Global Infant Formula Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

44.55 Billion

USD

63.49 Billion

2024

2032

USD

44.55 Billion

USD

63.49 Billion

2024

2032

| 2025 –2032 | |

| USD 44.55 Billion | |

| USD 63.49 Billion | |

|

|

|

|

Infant Formula Ingredients Market Size

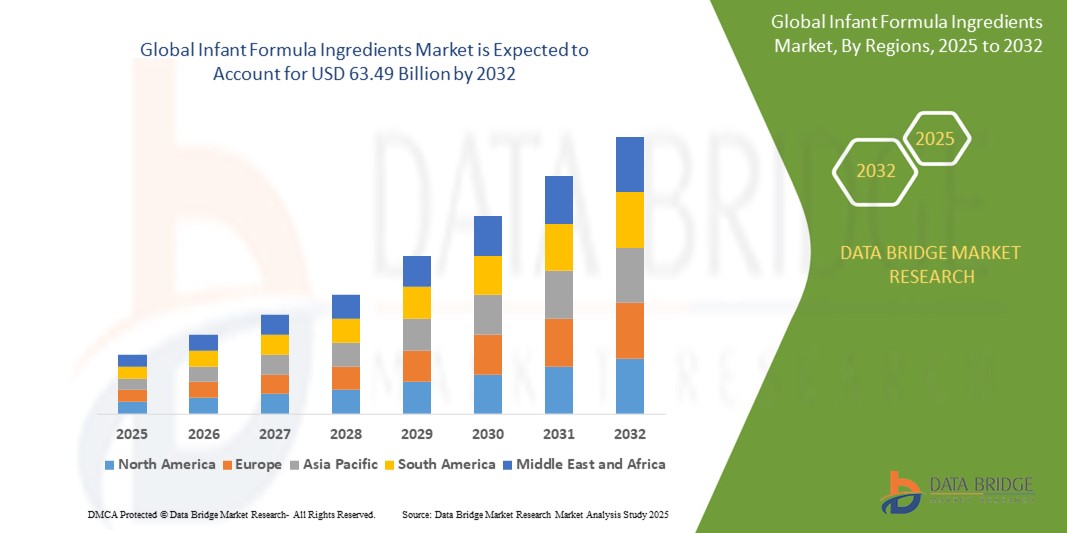

- The global infant formula ingredients market size was valued at USD 44.57 billion in 2024 and is expected to reach USD 63.49 billion by 2032, at a CAGR of 4.52 % during the forecast period

- This growth is driven by factors such as the rising number of working mothers, increasing awareness of infant nutrition, and demand for formula products that closely mimic breast milk

Infant Formula Ingredients Market Analysis

- The infant formula ingredients market is seeing steady growth as manufacturers focus on replicating the nutritional profile of human milk through advanced formulations

- Demand for high-quality, functional ingredients such as prebiotics and probiotics is driving innovation and product development in the market

- Asia-Pacific is expected to dominate the Infant formula ingredients market due to high birth rates, rising disposable incomes, and growing awareness of infant nutrition in countries such as China and India. China alone contributes to more than 30.5% of global infant formula sales, driven by demand for premium and organic formulations. India also shows strong growth potential due to its expanding consumer base and increasing demand for high-quality infant formula products.

- North America is expected to be the fastest growing region in the infant formula ingredients market during the forecast period due to rising awareness of product benefits, a growing working female population, and increasing preference for premium, organic, and plant-based formulas. The U.S., which accounts for over 60.5% of North America’s infant formula sales, benefits from strong regulatory standards and high consumer trust. Canada is also contributing to regional growth through government support for nutrient-enriched and sustainably sourced ingredients

- The follow-on formula segment is expected to dominate the Infant Formula Ingredients market with the largest share of 54.1% in 2025 due to its critical role in meeting the evolving nutritional needs of infants aged 6 to 12 months. As infants transition from exclusive breastfeeding or standard formula, follow-on formulas offer enhanced levels of iron, protein, and essential vitamins to support rapid growth and development. The increasing number of working mothers, rising awareness of child health, and expanding availability of fortified and specialty formulas have further accelerated its demand globally. Additionally, innovations in product formulations, including organic and hypoallergenic variants, are boosting consumer confidence and adoption.

Report Scope and Infant Formula Ingredients Market Segmentation

|

Attributes |

Infant Formula Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Infant Formula Ingredients Market Trends

“Increasing Demand for Organic and Clean-Label Infant Formula Ingredients”

- Parents are increasingly seeking organic and clean-label infant formulas to ensure safe and natural nutrition for their babies

- Brands are shifting to formulations free from synthetic additives, artificial flavors, and genetically modified ingredients to meet this demand

- For instance, Danone launched an organic formula line with simplified, transparent ingredients to align with parental preferences

- Nestlé has expanded its range with clean-label products that comply with EU organic certifications and sustainable sourcing practices

- Stricter global regulations and consumer advocacy are encouraging companies to adopt clean-label standards, boosting trust and driving market growth

Infant Formula Ingredients Market Dynamics

Driver

“Rising Demand for High-Quality Infant Nutrition”

- Growing urbanization and evolving lifestyles have led to a decline in breastfeeding practices, especially as more women join the workforce, increasing reliance on infant formula as a primary source of nutrition

- For instance, in countries such as Japan and the U.S., urban working mothers are significantly more such likely to use infant formula due to demanding schedules

- Rising awareness among parents about the importance of early childhood nutrition is driving the demand for high-quality ingredients in infant formula

- Manufacturers are focusing on developing formulas that closely resemble human breast milk to support cognitive, digestive, and immune system development

- For instance, companies are integrating bioactive proteins and prebiotics to replicate the natural composition of breast milk

- Increased disposable income, particularly in emerging economies, allows families to opt for premium and specialized infant nutrition products

- Consumer interest in tailored nutrition, including lactose-free, hypoallergenic, and organic formulations, is expanding product variety and encouraging innovation in ingredient development across the market

Opportunity

“Technological Advancements in Ingredient Processing”

- Technological advancements in processing methods are enabling the development of next-generation infant formula ingredients that mimic the composition of human breast milk

- For instance, enzymatic hydrolysis is being used to break down proteins for easier digestion in infants with sensitive stomachs

- Innovations such as microencapsulation and precision fermentation help preserve the nutritional value and improve the stability of sensitive compounds such as omega-3 fatty acids and probiotics

- Human-identical milk oligosaccharides are now being produced through fermentation techniques, enhancing gut health and immunity in infants

- Advanced filtration and drying technologies are improving ingredient purity, solubility, and shelf life, which is crucial for high-quality infant nutrition products

- These processing innovations are creating opportunities for premium and specialized formula products, meeting the needs of infants with dietary sensitivities or specific nutritional requirements

Restraint/Challenge

“Stringent Regulatory Environment”

- The infant formula ingredients market is heavily regulated due to the direct impact of infant nutrition on child health and development, making compliance complex and time-consuming

- Stringent safety, labeling, and quality standards vary by region, increasing the cost and complexity of global distribution and regulatory approval

- The inclusion of novel ingredients such as human milk oligosaccharides or probiotics often faces delays due to prolonged clinical trials and safety validations

- For instance, HMOs require extensive research and regulatory scrutiny before approval in markets such as the European Union or the U.S.

- Sudden regulatory changes, such as labeling updates or advertising restrictions, can lead to costly product reformulations and packaging redesigns

- Smaller companies with limited resources often struggle to meet these regulatory demands, hindering innovation and slowing their market penetration or expansion

Infant Formula Ingredients Market Scope

The market is segmented on the basis of ingredient type, form, source, and application.

|

Segmentation |

Sub-Segmentation |

|

By Ingredient Type |

|

|

By Form |

|

|

By Source |

|

|

By Application |

|

In 2025, the follow-on formula is projected to dominate the market with a largest share in ingredient type segment

The follow-on formula segment is expected to dominate the Infant Formula Ingredients market with the largest share of 54.1% in 2025 due to its critical role in meeting the evolving nutritional needs of infants aged 6 to 12 months. As infants transition from exclusive breastfeeding or standard formula, follow-on formulas offer enhanced levels of iron, protein, and essential vitamins to support rapid growth and development. The increasing number of working mothers, rising awareness of child health, and expanding availability of fortified and specialty formulas have further accelerated its demand globally. Additionally, innovations in product formulations, including organic and hypoallergenic variants, are boosting consumer confidence and adoption.

The powder is expected to account for the largest share during the forecast period in form segment

In 2025, the powder segment is expected to dominate the market with the largest market share due to its longer shelf life, ease of storage, and cost-effectiveness compared to liquid and semi-liquid forms. Powdered formulas are also more convenient for transportation and bulk purchasing, making them highly preferred in both developed and emerging markets. Additionally, the growing demand in regions such as Asia-Pacific, where affordability and product availability are key concerns, further supports its dominance. Manufacturers also favour powdered forms due to lower production and packaging costs, enhancing profitability.

Infant Formula Ingredients Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Infant Formula Ingredients Market”

- Asia Pacific holds the largest share in the infant formula ingredients market, accounting for over 46.5% of the global market

- The dominance of this region is driven by high birth rates, rising disposable incomes, and increasing awareness of infant nutrition, particularly in countries such as China and India

- China contributes to more than 30.5% of global infant formula sales, fuelled by strong demand for premium and organic formulations

- India demonstrates a robust the infant formula market, highlighting the country’s expanding consumer base and rising demand for high-quality infant formula products

“North America is Projected to Register the Highest CAGR in the Infant Formula Ingredients Market”

- North America is projected to experience substantial growth in the infant formula ingredients market, with the U.S. registering a high CAGR during the forecast period

- The growth in this region is attributed to increasing awareness of product benefits, a rising working female population, and a preference for premium, organic, and plant-based infant formulas

- The U.S. accounts for over 60.5% of North America’s infant formula sales, benefiting from strong regulatory oversight and consumer trust in product safety and quality

- Canada is also experiencing strong demand, with government initiatives supporting nutrient-enriched formulations and sustainable ingredient sourcing

Infant Formula Ingredients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Arla Foods Ingredients Group P/S (Denmark)

- Plum PBC (U.S.)

- The Honest Company, Inc. (U.S.)

- AAK AB (Sweden)

- Abbott (U.S.)

- Carbery Food Ingredients Limited (Ireland)

- BASF SE (Germany)

- DSM (Netherlands)

- Glanbia PLC. (Ireland)

- Vitablend Nederland B.V. (Netherlands)

- Co-operative Group Limited (U.K.)

- FrieslandCampina (Netherlands)

- Lactalis Ingredients (France)

- Kerry Group plc (Ireland)

- Chr. Hansen A/S, part of Novonesis (Denmark)

Latest Developments in Global Infant Formula Ingredients Market

- In September 2021, Bunge Loders Croklaan, the plant-based lipids division of U.S.-based Bunge, launched Betapol Organic, the first certified organic OPO (Oleic-Palmitic-Oleic or SN-2 palmitate) in both the Chinese and European markets. This launch represents a major step in the company’s efforts to provide organic ingredient solutions, especially for infant nutrition, aligning with growing consumer demand for clean-label and organic products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Infant Formula Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Infant Formula Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Infant Formula Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.