Global Industrial Tugger Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

1.46 Billion

2025

2033

USD

1.00 Billion

USD

1.46 Billion

2025

2033

| 2026 –2033 | |

| USD 1.00 Billion | |

| USD 1.46 Billion | |

|

|

|

|

Industrial Tugger Market Size

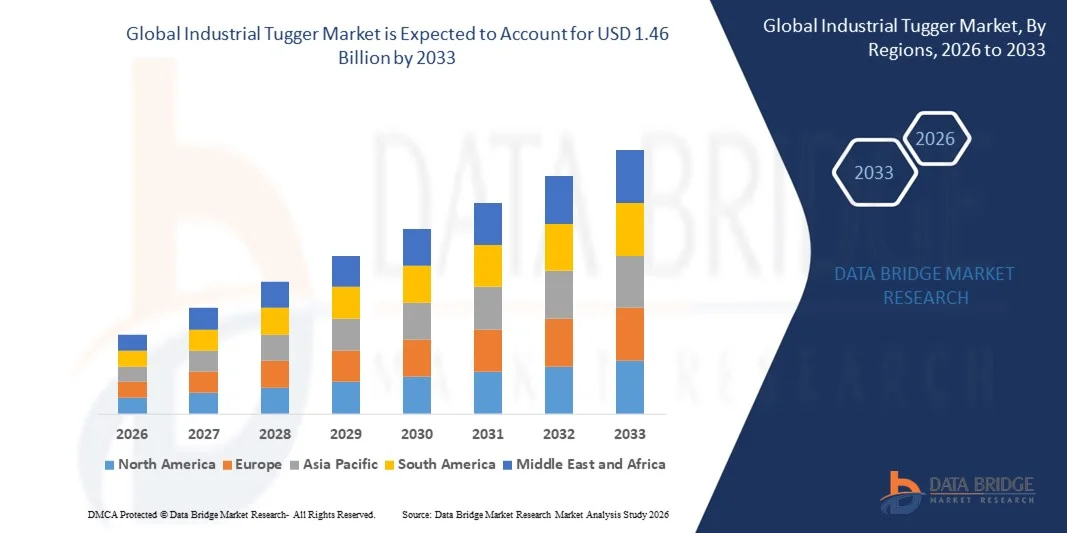

- The global industrial tugger market size was valued at USD 1.00 billion in 2025 and is expected to reach USD 1.46 billion by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and technological advancements within material handling and logistics operations, driving efficiency improvements in warehouses, manufacturing plants, and distribution centers

- Furthermore, rising demand for energy-efficient, safe, and flexible towing solutions in industrial environments is establishing electric and autonomous tuggers as preferred tools for internal transport. These converging factors are accelerating the uptake of industrial tugger solutions, thereby significantly boosting the industry’s growth

Industrial Tugger Market Analysis

- Industrial tuggers, designed to transport heavy loads across warehouses, manufacturing floors, and distribution centers, are increasingly vital for streamlining material movement, reducing manual labor, and improving operational productivity across industrial sectors

- The escalating demand for industrial tuggers is primarily fueled by rapid industrialization, growing e-commerce and logistics operations, and an increasing focus on workforce optimization and automation within material handling processes

- Asia-Pacific dominated the industrial tugger market with a share of 43.7% in 2025, due to rapid industrialization, growing e-commerce and manufacturing sectors, and a strong presence of material handling equipment manufacturers

- North America is expected to be the fastest growing region in the industrial tugger market during the forecast period due to increasing industrial automation, warehouse expansion, and the adoption of electric and hybrid tugger solutions

- Electric tugger segment dominated the market with a market share of 59.1% in 2025, due to its energy efficiency, lower operational costs, and environmentally friendly operation. Electric tuggers are widely adopted in warehouses and manufacturing units due to their quiet operation, low maintenance needs, and ability to navigate tight spaces. They are also increasingly integrated with fleet management systems to enhance productivity and monitoring, further boosting demand. The market sees growing interest in electric tuggers due to sustainability regulations and corporate initiatives to reduce carbon emissions

Report Scope and Industrial Tugger Market Segmentation

|

Attributes |

Industrial Tugger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Industrial Tugger Market Trends

Rising Adoption of Autonomous and Electric Tuggers

- The industrial tugger market is witnessing a significant trend towards the adoption of autonomous and electric tuggers, driven by the need for improved operational efficiency, reduced labor dependency, and energy savings in warehouses, manufacturing plants, and distribution centers

- For instance, in April 2024 Motrec, in partnership with Cyngn, launched a hybrid autonomous electric tugger capable of operating in both manual and autonomous modes, enhancing maneuverability and productivity in confined industrial spaces. Such innovations by key companies are encouraging wider adoption of automated tugger solutions across the industry

- Autonomous tuggers are increasingly integrated with warehouse management systems, enabling features such as route optimization, automated scheduling, and load tracking, thereby improving workflow efficiency and reducing human error

- The growing emphasis on sustainability and energy-efficient operations is pushing industries to replace traditional diesel tuggers with electric alternatives, minimizing carbon emissions and operational costs over time

- Advancements in AI and sensor technology are enhancing the safety and reliability of autonomous tuggers, allowing them to navigate complex industrial environments while avoiding obstacles and ensuring safe interaction with human operators

- The combined effect of operational efficiency, safety improvements, and energy savings is propelling the demand for autonomous and electric tuggers across multiple industrial sectors, establishing them as a preferred solution for modern material handling

Industrial Tugger Market Dynamics

Driver

Increasing Demand for Efficient and Safe Material Handling Solutions

- The rising complexity of industrial operations, coupled with higher production volumes, is increasing the demand for efficient material handling solutions that reduce manual labor and enhance workplace safety

- For instance, Toyota Material Handling has introduced electric tuggers in automotive assembly plants to streamline component movement and minimize the risk of worker injuries. Such deployments are driving market growth as companies prioritize efficiency and safety in logistics operations

- Automated and electric tuggers offer consistent performance, reliable load transport, and reduced downtime, which is highly valued in sectors such as e-commerce, manufacturing, and retail

- The integration of tuggers with smart industrial infrastructure and real-time monitoring systems allows managers to optimize routes, track assets, and maintain operational control, further reinforcing their adoption

- The increasing focus on operational cost reduction, labor optimization, and compliance with workplace safety standards is enhancing the market potential for industrial tuggers and promoting long-term growth

Restraint/Challenge

High Initial Investment and Maintenance Costs

- The high upfront cost of purchasing advanced autonomous and electric tuggers can be a significant barrier for small and medium-sized enterprises with limited budgets

- For instance, deploying a fleet of high-capacity DriveMod tuggers by Cyngn requires substantial capital investment and integration expenses, which may delay adoption in price-sensitive markets

- Maintenance and repair of technologically advanced tuggers, including battery replacement, sensor calibration, and software updates, add to the overall operational expenses and require skilled personnel

- Companies with limited technical expertise may face challenges in integrating autonomous tuggers with existing material handling systems, potentially hindering productivity gains and ROI

- Despite gradual cost reductions and increasing availability of financing options, high initial and ongoing costs remain a critical challenge for widespread industrial adoption, necessitating careful investment planning

Industrial Tugger Market Scope

The market is segmented on the basis of type, load capacity, application, and end use.

- By Type

On the basis of type, the industrial tugger market is segmented into electric tugger, gasoline tugger, diesel tugger, and others. The electric tugger segment dominated the market with the largest revenue share of 59.1% in 2025, driven by its energy efficiency, lower operational costs, and environmentally friendly operation. Electric tuggers are widely adopted in warehouses and manufacturing units due to their quiet operation, low maintenance needs, and ability to navigate tight spaces. They are also increasingly integrated with fleet management systems to enhance productivity and monitoring, further boosting demand. The market sees growing interest in electric tuggers due to sustainability regulations and corporate initiatives to reduce carbon emissions.

The diesel tugger segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in heavy-duty industrial environments requiring higher power and long operational hours. For instance, Toyota Material Handling has expanded its diesel tugger line to cater to large-scale manufacturing and port operations, where endurance and load-handling capacity are critical. Diesel tuggers offer robust performance in outdoor and demanding industrial settings, providing businesses with reliable solutions for heavy loads. Their compatibility with existing fuel infrastructure and ease of refueling contributes to accelerating market growth.

- By Load Capacity

On the basis of load capacity, the industrial tugger market is segmented into up to 5,000 lbs, 5,001–10,000 lbs, and above 10,000 lbs. The 5,001–10,000 lbs segment dominated the market in 2025 due to its versatility for handling moderate loads across warehouses, distribution centers, and manufacturing plants. This capacity range balances maneuverability with operational efficiency, making it a preferred choice for industries managing frequent material movements. Companies often adopt tuggers in this category for their adaptability to different load types and facility layouts, enhancing workflow productivity. Rising demand in logistics and e-commerce sectors for efficient material handling has also reinforced growth for this segment.

The above 10,000 lbs segment is expected to register the fastest CAGR from 2026 to 2033, driven by expanding industrialization and large-scale manufacturing operations requiring high-capacity material handling. For instance, Hyster-Yale Group has introduced high-capacity tuggers suitable for heavy-duty industrial yards and automotive plants, enabling the transport of massive loads safely and efficiently. These tuggers offer reinforced durability, powerful traction, and advanced safety features, making them ideal for large factories and distribution hubs. Their ability to handle oversized loads with minimal labor intervention supports operational efficiency, fueling rapid adoption.

- By Application

On the basis of application, the industrial tugger market is segmented into warehouse, manufacturing plants, distribution centers, and others. The warehouse segment dominated the market in 2025 due to the growing need for streamlined material movement, inventory management, and rapid order fulfillment. Warehouse tuggers facilitate the transportation of goods over short distances with minimal manual labor, reducing time and operational costs. They are compatible with automated storage and retrieval systems, improving workflow efficiency and safety. Increasing e-commerce operations and warehouse expansions continue to drive strong demand for tuggers in this segment.

The distribution centers segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising global logistics and last-mile delivery demands. For instance, DHL Supply Chain has adopted tuggers for high-volume distribution hubs, improving efficiency in loading and unloading processes. Tuggers in distribution centers enable faster movement of pallets and containers, supporting timely dispatches and inventory rotation. Their integration with warehouse management systems enhances tracking and operational control. The growing focus on supply chain optimization ensures accelerated adoption of tuggers in distribution centers.

- By End Use

On the basis of end use, the industrial tugger market is segmented into automotive, e-commerce, retail, food & beverage, pharmaceuticals, and others. The automotive segment dominated the market in 2025 due to the high demand for moving heavy components and assembly line efficiency. Tuggers in automotive plants assist in transporting engines, chassis, and other large parts across production lines, reducing manual labor and minimizing downtime. The compatibility of tuggers with automated systems and just-in-time production models enhances operational effectiveness. Rising vehicle production volumes and plant expansions in emerging economies reinforce strong demand for tuggers in the automotive sector.

The e-commerce segment is expected to witness the fastest growth rate from 2026 to 2033, driven by surging online order volumes and fast fulfillment requirements. For instance, Amazon has increasingly deployed electric tuggers in fulfillment centers to handle pallets and containers efficiently, ensuring rapid order processing. Tuggers facilitate seamless movement of goods in high-density storage setups, enhancing productivity and reducing operational bottlenecks. Their flexibility in adapting to dynamic warehouse layouts supports the scalability of e-commerce operations. Growing consumer demand for faster deliveries continues to drive the adoption of tuggers in the e-commerce sector.

Industrial Tugger Market Regional Analysis

- Asia-Pacific dominated the industrial tugger market with the largest revenue share of 43.7% in 2025, driven by rapid industrialization, growing e-commerce and manufacturing sectors, and a strong presence of material handling equipment manufacturers

- The region’s cost-effective production landscape, increasing adoption of automation in warehouses and distribution centers, and rising infrastructure investments are accelerating market growth

- Availability of skilled labor, supportive government policies, and increasing industrial output across developing economies are contributing to higher consumption of industrial tuggers in automotive, retail, and logistics sectors

China Industrial Tugger Market Insight

China held the largest share in the Asia-Pacific industrial tugger market in 2025, owing to its position as a global manufacturing hub and expanding industrial automation adoption. The country’s strong industrial base, government initiatives supporting smart logistics and material handling, and extensive export capabilities for industrial equipment are key growth drivers. Demand is further strengthened by increasing warehouse automation, growth in e-commerce fulfillment centers, and rising manufacturing output for automotive and electronics sectors.

India Industrial Tugger Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding industrial manufacturing, growth in e-commerce and retail distribution, and rising investment in logistics infrastructure. For instance, Godrej Material Handling has introduced electric tuggers in major warehouses to improve operational efficiency and reduce labor dependency. Government initiatives such as “Make in India” and incentives for industrial automation are further driving demand. Increasing focus on reducing operational costs and improving supply chain efficiency is supporting accelerated market adoption.

Europe Industrial Tugger Market Insight

The Europe industrial tugger market is expanding steadily, supported by stringent safety regulations, high adoption of automation technologies, and growing investments in sustainable industrial equipment. The region emphasizes workplace safety, energy efficiency, and ergonomic solutions in material handling, boosting demand for electric and hybrid tuggers. Rising use of tuggers in automotive assembly lines, distribution centers, and large-scale manufacturing facilities is enhancing market growth.

Germany Industrial Tugger Market Insight

Germany’s industrial tugger market is driven by its advanced manufacturing ecosystem, strong automotive sector, and focus on high-efficiency material handling solutions. The country has extensive R&D capabilities and collaboration between equipment manufacturers and industrial users, fostering innovation in tugger design and performance. Demand is particularly strong in automotive and heavy manufacturing sectors, with tuggers enhancing workflow efficiency, safety, and operational reliability.

U.K. Industrial Tugger Market Insight

The U.K. market is supported by a mature manufacturing and logistics sector, increasing adoption of warehouse automation, and a focus on energy-efficient material handling equipment. For instance, Jungheinrich and other key players have deployed electric tuggers in retail and distribution centers to optimize load movement and reduce labor costs. Growing e-commerce operations, investments in smart warehouses, and rising focus on productivity improvements are sustaining steady market expansion.

North America Industrial Tugger Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing industrial automation, warehouse expansion, and the adoption of electric and hybrid tugger solutions. The region’s focus on improving supply chain efficiency, reducing labor dependency, and integrating smart material handling systems is boosting demand. Rising reshoring of manufacturing operations, growth in e-commerce fulfillment centers, and continuous technological innovation in tugger design are further supporting market expansion.

U.S. Industrial Tugger Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive manufacturing and logistics sectors, strong R&D infrastructure, and significant investment in automation solutions. The country’s emphasis on operational efficiency, workplace safety, and energy-efficient equipment is driving adoption of electric and hybrid tuggers. For instance, Toyota Material Handling and Hyster-Yale have expanded their tugger offerings in the U.S. to cater to warehouse, distribution, and automotive industries, solidifying the country’s leading position in the region.

Industrial Tugger Market Share

The industrial tugger industry is primarily led by well-established companies, including:

- Godrej & Boyce Manufacturing Co. Ltd. (India)

- Crown Equipment Corporation (U.S.)

- Mitsubishi Logisnext Co., Ltd. (Japan)

- KION Group AG (Germany)

- The Raymond Corporation (U.S.)

- Jungheinrich AG (Germany)

- MasterMover, Inc. (U.S.)

- Toyota Material Handling (U.S.)

- Doosan Industrial Vehicle (South Korea)

- Cyngn Inc. (U.S.)

- Hyster‑Yale Materials Handling, Inc. (U.S.)

- CLARK Material Handling Company (U.S.)

- Lift Truck Center, Inc. (U.S.)

- Hangcha Group Co., Ltd. (China)

- Global Equipment Company Inc. (U.S.)

Latest Developments in Global Industrial Tugger Market

- In August 2025 the Cyngn-enabled DriveMod Tugger was fully deployed at Coats Company’s manufacturing facility in Tennessee, automating the movement of materials across production lines and freeing up over 500 labor‑hours. This deployment demonstrated the significant operational efficiency and cost-saving potential of autonomous tuggers, highlighting how manufacturers can optimize workflows while reducing manual labor. The successful implementation reinforced market confidence in autonomous tugger solutions for large-scale industrial operations and encouraged adoption across other heavy-duty manufacturing facilities

- In March 2025 Cyngn signed a contract to deploy DriveMod Tuggers at a global Fortune 500 automotive supplier, expanding its footprint in high-volume, precision-oriented manufacturing environments. This milestone showcased the increasing trust in autonomous tugger technology for critical industrial applications, where timely and safe material handling is essential. The deployment emphasized how industries are embracing automation to improve productivity, minimize human error, and meet growing demand in complex supply chains

- In January 2025 Cyngn began deployments of DriveMod Tuggers with at least five major automotive OEMs and Tier‑1 suppliers across the U.S. and Mexico. These deployments highlighted the scalability and adaptability of autonomous tugger systems across diverse industrial setups, demonstrating their role in streamlining production lines, reducing bottlenecks, and enhancing operational consistency. The wide adoption indicated growing recognition of tuggers as a strategic investment for modern industrial logistics and warehouse management

- In September 2024 the next-generation 12,000 lb DriveMod Tugger was built at Motrec International’s facility, doubling the towing capacity from the original 6,000 lb model. This upgrade significantly expanded the range of applications for autonomous tuggers, enabling them to handle heavier loads in automotive, logistics, and manufacturing sectors. The enhanced capabilities made these tuggers competitive with traditional heavy-duty tow tractors, attracting interest from larger facilities and signaling a new phase of market growth focused on high-capacity industrial automation

- In April 2024 Motrec introduced the first fully autonomous hybrid electric tugger in partnership with Cyngn, based on the MT‑160 model, capable of operating in both manual and autonomous modes with a 6,000 lb towing capacity and tight turning radius. This launch marked a major step in industrial automation, demonstrating how AI-driven tuggers can efficiently operate in confined warehouse and industrial yard environments. The innovative hybrid design and autonomous functionality set a precedent for future developments in material handling, generating strong interest from manufacturers seeking to enhance efficiency and reduce labor dependency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.