Global Industrial Lighting Market

Market Size in USD Billion

CAGR :

%

USD

11.80 Billion

USD

18.30 Billion

2024

2032

USD

11.80 Billion

USD

18.30 Billion

2024

2032

| 2025 –2032 | |

| USD 11.80 Billion | |

| USD 18.30 Billion | |

|

|

|

|

Industrial Lighting Market Size

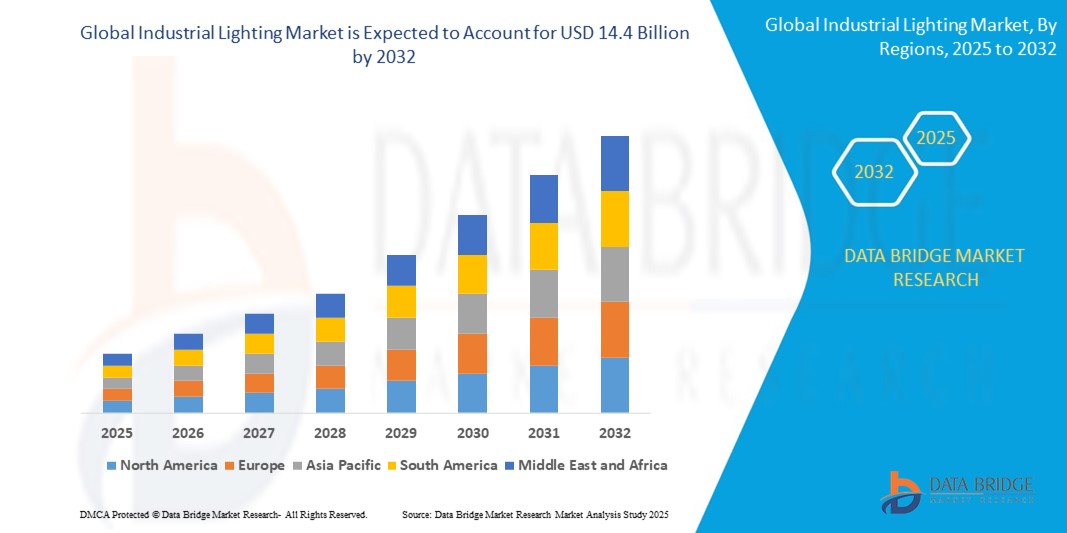

- The global industrial lighting market was valued at USD 10.1 billion in 2024 and is expected to reach USD 14.4 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.60%, primarily driven by the increasing demand for energy-efficient lighting solutions and the adoption of smart lighting technologies

- This growth is driven by factors such as growing awareness about energy conservation, advancements in LED technology, and rising industrial automation across various sectors

Industrial Lighting Market Analysis

- Industrial lighting solutions are vital in ensuring optimal visibility, energy efficiency, and safety in commercial, industrial, and manufacturing environments. These systems are crucial in warehouses, factories, and outdoor industrial settings, providing illumination that meets regulatory standards and enhances worker productivity

- The demand for industrial lighting is significantly driven by the increasing focus on energy-efficient lighting solutions and the rising adoption of smart technologies. The need for robust, long-lasting lighting in industrial environments has led to widespread use of LED technology, which accounts for a substantial portion of market growth

- The Asia-Pacific region dominates the global industrial lighting market, driven by rapid industrialization, manufacturing expansion, and the growing emphasis on energy-saving solutions across key countries such as China and India

- For instance, China’s push towards green technologies and its large manufacturing sector has led to a rise in demand for industrial lighting systems that offer energy savings and improved performance

- Globally, industrial lighting solutions are considered essential for ensuring workplace safety and operational efficiency, with energy-efficient LED lighting emerging as the top choice in reducing operational costs and enhancing overall performance in industrial settings

Report Scope and Industrial Lighting Market Segmentation

|

Attributes |

Industrial Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Lighting Market Trends

“Shift Towards Smart and Energy-Efficient Lighting Solutions”

- One prominent trend in the global industrial lighting market is the growing shift towards smart and energy-efficient lighting solutions

- These advanced lighting systems enhance energy savings, reduce operational costs, and offer greater control through automated systems and smart sensors

- For instance, smart lighting solutions allow for real-time monitoring and adaptive lighting based on occupancy and ambient light conditions, helping industrial facilities optimize energy usage and reduce waste

- The integration of IoT technology in industrial lighting enables enhanced connectivity, enabling remote control, maintenance alerts, and performance tracking, which improves operational efficiency and reduces downtime

- This trend is reshaping the way industrial lighting systems are deployed, contributing to sustainability goals and increasing demand for innovative lighting solutions in the market

Industrial Lighting Market Dynamics

Driver

“Growing Demand for Energy Efficiency and Sustainability”

- The increasing global emphasis on energy efficiency and sustainability is significantly driving the demand for industrial lighting solutions

- As industries face rising energy costs and stricter environmental regulations, the need for lighting systems that reduce energy consumption while maintaining high performance becomes critical

- LED technology, known for its energy efficiency and long lifespan, is becoming the preferred choice in industrial settings, offering a cost-effective solution for large-scale lighting installations

- Additionally, there is a growing trend toward green building standards and eco-friendly initiatives, further pushing industries to adopt sustainable lighting solutions that contribute to reduced carbon footprints

For instance,

- In 2023, the U.S. government introduced new incentives for energy-efficient lighting systems under its "Green New Deal," encouraging the widespread adoption of LED and smart lighting technologies in industrial sectors

- In 2022, according to a report from the International Energy Agency (IEA), energy-efficient lighting adoption in Europe increased by 35%, driving growth in the industrial lighting market as businesses sought to align with sustainability goals

- As organizations and governments push for energy reduction targets and carbon neutrality, the demand for advanced, energy-efficient industrial lighting systems continues to grow

Opportunity

“Integration of Smart Technologies and IoT in Industrial Lighting”

- The integration of smart technologies and the Internet of Things (IoT) in industrial lighting systems presents significant opportunities for market growth

- Smart lighting solutions, equipped with sensors, automation, and real-time monitoring capabilities, can optimize energy use, enhance operational efficiency, and provide valuable data insights for industrial facilities

- IoT-enabled lighting systems allow for remote control and maintenance, reducing downtime and ensuring consistent performance across large-scale industrial environments

For instance,

- In 2024, the European Union introduced new initiatives to promote smart manufacturing technologies, including IoT-based lighting systems, aiming to increase energy efficiency and reduce operational costs in industrial sectors

- In 2023, a major U.S.-based manufacturer implemented IoT-driven smart lighting across its production facilities, leading to a 25% reduction in energy consumption and improved operational efficiency, showcasing the vast potential of this technology in the industrial lighting market

- The increasing demand for smart buildings and factory automation drives the need for intelligent lighting systems that can adapt to changing conditions and improve overall energy management

Restraint/Challenge

“High Initial Investment and Installation Costs”

- The high initial investment and installation costs of advanced industrial lighting systems, particularly energy-efficient LED and smart lighting solutions, pose a significant challenge to market penetration

- These lighting systems, while offering long-term cost savings, require a considerable upfront expenditure for both purchasing the equipment and setting up the necessary infrastructure

- Smaller manufacturing facilities or businesses with limited budgets may be deterred from making the transition to modern lighting systems, opting to continue using less efficient, older technologies instead

For instance,

- In 2023, according to a report from the International Energy Agency (IEA), many small to medium-sized industrial enterprises in Europe expressed concern over the high initial costs of LED and smart lighting systems, despite their potential for long-term savings

- Consequently, the significant upfront costs of these advanced lighting solutions can limit their adoption, particularly in regions with budget constraints, ultimately slowing the growth of the global industrial lighting market

Industrial Lighting Market Scope

The market is segmented on the basis of light source, offerings, installation type, product, and application.

|

Segmentation |

Sub-Segmentation |

|

By Light Source |

|

|

By Offerings |

|

|

By Installation Type |

|

|

By Product |

|

|

By Application |

|

Industrial Lighting Market Regional Analysis

“North America is the Dominant Region in the Industrial Lighting Market”

- North America dominates the industrial lighting market, driven by advanced infrastructure, high demand for energy-efficient lighting solutions, and the presence of key market players

- The U.S. holds a significant share due to the widespread adoption of LED and smart lighting technologies in industrial sectors, along with strong regulations encouraging energy efficiency and sustainability

- The availability of government incentives, favorable policies for energy-saving solutions, and increasing investments in green technologies further strengthen the market

- Additionally, the growing trend of automation in industrial facilities and the need for improved lighting to enhance productivity and safety are fueling market growth across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global industrial lighting market, driven by rapid industrialization, expanding manufacturing sectors, and increasing demand for energy-efficient solutions

- Countries such as China, India, and Japan are emerging as key markets due to rapid urbanization, expanding industrial infrastructure, and a growing focus on sustainability and energy conservation

- China, with its large manufacturing base, continues to lead in adopting industrial lighting systems, while India’s industrial growth and government initiatives to improve energy efficiency contribute significantly to the market expansion

- Japan, known for its advanced technology and high adoption of energy-efficient lighting solutions, remains a crucial market in the region, setting trends in smart and automated lighting systems. The increasing need for cost-effective and energy-efficient solutions in industrial settings further boosts market growth in this region

Industrial Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Philips Lighting (Netherlands)

- OSRAM GmbH (Germany)

- General Electric (GE) (U.S.)

- Acuity Brands Lighting (U.S.)

- Cree Inc. (U.S.)

- Hubbell Lighting (U.S.)

- Zumtobel Group (Austria)

- Eaton Corporation (Ireland)

- Schneider Electric (France)

- Panasonic Corporation (Japan)

Latest Developments in Global Industrial Lighting Market

- In May 2022 Signify introduced the next-generation Pacific LED Gen5 waterproof luminaire, engineered for exceptional performance in challenging environments such as industrial facilities and parking areas. This advanced lighting solution is designed to meet the rigorous demands of heavy industrial applications. The luminaires feature a robust, compact architecture with superior protection against water, dust, and mechanical impact, ensuring reliability and durability in the most demanding conditions

- In June 2022 Cree LED unveiled the XLamp Element G LEDs, introducing a new product class that offers exceptionally high light output and efficiency for LEDs of this size. The XLamp Element G LEDs represent the latest addition to Cree LED's portfolio, delivering unparalleled light output and optical performance with advanced precision and enhanced control capabilities.

- In October 2021 Dialight plc announced the launch of the Ultra-Efficient Vigilant LED High Bay, a high-performance lighting fixture designed for heavy industrial applications. This advanced solution is positioned as a sustainable lighting option for industrial environments, providing a faster return on investment—up to one year earlier compared to previous Dialight High Bay models.

- In December 2021 Signify acquired Fluence, a leading specialist in horticultural LED lighting. This acquisition enhances Signify's comprehensive portfolio, enabling the combined entity to deliver the most innovative horticultural technologies to cultivators worldwide, further strengthening their position in the global market

- In August 2021 Zumtobel partnered with NICHIA, the world’s largest LED manufacturer and inventor of high-brightness blue and white LEDs. This collaboration focuses on delivering advanced human-centric lighting solutions. The resulting ZUMTOBEL Spectrum is a lighting solution designed for Zumtobel luminaires, incorporating proprietary technologies developed by NICHIA, particularly those from the Optisolis and Vitasolis initiatives, to create a more natural and beneficial color spectrum

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.