Global Industrial Safety Market

Market Size in USD Billion

CAGR :

%

USD

5.37 Billion

USD

9.87 Billion

2025

2033

USD

5.37 Billion

USD

9.87 Billion

2025

2033

| 2026 –2033 | |

| USD 5.37 Billion | |

| USD 9.87 Billion | |

|

|

|

|

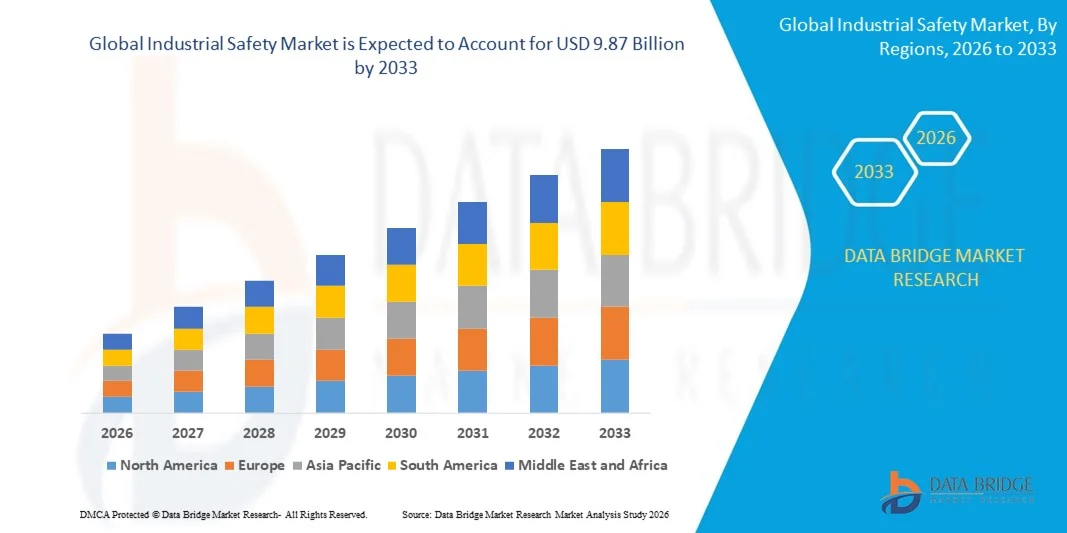

What is the Global Industrial Safety Market Size and Growth Rate?

- The global industrial safety market size was valued at USD 5.37 billion in 2025 and is expected to reach USD 9.87 billion by 2033, at a CAGR of7.90% during the forecast period

- Rising number of industries that are making industrial safety a vital part of their employee policies is a crucial factor accelerating the market growth, also rising demand for the safety systems in the oil and gas industry, rising rapid technological advancement producing reliable safety equipments, rising urbanization all over the globe, rising industrialization in some parts of the world and rising growth in the utilization of IoT in myriad industries among developing countries, are the major factors among others boosting the industrial safety market

What are the Major Takeaways of Industrial Safety Market?

- Rising research and development activities in the market, rising acceptance of workplace safety standards in emerging economies and rising usage of industrial internet of things will further create new opportunities for industrial safety market in the forecast period mentioned above

- However, increasing investments required for automation and installing industrial safety systems and rising lack of awareness and complexity of standards are the major factors among others restraining the market growth, while rising supply chain disruptions due to lockdown and social distancing norms and increasing failure to access all machinery-related risks will further challenge the industrial safety market

- North America dominated the Industrial Safety market with a 37.5% revenue share in 2025, driven by stringent safety regulations, high adoption of automation, and extensive deployment of industrial safety systems across chemical, oil & gas, power generation, and manufacturing sectors in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.32% from 2026 to 2033, fueled by rapid industrialization, smart manufacturing adoption, and expanding chemical, oil & gas, and power generation sectors in China, Japan, India, South Korea, and Southeast Asia

- The Emergency Shutdown Systems segment dominated the market with a 41.6% share in 2025, as these systems are critical for immediate risk mitigation in high-hazard industrial environments

Report Scope and Industrial Safety Market Segmentation

|

Attributes |

Industrial Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Safety Market?

Increasing Shift Toward Smart, Connected, and Digitally Integrated Industrial Safety Solutions

- The industrial safety market is witnessing growing adoption of smart safety systems integrated with IoT, AI, and real-time monitoring to enhance workplace hazard detection and prevention

- Manufacturers are introducing digitally enabled safety equipment, including connected sensors, intelligent safety controllers, and software-driven safety platforms for predictive risk management

- Rising demand for compact, modular, and easily deployable safety solutions is driving adoption across manufacturing plants, oil & gas facilities, power generation sites, and industrial automation environments

- For instance, companies such as Siemens, ABB, Schneider Electric, Honeywell, and Rockwell Automation are expanding portfolios with safety PLCs, functional safety software, and cloud-connected safety architectures

- Increasing focus on data-driven safety management, remote diagnostics, and real-time compliance monitoring is accelerating the shift toward digitally integrated industrial safety ecosystems

- As industrial operations become more automated and complex, Industrial Safety solutions remain critical for ensuring regulatory compliance, operational continuity, and workforce protection

What are the Key Drivers of Industrial Safety Market?

- Rising emphasis on worker safety, regulatory compliance, and accident prevention across high-risk industrial environments

- For instance, in 2024–2025, leading industrial automation companies launched advanced safety controllers, smart PPE, and functional safety systems to meet evolving global safety standards

- Growing adoption of industrial automation, robotics, and smart factories is increasing demand for integrated safety solutions across the U.S., Europe, and Asia-Pacific

- Advancements in sensor technology, safety analytics, machine vision, and AI-based monitoring have enhanced hazard detection accuracy and response time

- Increasing use of collaborative robots, high-speed machinery, and complex production lines is driving demand for multi-layered industrial safety systems

- Supported by continuous investments in Industry 4.0, infrastructure development, and occupational safety programs, the Industrial Safety market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Industrial Safety Market?

- High costs associated with advanced safety systems, functional safety certifications, and system integration limit adoption among small and medium-sized enterprises

- For instance, during 2024–2025, rising costs of industrial components, sensors, and compliance-related upgrades increased total ownership costs for safety infrastructure

- Complexity in integrating safety systems with legacy equipment and existing industrial control architectures creates operational challenges

- Limited awareness in emerging economies regarding international safety standards, functional safety practices, and digital safety technologies slows market penetration

- Presence of cost-sensitive local manufacturers and price competition affects margins for premium safety solution providers

- To overcome these challenges, companies are focusing on modular designs, scalable safety platforms, training programs, and software-driven solutions to expand global adoption of Industrial Safety systems

How is the Industrial Safety Market Segmented?

The market is segmented on the basis of product, component, and industry.

- By Product

On the basis of product, the Industrial Safety market is segmented into Emergency Shutdown Systems (ESD), Fire & Gas Monitoring Systems, High Integrity Pressure Protection Systems (HIPPS), and Others. The Emergency Shutdown Systems segment dominated the market with a 41.6% share in 2025, as these systems are critical for immediate risk mitigation in high-hazard industrial environments. ESD systems are widely deployed across oil & gas, chemicals, and power generation facilities to automatically shut down operations during abnormal conditions, preventing catastrophic accidents. Their reliability, regulatory necessity, and integration with distributed control systems support strong adoption.

The Fire & Gas Monitoring Systems segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing emphasis on real-time hazard detection, worker safety, and regulatory compliance. Advancements in gas sensors, flame detection technologies, and AI-enabled monitoring platforms are accelerating deployment across refineries, offshore platforms, and industrial plants. Growing investments in smart safety infrastructure further support long-term market growth.

- By Component

On the basis of component, the Industrial Safety market is segmented into Safety Sensors, Programmable Safety Systems, Safety Controllers/Modules/Relays, and Others. The Safety Controllers/Modules/Relays segment dominated the market with a 38.9% share in 2025, owing to their central role in executing safety logic, managing emergency responses, and ensuring compliance with functional safety standards such as IEC 61508 and ISO 13849. These components are extensively used in automated production lines, process industries, and machinery safety applications due to their robustness, flexibility, and scalability.

The Safety Sensors segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising deployment of gas sensors, pressure sensors, temperature sensors, and motion detection systems. Increasing adoption of IoT-enabled and wireless safety sensors enhances real-time monitoring and predictive safety maintenance. Continuous innovation in sensor accuracy, durability, and connectivity is strengthening their role in next-generation industrial safety systems.

- By Industry

On the basis of industry, the Industrial Safety market is segmented into Chemicals, Oil & Gas, Power Generation, and Others. The Oil & Gas segment dominated the market with a 44.3% share in 2025, driven by the inherently high-risk nature of upstream, midstream, and downstream operations. Strict safety regulations, high accident prevention requirements, and continuous investments in safety automation drive extensive deployment of shutdown systems, fire & gas monitoring, and pressure protection solutions across refineries and offshore facilities.

The Chemicals segment is expected to register the fastest CAGR from 2026 to 2033, propelled by increasing chemical production capacity, rising adoption of process automation, and stringent environmental and safety regulations. Growing focus on functional safety compliance, hazardous material handling, and digital safety management systems is accelerating adoption. Expansion of specialty chemicals and pharmaceutical manufacturing further strengthens demand for advanced industrial safety solutions.

Which Region Holds the Largest Share of the Industrial Safety Market?

- North America dominated the Industrial Safety market with a 37.5% revenue share in 2025, driven by stringent safety regulations, high adoption of automation, and extensive deployment of industrial safety systems across chemical, oil & gas, power generation, and manufacturing sectors in the U.S. and Canada. Rising investments in IoT-enabled safety monitoring, emergency shutdown systems, and advanced hazard detection solutions continue to fuel demand for Industrial Safety systems across industrial plants, refineries, and high-risk process facilities

- Leading companies in North America are launching integrated safety solutions with advanced sensor technology, AI-enabled monitoring, and remote diagnostics capabilities, reinforcing the region’s technological leadership. Continuous government initiatives, industrial automation growth, and skilled workforce availability support long-term market expansion

- High concentration of safety technology providers, regulatory compliance mandates, and advanced manufacturing ecosystems further strengthen North America’s position as the leading Industrial Safety market

U.S. Industrial Safety Market Insight

The U.S. is the largest contributor in North America, driven by strong industrial automation adoption, government safety regulations, and extensive deployment of emergency shutdown systems, fire & gas monitoring, and pressure protection systems across chemicals, oil & gas, and power generation industries. Rising industrial digitization, AI-enabled monitoring, and IoT-based hazard detection intensify demand for Industrial Safety systems capable of real-time monitoring and predictive risk prevention. Presence of leading safety system vendors, advanced R&D centers, and high awareness of functional safety standards further fuel market growth.

Canada Industrial Safety Market Insight

Canada significantly contributes to regional growth due to increasing investments in energy, chemicals, and manufacturing sectors. Industrial Safety systems are extensively used in plants, refineries, and critical infrastructure for real-time hazard detection and regulatory compliance. Government-backed safety programs, skilled workforce availability, and growing adoption of automation technologies strengthen Industrial Safety market penetration across the country. Rising focus on smart industrial safety solutions and predictive maintenance further supports growth.

Asia-Pacific Industrial Safety Market

Asia-Pacific is projected to register the fastest CAGR of 7.32% from 2026 to 2033, fueled by rapid industrialization, smart manufacturing adoption, and expanding chemical, oil & gas, and power generation sectors in China, Japan, India, South Korea, and Southeast Asia. High-volume production facilities, process automation, and stringent safety regulations drive demand for real-time hazard monitoring, emergency shutdown systems, and AI-enabled safety solutions. Growth in IoT adoption, industrial automation, and digital safety management systems continues to accelerate market expansion.

China Industrial Safety Market Insight

China is the largest contributor to Asia-Pacific, supported by massive industrial expansion, government safety mandates, and significant investments in automation and digital safety solutions. Industrial Safety adoption is driven by high-risk process industries, advanced chemical production, and oil & gas operations requiring emergency shutdown, fire & gas monitoring, and high-integrity safety systems. Competitive local manufacturing and government incentives further strengthen domestic and export market penetration.

Japan Industrial Safety Market Insight

Japan shows steady growth supported by high-quality manufacturing infrastructure, regulatory compliance requirements, and continuous modernization of industrial safety systems. Increasing adoption of automated chemical plants, oil & gas facilities, and smart manufacturing drives demand for advanced Industrial Safety systems. Focus on precision, reliability, and low-latency monitoring reinforces long-term market expansion.

India Industrial Safety Market Insight

India is emerging as a major growth hub, driven by expanding chemical, oil & gas, and power generation sectors, rising startup activity, and government-backed safety initiatives. Growing demand for emergency shutdown systems, fire & gas monitoring, and programmable safety systems fuels adoption of Industrial Safety technologies in industrial plants and refineries. Increasing industrial automation, R&D investments, and safety awareness accelerate market penetration.

South Korea Industrial Safety Market Insight

South Korea contributes significantly due to rising adoption of automated manufacturing, high-performance chemical plants, and smart energy infrastructure. Industrial Safety systems with advanced sensors, real-time monitoring, and AI-enabled hazard detection are increasingly deployed across process industries. Strong industrial technology development, skilled workforce, and growing focus on regulatory compliance support sustained market growth.

Which are the Top Companies in Industrial Safety Market?

The industrial safety industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- ABB (Switzerland)

- Schneider Electric (France)

- GENERAL ELECTRIC (U.S.)

- Yokogawa India Ltd. (Japan)

- HIMA (Germany)

- OMRON Corporation (Japan)

- Siemens (Germany)

- Ingenious Simplicity (India)

- Johnson Controls (Ireland)

- Balluff Automation India Pvt. Ltd. (Germany)

- EUCHNER GmbH + Co. KG (Germany)

- Fortress Interlocks (U.K.)

- 3M (U.S.)

- Tusker Industrial Safety (India)

- W.W. Grainger, Inc. (U.S.)

- Ceasefire Industries Pvt. Ltd. (India)

- DuPont (U.S.)

What are the Recent Developments in Global Industrial Safety Market?

- In June 2024, Sick introduced a new sensor specifically designed for harsh industrial environments, enhancing machinery reliability, durability, and consistency, while reducing maintenance needs and preventing costly operational disruptions. This sensor is aimed at manufacturers and system integrators frequently dealing with component failures, highlighting Sick’s commitment to industrial safety solutions

- In February 2024, Schneider Electric (France) announced the acquisition of Itron, Inc., a leading smart grid and metering solutions provider, strengthening Schneider Electric’s capabilities in industrial automation and control systems crucial for improving industrial safety. This strategic acquisition expands their portfolio in intelligent safety and monitoring solutions

- In January 2024, Schneider Electric (France) launched EcoStruxure for Mining, a comprehensive suite of integrated solutions focused on enhancing safety and productivity in mining operations, including tools for asset management, process optimization, and worker protection. This launch reinforces Schneider Electric’s leadership in industrial safety technology

- In November 2023, ABB (Switzerland) launched the ABB Ability Smart Sensor for Hazardous Areas, a wireless gas detector designed for demanding industrial environments, streamlining installation and maintenance while enhancing worker safety. This innovation demonstrates ABB’s focus on practical safety solutions for high-risk industries

- In April 2022, Rockwell Automation (U.S.) introduced its Allen-Bradley Armor PowerFlex AC variable frequency drives for industrial motor control applications, featuring integrated CIP safety and support for hardwired or integrated safe-torque-off (STO) and safe-stop-1 (SS1) functions. This launch emphasizes Rockwell’s commitment to enhancing industrial safety in motor control operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Safety Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Safety Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Safety Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.