Global Inertial Sensor Mems Market

Market Size in USD Billion

CAGR :

%

USD

1.09 Billion

USD

2.57 Billion

2024

2032

USD

1.09 Billion

USD

2.57 Billion

2024

2032

| 2025 –2032 | |

| USD 1.09 Billion | |

| USD 2.57 Billion | |

|

|

|

|

Inertial Sensor MEMs Market Size

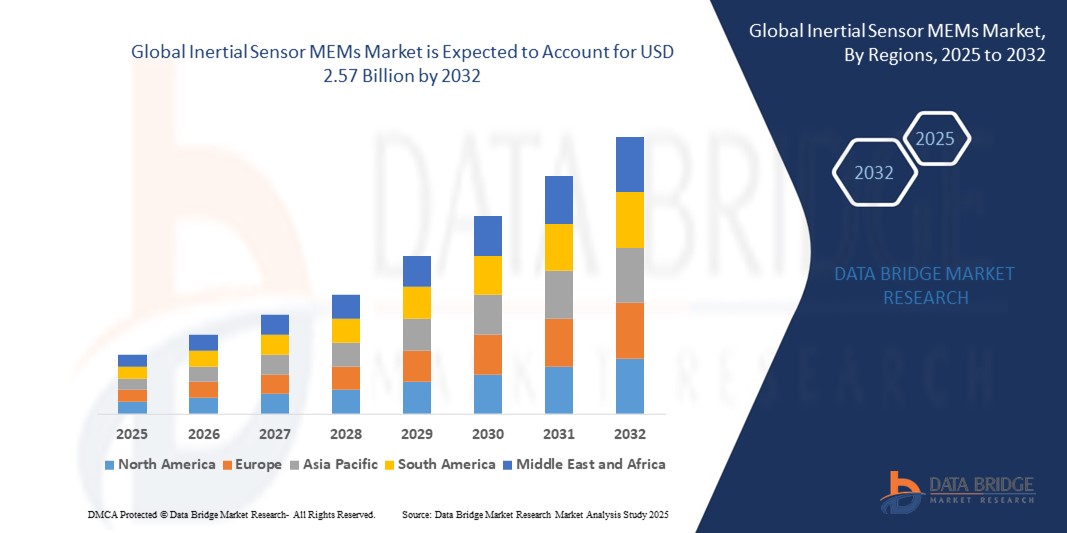

- The global inertial sensor MEMs market size was valued at USD 1.09 billion in 2024 and is expected to reach USD 2.57 billion by 2032, at a CAGR of 11.31% during the forecast period

- The market growth is largely fueled by the increasing adoption of consumer electronics, automotive, aerospace, and industrial automation applications, which require precise motion sensing and navigation capabilities

- Furthermore, rising demand for high-performance, compact, and low-power sensors is driving the development and integration of MEMS inertial sensors across multiple sectors. These converging factors are accelerating the adoption of accelerometers, gyroscopes, and IMUs, thereby significantly boosting the industry’s growth

Inertial Sensor MEMs Market Analysis

- Inertial sensor MEMS are micro-electromechanical devices that measure acceleration, angular rate, and orientation across one or more axes, providing critical data for motion detection, navigation, and stabilization systems. These sensors are widely used in smartphones, wearables, UAVs, autonomous vehicles, industrial machinery, and defense equipment.

- The escalating demand for MEMS inertial sensors is primarily fueled by the proliferation of smart devices, increasing reliance on autonomous and connected systems, and the need for precision sensing in mission-critical applications across automotive, aerospace, healthcare, and industrial domains

- North America dominated the inertial sensor MEMs market with a share of 39.2% in 2024, due to strong adoption across automotive, aerospace & defense, and consumer electronics sectors

- Asia-Pacific is expected to be the fastest growing region in the inertial sensor MEMs market during the forecast period due to rapid industrialization, urbanization, and rising demand for consumer electronics

- Accelerometers segment dominated the market with a market share of 47% in 2024, due to its extensive usage in smartphones, wearables, and automotive safety systems. Accelerometers play a critical role in detecting motion, tilt, and vibration, making them indispensable in consumer electronics for screen rotation, gaming applications, and fitness tracking. In the automotive sector, their application in airbag deployment systems and electronic stability control has further boosted demand. Their compact size, low cost, and continuous improvements in sensitivity and accuracy make accelerometers the most widely adopted MEMS inertial sensors across industries

Report Scope and Inertial Sensor MEMs Market Segmentation

|

Attributes |

Inertial Sensor MEMs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Inertial Sensor MEMs Market Trends

Growing Demand for Inertial Sensors in Automotive Safety Systems

- The market for MEMs inertial sensors is experiencing substantial growth driven by rising integration in automotive safety systems such as electronic stability control, airbag deployment, anti-lock braking, and advanced ADAS. MEMs accelerometers and gyroscopes enable precise detection of movement and orientation critical for vehicular safety and automation

- For instance, Bosch Sensortec supplies MEMs inertial sensors for major automotive OEMs, enhancing vehicle dynamics and safety performance through integration in stability, rollover, and crash detection modules

- Expansion of autonomous driving and electric vehicle platforms is accelerating demand for sophisticated inertial sensing to support real-time motion analysis, lane keeping, collision avoidance, and driver monitoring features

- Miniaturization and reduced power consumption in MEMs sensors allow integration into complex automotive electronics, broadening their application across tiers and vehicle types globally

- The rise of connected vehicle ecosystems and V2X communications is expanding adoption of inertial sensors to facilitate accurate position and motion data for networked and intelligent transportation infrastructure

- Growing regulatory mandates for improved safety and accident prevention are pushing automakers to implement MEMs-based inertial sensors in both luxury and mass-market vehicles

Inertial Sensor MEMs Market Dynamics

Driver

Increasing Adoption of MEMs-based Sensors in Consumer Electronics

- Rising adoption of smartphones, wearables, tablets, and gaming devices is a major driver for MEMs inertial sensors, as manufacturers seek ultra-compact, low-power components for motion tracking, orientation detection, and interactive user experiences

- For instance, TDK InvenSense provides MEMs accelerometers and gyroscopes widely used in flagship smartphones and wearable fitness bands, supporting gesture recognition, step counting, and augmented reality functionality

- The expansion of mobile and smart devices with advanced motion-based controls increases demand for highly scalable, cost-effective MEMs sensing solutions

- Growth in applications such as drone stabilization, smart remote controls, and personal navigation systems further supports market expansion for inertial sensors in the consumer electronics sector

- The proliferation of fitness, health, and lifestyle wearables with embedded inertial sensors is driving continuous volume growth and diversification across manufacturers worldwide

Restraint/Challenge

Concerns Regarding Accuracy and Calibration Issues

- Challenges related to accuracy and calibration of MEMs inertial sensors pose restraints to broader adoption, especially in precision-sensitive applications such as robotics, navigation, and high-performance automotive systems

- For instance, users of STMicroelectronics’ MEMs sensor modules report the need for frequent calibration and real-time error compensation to maintain measurement integrity in dynamic conditions

- Deviations due to temperature fluctuations, component aging, and mechanical stress can impact sensor reliability and necessitate ongoing system adjustments

- In addition, drift and bias errors in MEMs gyroscopes complicate long-term motion tracking and can result in degraded performance for position estimation, requiring algorithmic correction and calibration routines

- Continuous advances in sensor packaging and algorithmic filtering aim to address these challenges, but calibration complexity and performance variability continue to impact cost, integration effort, and market perception

Inertial Sensor MEMs Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the inertial sensor MEMS market is segmented into accelerometers, gyroscopes, magnetometers, and others. The accelerometer segment dominated the largest market revenue share of 47% in 2024, driven by its extensive usage in smartphones, wearables, and automotive safety systems. Accelerometers play a critical role in detecting motion, tilt, and vibration, making them indispensable in consumer electronics for screen rotation, gaming applications, and fitness tracking. In the automotive sector, their application in airbag deployment systems and electronic stability control has further boosted demand. Their compact size, low cost, and continuous improvements in sensitivity and accuracy make accelerometers the most widely adopted MEMS inertial sensors across industries.

The gyroscopes segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in navigation systems, autonomous vehicles, and drones. Gyroscopes provide precise orientation and angular velocity data, essential for advanced driver-assistance systems (ADAS), robotics, and aerospace applications. The growing emphasis on autonomous driving and unmanned aerial vehicles has created significant opportunities for MEMS gyroscopes. Moreover, their integration into gaming consoles, VR headsets, and AR devices enhances immersive user experiences, further contributing to their rapid adoption. Advancements in miniaturization and low-power consumption are expected to accelerate the use of MEMS gyroscopes in next-generation technologies.

- By Application

On the basis of application, the inertial sensor MEMS market is segmented into consumer electronics, automotive, aerospace & defense, industrial, healthcare, and others. The consumer electronics segment accounted for the largest market revenue share in 2024, supported by the widespread integration of MEMS sensors into smartphones, tablets, and wearables. These sensors enable key functionalities such as motion sensing, screen orientation, gesture recognition, and fitness tracking. The constant demand for feature-rich, compact, and energy-efficient devices drives large-scale deployment of MEMS inertial sensors. With billions of smartphones and wearable devices sold annually, consumer electronics remains the strongest revenue contributor to the market.

The automotive segment is projected to grow at the fastest CAGR from 2025 to 2032, owing to the rising penetration of advanced safety and automation features in vehicles. MEMS inertial sensors are integral to applications such as electronic stability control, navigation assistance, rollover detection, and airbag systems. The rapid development of electric and autonomous vehicles is further accelerating sensor adoption, as precise motion detection and positioning are crucial for vehicle control and navigation. Increasing regulatory focus on passenger safety and the expansion of ADAS and self-driving technologies position the automotive sector as the fastest-growing application area for MEMS inertial sensors.

Inertial Sensor MEMs Market Regional Analysis

- North America dominated the inertial sensor MEMs market with the largest revenue share of 39.2% in 2024, driven by strong adoption across automotive, aerospace & defense, and consumer electronics sectors

- The region benefits from a well-established technological ecosystem and significant investments in advanced driver assistance systems (ADAS), autonomous vehicles, and defense modernization programs

- Growing demand for high-performance navigation and positioning solutions in drones, robotics, and industrial automation further supports market expansion. The U.S. continues to lead innovation with strong R&D investments and robust semiconductor infrastructure, reinforcing North America’s dominance in MEMS inertial sensors

U.S. Inertial Sensor MEMS Market Insight

The U.S. inertial sensor MEMS market captured the largest revenue share in 2024 within North America, propelled by extensive deployment in defense, aerospace, and consumer electronics applications. Strong demand for precision sensors in military-grade navigation systems, coupled with rising integration in smartphones, wearables, and autonomous vehicles, is fueling growth. The country’s advanced semiconductor manufacturing base and the presence of leading MEMS sensor companies further drive market penetration. In addition, rapid adoption of IoT and smart devices enhances the application scope of MEMS inertial sensors across industrial and healthcare domains.

Europe Inertial Sensor MEMS Market Insight

The Europe inertial sensor MEMS market is projected to expand at a substantial CAGR during the forecast period, supported by stringent safety standards in automotive and aerospace industries. Increasing penetration of electric vehicles and growing reliance on advanced driver assistance technologies are fueling sensor demand. European aerospace programs, coupled with defense modernization initiatives, are further enhancing adoption of MEMS-based inertial navigation solutions. Moreover, the region’s strong focus on industrial automation, robotics, and precision healthcare devices strengthens its market position.

U.K. Inertial Sensor MEMS Market Insight

The U.K. inertial sensor MEMS market is anticipated to grow at a noteworthy CAGR, driven by rapid development in aerospace & defense and growing integration into industrial automation. The country’s strong focus on autonomous systems, drone applications, and healthcare innovations creates robust demand for precise motion-sensing solutions. In addition, increasing adoption of IoT and connected devices supports the integration of MEMS sensors across multiple sectors, positioning the U.K. as one of the key growth contributors in Europe.

Germany Inertial Sensor MEMS Market Insight

The Germany inertial sensor MEMS market is expected to expand at a considerable CAGR, propelled by the country’s leadership in automotive manufacturing and industrial automation. German automakers’ focus on electric and autonomous vehicles significantly drives sensor demand, particularly in safety, navigation, and stability systems. In addition, strong investment in Industry 4.0 technologies and precision manufacturing promotes the integration of MEMS inertial sensors. The country’s emphasis on high-quality engineering and innovation ensures growing adoption in healthcare and aerospace applications.

Asia-Pacific Inertial Sensor MEMS Market Insight

The Asia-Pacific inertial sensor MEMS market is poised to grow at the fastest CAGR during 2025–2032, fueled by rapid industrialization, urbanization, and rising demand for consumer electronics. Countries such as China, Japan, and India are driving significant adoption, supported by increasing disposable incomes and a growing shift toward smart devices. The region’s expanding automotive and defense industries are further boosting sensor integration in navigation, stability, and safety systems. Moreover, APAC’s position as a global hub for semiconductor and MEMS manufacturing ensures cost-effective production and wider availability of advanced inertial sensors.

Japan Inertial Sensor MEMS Market Insight

The Japan inertial sensor MEMS market is witnessing strong momentum, supported by the country’s advanced electronics ecosystem and demand for high-precision applications. Widespread use of MEMS sensors in robotics, healthcare devices, and automotive systems is driving adoption. Japan’s emphasis on innovation, coupled with the growing presence of smart factories and industrial automation, reinforces demand. The increasing integration of sensors in wearables, gaming, and AR/VR devices also contributes to market expansion.

China Inertial Sensor MEMS Market Insight

The China inertial sensor MEMS market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its thriving consumer electronics and automotive industries. Rapid growth in smartphone production, coupled with rising demand for navigation and safety systems in vehicles, significantly boosts adoption. The country’s strong push toward smart manufacturing and industrial automation further propels demand for MEMS sensors. With government-backed initiatives in aerospace, defense, and smart city projects, China stands as the most influential market for MEMS inertial sensors in APAC.

Inertial Sensor MEMs Market Share

The inertial sensor MEMs industry is primarily led by well-established companies, including:

- Analog Devices, Inc. (U.S.)

- Bosch Sensortec GmbH (Germany)

- STMicroelectronics (Switzerland)

- Murata Manufacturing Co., Ltd. (Japan)

- TDK Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Honeywell International Inc. (U.S.)

- InvenSense Inc. (U.S.)

- KIONIX, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- MEMSIC, Inc. (U.S.)

- Silicon Sensing Systems Ltd. (U.K.)

- Sensonor AS (Norway)

- Memsic Inc. (U.S.)

- Epson Electronics America, Inc. (U.S.)

- LORD MicroStrain Sensing Systems (U.S.)

- Maxim Integrated (U.S.)

- Colibrys Ltd. (Switzerland)

- KVH Industries, Inc. (U.S.)

- TDK Corporation (Japan)

Latest Developments in Global Inertial Sensor MEMs Market

- In June 2025, TDK Corporation expanded its MEMS inertial sensors portfolio with the launch of the Tronics AXO315®T0, a high-temperature MEMS accelerometer featuring a ±14 g input range and digital interface. Targeted for measurement while drilling (MWD) applications in the energy market, this innovation addresses the growing need for precise sensing in harsh environments such as oil and gas exploration. By enhancing performance under extreme temperature conditions, TDK strengthens its competitive positioning in industrial-grade MEMS sensors and taps into the expanding demand for energy sector digitalization and safety-critical applications

- In May 2025, Inertial Labs, a VIAVI Solutions Inc. company, introduced the IMU-H100, a MEMS-based inertial measurement unit (IMU) designed to enhance tactical guidance and navigation in unmanned aerial vehicles (UAVs), short-range missiles, and precision-guided munitions. Beyond defense applications, the IMU-H100 also serves commercial markets, such as autonomous systems and robotics. This launch reinforces Inertial Labs’ presence in the growing defense electronics market, while also broadening adoption of MEMS inertial sensors across dual-use applications where reliability and precision are critical

- In December 2023, Panasonic Life Solutions India’s Industrial Devices Division unveiled a 6-in-1, 6DoF (Degrees of Freedom) inertial sensor capable of measuring acceleration and angular rate across three axes (X, Y, Z). Designed with ISO26262 Functional Safety Standards, including ASIL-D certification, the sensor enhances vehicle safety and stability in mission-critical automotive systems. This launch strengthens Panasonic’s role in the automotive MEMS sensor market by addressing the rising global demand for advanced safety features in electric and autonomous vehicles, aligning with stricter automotive safety regulations

- In October 2023, Analog Devices, Inc. launched a next-generation MEMS accelerometer with improved accuracy and integration capabilities, focusing on consumer electronics and automotive markets. This innovation expands ADI’s presence in smartphones, wearables, and advanced driver assistance systems (ADAS), where high accuracy is crucial for motion sensing and stability. By offering greater precision and ease of integration, the development drives broader adoption of MEMS accelerometers in mass-market and safety-critical applications, boosting ADI’s competitive advantage

- In September 2023, Bosch Sensortec GmbH introduced a high-performance MEMS gyroscope with enhanced stability and low power consumption, targeting industrial and healthcare applications. This innovation addresses the increasing demand for energy-efficient, reliable sensors in robotics, medical devices, and diagnostic equipment. By improving power efficiency without compromising accuracy, Bosch is well-positioned to capture growth in the industrial IoT and healthcare device markets, where continuous monitoring and precision are essential

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.