Global Industrial Gas Regulators Market

Market Size in USD Billion

CAGR :

%

USD

19.82 Billion

USD

28.19 Billion

2024

2032

USD

19.82 Billion

USD

28.19 Billion

2024

2032

| 2025 –2032 | |

| USD 19.82 Billion | |

| USD 28.19 Billion | |

|

|

|

|

Industrial Gas Regulators Market Size

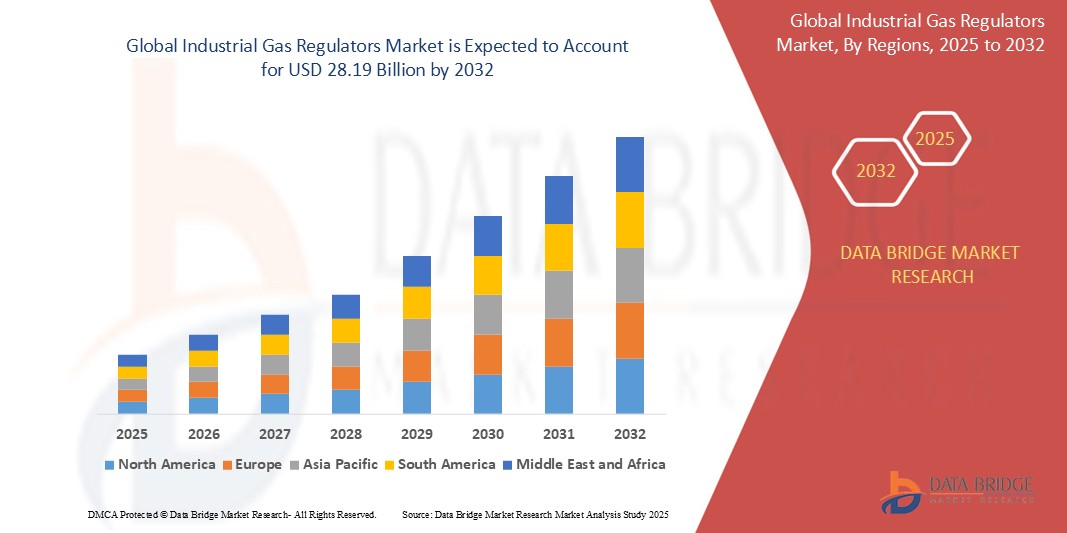

- The global industrial gas regulators market size was valued at USD 19.82 billion in 2024 and is expected to reach USD 28.19 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the rising demand across manufacturing, healthcare, and energy sectors, along with increasing applications in welding, cutting, and chemical processing industries

- Technological advancements in gas flow control systems and the growing emphasis on safety and efficiency in industrial operations are also contributing significantly to market expansion

Industrial Gas Regulators Market Analysis

- The industrial gas regulators market is experiencing steady growth, driven by the increasing demand for precise gas control in various sectors such as manufacturing, healthcare, and energy

- Technological advancements in gas regulator designs, including the development of regulators capable of handling high temperatures and corrosive gases, are contributing to market expansion

- North America dominates the industrial gas regulators market with the largest revenue share in 2025, driven by well-established industrial infrastructure and high adoption of advanced gas control technologies

- Asia-Pacific is expected to be the fastest growing region in the industrial gas regulators market during the forecast period due to rapid industrialization, rising energy demand, and expanding manufacturing activities across emerging economies

- The single-stage regulator segment remains a preferred choice for applications that do not require strict pressure accuracy, such as general welding, heating, and industrial cleaning. Its simple design and low maintenance requirements make it ideal for environments with moderate gas usage. For instance, in small-scale fabrication units, single-stage regulators are widely used for their ease of operation and affordability

Report Scope and Industrial Gas Regulators Market Segmentation

|

Attributes |

Industrial Gas Regulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Gas Regulators Market Trends

“Growing Integration of Smart Technologies in Gas Regulation”

- The market is shifting toward smart and automated gas regulators that support real-time monitoring, remote access, and predictive maintenance

- These systems use sensors and connectivity features to detect leaks and pressure fluctuations early, helping prevent costly downtime and safety risks

- For instance, Shell has implemented smart gas regulators in its refining units to monitor distribution remotely and enhance safety during critical operations

- In another case, Apollo Hospitals in India adopted automated oxygen regulators to ensure uninterrupted and accurate oxygen flow for patients in intensive care units

- This trend aligns with Industry 4.0 initiatives, driving the demand for intelligent solutions in increasingly complex industrial environments

Industrial Gas Regulators Market Dynamics

Driver

“Increasing Demand for Gas Control Across Diverse Industrial Applications”

- The demand for efficient gas control in industries such as manufacturing, chemicals, healthcare, and energy is boosting the adoption of industrial gas regulators

- Industrial gases such as oxygen, hydrogen, and nitrogen are vital for key operations such as welding, sterilization, and combustion, requiring precise regulation for safety and efficiency

- For instance, steel manufacturing units use regulators to maintain accurate gas flow during cutting and welding, ensuring product quality and worker safety

- Another instance is the use of advanced regulators in semiconductor fabrication, where consistent gas delivery is critical to prevent contamination and defects

- The rise of clean energy sources such as hydrogen and the development of smart regulators with digital monitoring capabilities are driving consistent market expansion across evolving industrial applications

Restraint/Challenge

“High Cost and Technical Complexity of Advanced Regulators”

- One major challenge in the industrial gas regulators market is the high cost and complexity of modern regulators with digital monitoring and automated controls

- These systems often require costly installation, regular maintenance, and integration with advanced infrastructure, making them less accessible to small and medium-sized enterprises

- For instance, a mid-sized metal fabrication company might avoid adopting smart regulators due to the added costs of upgrading its gas supply system and staff training

- Another instance is a small pharmaceutical plant facing delays in smart regulator deployment because of limited access to skilled technicians for system integration and support

- As a result, many companies continue to use basic regulators that offer lower precision and safety, slowing the overall adoption of advanced solutions and hindering market innovation

Industrial Gas Regulators Market Scope

The market is segmented on the basis of type, gas type, material, and application.

- By Type

On the basis of type, the industrial gas regulators market is segmented into single-stage regulators and dual-stage regulators. The single-stage regulator segment remains a preferred choice for applications that do not require strict pressure accuracy, such as general welding, heating, and industrial cleaning. Its simple design and low maintenance requirements make it ideal for environments with moderate gas usage. For instance, in small-scale fabrication units, single-stage regulators are widely used for their ease of operation and affordability.

The dual-stage regulator segment is gaining traction in high-precision industries where stable pressure is crucial from full cylinder to near-empty levels. These regulators offer better pressure stability and reduced chances of gas contamination or process disruption. For instance, in semiconductor production, consistent gas flow is vital to avoid defects, making dual-stage regulators a necessity. In addition, the growing emphasis on process accuracy and safety across critical sectors is expected to further propel the adoption of dual-stage regulators in the coming years.

- By Gas Type

On the basis of gas type, the industrial gas regulators market is segmented into inert gases, toxic gases, and corrosive gases. The inert gases segment maintained its lead due to the high demand for stable and non-reactive gases in sectors such as electronics, food processing, and metal fabrication. These gases ensure product integrity and process safety, making them indispensable in controlled environments. For instance, nitrogen is widely used for packaging in the food industry, while argon is a staple in arc welding.

The corrosive gases segment is poised for rapid growth as industries increasingly adopt sophisticated processes requiring hazardous gas handling. Enhanced regulator technologies featuring corrosion-resistant materials such as stainless steel and specialized coatings are supporting this trend. For instance, in chemical manufacturing, regulators for chlorine and ammonia are designed to withstand extreme conditions, ensuring both safety and performance.

- By Material

On the basis of material, the industrial gas regulators market is segmented into brass and stainless steel. The brass segment continues to lead due to its affordability, ease of machining, and compatibility with gases such as nitrogen, oxygen, and air in non-corrosive environments. These regulators are commonly found in manufacturing, welding, and general-purpose gas systems where moderate durability suffices. For instance, small-scale fabrication workshops often prefer brass regulators for their low maintenance needs.

The stainless-steel segment is seeing accelerated adoption as industries face harsher operational conditions and stricter safety standards. Its superior strength and corrosion resistance make it ideal for aggressive gases and demanding applications. For instance, pharmaceutical production facilities and offshore drilling rigs rely on stainless steel regulators to ensure longevity and safety in corrosive or sterile conditions.

- By Application

On the basis of application, the industrial gas regulators market is segmented into oil and gas, chemical, steel and metal processing, medical care, food and beverage, and others. The oil and gas segment remains dominant due to its high dependency on gas regulators for maintaining pressure integrity and operational safety across upstream and downstream activities. These regulators are vital in handling volatile and high-pressure gases under extreme environmental conditions. For instance, offshore platforms and gas processing units extensively use robust regulator systems to ensure smooth operations and prevent hazards.

The chemical segment is poised for rapid growth as emerging technologies and specialty chemical production demand tighter process control. Precision in gas flow is essential to avoid contamination and ensure reaction efficiency. For instance, advanced regulators are crucial in fine chemical synthesis and gas-phase reactions, where even minor pressure deviations can affect product quality and yield.

Industrial Gas Regulators Market Regional Analysis

- North America dominates the industrial gas regulators market with a substantial revenue share in 2024, driven by increasing demand for automation and safety across industries, along with a growing awareness of advanced gas control technologies.

- Consumers in this region place a high value on precise pressure regulation, and seamless integration of gas delivery systems in sectors such as oil and gas, chemicals, and healthcare.

- This widespread adoption is supported by stringent regulatory standards, a strong industrial base, and continuous technological advancements, establishing industrial gas regulators as essential components in both traditional and emerging applications.

U.S. Industrial Gas Regulators Market Insight

The U.S. industrial gas regulators market captured a significant revenue share within North America in 2025, fueled by the rapid expansion of industrial activities and the increasing focus on process efficiency. Industries are progressively prioritizing the enhancement of operational safety and productivity through the implementation of sophisticated gas control solutions. The growing preference for automation, combined with robust demand for high-performance regulators in sectors such as aerospace and pharmaceuticals, is further propelling the industrial gas regulators industry. Moreover, the increasing adoption of digital technologies and IoT integration is significantly contributing to the market's expansion.

Europe Industrial Gas Regulators Market Insight

The Europe industrial gas regulators market is projected to expand at a steady growth rate throughout the forecast period, primarily driven by stringent safety regulations and the escalating need for energy-efficient solutions in manufacturing and processing. The rise in industrial automation, coupled with the demand for reliable gas control in sectors such as food and beverage and chemical production, is fostering the adoption of advanced regulators. European industries are also drawn to the durability and precision these devices offer. The region is experiencing considerable growth across various applications, with gas regulators being integrated into both new and existing industrial facilities.

U.K. Industrial Gas Regulators Market Insight

The U.K. industrial gas regulators market is anticipated to grow at a steady growth rate during the forecast period, driven by the escalating trend of industrial modernization and a strong emphasis on safety and efficiency. In addition, concerns regarding operational risks and the need for precise gas delivery are encouraging both large-scale industries and SMEs to adopt advanced regulator technologies. The UK's focus on innovation, alongside its robust manufacturing and energy sectors, is expected to continue to stimulate market growth.

Germany Industrial Gas Regulators Market Insight

The German industrial gas regulators market is expected to expand at a considerable growth rate during the forecast period, fueled by increasing awareness of workplace safety and the demand for technologically advanced, high-quality solutions. Germany’s well-established industrial infrastructure, combined with its emphasis on precision engineering and sustainability, promotes the adoption of sophisticated gas regulators, particularly in the automotive, chemical, and energy sectors. The integration of gas regulators with automated control systems is also becoming increasingly prevalent, with a strong preference for reliable, high-performance products aligning with local industry standards.

Asia-Pacific Industrial Gas Regulators Market Insight

The Asia-Pacific industrial gas regulators market is poised to grow at the fastest growth rate during the forecast period, driven by rapid industrialization, rising investments in manufacturing, and increasing demand for energy across countries such as China, Japan, and India. The region's growing focus on industrial safety, supported by government initiatives promoting industrial development, is driving the adoption of advanced gas regulators. Furthermore, as APAC emerges as a manufacturing hub for various industries, the demand for efficient and reliable gas control solutions is expanding to a wider industrial base.

Japan Industrial Gas Regulators Market Insight

The Japan industrial gas regulators market is gaining momentum due to the country’s focus on technological advancement, stringent safety standards, and demand for high-precision control. The Japanese market places a significant emphasis on quality and reliability, and the adoption of advanced regulators is driven by the increasing need for efficiency in industrial processes and the expansion of sectors such as electronics and healthcare. The integration of gas regulators with sophisticated automation systems is fueling growth. Moreover, Japan's focus on innovation and automation is such as to spur demand for cutting-edge gas control solutions in both traditional and high-tech industries.

China Industrial Gas Regulators Market Insight

The China industrial gas regulators market accounted for the largest market revenue share in Asia Pacific, attributed to the country's expanding manufacturing sector, rapid urbanization, and high rates of industrial growth. China stands as one of the largest markets for industrial goods, and gas regulators are becoming increasingly crucial in diverse sectors such as chemicals, steel, and energy. The push towards upgrading industrial infrastructure and the availability of a wide range of gas regulator options, alongside strong domestic manufacturing capabilities, are key factors propelling the market in China. Industrial Gas

Industrial Gas Regulators Market Share

The industrial gas regulators industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- Dupont (U.S.)

- Linde (Germany)

- Air Liquide (France)

- Praxair Technology, Inc. (U.S.)

- SOLVAY (Belgium)

- Air Products and Chemicals Inc. (U.S.)

- Cavagna Group SPA (Italy)

- GCE Group (Sweden)

- Iwatani Corporation (Japan)

- Messer SE & Co. KGaA (Germany)

- Matheson Tri-Gas Inc. (U.S.)

- Iceblick Ltd. (Ukraine)

- Advanced Specialty Gases (U.S.)

- BASF SE (Germany)

- Buzwair Group (Qatar)

- Ellenbarrie Industrial Gases (India)

- Gulf Cryo (UAE)

- Proton Gases (India)

Latest Developments in Global Industrial Gas Regulators Market

- In October 2023, Emerson completed its acquisition of National Instruments (NI) for USD 8.2 billion, marking a significant development in the automation industry. This strategic move aims to enhance Emerson's capabilities in software-connected automated test and measurement systems, integrating NI as a new Test & Measurement segment within Emerson's Software and Control group. The acquisition is expected to expand Emerson's reach into high-growth markets such as semiconductors, transportation, and aerospace, while also increasing its exposure to industrial software markets. In addition, Emerson anticipates achieving USD165 million in cost synergies over five years, bolstering its position as a global automation leader

- In December 2023, Chemours, DuPont, and Corteva reaffirmed their commitment to a USD 1.185 billion settlement addressing PFAS-related drinking water claims from U.S. public water systems. This agreement aims to resolve liabilities associated with PFAS contamination, ensuring funds are allocated for water treatment and remediation efforts. By supporting this settlement, the companies seek to mitigate legal uncertainties and reinforce their dedication to environmental responsibility, potentially setting a precedent for industry-wide accountability in managing PFAS impacts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Gas Regulators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Gas Regulators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Gas Regulators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.