Global Industrial Hemp Market

Market Size in USD Billion

CAGR :

%

USD

8.16 Billion

USD

37.53 Billion

2024

2032

USD

8.16 Billion

USD

37.53 Billion

2024

2032

| 2025 –2032 | |

| USD 8.16 Billion | |

| USD 37.53 Billion | |

|

|

|

|

Industrial Hemp Market Size

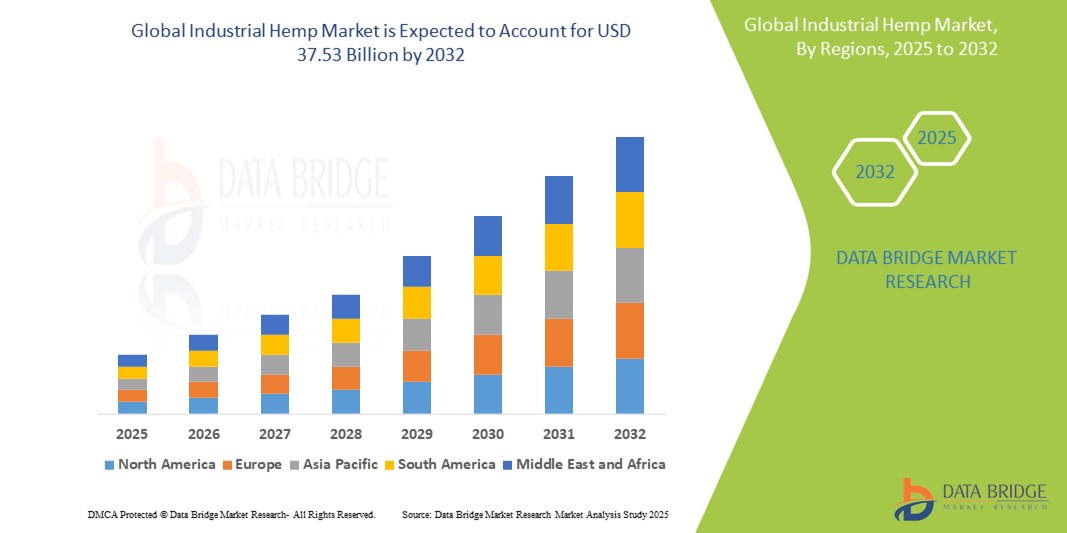

- The global industrial hemp market was valued at USD 8.16 billion in 2024 and is expected to reach USD 37.53 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 21.02%, primarily driven by the growing demand for hemp-based products in industries such as textiles, construction, and pharmaceuticals

- This growth is driven by factors such as increasing consumer awareness about sustainable products, regulatory support for hemp cultivation, and advancements in hemp processing technologies

Industrial Hemp Market Analysis

- Industrial hemp is a versatile and sustainable crop used in a wide range of industries, including textiles, construction, pharmaceuticals, and food. It is valued for its eco-friendly properties and high-value applications such as CBD production, bioplastics, and building materials

- The demand for industrial hemp is driven by the growing preference for sustainable materials, advancements in hemp cultivation techniques, and increasing legalization and regulatory support in various countries. A key driver is the rising demand for hemp-based products, particularly in the wellness and health sectors

- North America, particularly the United States and Canada, is one of the dominant regions for industrial hemp, supported by favourable regulatory frameworks and the increasing popularity of CBD and hemp-derived products

- For instance, the U.S. has witnessed significant growth in the hemp industry since the 2018 Farm Bill legalized hemp cultivation, leading to more farmers entering the market and expanding the hemp supply chain

- Globally, industrial hemp is gaining traction as a key raw material in sustainable product manufacturing, and its growing popularity positions it as a critical resource for industries focused on reducing environmental impact

Report Scope and Industrial Hemp Market Segmentation

|

Attributes |

Industrial Hemp Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Industrial Hemp Market Trends

“Growing Demand for Hemp-Based Products Across Multiple Industries”

- A key trend in the global industrial hemp market is the growing demand for hemp-based products in various sectors such as healthcare, textiles, construction, and food

- Hemp is increasingly being used in eco-friendly materials, textiles, bioplastics, and sustainable packaging solutions, catering to the rising consumer demand for sustainable and natural alternatives

- For instance, hemp fibers are being utilized in the production of biodegradable plastics and clothing, which are seen as more environmentally friendly compared to conventional materials like cotton and synthetics

- The expanding acceptance of hemp-derived products, including CBD oils, dietary supplements, and personal care items, is driving substantial market growth, particularly in regions where regulatory frameworks are becoming more favorable.

- This trend is expected to continue as consumers increasingly prioritize sustainability and wellness, creating a significant opportunity for hemp-based innovations across industries

Industrial Hemp Market Dynamics

Driver

“Increasing Demand for Sustainable and Eco-Friendly Products”

- The rising global focus on sustainability and environmental conservation is significantly driving the demand for industrial hemp products

- Hemp is considered one of the most sustainable crops, requiring fewer resources like water and pesticides compared to traditional crops, which aligns with the increasing consumer preference for eco-friendly and renewable materials

- The growing adoption of hemp in industries like construction (hempcrete), textiles (hemp fabrics), and biodegradable packaging solutions is contributing to market growth as companies strive to meet the demand for green alternatives

- Moreover, the environmental benefits of hemp-based products, such as carbon sequestration and reduced environmental footprints, are creating opportunities for the market to expand in both established and emerging markets

For instance,

- In May 2022, a study from the Hemp Industries Association highlighted that hemp's potential to absorb more CO2 than most crops, combined with its ability to regenerate soil health, is fueling its popularity as a sustainable raw material

- In January 2023, according to a report by Grand View Research, the construction industry’s growing shift towards using hemp-based products like hempcrete for eco-friendly building materials is expected to drive substantial market growth over the forecast period

- This trend toward sustainability and eco-conscious consumer behavior is positioning industrial hemp as a key material for future industrial applications

Opportunity

“Integration of Industrial Hemp in Emerging Applications”

- Industrial hemp is increasingly being adopted in emerging sectors, creating new opportunities for market growth

- One such application is in the development of biodegradable plastics and packaging, where hemp-based alternatives are gaining popularity due to their sustainability and environmental benefits

- As global regulations around plastic waste and sustainability tighten, the demand for hemp-derived bioplastics is expected to rise, creating significant market opportunities

- Hemp’s potential use in the automotive and construction industries is also expanding, with applications such as hemp-based composites for vehicle panels and eco-friendly building materials like hempcrete

For instance,

- In March 2024, according to a report by Hemp Business Journal, the use of hemp-based bioplastics in automotive interiors has seen a significant increase, with several car manufacturers adopting hemp for interior parts to reduce their carbon footprints

- In July 2023, the European Union’s shift towards sustainable building practices has increased the demand for hempcrete as a low-carbon, energy-efficient construction material, with the European Hemp Association projecting growth in this segment

- The rising interest in eco-friendly, sustainable materials in construction, automotive, and packaging is a key market opportunity for industrial hemp, positioning it as a crucial material for future industrial applications

Restraint/Challenge

“High Initial Capital Investment in Hemp Processing Facilities”

- The significant upfront costs required for setting up hemp processing facilities represent a major barrier for market expansion, especially for new entrants and small-scale producers

- Establishing facilities with equipment such as decorticators, extraction units, and dryers can require millions of dollars, which may not be affordable for emerging players or startups looking to enter the industrial hemp market

- This high initial investment can lead to slower market growth, as smaller players are either unable to enter the market or face long-term financial pressure to generate returns

For instance,

- In June 2023, according to an article published by Hemp Business Journal, one of the primary challenges faced by small-scale hemp producers is the significant capital required for setting up processing plants. Many are unable to bear the financial strain, thus slowing down the adoption of industrial-scale hemp production

- Consequently, these financial barriers may restrict market penetration, with larger companies dominating the space while smaller, independent producers are left behind, limiting industry diversification and competition

Industrial Hemp Market Scope

The market is segmented on the basis of type, application, and source

|

Segmentation |

Sub-Segmentation |

|

By Types |

|

|

By Application |

|

|

By Source |

|

Industrial Hemp Market Regional Analysis

“North America is the Dominant Region in the Industrial Hemp Market”

- North America holds a dominant position in the global industrial hemp market, primarily driven by the increasing adoption of hemp-based products, favourable regulatory frameworks, and robust demand across various industries such as textiles, construction, and healthcare

- The U.S. plays a pivotal role due to its growing hemp cultivation, expansion of hemp-derived CBD products, and supportive state and federal legislation that is gradually legalizing hemp cultivation and production

- Furthermore, the presence of key market players, along with significant investments in R&D for innovative hemp-based applications, continues to bolster North America’s market leadership

- The U.S. also benefits from advanced agricultural technologies and an increasing trend toward sustainability, which further fuels the demand for industrial hemp across several sectors

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to register the highest growth rate in the global industrial hemp market, spurred by rising interest in hemp-based products and increasing government support for hemp cultivation in countries like China, India, and Japan

- China, as the largest hemp producer globally, continues to dominate the market, while India is seeing a surge in hemp farming due to its vast agricultural land and growing focus on sustainable agricultural practices

- Japan, with its advanced technology and focus on eco-friendly industries, is also emerging as a key market for industrial hemp, particularly in the construction and textile sectors

- The Asia-Pacific market benefits from the region's rapidly expanding healthcare and wellness industries, where hemp-derived CBD products are gaining traction, as well as growing demand for sustainable and alternative raw materials in manufacturing

Industrial Hemp Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Canopy Growth Corporation (Canada)

- Aurora Cannabis Inc. (Canada)

- Charlotte's Web Holdings, Inc. (U.S.)

- The Hemp Collect (U.K.)

- HempFlax (Netherlands)

- CV Sciences, Inc. (U.S.)

- Tilray, Inc. (Canada)

- GW Pharmaceuticals (U.K.)

- Hempika (Slovenia)

- Green Organic Dutchman Holdings (Canada)

Latest Developments in Global Industrial Hemp Market

- In October 2024, Canopy Growth Corporation completed the acquisition of Wana, encompassing Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. Following this acquisition, Canopy USA now holds full ownership of Wana’s equity interests. This strategic move enhances the company's position in establishing a prominent, brand-focused cannabis business in the U.S.

- In October 2024, Aurora Cannabis Inc. broadened its portfolio of premium medical cannabis oils in Australia through a collaboration with MedReleaf Australia. The newly launched products, tailored to meet a variety of patient needs, include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescriptions

- In June 2024, Curaleaf Holdings, Inc. launched a new range of hemp-derived THC products under its Select and Zero Proof brands. These products will be available across 25 states and the District of Columbia through direct-to-consumer delivery as well as Curaleaf's extensive national distribution network

- In May 2024, The Cronos Group partnered with GROW Pharma, a prominent medicinal cannabis distributor in the UK, to introduce its PEACE NATURALS brand to the UK market. This collaboration will enable Cronos to deliver premium, high-quality cannabis products, granting UK patients access to the internationally recognized PEACE NATURALS brand

- In January 2023, HempMeds Brasil introduced two new full-spectrum products designed to meet the evolving needs of Brazilian healthcare professionals. These products were specifically developed to align with the preferences of doctors looking to recommend effective hemp-based solutions to their patients

- In October 2021, HempFlax Group revealed an investment of approximately USD 3.2 million aimed at enhancing its operations at the Dutch headquarters. Of this amount, around USD 1.9 million will be allocated to machinery upgrades, which are expected to double the hemp fiber processing capacity from 3 tons per hour to 6 tons per hour. These improvements are projected to reduce the company's operational hours from 24 to 16 hours per day, resulting in lower energy consumption and enhanced productivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.