Global Industrial Valves And Actuators Market

Market Size in USD Billion

CAGR :

%

USD

85.50 Billion

USD

113.60 Billion

2024

2032

USD

85.50 Billion

USD

113.60 Billion

2024

2032

| 2025 –2032 | |

| USD 85.50 Billion | |

| USD 113.60 Billion | |

|

|

|

|

Industrial Valves and Actuators Market Size

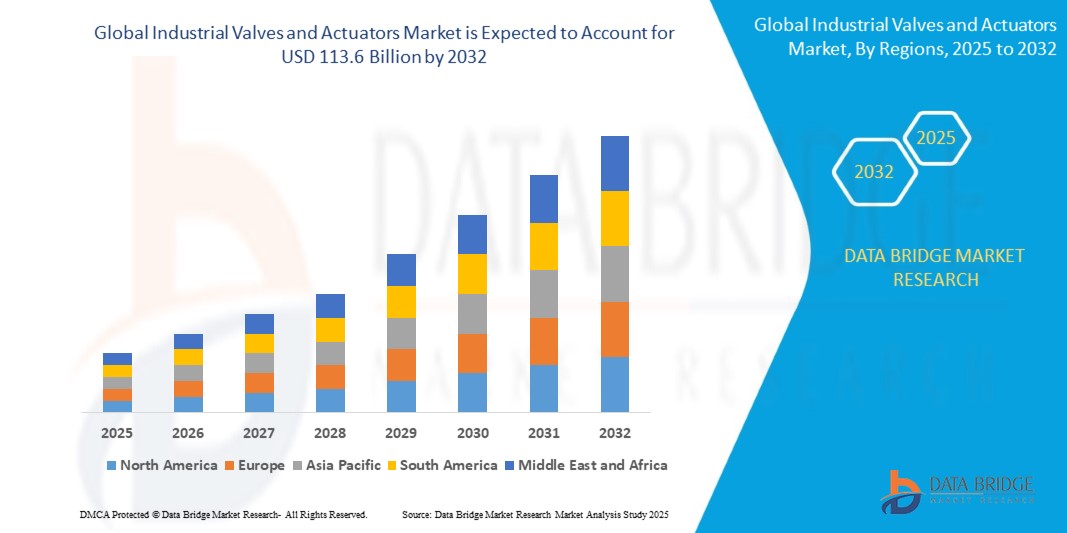

- The Industrial Valves and Actuators Market was valued at USD 85.5 billion in 2024 and is projected to reach USD 113.6 billion by 2032, growing at a CAGR of 4.10% during the forecast period.

- Market expansion is being propelled by the increasing adoption of industrial automation and smart flow control technologies, which enhance safety, reduce operational costs, and improve system efficiency across various industries. Advanced valve actuators, real-time monitoring systems, and integration of IoT and AI are becoming core components of modern fluid management and control strategies in sectors such as oil & gas, water treatment, power, and chemicals.

Industrial Valves and Actuators Market

- The Industrial Valves and Actuators Market is experiencing robust growth as industries across oil & gas, power, water treatment, and chemicals prioritize safety, operational efficiency, and cost optimization. The integration of automation technologies—including smart actuators, control valves, and IoT-enabled monitoring systems—is enhancing process reliability and reducing the need for manual intervention in critical flow operations.

- Electric and pneumatic actuators, along with automated control valves, dominate the market due to their significant role in enabling precise flow regulation, reducing energy usage, and minimizing operational downtime. Butterfly, ball, and globe valves are widely adopted in diverse industrial applications to streamline pressure and fluid control processes.

- AI and IoT technologies are leading the transformation in this sector by enabling predictive maintenance, remote diagnostics, and real-time flow analytics. Smart sensors track valve position, leakage, pressure, and system performance, allowing for proactive decision-making and improved asset utilization.

- Among applications, the oil & gas industry represents the largest share due to high demand for reliable flow control in upstream and downstream processes. Water and wastewater treatment and power generation sectors are also accelerating adoption to meet regulatory compliance and efficiency targets.

- Industrial facilities remain the dominant end-user segment due to high-scale infrastructure and process demands. However, municipal utilities and commercial sectors are increasingly adopting intelligent valve and actuator solutions to optimize operations and support sustainability goals.

Report Scope and Industrial Valves and Actuators Market Segmentation

|

Attributes |

Industrial Valves and Actuators Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Valves and Actuators Market Trends

“Surge in Demand for Hydrogen and Carbon Capture Infrastructure Driving Valve Innovation”

- The global push toward clean energy and decarbonization is fueling investment in hydrogen production, storage, and carbon capture and storage (CCS) infrastructure—significantly influencing demand for high-performance industrial valves and actuators. These applications require valves that can handle extreme pressures, cryogenic temperatures, and corrosive media with high precision and durability.

- Hydrogen, due to its small molecule size and high flammability, presents unique sealing and containment challenges. As a result, manufacturers are developing specialized valve technologies with advanced seat designs, metal-to-metal seals, and leak-proof actuators to support green hydrogen electrolyzers, fuel cell systems, and hydrogen refueling networks.

- Similarly, CCS facilities require highly reliable valve systems capable of operating under supercritical CO₂ conditions. The need for zero-leakage, high-integrity valves in compressor stations, pipelines, and injection wells is pushing innovation in material science, actuator control, and safety mechanisms.

- Countries in Europe, North America, and Asia-Pacific are investing heavily in hydrogen and CCS pilots and infrastructure, supported by net-zero roadmaps and government funding. This surge in infrastructure development is creating new demand centers for advanced valve-actuator solutions engineered for sustainability-focused energy transition projects.

Industrial Valves and Actuators Market Dynamics

Driver

“Rising Infrastructure Modernization and Automation in Process Industries”

- Increasing global investment in infrastructure modernization is driving demand for advanced valve and actuator systems across sectors like oil & gas, water treatment, power, and manufacturing. The push toward energy efficiency, remote operations, and reduced downtime is compelling industries to replace legacy manual valves with automated, sensor-equipped alternatives.

- For instance, in February 2025, the U.S. Department of Energy allocated USD 1.2 billion toward refinery modernization projects, with a significant portion earmarked for smart flow control systems. These investments aim to reduce emissions, improve energy use, and support Industry 4.0 readiness through automation and digitization of critical fluid handling equipment.

- Similarly, the European Union’s Green Industrial Plan encourages process industries to deploy automated valve networks to meet decarbonization and safety targets. Member states such as Germany and France are offering incentives for upgrading to IIoT-integrated actuators that enable predictive maintenance and real-time flow optimization.

- In emerging markets like India and Southeast Asia, rapid urbanization and industrialization are spurring construction of new water plants, chemical facilities, and power stations—each requiring scalable, automated valve infrastructures. Governments are also promoting local manufacturing of flow control components to reduce import dependency and boost industrial resilience.

- Global EPC contractors and utility operators are increasingly specifying intelligent valve systems with digital positioners and remote diagnostics capabilities in new project tenders. This shift reflects the growing preference for automation-ready components that reduce manual intervention and enhance lifecycle performance.

Restraint/Challenge

“Supply Chain Disruptions and Raw Material Price Volatility”

- The industrial valves and actuators market is significantly affected by fluctuations in raw material prices and disruptions in the global supply chain. Key components such as stainless steel, cast iron, brass, and specialized alloys are subject to price volatility due to factors such as global trade tensions, geopolitical instability, and fluctuations in demand from major end-use sectors like oil & gas and power generation.

- These uncertainties directly impact the manufacturing cost structure, affecting the profit margins of suppliers and OEMs. For instance, sudden spikes in raw material costs often lead to price revisions, longer lead times, or order deferrals—especially for projects with tight budgets or rigid timelines.

- In addition, the COVID-19 pandemic and subsequent global events have exposed deep vulnerabilities in global logistics and component sourcing. The market continues to face extended delivery times, shortages of critical components, and limited availability of skilled labor in some regions, leading to project delays and operational inefficiencies for end users.

- This supply-side unpredictability makes it challenging for valve and actuator manufacturers to maintain consistent product availability, adhere to delivery schedules, and fulfill long-term contracts—particularly in sectors like power, water treatment, and energy, where project continuity is essential. As a result, procurement risks and supply chain bottlenecks are emerging as critical restraints to market growth and global scalability.

Industrial Valves and Actuators Market Scope

The market is segmented on the basis of type, material, application, end user and cooling type (for actuators).

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Application |

|

|

By End User |

|

|

By Cooling Type |

|

Industrial Valves and Actuators Market Scope

• By Type

The market includes Quarter-Turn Valves (Ball, Butterfly), Multi-Turn Valves (Gate, Globe), Control Valves, Pneumatic Actuators, Electric Actuators, and Hydraulic Actuators. Quarter-turn valves dominate in 2025, widely used in oil & gas, water treatment, and chemical sectors for fast shutoff and flow control. Electric actuators are experiencing rapid adoption due to their clean energy profile, reduced maintenance, and compatibility with digital control systems in Industry 4.0 environments.

• By Material

Key materials include Cast Iron, Steel (Stainless, Carbon), Alloy-Based (Bronze, Brass, Others), and Others. Stainless steel is the leading material, valued for its durability and corrosion resistance in aggressive media. Cast iron remains cost-effective for general-purpose applications, while alloy-based components are favored in high-pressure, high-temperature processes within the power and refining sectors.

• By Application

Applications include Flow Control, Isolation, Safety Relief, and Regulation. Flow control holds the largest share in 2025, essential across continuous and batch process industries. Safety relief applications are gaining momentum due to increasing safety regulations and the need for pressure control in critical systems, particularly in power and chemical manufacturing environments.

• By End User

End users span Oil & Gas, Water & Wastewater, Power Generation, Chemical & Petrochemical, Food & Beverage, Pharmaceuticals, Pulp & Paper, and Others. Oil & gas dominates due to extensive infrastructure and the need for reliable flow management across upstream, midstream, and downstream operations. Water & wastewater utilities are investing in valve automation to improve flow efficiency and reduce leakage across networks.

• By Cooling Type (for Actuators)

Actuator cooling technologies include Air-Based Cooling, Liquid Cooling, and Fan-Assisted Thermal Control. Air-based systems remain the most widely used, offering simplicity and lower cost. However, liquid cooling is gaining popularity in high-power or high-frequency actuation systems, especially in power plants and mining. Fan-assisted thermal control is preferred where rapid heat dissipation is necessary to prevent overheating and performance degradation.

Industrial Valves and Actuators Market Regional Analysis

- Asia-Pacific holds a dominant position in the industrial valves and actuators market, driven by rapid industrialization, urbanization, and substantial infrastructure development in countries like China, India, and Southeast Asia.

- Growth in industries such as oil & gas, chemical processing, power generation, and water treatment has fueled demand for industrial valves. Additionally, the ongoing adoption of smart technologies and automation in the manufacturing sector, along with government investments in large-scale infrastructure projects, continues to drive market expansion,

United States Industrial Valves and Actuators Market Insight

The United States leads the North American market due to its extensive oil & gas infrastructure, power generation capacity, and highly automated industrial base. The presence of major players like Emerson and Flowserve, combined with significant investment in shale exploration, LNG terminals, and industrial retrofits, strengthens the country’s dominance.

Germany Industrial Valves and Actuators Market Insight

Germany is the leading market in Europe, supported by its advanced manufacturing sector, stringent environmental regulations, and strong presence in chemical, pharmaceutical, and energy industries. The country's emphasis on industrial automation, Industry 4.0 implementation, and energy transition initiatives drives sustained demand for high-performance valve and actuator systems.

China Industrial Valves and Actuators Market Insight

China holds the top position in the Asia-Pacific region, driven by rapid industrialization, large-scale infrastructure projects, and dominance in sectors like power, petrochemicals, and water treatment. Government support for smart manufacturing and expansion of domestic valve production capacity further consolidates its leadership.

Saudi Arabia Industrial Valves and Actuators Market Insight

Middle East & Africa –Saudi Arabia leads the MEA market due to its vast oil and gas operations, refinery expansions, and investments in downstream petrochemical projects. National programs like Vision 2030 emphasize infrastructure modernization and industrial diversification, increasing demand for automated flow control systems

Brazil Industrial Valves and Actuators Market Insight

Brazil is the dominant player in South America, fueled by its significant mining activity, oil production (including deepwater projects), and growing investments in water and wastewater infrastructure. Government incentives for industrial modernization and local manufacturing support continued growth in the sector.

Industrial Valves and Actuators Market Share

The Industrial Valves and Actuators Market is primarily led by a combination of established industrial equipment manufacturers and specialized automation technology providers, including:

- Flowserve Corporation (US)

- Emerson Electric Co. (US)

- Rotork Plc (UK)

- Siemens AG (Germany)

- Schlumberger Limited (US)

- IMI Plc (UK)

- Honeywell International Inc. (US)

- ABB Ltd. (Switzerland)

- Festo SE & Co. KG (Germany)

- Bürkert Fluid Control Systems (Germany)

Latest Developments in Industrial Valves and Actuators Market

- In March 2025 – Emerson unveiled a new series of digital valve positioners featuring integrated AI diagnostics, designed to enhance predictive failure detection in critical process pipelines. This innovation aims to improve operational reliability and reduce unplanned downtime in complex industrial systems.

- In January 2025 – Rotork introduced an advanced electric actuator platform equipped with intelligent torque control and cloud-based monitoring. Targeted at water utility systems, the solution enables precise flow regulation and supports remote diagnostics for improved maintenance efficiency.

- In November 2024 – Flowserve expanded its manufacturing capacity in India to meet the rising demand in the Asia-Pacific region. The move supports large-scale projects in oil & gas and thermal power, reinforcing the company's regional presence and supply chain capabilities.

- In August 2024 – Siemens launched modular valve automation systems specifically designed for hydrogen-ready industrial plants. This development supports the global shift toward decarbonization and aligns with clean energy goals across energy-intensive sectors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.