Global Industrial Salts Market

Market Size in USD Billion

CAGR :

%

USD

17.52 Billion

USD

26.89 Billion

2024

2032

USD

17.52 Billion

USD

26.89 Billion

2024

2032

| 2025 –2032 | |

| USD 17.52 Billion | |

| USD 26.89 Billion | |

|

|

|

|

What is the Global Industrial Salts Market Size and Growth Rate?

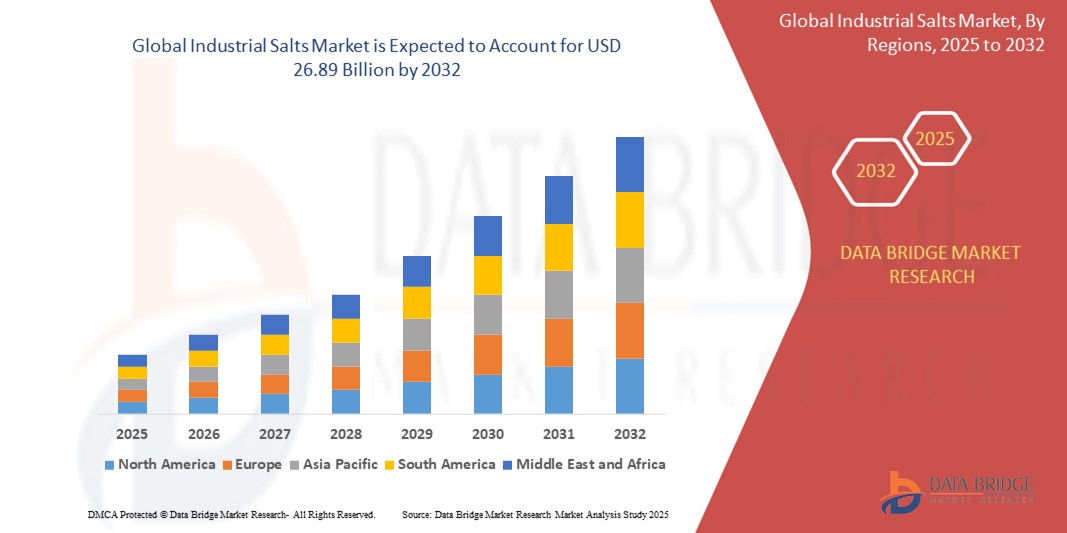

- The global industrial salts market size was valued at USD 17.52 billion in 2024 and is expected to reach USD 26.89 billion by 2032, at a CAGR of 5.50% during the forecast period

- The industrial salts market is experiencing significant advancements and growth driven by innovative uses and the latest technologies. Key sectors such as chemical processing, water treatment, and pharmaceuticals are leveraging refined production methods to meet increasing demands. This growth is propelled by the versatility of industrial salts in diverse applications, promising enhanced efficiency and sustainability in industrial processes worldwide

What are the Major Takeaways of Industrial Salts Market?

- The chemical industry drives significant demand for industrial salts such as sodium chloride (NaCl), crucial in manufacturing chlorine and caustic soda. These chemicals are fundamental in various industrial processes, from water treatment to pharmaceuticals and food processing

- For instance, chlorine is essential for producing PVC, while caustic soda is pivotal in soap and detergent manufacturing. This dependency underscores industrial salts' indispensable role in sustaining chemical production and overall market growth

- Asia-Pacific dominated the industrial salts market with the largest revenue share of 52.36% in 2024, driven by strong demand from industries such as chemical processing, water treatment, agriculture, and de-icing, alongside the region’s growing industrialization and infrastructure development

- North America industrial salts market is projected to grow at the fastest CAGR of 13.68% from 2025 to 2032, driven by expanding applications in de-icing, chemical processing, water treatment, food processing, and oil & gas industries across the U.S., Canada, and Mexico

- The Brine segment dominated the industrial salts market with the largest market revenue share of 62.4% in 2024, driven by the cost-effectiveness, scalability, and environmental advantages of extracting salt from brine sources, especially for large-scale industrial applications

Report Scope and Industrial Salts Market Segmentation

|

Attributes |

Industrial Salts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Salts Market?

“Sustainability-Driven Adoption of Eco-Friendly De-Icing and Water Treatment Solutions”

- A significant and accelerating trend in the global industrial salts market is the growing focus on sustainable de-icing, water treatment, and chemical processing applications, driven by environmental concerns, regulatory pressures, and infrastructure development

- For instance, major companies are increasingly offering eco-friendly de-icing salts that minimize soil and water contamination, catering to the transportation sector's demand for safer, low-environmental-impact road maintenance solutions

- Industrial Salts, particularly sodium chloride and magnesium chloride, are gaining importance in water treatment processes, where they help in softening water and regenerating ion exchange systems, supporting industries and municipalities with clean water management

- In addition, industrial salts play a crucial role in chemical manufacturing, such as chlor-alkali production, where their demand is rising alongside increased output of essential chemicals such as caustic soda and chlorine, which are vital for sectors such as textiles, paper, and plastics

- Companies such as Compass Minerals and Cargill, Incorporated are investing in sustainable salt mining and processing technologies to meet market demands while reducing ecological footprints

- The push for environmentally friendly, high-purity Industrial Salts across de-icing, water treatment, and chemical manufacturing is reshaping the market, creating new growth avenues aligned with global sustainability goals

What are the Key Drivers of Industrial Salts Market?

- The rising demand for industrial salts in de-icing and road safety applications, especially in regions with extreme winters, is a key market growth driver, with governments emphasizing road safety and infrastructure resilience

- For instance, in February 2024, K+S Aktiengesellschaft expanded its de-icing salt production to address increasing demand for winter road safety solutions across Europe and North America, reflecting the market's response to changing weather patterns

- Growing water scarcity and the need for efficient water treatment in industrial and municipal sectors are propelling the use of industrial salts, particularly in water softening and disinfection processes

- The expansion of chemical industries, driven by demand for PVC, detergents, and other essential products, fuels the consumption of Industrial Salts in chlor-alkali processes, supporting market growth

- The versatility, cost-effectiveness, and widespread availability of industrial salts, combined with regulatory support for infrastructure maintenance and clean water initiatives, continue to accelerate market demand globally

Which Factor is challenging the Growth of the Industrial Salts Market?

- Environmental concerns over the excessive use of de-icing salts, leading to soil degradation, water contamination, and damage to roadside vegetation, present a key challenge for the market

- For instance, regulatory bodies in North America and Europe are increasingly scrutinizing the environmental impacts of road salt usage, driving the need for innovative, less harmful alternatives

- Fluctuations in raw material availability and transportation costs, particularly during severe weather events or geopolitical tensions, can disrupt Industrial Salts supply chains and pricing stability

- In addition, health concerns associated with excessive sodium exposure in certain industrial processes require careful handling, regulatory compliance, and investment in safer application practices

- To address these challenges, manufacturers are developing alternative de-icing solutions, optimizing salt usage through advanced spreading technologies, and investing in sustainable mining practices to ensure long-term, responsible market growth

How is the Industrial Salts Market Segmented?

The market is segmented on the basis of source, product, application, and manufacturing process.

• By Source

On the basis of source, the industrial salts market is segmented into Brine and Salt Mines. The Brine segment dominated the industrial salts market with the largest market revenue share of 62.4% in 2024, driven by the cost-effectiveness, scalability, and environmental advantages of extracting salt from brine sources, especially for large-scale industrial applications. Brine-derived salts are extensively used in chemical processing and water treatment due to their high purity and efficient extraction processes.

The Salt Mines segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising global demand for rock salt in de-icing, food processing, and oil & gas applications. Salt mining provides a reliable supply of bulk industrial salts, particularly in regions with rich geological reserves.

• By Product

On the basis of product, the industrial salts market is segmented into Rock Salt, Salt in Brine, Solar Salt, and Vacuum Pan Salt. The Rock Salt segment accounted for the largest market revenue share of 44.1% in 2024, attributed to its widespread use in de-icing, water treatment, and chemical manufacturing. Rock salt's affordability, easy transportation, and high availability make it a preferred option for bulk industrial applications, particularly in regions with harsh winters.

The Solar Salt segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the increasing emphasis on sustainable, renewable production methods. Solar salt, produced through natural evaporation processes, aligns with environmental goals and is gaining traction across food processing, pharmaceuticals, and specialty chemical industries.

• By Application

On the basis of application, the industrial salts market is segmented into Chemical Processing, Water Treatment, De-icing, Agriculture, Food Processing, Oil and Gas, and Other Applications. The Chemical Processing segment dominated the Industrial Salts market with the largest market revenue share of 36.7% in 2024, owing to its critical role in chlor-alkali production, which supplies essential chemicals such as chlorine, caustic soda, and soda ash for diverse industries including paper, textiles, and construction.

The Water Treatment segment is projected to register the fastest CAGR from 2025 to 2032, fueled by rising global demand for clean, safe water, stricter water quality regulations, and growing applications of salts in softening, disinfection, and wastewater management across industrial and municipal sectors.

• By Manufacturing Process

On the basis of manufacturing process, the industrial salts market is segmented into Solar Evaporation, Vacuum Evaporation, and Conventional Mining. The Solar Evaporation segment held the largest market revenue share of 51.3% in 2024, driven by its eco-friendly, cost-efficient, and scalable production method that relies on natural resources such as sunlight and seawater. Solar evaporation is a preferred process in regions with favorable climatic conditions, contributing significantly to global salt supply.

The Vacuum Evaporation segment is expected to experience the fastest growth during the forecast period, supported by its ability to produce high-purity, specialty salts required for pharmaceutical, food-grade, and advanced industrial applications. The precise control and efficiency of this method make it ideal for meeting the stringent quality standards of premium markets.

Which Region Holds the Largest Share of the Industrial Salts Market?

- Asia-Pacific dominated the industrial salts market with the largest revenue share of 52.36% in 2024, driven by strong demand from industries such as chemical processing, water treatment, agriculture, and de-icing, alongside the region’s growing industrialization and infrastructure development. Countries such as China, India, and Japan are major contributors, benefiting from abundant salt reserves and large-scale production facilities

- The rising need for chlor-alkali chemicals, along with expanding applications of Industrial Salts in food processing, pharmaceuticals, and oil & gas industries, further accelerates the region's growth

- In addition, the presence of favorable climatic conditions for solar evaporation, combined with low-cost labor and supportive government policies, continues to enhance the market's dominance across Asia-Pacific

China Industrial Salts Market Insight

The China industrial salts market accounted for the largest revenue share within Asia-Pacific in 2024, supported by vast natural reserves, high-volume salt production, and rising demand across chemical, water treatment, and food industries. Expanding exports, infrastructure growth, and technological advancements continue to drive market expansion in the country.

India Industrial Salts Market Insight

The India industrial salts market is witnessing significant growth, driven by increasing agricultural activities, rising demand for water treatment chemicals, and expansion of the pharmaceutical and chemical industries. The country’s abundant salt resources, especially in coastal regions such as Gujarat, and supportive government policies are key growth contributors.

Which Region is the Fastest Growing Region in the Industrial Salts Market?

North America industrial salts market is projected to grow at the fastest CAGR of 13.68% from 2025 to 2032, driven by expanding applications in de-icing, chemical processing, water treatment, food processing, and oil & gas industries across the U.S., Canada, and Mexico. The region’s advanced industrial infrastructure, coupled with harsh winter conditions in parts of North America, sustains high demand for de-icing salts, while increasing investments in water treatment and clean technologies are accelerating overall market growth.

U.S. Industrial Salts Market Insight

The U.S. industrial salts market leads North America, supported by consistent demand for de-icing salts, chemical manufacturing, food processing, and water treatment. Severe winter conditions in many states drive de-icing salt consumption, while technological innovations and regulatory emphasis on clean water and safety are fueling rapid growth across other applications.

Canada Industrial Salts Market Insight

The Canada industrial salts market is experiencing robust growth, driven by extensive use of Industrial Salts in de-icing operations, particularly due to harsh winter weather across provinces. In addition, rising demand in chemical processing, agriculture, and water treatment is boosting the market. Canada's focus on sustainable resource management and domestic salt production, especially from salt mines and solar evaporation sources, further supports market expansion.

Mexico Industrial Salts Market Insight

The Mexico industrial salts market is growing steadily, supported by the country’s role as a significant global producer of solar salt, especially from coastal regions such as Baja California. Industrial Salts in Mexico are widely used across chemical processing, agriculture, and food industries, with increasing investments in water treatment and manufacturing further propelling growth. The country's favorable climate for solar salt production and proximity to key export markets position it as a competitive player in the global industrial salts industry.

Which are the Top Companies in Industrial Salts Market?

The industrial salts industry is primarily led by well-established companies, including:

- Compass Minerals (U.S.)

- Cargill, Incorporated (U.S.)

- ACIL (India)

- Tata Chemicals Ltd. (India)

- K+S Aktiengesellschaft (Germany)

- Morton Salt, Inc. (U.S.)

- Nahta Salt & Chemicals Pvt Ltd (India)

- Ahir Salt Industries (India)

- Satyesh Brinechem (India)

- Amra Salt Factory (India)

- MITSUI & CO., LTD. (Japan)

- Rio Tinto (U.K.)

- SKC Salt (India)

- Kutch Brine Chem Industries (India)

- Dev Salt Pvt. Ltd. (India)

- Donald Brown Group (U.S.)

- EUsalt c/o KELLEN (Belgium)

What are the Recent Developments in Global Industrial Salts Market?

- In July 2022, Compass Minerals reported a significant increase, selling approximately 4.8 million tons of highway anti-icing products across Canada, the U.S., and the United Kingdom. This growth reflects robust demand for their highway maintenance solutions in multiple markets

- In January 2021, Tata Chemicals Ltd. is currently negotiating the acquisition of Archean's Group salt unit. This potential acquisition aims to expand Tata Chemicals' portfolio in minerals, alkali products, and other chemical-based offerings

- In January 2021, Tata Chemicals Ltd announced plans to acquire Archean Group's industrial salt unit. This strategic move aimed to bolster Tata Chemicals' business by integrating a facility with an annual production capacity of 3 million tons. The acquisition was poised to strengthen Tata Chemicals' position in the industrial salt market, fostering potential growth and operational synergy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Salts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Salts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Salts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.