and labeling sectors

- In December 2022, Hahn & Co., a leading South Korean private equity firm, completed the $1.2 billion acquisition of SKC’s industrial film business, marking one of the country’s largest M&A deals that year. The acquired unit, a global leader in polyester (PET) film production, ranks fourth worldwide and serves sectors such as mobile displays, semiconductors, and industrial packaging. This strategic move reflects ongoing consolidation trends in the industrial film market, as firms aim to enhance competitiveness, scale operations, and drive innovation through targeted acquisitions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.