Global Industrial Wood And Metal Packaging Market

Market Size in USD Billion

CAGR :

%

USD

75.20 Billion

USD

122.50 Billion

2025

2033

USD

75.20 Billion

USD

122.50 Billion

2025

2033

| 2026 –2033 | |

| USD 75.20 Billion | |

| USD 122.50 Billion | |

|

|

|

|

Industrial Wood and Metal Packaging Market Size

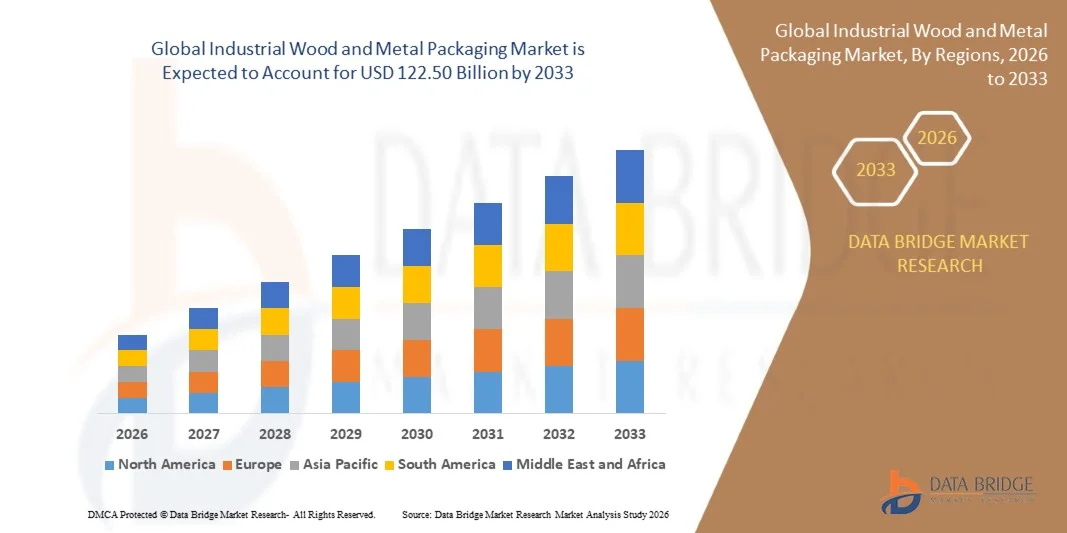

- The global industrial wood and metal packaging market size was valued at USD 75.20 billion in 2025 and is expected to reach USD 122.50 billion by 2033, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and reusable packaging solutions across logistics, food and beverage, and chemical industries

- Rising international trade and the need for secure transportation of goods are driving adoption of durable wood and metal packaging

Industrial Wood and Metal Packaging Market Analysis

- The market is witnessing robust growth due to a combination of regulatory support for sustainable packaging, technological innovations in manufacturing processes, and rising awareness of product safety and damage prevention

- Increasing preference for customized and lightweight packaging solutions is enhancing operational efficiency for end-users across multiple sectors

- North America dominated the industrial wood and metal packaging market with the largest revenue share of 38.75% in 2025, driven by the presence of large-scale manufacturing and logistics industries, along with increasing emphasis on sustainable and reusable packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global industrial wood and metal packaging market, driven by rising manufacturing activities, expanding e-commerce and logistics sectors, and increasing focus on sustainable and efficient packaging solutions

- The pallets segment held the largest market share in 2025 due to its extensive use in warehousing, storage, and transportation, providing easy handling and compatibility with material handling systems. Pallets offer standardized dimensions, which simplify stacking, loading, and shipping across global supply chains. Their durability and reusability reduce operational costs and minimize product damage during transit

Report Scope and Industrial Wood and Metal Packaging Market Segmentation

|

Attributes |

Industrial Wood and Metal Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Wood and Metal Packaging Market Trends

“Rise of Sustainable and Durable Industrial Packaging”

• The growing focus on sustainable and reusable industrial wood and metal packaging is transforming the market by reducing environmental impact and enhancing product safety. Durable packaging ensures minimal damage during storage and transport, especially for heavy or fragile goods, leading to cost savings and improved operational efficiency. The increasing emphasis on carbon footprint reduction is also encouraging adoption of eco-friendly packaging materials, supporting corporate sustainability goals

• Increasing demand for lightweight, stackable, and modular packaging solutions is accelerating the adoption of engineered wood pallets, metal drums, and customized containers. These solutions are particularly effective in optimizing warehouse space and simplifying logistics, supporting industries with high-volume shipping requirements. Integration with automated material handling systems further enhances operational efficiency and reduces labor dependency

• The versatility and compatibility of modern wood and metal packaging with automation and material handling systems are making them attractive for routine industrial operations. Businesses benefit from standardized, durable packaging that reduces replacement costs and improves supply chain efficiency. In addition, modular designs allow for easy customization, enabling companies to meet diverse storage and shipping requirements

• For instance, in 2023, several chemical and food processing plants in Europe reported a significant reduction in product damage and storage inefficiencies after switching to reinforced metal drums and engineered wood pallets, boosting operational productivity. Companies also reported decreased packaging waste and improved compliance with environmental regulations, enhancing corporate reputation

• While sustainable and durable packaging solutions are driving efficiency and cost savings, their impact depends on continued material innovation, regulatory compliance, and industry adoption. Manufacturers must focus on lightweight, recyclable, and scalable designs to fully capitalize on this growing demand. Continuous RandD into stronger, more sustainable materials will further expand market opportunities

Industrial Wood and Metal Packaging Market Dynamics

Driver

“Rising Demand for Sustainable and Efficient Packaging Solutions”

• The growing emphasis on environmental sustainability and circular economy practices is driving demand for wood and metal packaging. Businesses are increasingly seeking eco-friendly, reusable, and recyclable solutions to comply with environmental regulations and meet consumer expectations. The shift toward green logistics and sustainable supply chains is further supporting adoption across global industries

• Industries are also recognizing the operational benefits of durable and standardized packaging, including reduced product damage, improved transport efficiency, and lower overall logistics costs. This awareness is supporting investment in premium wood and metal packaging solutions. The ability to reuse and repurpose packaging materials is also helping companies reduce overall packaging expenditure

• Government initiatives and regulatory frameworks promoting sustainable packaging practices have strengthened adoption across industrial sectors. From mandatory packaging standards to sustainability incentives, supportive policies are accelerating market growth. Regulatory compliance in regions such as the EU and North America encourages manufacturers to implement innovative wood and metal packaging solutions to avoid penalties

• For instance, in 2022, the European Union implemented updated packaging regulations emphasizing recyclability and material efficiency, prompting manufacturers to adopt metal and engineered wood packaging solutions across supply chains. Companies reported improved compliance, reduced waste, and enhanced logistics efficiency due to these mandates

• While sustainability and operational efficiency are key growth drivers, adoption depends on material innovation, cost-effectiveness, and compatibility with modern industrial logistics. Continuous collaboration between manufacturers, suppliers, and regulatory bodies is vital to ensure solutions meet both environmental and operational requirements

Restraint/Challenge

“High Material Costs and Limited Availability of Raw Materials”

• The high cost of premium wood and metal materials, particularly for treated or engineered products, limits adoption among small and mid-sized industrial operators. Upfront investment for durable packaging can be a significant barrier to entry. In addition, fluctuating raw material prices can affect profit margins, making budgeting challenging for smaller firms

• Supply chain disruptions and limited availability of sustainably sourced raw materials restrict the production and timely delivery of wood and metal packaging. This can affect industries that rely on just-in-time manufacturing and global logistics. Delays in sourcing certified wood or specialty metals can lead to production slowdowns and increased operational costs

• Market penetration is further constrained by the need for specialized handling and storage of metal containers and engineered wood pallets. Many facilities require additional infrastructure to store, maintain, and transport these packaging solutions safely. Training staff to handle heavy or fragile packaging components also adds to operational complexity and costs

• For instance, in 2023, several packaging manufacturers in Asia-Pacific reported delays and increased costs due to raw material shortages and rising lumber and steel prices, affecting market expansion. The shortage led some companies to seek alternative suppliers, driving up procurement costs and slowing adoption of new packaging solutions

• While industrial wood and metal packaging technologies continue to advance, addressing cost, supply, and infrastructure challenges is essential to unlock the market’s full growth potential. Strategic partnerships, local sourcing, and investment in alternative sustainable materials could mitigate these constraints and enhance market resilience

Industrial Wood and Metal Packaging Market Scope

The market is segmented on the basis of material type, packaging type, and end-user industry.

• By Packaging Type

On the basis of packaging type, the market is segmented into pallets, crates, drums, barrels, and others. The pallets segment held the largest market share in 2025 due to its extensive use in warehousing, storage, and transportation, providing easy handling and compatibility with material handling systems. Pallets offer standardized dimensions, which simplify stacking, loading, and shipping across global supply chains. Their durability and reusability reduce operational costs and minimize product damage during transit.

The drums segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand in chemical, pharmaceutical, and food industries for safe and durable liquid containment solutions. Drums offer leak-proof storage, stackability, and compliance with industry regulations, making them highly suitable for industrial logistics.

• By End-User Industry

On the basis of end-user industry, the market is segmented into food and beverage, chemicals and petrochemicals, pharmaceuticals, automotive, construction, and others. The food and beverage segment held the largest market revenue share in 2025, fueled by the need for hygienic, durable, and transport-efficient packaging solutions.

The chemicals and petrochemicals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by strict regulations regarding safe storage and transportation of hazardous materials. Industries increasingly prefer metal and reinforced wood packaging for compliance, durability, and operational efficiency.

Industrial Wood and Metal Packaging Market Regional Analysis

• North America dominated the industrial wood and metal packaging market with the largest revenue share of 38.75% in 2025, driven by the presence of large-scale manufacturing and logistics industries, along with increasing emphasis on sustainable and reusable packaging solutions

• Businesses in the region highly value durable, stackable, and modular packaging solutions that enhance operational efficiency, reduce product damage, and optimize warehouse space

• This widespread adoption is further supported by strong industrial infrastructure, technological advancements in material handling, and stringent regulations on packaging sustainability, establishing wood and metal packaging as a preferred choice across multiple industrial sectors

U.S. Industrial Wood and Metal Packaging Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by growing demand for engineered wood pallets, metal drums, and reusable containers across food and beverage, chemical, and pharmaceutical industries. Companies are increasingly investing in durable packaging solutions to reduce logistics costs, prevent product damage, and enhance supply chain efficiency. Moreover, government initiatives promoting sustainable packaging and recycling practices are significantly contributing to market expansion.

Europe Industrial Wood and Metal Packaging Market Insight

The Europe market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict regulations on packaging sustainability, rising industrial automation, and the increasing adoption of reusable and modular packaging solutions. Industries across automotive, chemicals, and construction sectors are implementing engineered wood and metal containers to improve transport efficiency, reduce product loss, and comply with circular economy practices. Urbanization, advanced material handling systems, and growing environmental awareness are further accelerating market adoption.

U.K. Industrial Wood and Metal Packaging Market Insight

The U.K. market is expected to witness significant growth from 2026 to 2033, driven by increasing demand for sustainable and standardized packaging in industrial operations. Companies are focusing on reducing packaging waste, improving logistics efficiency, and complying with environmental regulations through the adoption of engineered wood pallets, crates, and metal drums. The country’s robust industrial base and growing trend of green manufacturing practices are further supporting market expansion.

Germany Industrial Wood and Metal Packaging Market Insight

The Germany market is expected to witness strong growth from 2026 to 2033, fueled by the country’s focus on sustainable industrial practices and innovative packaging solutions. Industrial operators are adopting durable wood and metal packaging to reduce product damage, streamline supply chains, and comply with environmental regulations. Integration with automated logistics systems and advanced handling equipment is also becoming increasingly common, enhancing operational efficiency and market adoption.

Asia-Pacific Industrial Wood and Metal Packaging Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrialization, rising exports, and growing awareness of sustainable packaging solutions in countries such as China, India, and Japan. The adoption of engineered wood pallets, metal drums, and modular containers is rising across food processing, chemicals, and automotive industries. Furthermore, as APAC emerges as a major manufacturing hub for industrial packaging components, affordability, scalability, and accessibility of wood and metal packaging solutions are expanding to a wider industrial base.

Japan Industrial Wood and Metal Packaging Market Insight

The Japan market is expected to witness strong growth from 2026 to 2033, owing to the country’s focus on efficiency, automation, and environmentally responsible packaging solutions. Companies are investing in high-quality wood and metal packaging to protect products, optimize warehouse storage, and streamline supply chains. The increasing integration of packaging solutions with automated handling systems and the trend toward sustainable manufacturing are driving market adoption in both domestic and export-oriented industries.

China Industrial Wood and Metal Packaging Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expansive industrial base, rapid manufacturing growth, and increasing export activities. Demand for durable, reusable, and modular wood and metal packaging is growing across food and beverage, chemicals, and automotive sectors. The push toward sustainable practices, coupled with cost-effective local production and strong domestic manufacturers, are key factors driving the market in China.

Industrial Wood and Metal Packaging Market Share

The Industrial Wood and Metal Packaging industry is primarily led by well-established companies, including:

- IFCO Systems GmbH (Germany)

- Greif, Inc. (U.S.)

- Conitex Sonoco (U.S.)

- Schäfer Container Systems (Germany)

- BWAY Corporation (U.S.)

- Pall-Ex Ltd (U.K.)

- CABKA Group GmbH (Germany)

- Mauser Packaging Solutions (Germany)

- ORBIS Corporation (U.S.)

- Linpac Packaging Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Wood And Metal Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Wood And Metal Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Wood And Metal Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.