Global Industrial Reels Market

Market Size in USD Million

CAGR :

%

USD

450.00 Million

USD

640.43 Million

2024

2032

USD

450.00 Million

USD

640.43 Million

2024

2032

| 2025 –2032 | |

| USD 450.00 Million | |

| USD 640.43 Million | |

|

|

|

|

Industrial Reels Market Size

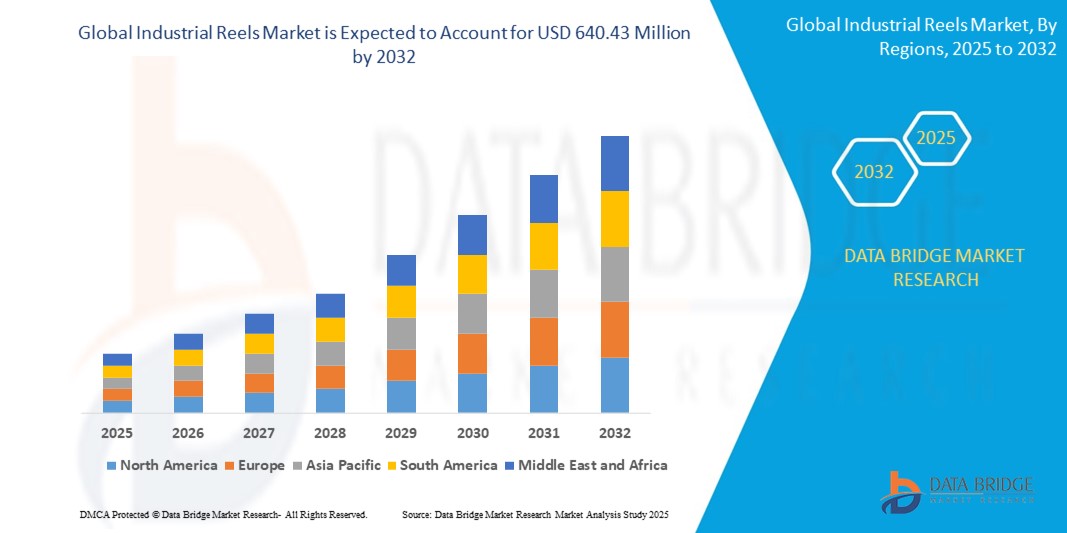

- The global industrial reels market size was valued at USD 450 million in 2024 and is expected to reach USD 640.43 million by 2032, at a CAGR of 4.51% during the forecast period

- The market growth is largely fueled by the increasing demand for efficient cable, hose, and wire management solutions across industrial sectors such as construction, oil & gas, mining, and renewable energy, driven by rising automation and safety requirements in operational environments

- Furthermore, expanding infrastructure projects, growing electrification, and the integration of motorized and spring-loaded reels in modern equipment are establishing industrial reels as essential components in enhancing productivity and minimizing downtime. These converging factors are accelerating the adoption of industrial reels, thereby significantly boosting the industry's growth

Industrial Reels Market Analysis

- Industrial reels are mechanical devices used to wind, unwind, and store hoses, cables, and cords, ensuring organized handling and safety across various industrial applications. These reels support both manual and automated operations, providing critical functionality in energy, telecom, transportation, and manufacturing environments

- The accelerating demand for industrial reels is primarily driven by increasing emphasis on workplace safety, rising labor cost pressures, and the shift toward automated systems requiring precise cable management, particularly in high-performance and space-constrained industrial settings

- Asia-Pacific dominated the industrial reels market with a share of 42.5% in 2024, due to rapid industrialization, infrastructure development, and expanding manufacturing activities across the region

- North America is expected to be the fastest growing region in the industrial reels market during the forecast period due to increasing automation, stringent safety regulations, and the growing complexity of industrial operations across construction, oil & gas, and renewable energy sectors

- Metal reels segment dominated the market with a market share of 52.9% in 2024, due to their superior strength, durability, and ability to withstand harsh environmental conditions. Their load-bearing capacity and corrosion resistance make them a preferred choice in heavy-duty industries such as oil & gas, construction, and mining. Metal reels are particularly valued for their longevity and support of high-torque winding operations, essential for demanding industrial settings

Report Scope and Industrial Reels Market Segmentation

|

Attributes |

Industrial Reels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Reels Market Trends

“Growing Adoption in the Aerospace Sector”

- The industrial reels market is witnessing increasing adoption within the aerospace sector as manufacturers and maintenance operations require efficient management of power cables, hydraulic hoses, and fiber-optic lines during aircraft assembly, maintenance, and testing

- For instance, companies such as Hannay Reels, Reelcraft Industries, and Coxreels provide advanced reel systems for aerospace applications, enabling organized deployment and safety compliance on factory floors and in maintenance hangars

- The need for lightweight, corrosion-resistant, and high-durability materials—such as aluminum and composite reels—is accelerating, driven by harsh aerospace environments and demands for reduced downtime

- Automation and integration with smart factory technologies—such as IoT-enabled monitoring, automated retraction, and predictive maintenance—are enhancing the efficiency and reliability of cable and hose management in critical aerospace operations

- The growth of commercial spaceflight and defense aviation is stimulating new product development, with reels tailored for rapid deployment, safe storage, and easy mobility of specialized lines and hoses

- Regulatory focus on safety and cleanliness standards in aerospace operations is also prompting broader adoption of industrial reels for cable management, fluid transfer, and ground support systems

Industrial Reels Market Dynamics

Driver

“Growth in Construction and Infrastructure Projects”

- Accelerating construction and infrastructure development worldwide is a major driver for the industrial reels market, as these projects demand robust cable, hose, and wire management solutions to ensure workplace safety and operational efficiency

- For instance, leading suppliers such as Hannay Reels, Reelcraft Industries, and Conductix-Wampfler are pivotal in providing reels used for managing heavy-duty air, water, welding, and electrical cords on large construction sites and urban development projects

- Reels are essential for organized deployment of temporary power, communication, hydraulic, and pneumatic lines during bridge building, roadwork, and utility infrastructure upgrades

- Increased investment in energy and renewable sectors, including electric vehicle charging and smart grid expansion, raises the need for reels to manage long and high-capacity cables

- Enhanced safety standards and the drive to reduce downtime on construction sites drive adoption of reels that minimize hazards from loose cables and hoses, supporting better project outcomes. Technological advancements—such as slip-ring-free cable reels for uninterrupted power supply and integration with automated construction equipment—are fueling market growth

Restraint/Challenge

“High Initial Costs”

- The high initial procurement cost of industrial reels, especially advanced motor-driven or automated variants, stands as a core market restraint

- For instance, customizable reels from top brands such as Reelcraft and Coxreels often involve premium materials (stainless steel, aluminum) and engineering, resulting in elevated purchase prices that can be prohibitive for small and medium enterprises (SMEs)

- Additional expenses arise from ongoing maintenance—such as engineered bearings, motor replacements, and compliance with safety protocols—which can further deter investment by budget-conscious buyers

- Volatile raw material prices and the technical complexity of new-generation reels (with IoT sensors and predictive analytics) sometimes add to the total cost of ownership, making buyers cautious in price-sensitive markets

- In many cases, potential customers may opt for less advanced manual solutions or delay upgrades, limiting market penetration of high-tech reel systems. Educational efforts and demonstrations of long-term savings and safety gains are needed to justify upfront costs and promote adoption in more cost-sensitive regions

Industrial Reels Market Scope

The market is segmented on the basis of type, material, reel diameter/capacity, and end-use industry.

- By Type

On the basis of type, the industrial reels market is segmented into reels, motorized reels, and spring-loaded reels. The reels segment accounted for the largest market revenue share in 2024, owing to their widespread use across multiple industries due to durability, simple design, and cost-effectiveness. Standard reels are preferred for manual and semi-automated operations in sectors such as construction and mining, where rugged performance and ease of maintenance are critical. Their adaptability across varied cable, hose, and wire applications reinforces their position as a foundational component in industrial operations.

The motorized reels segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising automation trends and the need for efficient cable and hose management in high-demand industrial environments. These reels offer enhanced operational safety and productivity by automating retraction and extension processes, reducing manual labor and cable damage. Industries such as oil & gas and aerospace are increasingly deploying motorized reels to streamline workflow, reduce downtime, and support remote-control capabilities.

- By Material

On the basis of material, the industrial reels market is segmented into metal reels, plastic reels, and wooden reels. Metal reels dominated the market revenue share of 52.9% in 2024 due to their superior strength, durability, and ability to withstand harsh environmental conditions. Their load-bearing capacity and corrosion resistance make them a preferred choice in heavy-duty industries such as oil & gas, construction, and mining. Metal reels are particularly valued for their longevity and support of high-torque winding operations, essential for demanding industrial settings.

Plastic reels are expected to register the fastest CAGR from 2025 to 2032, supported by their lightweight nature, lower cost, and resistance to moisture and chemicals. These properties make them ideal for applications in the electrical & electronics and telecom sectors. In addition, growing emphasis on material sustainability and recyclability is encouraging manufacturers to develop high-performance plastic reels with improved structural integrity and environmental compliance.

- By Reel Diameter/Capacity

On the basis of reel diameter/capacity, the market is segmented into small (up to 500 mm), medium (500 mm to 1500 mm), and large (above 1500 mm). The medium segment held the largest market revenue share in 2024, as it balances portability and storage capacity, making it suitable for a broad spectrum of industrial applications. These reels are frequently used for managing cables, wires, and hoses in construction, renewable energy, and telecom installations, where moderate load capacities are sufficient for effective operation.

The large segment is projected to grow at the highest rate from 2025 to 2032 due to increasing demand for heavy-load handling and extended cable lengths in industries such as mining and offshore drilling. These reels enable efficient transportation, deployment, and retrieval of industrial equipment and hoses over long distances, reducing operational strain and downtime in complex field environments.

- By End-Use Industry

On the basis of end-use industry, the industrial reels market is segmented into construction, electrical & electronics, automotive & aerospace, oil & gas, mining, renewable energy, telecom, industrial equipment, and others. The construction segment accounted for the highest revenue share in 2024, driven by the extensive use of reels in managing power cables, welding hoses, and lifting slings. Infrastructure expansion across emerging economies and increasing investments in residential and commercial developments are further boosting demand.

The renewable energy sector is expected to witness the fastest CAGR from 2025 to 2032, supported by the global transition to sustainable power generation and the growing installation of solar and wind farms. Reels are vital for managing long and heavy-duty cables during setup and maintenance of renewable energy systems. Their role in ensuring safety, operational efficiency, and cable protection is critical in facilitating large-scale renewable projects.

Industrial Reels Market Regional Analysis

- Asia-Pacific dominated the industrial reels market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, infrastructure development, and expanding manufacturing activities across the region

- Rising investments in construction, mining, and renewable energy sectors, along with government-backed industrial expansion programs, are major contributors to market growth

- Strong presence of local reel manufacturers, increasing demand for heavy-duty cable and hose management, and growth in power transmission and telecom infrastructure are fueling regional adoption

Japan Industrial Reels Market Insight

The industrial reels market in Japan is expanding steadily, underpinned by the country's advanced manufacturing landscape and emphasis on high-precision industrial processes. Demand is particularly strong in the automotive and electronics sectors, where safety, compactness, and automated handling systems are crucial. Japanese industries are increasingly incorporating motorized and spring-loaded reels to streamline operations, reduce manual intervention, and ensure workplace safety. In addition, the nation’s aging workforce is accelerating the shift toward automation, making industrial reels an essential component in equipment upgrades and production efficiency improvements.

China Industrial Reels Market Insight

China held the largest share within the Asia-Pacific industrial reels market in 2024, bolstered by its status as a global industrial hub. Massive infrastructure projects, growing exports, and continued investments in sectors such as construction, energy, and mining are driving reel usage across the country. Government initiatives promoting high-tech manufacturing and industrial automation are fueling the adoption of advanced reel systems for cable, wire, and hose management. With strong domestic production capabilities and a highly competitive market landscape, China continues to lead the region in volume and value.

Europe Industrial Reels Market Insight

Europe is projected to witness steady growth in the industrial reels market over the forecast period, supported by increasing investments in infrastructure modernization and stringent safety standards across sectors such as oil & gas, automotive, and renewable energy. The region is experiencing growing demand for advanced reel systems that align with sustainability goals and enhance operational efficiency. Rising adoption of cable management solutions in offshore wind farms, smart grids, and industrial automation projects is driving the market forward. Countries with strong engineering capabilities and environmental mandates are particularly instrumental in shaping market demand.

U.K. Industrial Reels Market Insight

The U.K. industrial reels market is poised for consistent growth, fueled by the expanding deployment of reels in offshore energy installations and utility infrastructure projects. Increasing focus on renewable energy, particularly offshore wind farms, has created demand for corrosion-resistant, weatherproof reel systems. Furthermore, the country's push for smart infrastructure and investment in telecommunications is boosting the requirement for reel-based cable handling in both urban and remote areas. Government-led sustainability initiatives are also encouraging the use of efficient and recyclable materials in reel manufacturing.

Germany Industrial Reels Market Insight

Germany’s industrial reels market is expected to grow substantially, backed by its global reputation for industrial automation, engineering precision, and sustainability leadership. The country’s automotive and manufacturing sectors are key drivers of demand, requiring robust and high-performance reel systems for assembly lines and maintenance operations. Germany’s strong focus on energy efficiency and the use of advanced equipment in industrial processes has led to the increased integration of motorized reels in various applications. Innovation in reel materials and technologies, combined with environmental compliance, further supports the country’s market expansion.

North America Industrial Reels Market Insight

North America is projected to register the fastest CAGR in the industrial reels market from 2025 to 2032, propelled by increasing automation, stringent safety regulations, and the growing complexity of industrial operations across construction, oil & gas, and renewable energy sectors. The need for effective cable management solutions in heavy-duty applications is accelerating demand for motorized and spring-loaded reels. Investments in telecom infrastructure, EV manufacturing, and smart grid projects are also contributing to sustained market growth. The region benefits from a strong R&D ecosystem and proactive regulatory frameworks that support safety and innovation.

U.S. Industrial Reels Market Insight

The U.S. accounted for the largest revenue share within the North America market in 2024, driven by its dynamic construction industry, advanced oilfield operations, and extensive infrastructure investments. Demand is surging for reels in sectors such as utilities, telecom, and industrial equipment, where safe and efficient cable handling is a priority. Adoption of automated reel systems is increasing as companies focus on reducing labor costs and enhancing workplace safety. The expansion of electric vehicle infrastructure, coupled with growing demand for power and data cabling solutions, is further boosting the industrial reels market in the country.

Industrial Reels Market Share

The industrial reels industry is primarily led by well-established companies, including:

- Hannay Reels Inc. (U.S.)

- Reelcraft Industries (U.S.)

- Coxreels (U.S.)

- Nederman Holding AB (Sweden)

- Cavotec SA (Switzerland)

- United Equipment Accessories, Inc. (U.S.)

- Cejn Ab (Sweden)

- Hubbell (U.S.)

- Winkel GmbH (Germany)

- SANKYO REELS (Japan)

- The Ericson Manufacturing Co (U.S.)

- Conductix-Wampfler GmbH (Germany)

- Paul Vahle GmbH & Co. KG (Germany)

- Molex (U.S.)

- Hartmann & König Stromzuführungs AG (Germany)

Latest Developments in Global Industrial Reels Market

- In January 2025, Cavotec SA secured a major order for 1,000 spring cable reels from Qwello, a leading German electric vehicle charging station operator, aimed at deployment across Europe. This significant contract reinforces Cavotec’s strong positioning within the rapidly expanding EV infrastructure sector and also highlights its commitment to supporting Europe’s transition to sustainable transportation. By supplying advanced cable reels tailored for reliable and scalable EV charging, Cavotec is strengthening its relevance in green energy networks and boosting its market influence across environmentally progressive regions

- In July 2024, Cavotec SA launched a new manufacturing facility in India to expand its production capacity for industrial reels and shore power solutions. This development enhances the company’s operational efficiency and regional responsiveness, particularly across South Asia and the Middle East. The facility is strategically positioned to meet rising demand in industrial, maritime, and port sectors, while also reducing lead times and production costs. This move significantly strengthens Cavotec’s market presence in emerging economies by anchoring its supply chain closer to key growth regions

- In November 2022, United Equipment Accessories, Inc. acquired American Reeling Devices, Inc., a well-established manufacturer of heavy-duty hose, cord, and cable reels. This strategic acquisition enables United Equipment Accessories to diversify its product offerings and tap into new customer segments across industries such as construction, utilities, and industrial equipment. By integrating American Reeling Devices’ product expertise and customer base, United Equipment Accessories enhanced its competitive positioning in the North American market and solidified its ability to deliver complete, high-performance reel solutions with superior after-sales support

- In November 2024, Cavotec Hong Kong Limited, a subsidiary of Cavotec SA, formed a strategic cooperation agreement with Shanghai Zhenhua Heavy Industries Company Limited to advance global port infrastructure solutions. This collaboration centers on leveraging Cavotec’s motorized cable reel technology to drive automation and electrification in crane and cargo handling systems. The partnership is expected to boost Cavotec’s market share in the port automation space by enabling ports worldwide to improve energy efficiency, reduce environmental impact, and modernize operations in line with smart port initiatives

- In March 2023, Hanny Reels Inc. introduced the MS-1000 Spray Series, a compact and lightweight manual reel tailored for pressure washing, washdown, and spray-related applications. Designed with a smaller crank handle and internal mounting holes, the product offers an optimized footprint ideal for tight and confined workspaces. This launch marks a strategic expansion of Hanny Reels’ product line, enhancing its appeal to commercial and industrial users seeking ergonomic, space-efficient, and user-friendly reel solutions. It also positions the company to capture greater market share in the maintenance and cleaning equipment segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Reels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Reels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Reels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.