Global Industrial Wheeled Loader Market

Market Size in USD Billion

CAGR :

%

USD

14.87 Billion

USD

20.35 Billion

2024

2032

USD

14.87 Billion

USD

20.35 Billion

2024

2032

| 2025 –2032 | |

| USD 14.87 Billion | |

| USD 20.35 Billion | |

|

|

|

|

Industrial Wheeled Loader Market Size

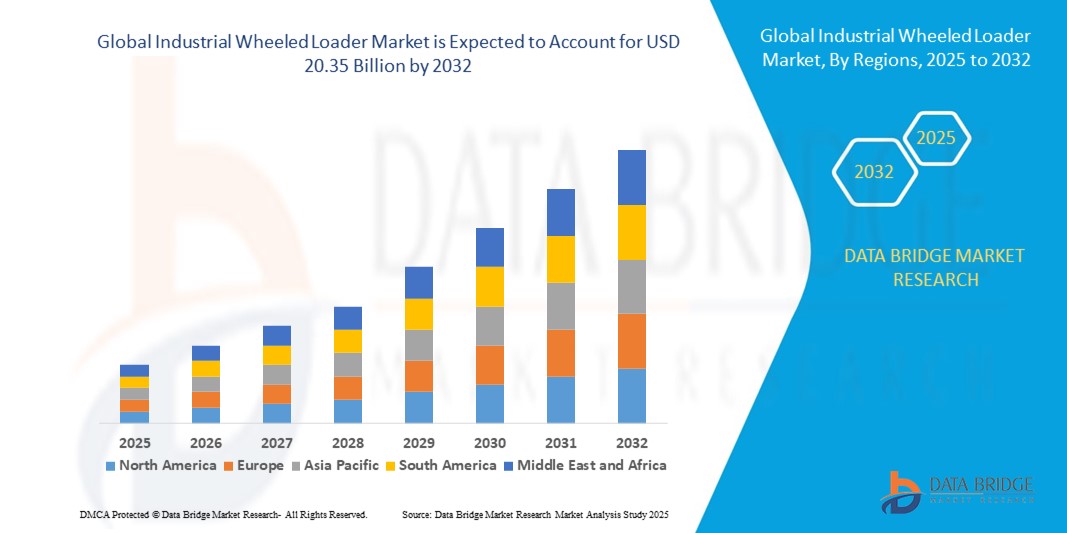

- The global industrial wheeled loader market size was valued at USD 14.87 billion in 2024 and is expected to reach USD 20.35 billion by 2032, at a CAGR of 4.0% during the forecast period

- The market growth is largely fueled by the increasing adoption of mechanized material handling equipment across construction, mining, agriculture, and industrial sectors, coupled with advancements in loader technology enhancing efficiency, durability, and operator comfort

- Furthermore, rising infrastructure investments, rapid urbanization, and the growing need for high-capacity, versatile equipment capable of operating in diverse terrains are accelerating the uptake of industrial wheeled loaders, thereby significantly boosting the industry's growth

Industrial Wheeled Loader Market Analysis

- Industrial wheeled loaders are heavy-duty machines used for loading, transporting, and handling bulk materials in applications ranging from construction and mining to agriculture and industrial operations. They are valued for their high load capacity, maneuverability, and compatibility with various attachments, enabling versatility in operations

- The escalating demand for industrial wheeled loaders is primarily fueled by large-scale infrastructure development projects, expansion in mining activities, and technological innovations such as fuel-efficient engines, telematics, and hybrid or electric models aimed at improving productivity while reducing operational costs and environmental impact

- North America dominated the industrial wheeled loader market with a share of 40.5% in 2024, due to rising infrastructure development, urban construction projects, and strong mechanization trends across construction and industrial sectors

- Asia-Pacific is expected to be the fastest growing region in the industrial wheeled loader market during the forecast period due to rapid urbanization, large-scale infrastructure projects, and rising industrial activities in countries such as China, India, and Japan

- Standard wheeled loaders segment dominated the market with a market share of 62.5% in 2024, due to their high load capacity, versatility, and suitability for heavy-duty operations across construction, mining, and industrial sectors. Standard loaders are preferred for their robust design, advanced hydraulics, and ability to handle large-scale material handling efficiently. Their compatibility with various attachments such as buckets, forks, and grapples further enhances their operational flexibility, making them the go-to choice for large projects

Report Scope and Industrial Wheeled Loader Market Segmentation

|

Attributes |

Industrial Wheeled Loader Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Wheeled Loader Market Trends

Growing Adoption of Hybrid and Electric Wheeled Loaders

- Surge in demand for hybrid and electric wheeled loaders reflects the need for fuel efficiency, emissions reduction, and operational cost savings, prompting manufacturers and fleet owners to invest in modernized, sustainable equipment

- For instance, Caterpillar Inc., Komatsu Ltd., and Volvo Construction Equipment have introduced hybrid and fully electric wheeled loader models featuring advanced battery technologies and energy regeneration systems that lower fuel consumption and comply with stricter emissions regulations, driving adoption in construction, mining, and material handling sectors

- Expanding infrastructure projects and high construction activity accelerate the replacement of older diesel models with new electric and hybrid loaders, supporting productivity gains and regulatory compliance

- Technological advancements such as telematics, autonomous operation, and IoT-enabled diagnostics enhance machine performance and customer value, fostering market growth for smarter, connected wheeled loaders

- Rapid growth in rental and leasing markets enables broader accessibility of the newest hybrid and electric loader technologies to smaller businesses and short-duration projects

- Growing focus on operator safety and ergonomics leads to improved loader cabins, better visibility, and enhanced comfort, supporting overall industry adoption of advanced loader designs

Industrial Wheeled Loader Market Dynamics

Driver

Increasing Infrastructure Investments

- Expanding global infrastructure investments in roads, bridges, commercial buildings, and public utilities stimulate strong demand for wheeled loaders that efficiently handle bulk materials and support project execution

- For instance, large-scale government spending on construction projects in regions such as North America, Europe, and Asia-Pacific, with companies such as Caterpillar and Liebherr providing high-capacity loaders for earthmoving and material transport, has contributed to double-digit growth in loader demand

- Increasing urbanization and population growth require more equipment for land development, remediation, and waste management activities, further driving utilization

- Demand for advanced loaders capable of supporting multiple applications, from mining to solid waste and forestry, enables manufacturers to diversify product offerings and capture broader markets

- In addition, aging machine fleets and focus on operational efficiency prompt fleet owners to upgrade to modern wheeled loaders with longer lifespan and lower maintenance costs. Rental market expansion driven by infrastructure investments allows cost-effective fleet scaling and access to the latest loader technologies

Restraint/Challenge

High Fuel Costs and Emissions

- Persistent high fuel costs and emissions pressures challenge profitability and regulatory compliance for users of traditional diesel wheeled loaders, propelling a gradual shift towards alternative powertrains

- For instance, smaller construction firms and agricultural operators often face greater financial impact due to fluctuating fuel prices and rising environmental levies, making it harder to upgrade fleets without significant capital investment

- Emissions standards such as Euro VI and Tier 4 Final in major markets create barriers for continued use of older diesel loaders, compelling retrofit programs or accelerated equipment replacement

- Cost challenges associated with acquiring, maintaining, and operating hybrid/electric loaders slow widespread market penetration, especially in regions with limited supporting subsidies or incentives

- In addition, achieving optimal performance and reliability in electric or hybrid loader designs requires ongoing R&D, supply chain stability, and skilled service networks, presenting challenges for manufacturers and end-users alike

Industrial Wheeled Loader Market Scope

The market is segmented on the basis of product type and end-user.

- By Product Type

On the basis of product type, the industrial wheeled loader market is segmented into compact wheeled loaders and standard wheeled loaders. The standard wheeled loaders segment dominated the largest market revenue share of 62.5% in 2024, driven by their high load capacity, versatility, and suitability for heavy-duty operations across construction, mining, and industrial sectors. Standard loaders are preferred for their robust design, advanced hydraulics, and ability to handle large-scale material handling efficiently. Their compatibility with various attachments such as buckets, forks, and grapples further enhances their operational flexibility, making them the go-to choice for large projects. Moreover, the increasing mechanization in developing regions has fueled demand for standard loaders to optimize productivity and reduce manual labor costs.

The compact wheeled loaders segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for machines suitable for confined spaces and urban construction sites. Compact loaders offer high maneuverability, ease of transport, and reduced operational costs, making them ideal for small-scale construction and landscaping projects. Their integration with advanced features such as telematics and fuel-efficient engines is encouraging adoption across industrial and agricultural applications. Growing emphasis on eco-friendly and low-emission equipment also supports the expansion of the compact loader segment.

- By End-User

On the basis of end-user, the industrial wheeled loader market is segmented into construction, mining, agriculture, and industrial sectors. The construction segment held the largest market revenue share in 2024, driven by rapid urbanization, infrastructure development, and increased investments in residential and commercial projects. Construction companies rely on wheeled loaders for tasks such as earthmoving, material transport, and site preparation, as these machines offer operational efficiency and reduce project timelines. The demand is further supported by government initiatives to modernize infrastructure and the need for reliable equipment in both urban and remote project sites.

The mining segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing mineral exploration activities and the need for high-performance loaders capable of operating in harsh environments. Mining operations demand machines with high durability, load capacity, and advanced safety features to handle heavy materials such as ores and aggregates. The integration of telematics, automation, and predictive maintenance solutions is enhancing the efficiency of mining loaders, driving their adoption across both surface and underground mining projects.

Industrial Wheeled Loader Market Regional Analysis

- North America dominated the industrial wheeled loader market with the largest revenue share of 40.5% in 2024, driven by rising infrastructure development, urban construction projects, and strong mechanization trends across construction and industrial sectors

- Consumers and businesses in the region prioritize high-performance, durable equipment capable of handling heavy-duty operations efficiently

- This widespread adoption is further supported by advanced dealer networks, high disposable incomes, and technologically inclined construction practices, establishing wheeled loaders as essential machinery for both commercial and industrial projects

U.S. Industrial Wheeled Loader Market Insight

The U.S. industrial wheeled loader market captured the largest revenue share in North America in 2024, fueled by rapid infrastructure expansion, road construction, and urban development projects. Contractors and construction firms increasingly rely on wheeled loaders for their versatility, high load capacity, and ability to operate in diverse terrains. The demand is further driven by technological advancements, including fuel-efficient engines and telematics integration, which enhance operational efficiency and lower maintenance costs.

Europe Industrial Wheeled Loader Market Insight

The Europe industrial wheeled loader market is projected to expand at a substantial CAGR during the forecast period, driven by the region’s focus on modernization of infrastructure, sustainable construction practices, and rising adoption of heavy machinery across the construction and mining sectors. European buyers emphasize durability, energy efficiency, and compliance with stringent emission norms, fostering the demand for technologically advanced wheeled loaders. The market is also witnessing increased deployment in industrial and agricultural applications, contributing to steady growth.

U.K. Industrial Wheeled Loader Market Insight

The U.K. industrial wheeled loader market is anticipated to grow at a noteworthy CAGR, driven by the increasing number of urban construction projects and industrial developments. Contractors and municipal authorities prefer high-performance wheeled loaders for material handling and site preparation tasks. The market growth is further fueled by government initiatives in infrastructure modernization and the demand for reliable, versatile machinery suitable for both urban and rural projects.

Germany Industrial Wheeled Loader Market Insight

The Germany industrial wheeled loader market is expected to expand at a considerable CAGR, driven by the country’s focus on industrial automation, construction modernization, and mining activities. Germany’s emphasis on technological innovation, sustainability, and efficiency promotes the adoption of wheeled loaders equipped with advanced hydraulics and telematics. The integration of environmentally friendly engines and precision attachments aligns with local regulations and consumer expectations, bolstering market growth.

Asia-Pacific Industrial Wheeled Loader Market Insight

The Asia-Pacific industrial wheeled loader market is poised to grow at the fastest CAGR during 2025–2032, fueled by rapid urbanization, large-scale infrastructure projects, and rising industrial activities in countries such as China, India, and Japan. Increasing mechanization, government investments in construction, and growing industrial sectors are driving the adoption of wheeled loaders. The availability of cost-effective machinery from regional manufacturers and expanding dealer networks is further enhancing accessibility and adoption across residential, industrial, and agricultural projects.

Japan Industrial Wheeled Loader Market Insight

The Japan industrial wheeled loader market is gaining momentum due to high technological adoption, urban redevelopment projects, and the demand for efficient construction and material handling machinery. Japanese contractors value compact, versatile loaders capable of operating in limited spaces while maintaining high productivity. Integration with advanced controls and telematics enhances operational efficiency, supporting growth in both industrial and construction sectors.

China Industrial Wheeled Loader Market Insight

The China industrial wheeled loader market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, industrialization, and large-scale infrastructure development. The country’s expanding construction and mining sectors rely heavily on durable, high-capacity wheeled loaders. Competitive pricing, strong domestic manufacturing capabilities, and increasing adoption of advanced technologies in machinery are key factors propelling market growth in China.

Industrial Wheeled Loader Market Share

The industrial wheeled loader industry is primarily led by well-established companies, including:

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- Volvo Construction Equipment (Sweden)

- JCB (U.K.)

- SANY Heavy Industry Co., Ltd. (China)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- Deere & Company (U.S.)

- Liebherr Group (Switzerland)

- Terex Corporation (U.S.)

- XCMG Group (China)

Latest Developments in Global Industrial Wheeled Loader Market

- In September 2024, Volvo Construction Equipment (Volvo CE) inaugurated new facilities at its Arvika plant in Sweden to ramp up production of electric wheel loaders, reinforcing its commitment to decarbonizing construction equipment and meeting rising demand for emission-free machinery. The move supports Volvo’s ambitious goal of achieving fossil-free status by 2040 and ensuring that electric machines contribute 35% of its sales by 2030

- In July 2024, Liebherr-Werk Bischofshofen GmbH announced a major production capacity expansion through a new manufacturing facility in Styria, Austria, dedicated to small wheel loaders. This strategic move is aimed at meeting the surging global demand for compact wheeled loaders, with completion targeted for 2029. The site’s current capacity of 7,000 units annually will rise to 10,000 units once operational, enabling the company to strengthen its position in the high-growth compact loader segment. The facility will produce the L 504 to L 518 models and cater to OEM partners such as Claas and John Deere, enhancing Liebherr’s competitiveness and ability to serve diverse markets efficiently

- In June 2024, Doosan Bobcat revealed plans to establish its first manufacturing facility in Mexico, located in Salinas, Victoria, with operations expected to commence in 2026. This expansion will increase the company’s loader production capacity in North America by approximately 20%, allowing it to better meet growing regional demand. By adding Mexico to its existing production network in South Korea, India, China, Germany, France, Czech Republic, and the U.S., Doosan Bobcat is reinforcing its global manufacturing footprint and improving supply chain flexibility for the industrial wheeled loader market

- In March 2023, Komatsu Ltd. introduced a hybrid wheeled loader model designed to reduce emissions and noise pollution, aligning with global sustainability trends and tightening environmental regulations. This innovation strengthens Komatsu’s portfolio in the eco-friendly equipment segment, appealing to environmentally conscious buyers and markets prioritizing low-carbon construction solutions. By offering enhanced operational efficiency with reduced environmental impact, Komatsu is positioning itself to capture growth in both developed and emerging markets focused on green construction practices

- In February 2023, Caterpillar Inc. launched a new series of wheeled loaders featuring improved fuel efficiency and advanced operator assistance systems. These enhancements address key market demands for productivity, safety, and operational cost reduction. The advanced assistance systems improve precision and ease of operation, attracting both experienced operators and newer users in the construction, mining, and industrial sectors. This product launch reinforces Caterpillar’s competitive edge in delivering technologically advanced, performance-driven solutions in the wheeled loader segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Wheeled Loader Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Wheeled Loader Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Wheeled Loader Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.