Global Industrial Tapes Market

Market Size in USD Million

CAGR :

%

USD

76.66 Million

USD

126.88 Million

2024

2032

USD

76.66 Million

USD

126.88 Million

2024

2032

| 2025 –2032 | |

| USD 76.66 Million | |

| USD 126.88 Million | |

|

|

|

|

Industrial Tapes Market Size

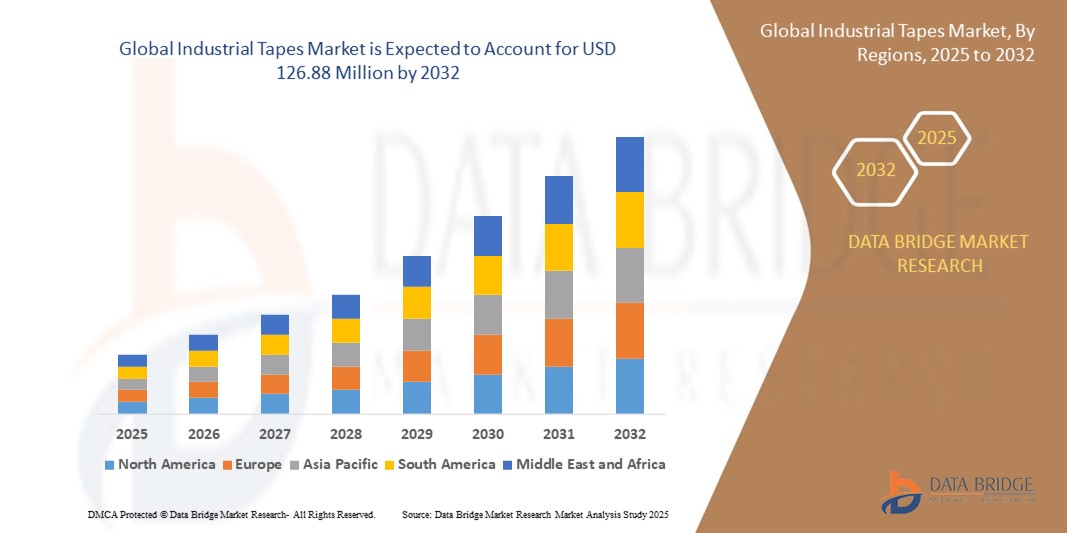

- The global industrial tapes market size was valued at USD 76.66 million in 2024 and is expected to reach USD 126.88 million by 2032, at a CAGR of 6.50% during the forecast period

- Market expansion is primarily driven by the increased usage of industrial tapes in packaging, automotive, electrical, and construction sectors, where high-performance bonding, insulation, and sealing solutions are in demand

- In addition, growing preference for lightweight and durable bonding materials, along with innovations in pressure-sensitive adhesives and environmentally friendly tapes, is accelerating the adoption of industrial tapes worldwide

Industrial Tapes Market Analysis

- Industrial Tapes are essential multifunctional materials used for bonding, sealing, masking, insulating, and surface protection across various industries. Comprising a backing material (such as paper, plastic, or metal) and a pressure-sensitive adhesive, these tapes offer reliable performance in harsh environments, making them integral to construction, automotive, electronics, and packaging applications

- The market's rapid growth is largely driven by increased adoption in industrial packaging, automotive assembly, and electrical insulation applications, along with a growing emphasis on lightweight, high-performance materials. In addition, the demand for eco-friendly, solvent-free, and high-durability tapes is contributing to the transformation of the industrial tapes landscape

- North America is expected to dominate the Industrial Tapes market with the largest revenue share in 2024, fueled by the presence of leading tape manufacturers, technological innovations, and robust growth in automotive and aerospace sectors

- Asia-Pacific is expected to register the fastest growth rate through 2032, driven by the booming construction and electronics industries in China, India, and Southeast Asia, coupled with infrastructure development and rising exports that continue to stimulate demand for durable and versatile tape solutions

- The filament tapes segment is expected to hold the largest market share in 2024, driven by its exceptional tensile strength and growing usage in bundling and palletizing applications across the logistics and construction sectors

Report Scope and Industrial Tapes Market Segmentation

|

Attributes |

Industrial Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Tapes Market Trends

“Rising Demand for High-Performance and Specialized Industrial Tapes”

- A significant and accelerating trend in the global industrial tapes market is the increasing demand for specialized tapes designed to meet the specific and demanding requirements of various industrial applications. This is driven by technological advancements across industries and the need for tapes with enhanced performance characteristics

- Companies are focusing on developing tapes with superior properties such as high temperature resistance, electrical conductivity, chemical resistance, and adhesion strength.

- For instance, the automotive industry requires tapes for bonding, sealing, and wire harnessing that can withstand extreme conditions, while the electronics sector needs tapes with specific electrical and thermal properties for device assembly

- Advanced material science and adhesive technologies are leading to the development of innovative industrial tapes with tailored functionalities. This includes tapes with controlled release properties, conformable backings for irregular surfaces, and non-residue adhesives for temporary applications

- The trend towards miniaturization in electronics and the use of lightweight materials in automotive are further driving the demand for specialized industrial tapes that can meet these evolving needs. This requires tapes with precise dimensions, excellent bonding capabilities on diverse substrates, and reliable long-term performance

- Consequently, manufacturers are investing in research and development to innovate and introduce new categories of high-performance industrial tapes that can address the specific challenges and requirements of niche applications across sectors such as aerospace, renewable energy, and medical devices

- The demand for industrial tapes offering superior performance, durability, and specialized functionalities is growing rapidly as industries seek reliable solutions for increasingly complex manufacturing processes and product designs

Industrial Tapes Market Dynamics

Driver

“Increasing Adoption of Automation and Robotics in Manufacturing”

- The increasing adoption of automation and robotics across various manufacturing industries globally is a significant driver for the heightened demand for industrial tapes

- Automated production lines and robotic systems often require specialized tapes for a wide range of applications, including component assembly, wire and cable management, surface protection during manufacturing processes, and securing parts for automated handling

- Industrial tapes play a crucial role in enhancing the efficiency and precision of automated manufacturing processes. They are used in temporary fixturing, masking during painting or coating, and joining materials where traditional fastening methods might be less suitable for automated systems

- The growth of industries such as electronics, automotive, and pharmaceuticals, which have high levels of automation, directly contributes to the increased consumption of specialized industrial tapes designed for automated handling and application

- As more companies invest in advanced automation technologies to improve productivity and reduce costs, the demand for industrial tapes that can seamlessly integrate with these automated processes is expected to continue its upward trajectory

Restraint/Challenge

“Intensifying Competition and Price Sensitivity”

- Intensifying competition among a large number of global and regional players in the industrial tapes market poses a considerable challenge to manufacturers

- The market includes well-established multinational corporations as well as numerous smaller, regional manufacturers, leading to a highly competitive landscape. This intense competition often results in price pressures, especially for commodity-grade industrial tapes used in general packaging and sealing applications

- The increasing availability of a wide range of tape products from various suppliers makes buyers more price-sensitive, impacting the profit margins of tape manufacturers. This requires manufacturers to continuously innovate and differentiate their products based on performance, quality, and specialized features rather than just price

- Furthermore, the rise of e-commerce and online marketplaces has increased transparency in pricing, making it easier for customers to compare offerings from different suppliers and choose the most cost-effective options

- To overcome this challenge, industrial tape manufacturers need to focus on developing value-added products, building strong customer relationships, providing technical support, and exploring niche applications where price competition might be less intense

Industrial Tapes Market Scope

The market is segmented on the basis of product type, application, mode of application, tape backing material and end user.

• By Product Type

On the basis of product type, the industrial tapes market is segmented into filament tapes, aluminium tapes, adhesive transfer tapes, duct tapes, and others. The filament tapes segment is anticipated to hold the largest market share in 2024, driven by its exceptional tensile strength and growing usage in bundling and palletizing applications across the logistics and construction sectors.

The aluminium tapes segment is projected to witness rapid growth between 2025 and 2032 due to its superior heat resistance and electrical conductivity, making it highly suitable for HVAC and electrical applications.

• By Application

On the basis of application, the market is segmented into packaging application, specialized application, and others. The packaging application segment dominates the market in 2024, fueled by increasing e-commerce activity and demand for secure, tamper-proof packaging solutions.

The specialized application segment is expected to grow at the fastest CAGR through 2032, driven by niche uses in aerospace, automotive, and electronics industries where high-performance bonding solutions are required.

• By Mode of Application

On the basis of mode of application, the market is categorized into pressure sensitive application, solvent based application, hot melt based application, and acrylic based application. The pressure sensitive application segment held the largest revenue share in 2024, supported by ease of use, clean application, and wide adoption across industries including retail, manufacturing, and healthcare.

The hot melt based application segment is expected to register significant growth through 2032 due to fast bonding speed and superior adhesion to irregular surfaces, especially in packaging and assembly operations.

• By Tape Backing Material

On the basis of tape backing material, the market is segmented into polypropylene, paper, polyvinyl chloride (PVC), and others. The polypropylene segment leads the market in 2024 due to its affordability, flexibility, and growing application in carton sealing and labeling.

The polyvinyl chloride (PVC) segment is projected to grow steadily from 2025 to 2032, driven by demand for durable and water-resistant tapes in electrical insulation and industrial masking tasks.

• By End User

On the basis of end user, the market is segmented into manufacturing industry, automotive industry, construction industry, logistics industry, electrical industry, and others. The manufacturing industry segment holds the largest market share in 2024, propelled by the widespread use of industrial tapes in assembly lines, surface protection, and fastening applications.

The automotive industry is expected to witness the highest growth rate through 2032, with increasing reliance on tapes for lightweight bonding solutions, vibration damping, and component fastening in electric vehicles and hybrid models.

Industrial Tapes Market Regional Analysis

- North America dominates the industrial tapes market with the largest revenue share in 2024, driven by the by the robust packaging industry and the flourishing e-commerce sector in the region

- The convenience and efficiency offered by industrial tapes for various applications contribute to their widespread adoption across diverse industries. The increasing demand for packaged goods and stringent industry standards are driving market growth

U.S. Industrial Tapes Market Insight

The U.S. stands as a major market for industrial tapes within North America. The substantial demand stems from diverse sectors including packaging, manufacturing, electronics, and healthcare. The increasing consumption of goods and the need for tapes in manufacturing processes contribute to the significant market presence of Industrial Tapes in the U.S.

Europe Industrial Tapes Market Insight

The European market for industrial tapes is experiencing consistent growth, propelled by the demand for packaged goods across various consumer and industrial sectors. The need for tapes in packaging, automotive, construction, and electrical applications drives the market in Europe. A focus on sustainability is also influencing material choices in this region.

U.K. Industrial Tapes Market Insight

The U.K. industrial tapes market is witnessing steady expansion, supported by the growth of the retail industry and the increasing prevalence of e-commerce activities. The demand for efficient and reliable tapes for packaging, as well as for use in construction and other industrial applications, is a key factor driving market growth in the U.K.

Germany Industrial Tapes Market Insight

Germany presents a substantial market for industrial tapes, owing to its strong manufacturing base across various sectors, including automotive, chemicals, and electronics, alongside a significant consumer goods industry. The need for high-performance and durable tapes for both industrial and consumer products, with an increasing emphasis on specialized tapes for automotive and electronics, fuels the German market.

Asia-Pacific Industrial Tapes Market Insight

Asia-Pacific region is expected to witness the highest growth rate in the global industrial tapes market. This growth is primarily attributed to the increasing manufacturing activities in countries such as China and India, along with the expansion of the food and beverage and consumer goods sectors. The rising demand for packaged products and the need for tapes in various manufacturing processes are key drivers in this region.

Japan Industrial Tapes Market Insight

The Japanese market for industrial tapes is characterized by a strong emphasis on high-quality and technologically advanced tape solutions. The demand from sectors such as electronics, automotive, and healthcare, which require precise and reliable tapes for product assembly and specialized applications, contributes to the growth of the industrial tapes market in Japan.

China Industrial Tapes Market Insight

China represents the largest market for industrial tapes in the Asia-Pacific region. The country's vast manufacturing industry, coupled with a burgeoning consumer goods sector, generates significant demand for various types of industrial tapes used for packaging, product assembly, and electrical applications across numerous industries. The continuous growth in both domestic consumption and export activities further propels the Chinese industrial tapes market.

Industrial Tapes Market Share

The Industrial Tapes industry is primarily led by well-established companies, including:

- Dow (U.S.)

- 3M (U.S.)

- Henkel AG (Germany)

- Eastman Chemical Company or its subsidiaries (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Ashland (U.S.)

- H.B. Fuller Company (U.S.)

- Von Roll Holding AG (Germany)

- tesa Tapes (India) Private Limited (India)

- Intertape Polymer Group (Canada)

- Muparo AG (Switzerland)

- PPM Industries, Inc. (U.K.)

- Adhesive Applications (U.S.)

- Berry Global Inc. (U.S.)

- Merck KGaA (Germany)

- Microseal Industries Inc. (U.S.)

- Essentra Specialty Tapes (U.S.)

- FLEXcon Company Inc. (U.S.)

- Lamart Corp (U.S.)

- Shurtape Technologies, LLC (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- Necal Corporation (U.S.)

Latest Developments in Global Industrial Tapes Market

- In May 2025, IPG, a prominent provider of high-performance tapes and films, announced the launch of its Polyethylene Surface Protection Film Tape (PESP). This innovative low-tack, clean-removal PE tape is engineered to protect a wide range of smooth and textured surfaces across multiple industries. This launch marks IPG’s continued focus on versatile and application-specific protective tape solutions

- In February 2025, Nautic Partners, LLC, in collaboration with management, finalized the acquisition of the Specialty Tapes business from Berry Global Group, Inc., and introduced it as the newly branded company, Vybond. As an independent entity, Vybond aims to strengthen its leadership in pressure-sensitive adhesive tape solutions for industrial and specialty markets globally. This strategic move positions Vybond for rapid innovation and market expansion

- In April 2021, Dow, a global materials science leader, and Mura Technology, a pioneer in plastic recycling technologies, announced a strategic collaboration to combat plastic pollution. The partnership is designed to support scalable, circular recycling systems to keep plastic waste out of the environment. This initiative emphasizes both companies’ commitment to sustainability and closed-loop recycling

- In August 2021, Ajit Industries Private Limited (AIPL), a leading industrial tape manufacturer in India, introduced India’s first eco-friendly green tapes. These tapes are designed to support sustainable packaging initiatives and reduce environmental impact. The launch highlights AIPL’s leadership in eco-conscious tape manufacturing in the Indian market

- In January 2021, Irplast unveiled its Eco+ tape, a sustainable adhesive tape that cuts CO₂ emissions by 18% compared to standard alternatives (excluding inks and coatings). The tape consists of 34% post-industrial recycled BOPP film from Irplast. Eco+ represents a major step in Irplast’s effort to develop environmentally friendly packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.