Global Industrial Lasers Market

Market Size in USD Billion

CAGR :

%

USD

19.36 Billion

USD

53.80 Billion

2024

2032

USD

19.36 Billion

USD

53.80 Billion

2024

2032

| 2025 –2032 | |

| USD 19.36 Billion | |

| USD 53.80 Billion | |

|

|

|

|

Industrial Lasers Market Size

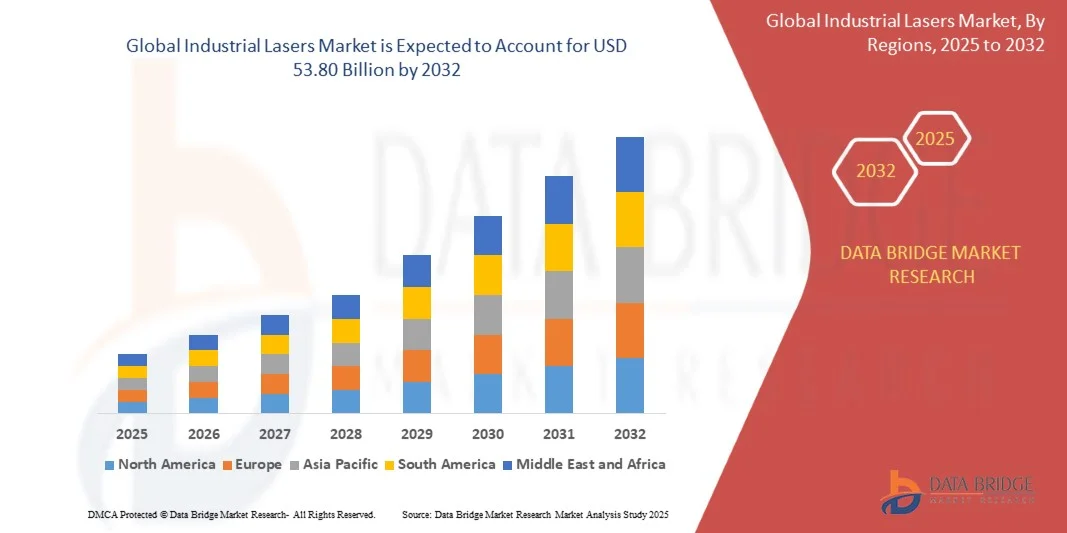

- The global industrial lasers market size was valued at USD 19.36 billion in 2024 and is expected to reach USD 53.80 billion by 2032, at a CAGR of 13.63% during the forecast period

- The market growth is largely fueled by the increasing adoption of laser-based manufacturing technologies across automotive, electronics, and medical industries, driven by the need for high precision, automation, and material efficiency in production processes

- Furthermore, rising investments in industrial automation and the growing shift toward advanced laser systems for cutting, welding, marking, and 3D printing applications are propelling market expansion. These developments are strengthening productivity, reducing operational costs, and accelerating industrial innovation, thereby significantly boosting market growth

Industrial Lasers Market Analysis

- Industrial lasers, used for material processing applications such as cutting, drilling, welding, and engraving, are increasingly integral to modern manufacturing due to their accuracy, speed, and ability to process diverse materials with minimal waste

- The demand for industrial lasers is primarily driven by the expansion of precision manufacturing in automotive, electronics, and aerospace sectors, coupled with the growing need for energy-efficient and contactless production technologies that enhance output quality and flexibility

- Asia-Pacific dominated the industrial lasers market with a share of 49.82%in 2024, due to rapid industrialization, expanding manufacturing bases, and growing adoption of automation technologies across sectors such as automotive, electronics, and metal processing

- North America is expected to be the fastest growing region in the industrial lasers market during the forecast period due to widespread adoption of laser-based technologies in industrial automation, metal processing, and additive manufacturing

- Macro processing segment dominated the market with a market share of 52.9% in 2024, due to the extensive use of industrial lasers in large-scale cutting, welding, and drilling of metals and alloys. Industries such as automotive, shipbuilding, and construction rely on macro processing for high-speed and high-precision fabrication. The ability of lasers to replace conventional mechanical tools due to their superior efficiency, minimal material waste, and consistent results continues to boost this segment’s growth

Report Scope and Industrial Lasers Market Segmentation

|

Attributes |

Industrial Lasers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Lasers Market Trends

“Growing Use of Fiber Lasers in Precision Manufacturing”

- The industrial lasers market is witnessing accelerated adoption of fiber laser technology as manufacturers increasingly prioritize precision, energy efficiency, and versatility in production processes. Fiber lasers have emerged as the preferred choice across industries such as automotive, aerospace, and electronics due to their superior beam quality, higher efficiency, and minimal maintenance requirements compared to conventional CO₂ and solid-state lasers

- For instance, IPG Photonics Corporation has continually expanded its portfolio of high-power fiber lasers used in precision cutting, welding, and surface processing across industrial manufacturing. The company’s innovations have enabled wider market penetration of compact, reliable, and cost-efficient fiber laser solutions that optimize throughput and reduce operational downtime

- Fiber lasers offer exceptional advantages in metal cutting, micromachining, and additive manufacturing, providing high speed and accuracy while consuming less energy. Their ability to perform intricate processing on materials such as stainless steel, aluminum, and titanium has made them indispensable in sectors demanding high tolerance and repeatability

- In addition, advancements in integrated control systems and automated laser modules are expanding industrial applications, enabling seamless incorporation into smart manufacturing environments. These systems allow data-driven adjustments and remote monitoring, which enhance productivity and reduce waste across industrial operations

- Manufacturers are also leveraging fiber lasers to achieve sustainable production goals, as their efficient energy conversion and long lifespan contribute to lower carbon emissions and reduced resource consumption. The trend supports the transition toward greener and smarter manufacturing ecosystems across global markets

- The growing preference for fiber lasers demonstrates a pivotal evolution in industrial processing standards. As automation, miniaturization, and material innovation continue to progress, fiber laser technology is set to define the next phase of industrial precision manufacturing through its superior performance, scalability, and sustainability attributes

Industrial Lasers Market Dynamics

Driver

“Rising Demand for Laser Processing in Automotive and Electronics”

- The growing complexity of manufacturing processes in automotive and electronics industries has significantly boosted the demand for laser-based cutting, welding, marking, and drilling systems. Industrial lasers enable high precision, design flexibility, and repeatability that support the development of lightweight vehicle components and miniaturized electronic circuits

- For instance, Trumpf Group has advanced its range of laser processing technologies, including high-performance fiber and diode lasers, which are widely used for automotive body welding, electric vehicle battery production, and semiconductor applications. The company’s innovations highlight how laser processing supports higher production accuracy and throughput for modern industrial applications

- The automotive sector benefits from laser cutting and welding in assembling complex designs with minimal heat distortion. Similarly, the electronics industry relies on laser micromachining for producing fine features in printed circuit boards and semiconductor components, ensuring reliability and dimensional consistency

- In addition, technological progress in laser automation systems has enhanced productivity by integrating robotics and vision-based monitoring tools. These integrations facilitate precise alignment, defect detection, and efficient process management, further expanding laser adoption across global production plants

- The overall shift toward advanced manufacturing methodologies is consolidating the importance of laser systems in enabling industrial innovation. As industries pursue higher efficiency, quality, and customization, the use of laser processing in automotive and electronics manufacturing will continue to be a key growth catalyst for the industrial lasers market

Restraint/Challenge

“High Cost of Advanced Laser Systems”

- The high initial investment and maintenance costs associated with advanced laser systems remain a major challenge for widespread market adoption, particularly among small and medium enterprises. Sophisticated components including beam delivery optics, cooling units, and power supplies contribute to elevated capital expenditure requirements

- For instance, Coherent Corp. has noted that its next-generation laser platforms incorporate advanced fiber designs and precision controls, which, while improving performance, also significantly increase system costs. This poses financial constraints for smaller manufacturers seeking to modernize operations with laser-based automation equipment

- The integration of laser systems into existing manufacturing lines often requires specialized training, customized installation, and safety infrastructure additions. These factors collectively increase total cost of ownership and delay ROI expectations for medium-scale industrial users

- In addition, the rapid pace of technological advancement results in frequent product upgrades, making earlier systems obsolete in shorter periods. This dynamic creates capital planning challenges for companies attempting to balance innovation adoption with cost control and operational continuity

- Addressing high system costs will require collaborative innovation between equipment manufacturers, integrators, and end-users. The increasing availability of modular platforms, leasing options, and energy-efficient designs is expected to gradually reduce financial barriers, supporting broader adoption of advanced laser technology in industrial manufacturing globally

Industrial Lasers Market Scope

The market is segmented on the basis of type, power, application, and end-use industry.

• By Type

On the basis of type, the industrial lasers market is segmented into CO₂, solid-state, diode, fiber, and others. The fiber laser segment dominated the market with the largest revenue share in 2024, attributed to its superior beam quality, high efficiency, and low maintenance requirements compared to other laser types. Its ability to perform precise and high-speed cutting and welding operations across a wide range of materials has made it the preferred choice in metal processing, automotive, and aerospace industries. Moreover, the compact design and energy efficiency of fiber lasers contribute to reduced operational costs, enhancing their adoption across advanced manufacturing facilities.

The diode laser segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing demand for compact, cost-effective, and energy-efficient laser systems in material processing and additive manufacturing. Diode lasers are gaining traction in micro-processing and marking applications due to their excellent wavelength stability and scalability. Their versatility in non-metal processing and emerging use in medical and photonic applications further position diode lasers as a key growth driver in the evolving industrial laser landscape.

• By Power

Based on power, the market is bifurcated into less than 1 kW and more than 1.1 kW segments. The more than 1.1 kW segment dominated the market in 2024, driven by extensive use in heavy-duty industrial applications requiring deep penetration cutting, welding, and surface treatment. High-power lasers are particularly favored in automotive, aerospace, and metal fabrication industries due to their ability to handle thicker materials and deliver consistent performance in mass production environments. The technological advancements improving beam quality and thermal management have also strengthened the adoption of high-power lasers.

The less than 1 kW segment is expected to register the fastest growth rate from 2025 to 2032, owing to increasing adoption in precision applications such as microelectronics, medical devices, and fine engraving. These low-power lasers are valued for their accuracy, reduced heat-affected zones, and suitability for intricate designs and thin materials. The growing miniaturization of components in electronics manufacturing is fueling the demand for sub-kilowatt laser systems globally.

• By Application

On the basis of application, the market is segmented into macro processing, micro processing, and marking/engraving. The macro processing segment dominated the market with a share of 52.9% in 2024, driven by the extensive use of industrial lasers in large-scale cutting, welding, and drilling of metals and alloys. Industries such as automotive, shipbuilding, and construction rely on macro processing for high-speed and high-precision fabrication. The ability of lasers to replace conventional mechanical tools due to their superior efficiency, minimal material waste, and consistent results continues to boost this segment’s growth.

The micro processing segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the rising need for precision fabrication in semiconductors, microelectronics, and medical devices. Micro processing lasers enable ultra-fine cutting and drilling with micron-level accuracy, catering to the increasing demand for miniaturized and high-performance electronic components. The shift toward advanced photonics and micro-manufacturing technologies is further accelerating the adoption of micro processing lasers.

• By End-Use Industry

By end-use industry, the industrial lasers market is categorized into electronics, metal processing, automotive, and non-metal processing. The metal processing segment dominated the market with the largest revenue share in 2024, driven by the widespread use of lasers for cutting, welding, and surface modification in industrial production. The ongoing automation in manufacturing and the growing demand for high-precision tools in automotive and heavy machinery industries continue to strengthen the adoption of laser-based metal processing systems. Their ability to improve productivity and reduce post-processing costs is a key factor driving this dominance.

The electronics segment is anticipated to record the fastest growth from 2025 to 2032, attributed to the increasing miniaturization of electronic devices and the demand for high-precision manufacturing. Industrial lasers are increasingly used in printed circuit board (PCB) fabrication, wafer dicing, and micro-drilling processes due to their precision and non-contact operation. The growing production of semiconductors and consumer electronics across Asia-Pacific further propels the expansion of this segment.

Industrial Lasers Market Regional Analysis

- Asia-Pacific dominated the industrial lasers market with the largest revenue share of 49.82% in 2024, driven by rapid industrialization, expanding manufacturing bases, and growing adoption of automation technologies across sectors such as automotive, electronics, and metal processing

- The region’s strong presence of laser manufacturing hubs, coupled with government initiatives promoting smart manufacturing and Industry 4.0, is further accelerating market growth

- High investments in infrastructure development, the rise of precision engineering industries, and increasing integration of laser-based technologies in metal cutting, welding, and marking applications continue to fuel regional demand

China Industrial Lasers Market Insight

China held the largest share in the Asia-Pacific industrial lasers market in 2024, owing to its strong dominance in manufacturing and metal processing industries. The nation’s leadership in automotive production, electronics fabrication, and industrial automation has significantly boosted demand for fiber and diode lasers. Supportive government policies encouraging advanced manufacturing, coupled with growing domestic laser component production, are propelling market expansion. Continuous investments in smart factories and precision machining also strengthen China’s position in the global industrial laser landscape.

India Industrial Lasers Market Insight

India is expected to witness the fastest growth in the Asia-Pacific region, fueled by rapid industrialization, rising adoption of automation in manufacturing, and growing investments in electronics and metal fabrication sectors. The government’s “Make in India” initiative and increasing focus on indigenous production of high-tech equipment are driving the adoption of laser-based technologies. Expanding automotive and electronics industries, along with improving access to advanced laser systems, are expected to further accelerate market growth in the country.

Europe Industrial Lasers Market Insight

The Europe industrial lasers market is growing steadily, supported by a strong focus on industrial automation, technological innovation, and the shift toward energy-efficient laser systems. High demand for precision metal fabrication, additive manufacturing, and electric vehicle components is fueling adoption. The region’s commitment to sustainability and digital transformation in manufacturing processes continues to drive demand for advanced laser technologies across automotive and aerospace sectors.

Germany Industrial Lasers Market Insight

Germany dominated the European market in 2024, driven by its advanced industrial ecosystem, leadership in automotive engineering, and strong focus on automation and precision manufacturing. The country’s extensive adoption of laser technology in metal cutting, welding, and additive manufacturing applications underpins its market strength. Strategic investments in research and development and collaborations between industry leaders and technology providers are further enhancing Germany’s technological leadership.

U.K. Industrial Lasers Market Insight

The U.K. market is supported by a growing focus on reshoring manufacturing, increasing adoption of digital fabrication technologies, and strong investments in high-precision production for aerospace and defense sectors. The government’s emphasis on advanced manufacturing and R&D collaborations between universities and industrial players are enhancing innovation in laser-based systems. Rising integration of lasers in microfabrication and electronic component manufacturing is also strengthening market growth.

North America Industrial Lasers Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by widespread adoption of laser-based technologies in industrial automation, metal processing, and additive manufacturing. Strong R&D infrastructure, early adoption of advanced manufacturing systems, and demand for precision engineering across aerospace and defense industries are key factors fueling growth. Increasing reshoring of production and investments in smart factories are further boosting regional market expansion.

U.S. Industrial Lasers Market Insight

The U.S. accounted for the largest share in the North America industrial lasers market in 2024, owing to its well-established industrial base, strong technological innovation, and extensive use of lasers in manufacturing and defense applications. The presence of major laser technology providers, continuous R&D funding, and the adoption of high-power laser systems in metal processing and 3D printing applications contribute to market dominance. Ongoing advancements in photonics and automation technologies continue to reinforce the U.S.’s leadership in the global industrial laser market.

Industrial Lasers Market Share

The industrial lasers industry is primarily led by well-established companies, including:

- Calmar Laser (U.S.)

- Amonics Ltd. (China)

- TRUMPF (Germany)

- Coherent Inc. (U.S.)

- Newport Corporation (U.S.)

- IPG Photonics Corporation (U.S.)

- Bystronic Laser AG (Switzerland)

- JENOPTIK AG (Germany)

- Lumentum Operations LLC (U.S.)

- nLight Inc. (U.S.)

- ACSYS Lasertechnik Inc. (Germany)

- Han’s Laser Technology Industry Group Co. Ltd. (China)

- Clark-MXR Inc. (U.S.)

- Lumibird SA (France)

- Toptica Photonics AG (Germany)

- Quantel Group (U.K.)

- NKT Photonics A/S (Denmark)

- CY Laser SRL (Italy)

- Apollo Instruments (U.S.)

- Laser Lab India Pvt. Ltd. (India)

Latest Developments in Global Industrial Lasers Market

- In September 2024, Laser Photonics Corporation (LPC) expanded its market footprint across multiple high-growth sectors, including solar energy, semiconductors, and defense, through the adoption of its CleanTech laser systems by Acuren, a key player in nondestructive testing and oil & gas services. This strategic expansion is expected to strengthen LPC’s position in industrial maintenance and inspection markets, enhancing demand for its precision laser cleaning and surface treatment technologies

- In August 2024, BWT introduced a 200kW ultra-high-power industrial-grade fiber laser designed to significantly improve material processing efficiency. Featuring high-brightness long-fiber delivery and femtosecond laser fiber grating technology, this innovation broadens BWT’s application reach across industries such as manufacturing, aerospace, and energy. The launch reinforces BWT’s technological leadership and addresses the growing demand for high-power, high-precision fiber lasers

- In July 2024, MedWorld Advisors completed the acquisition of ARC Laser GmbH and GNS neoLaser Ltd. to establish the MedTech Laser Group, consolidating expertise in medical laser technologies. This move enhances the company’s product portfolio for medical device manufacturing and laser-based treatments, strengthening its competitive presence in the medical and industrial laser markets while driving innovation in laser applications for healthcare

- In October 2023, TRUMPF unveiled its automated punch laser machine, the TruMatic 5000, capable of performing laser cutting, punching, and forming within a fully integrated smart factory system. This development enhances TRUMPF’s product offering for industrial automation, boosting manufacturing efficiency and precision. The innovation reflects the company’s focus on intelligent production solutions that align with Industry 4.0 standards

- In May 2022, Lumentum expanded its ultrafast laser portfolio with the launch of the FemtoBlade femtosecond laser system, aimed at high-precision micromachining applications such as OLED, glass cutting, engraving, and solar cell processing. The introduction of FemtoBlade strengthens Lumentum’s position in the precision laser market, catering to industries demanding superior speed, flexibility, and accuracy in advanced manufacturing processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Lasers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Lasers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Lasers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.