Global Infection Surveillance Solutions Systems Market

Market Size in USD Million

CAGR :

%

USD

832.00 Million

USD

2,259.24 Million

2025

2033

USD

832.00 Million

USD

2,259.24 Million

2025

2033

| 2026 –2033 | |

| USD 832.00 Million | |

| USD 2,259.24 Million | |

|

|

|

|

Infection Surveillance Solutions Systems Market Size

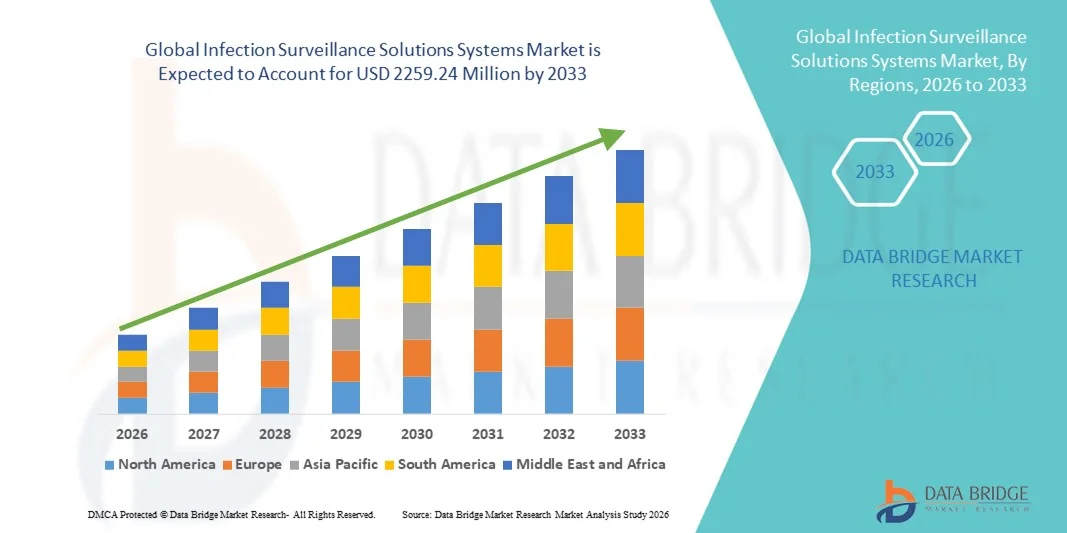

- The global infection surveillance solutions systems market size was valued at USD 832.00 Million in 2025 and is expected to reach USD 2259.24 Million by 2033, at a CAGR of 13.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital healthcare technologies, advanced monitoring systems, and data-driven infection control protocols in hospitals and healthcare facilities

- Furthermore, rising awareness among healthcare providers about hospital-acquired infections and regulatory requirements for patient safety is accelerating the uptake of Infection Surveillance Solutions Systems, thereby significantly boosting the industry's growth

Infection Surveillance Solutions Systems Market Analysis

- Infection Surveillance Solutions Systems, offering digital monitoring, real-time analytics, and automated reporting for healthcare-associated infections, are increasingly vital components of modern hospital and clinical infection control programs due to their ability to enhance patient safety, streamline workflows, and ensure regulatory compliance

- The escalating demand for infection surveillance solutions is primarily fueled by rising awareness of hospital-acquired infections, stringent regulatory requirements, and the growing need for data-driven infection prevention strategies

- North America dominated the infection surveillance solutions systems market with the largest revenue share of 45% in 2025, supported by well-established healthcare infrastructure, high adoption of digital health solutions, and the presence of leading market players, with the U.S. experiencing substantial growth in infection surveillance system implementations driven by technological advancements, increasing patient safety initiatives, and strong R&D investments

- Asia-Pacific is expected to be the fastest-growing region in the infection surveillance solutions systems market during the forecast period, with a market share in 2025, driven by increasing healthcare digitization, rising awareness of infection prevention, and growing investments in hospitals and clinics across countries such as China, India, and Japan

- The Software segment dominated the largest market revenue share of 45.5% in 2025, driven by hospitals and healthcare facilities increasingly adopting automated infection detection platforms for real-time monitoring and compliance reporting

Report Scope and Infection Surveillance Solutions Systems Market Segmentation

|

Attributes |

Infection Surveillance Solutions Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Infection Surveillance Solutions Systems Market Trends

Enhanced Convenience Through AI and Data-Driven Integration

- A significant and accelerating trend in the global infection surveillance solutions systems market is the growing integration of advanced analytics, artificial intelligence (AI), and cloud-based platforms into infection surveillance workflows. This enables real-time monitoring, predictive outbreak detection, and automated reporting, which enhances hospital and public health decision-making

- For instance, AI-enabled infection surveillance systems can automatically detect patterns in hospital-acquired infections (HAIs), flag anomalies, and generate alerts for infection control teams, reducing manual tracking and improving response time

- Machine learning algorithms help predict potential outbreaks by analyzing historical infection data, patient demographics, and environmental conditions, which allows proactive preventive measures

- Cloud-based platforms provide centralized dashboards for infection trends across multiple facilities, enabling healthcare administrators to monitor compliance, report metrics, and benchmark performance efficiently

- Integration with electronic health records (EHRs) and laboratory information systems (LIS) allows automatic data ingestion, reducing errors and ensuring accurate reporting for regulatory requirements

- Predictive and prescriptive analytics facilitate targeted interventions, helping healthcare providers allocate resources effectively and prioritize high-risk areas or patient populations

- Automated reporting features improve compliance with local, regional, and international infection control standards and regulations

- The adoption of mobile and remote monitoring tools enables staff to receive instant alerts on potential infection risks, even outside hospital premises, improving patient safety and operational efficiency

- Cloud-enabled platforms also support collaborative research and benchmarking, allowing hospitals and clinics to share anonymized data for better infection management strategies

- Companies such as Cerner, Hillrom, and BioMérieux are actively enhancing their solutions with AI-driven dashboards and integrated reporting capabilities

- The trend toward data-driven, connected infection surveillance systems is fundamentally transforming infection prevention protocols and shaping new standards for patient safety

- Hospitals and public health agencies are increasingly prioritizing AI-augmented infection surveillance tools to achieve faster detection, reduced infection rates, and improved operational efficiency

Infection Surveillance Solutions Systems Market Dynamics

Driver

Growing Need for Real-Time Infection Monitoring and Regulatory Compliance

- Rising awareness about hospital-acquired infections (HAIs) and the critical need for timely detection is a major driver of market growth

- For instance, in March 2024, BioMérieux launched its EPISEQ® HAI solution, which combines next-generation sequencing and automated reporting for rapid infection outbreak detection in healthcare facilities

- Increasing regulatory scrutiny and mandatory reporting requirements by organizations such as the CDC and WHO are compelling healthcare facilities to adopt advanced surveillance systems

- Integration of AI and analytics in infection surveillance helps facilities detect, track, and respond to infections in real-time, reducing the spread of HAIs and improving patient outcomes

- Hospitals are investing in automated infection surveillance to minimize manual data collection, reduce errors, and accelerate compliance with regulatory standards

- Growing focus on patient safety, along with the rising adoption of electronic health record (EHR) systems, is driving demand for integrated infection surveillance solutions

- The emergence of cloud-based and mobile-enabled solutions allows remote monitoring and data-driven decision-making, which enhances workflow efficiency

- Increasing hospital digitalization, including IoT-connected medical devices and laboratory systems, supports the adoption of comprehensive infection surveillance solutions

- Vendors are expanding their portfolios to include predictive analytics, enabling facilities to forecast infection outbreaks and optimize preventive interventions

- In July 2023, Hillrom (BD) expanded its infection prevention portfolio by launching a cloud-based analytics platform to track HAIs across multiple hospital locations in real-time

- Adoption is further accelerated by the global focus on pandemic preparedness and proactive infection control strategies across healthcare facilities

- The integration of automated dashboards, alerts, and reporting tools ensures faster decision-making, contributing to better clinical outcomes and operational efficiency

Restraint/Challenge

Data Privacy, High Implementation Costs, and Integration Complexity

- Concerns regarding patient data security and privacy pose a major challenge to wider adoption, as infection surveillance systems handle sensitive health information

- For instance, in October 2022, a regional healthcare provider experienced data access issues during EHR integration with an infection monitoring system, highlighting potential cybersecurity risks

- The relatively high upfront investment required for advanced infection surveillance systems, including software, AI modules, and staff training, can hinder adoption, especially in developing regions

- Integration with existing EHRs, LIS, and hospital workflows can be complex, requiring dedicated IT resources and specialized training for staff to fully leverage the system’s capabilities

- Healthcare facilities may face operational challenges during the initial deployment phase, including system downtime, workflow disruption, and staff adaptation

- Continuous software updates, maintenance, and technical support are required to ensure reliable performance, adding to operational expenses

- Some smaller clinics and ambulatory care centers may delay adoption due to cost and lack of in-house technical expertise

- Ensuring interoperability across multiple hospital departments and devices is crucial to gain full value from surveillance solutions but can be challenging to implement

- Cloud-based platforms require reliable network infrastructure, which may be limited in certain regions, affecting real-time monitoring capabilities

- Addressing these challenges through robust encryption, compliance with data protection regulations (HIPAA, GDPR), and modular, cost-effective solutions will be essential for sustained market growth

- Vendor collaborations, government incentives, and scalable subscription-based delivery models are emerging as potential solutions to overcome cost and integration barriers

- As technology evolves, the market is expected to focus on secure, cost-effective, and highly interoperable solutions to drive broader adoption across healthcare settings

Infection Surveillance Solutions Systems Market Scope

The market is segmented on the basis of products, infection type, and end-user.

- By Products

On the basis of products, the Infection Surveillance Solutions Systems market is segmented into Software and Services. The Software segment dominated the largest market revenue share of 45.5% in 2025, driven by hospitals and healthcare facilities increasingly adopting automated infection detection platforms for real-time monitoring and compliance reporting. Software solutions provide robust analytics, predictive modeling, and integration with electronic health records (EHRs), enabling rapid identification of hospital-acquired infections (HAIs). The demand for software is further fueled by regulatory compliance requirements and the need for centralized dashboards to monitor multiple infection types across departments. Advanced analytics embedded within software solutions support trend detection and proactive interventions, reducing patient risk and improving clinical outcomes. Hospitals and academic institutes prefer software platforms due to their scalability and long-term cost efficiency compared to manual tracking systems. The growing prevalence of surgical site infections (SSI), bloodstream infections (BSI), and urinary tract infections (UTI) increases reliance on automated software systems. Continuous updates, AI-powered analytics, and interoperability with existing hospital IT infrastructure strengthen the segment’s dominance. Market leaders, such as Cerner, Hillrom, and BioMérieux, are enhancing software offerings with predictive alerting, mobile monitoring, and cloud-based deployment. Furthermore, software adoption supports multi-facility monitoring, benchmarking, and regulatory submissions, adding operational and strategic value.

The Services segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, driven by the rising need for specialized infection control consulting, data management, training, and implementation support. Hospitals, long-term care facilities, and clinics are increasingly outsourcing infection surveillance services to reduce internal workload and improve compliance with standards. Services include setup of surveillance protocols, staff training, and remote monitoring support. The rising prevalence of complex procedures and multi-drug-resistant infections fuels demand for expert services. Outsourced services also allow smaller hospitals and clinics to access advanced analytics without heavy capital investment. Continuous service engagement ensures timely updates to systems and compliance with evolving healthcare regulations. The integration of AI and cloud-based solutions into service packages enhances predictive capabilities and real-time outbreak detection. Additionally, infection prevention organizations are providing subscription-based services with modular packages to suit varying facility sizes and needs. Rising awareness of patient safety, hospital accreditation requirements, and infection reduction targets further accelerate service adoption. The trend towards collaborative, outsourced infection surveillance is expected to expand globally, with North America and Europe leading in market uptake.

- By Infection Type

On the basis of infection type, the market is segmented into Surgical Site Infections (SSI), Bloodstream Infections (BSI), Urinary Tract Infections (UTI), Central Line-Associated Bloodstream Infections (CLABSI), Catheter-Associated Urinary Tract Infection (CAUTI), and Others. The Surgical Site Infections (SSI) segment held the largest market revenue share of 38.7% in 2025, owing to the high prevalence of post-surgical complications and the critical need for early detection. SSI surveillance is vital for hospitals to comply with regulatory requirements, avoid penalties, and enhance patient outcomes. Automated SSI monitoring systems reduce manual reporting errors and improve response times. Integration with EHRs and laboratory systems ensures real-time data capture and faster analysis. Hospitals with high surgical volumes rely heavily on SSI-focused modules for proactive infection management. The segment’s dominance is reinforced by the increasing number of elective surgeries, rising geriatric population, and growing awareness of infection prevention protocols. Advanced predictive analytics allow healthcare providers to identify risk factors and implement targeted preventive measures. Additionally, SSI-focused solutions facilitate benchmarking against national and international infection standards. The emergence of AI-driven SSI detection tools enhances predictive accuracy, reduces hospital stay durations, and mitigates treatment costs. SSI monitoring is also critical for maintaining hospital accreditation and improving public reporting metrics. The segment continues to attract investments from leading vendors for product enhancements.

The Catheter-Associated Urinary Tract Infection (CAUTI) segment is anticipated to witness the fastest CAGR of 21.3% from 2026 to 2033, driven by growing awareness of catheter-related infection risks in long-term care facilities and hospitals. Increasing use of indwelling catheters, aging patient populations, and rising incidence of multi-drug-resistant infections propel CAUTI surveillance adoption. Automated detection tools with real-time alerts reduce unnecessary catheterization and prevent prolonged catheter use. AI-enabled CAUTI monitoring allows predictive risk analysis and timely clinical interventions. End-users increasingly implement CAUTI-focused protocols to meet infection prevention targets and improve patient safety. Continuous training and support services for staff amplify adoption, particularly in long-term care and ambulatory settings. Hospitals are integrating CAUTI detection with broader infection surveillance software for comprehensive oversight. Regulatory guidelines and quality metrics emphasizing CAUTI reduction further drive market growth. Real-time monitoring, data analytics, and reporting capabilities enhance clinical decision-making and optimize patient outcomes. Smaller clinics and long-term care facilities increasingly rely on modular solutions for CAUTI surveillance due to lower implementation barriers. The segment’s growth is supported by global initiatives to reduce healthcare-associated infections and improve care quality.

- By End-User

On the basis of end-user, the market is segmented into Hospitals, Long-Term Care Facilities, Clinics, Ambulatory Surgical Centers, Academic Institutes, and Others. The Hospitals segment accounted for the largest market revenue share of 49.1% in 2025, driven by high patient volumes, complex procedures, and regulatory compliance mandates. Hospitals adopt comprehensive surveillance systems to track multiple infection types, improve patient safety, and optimize operational workflows. Integration with EHRs and laboratory systems allows real-time reporting, predictive analytics, and benchmarking. High surgical volumes, intensive care units (ICUs), and multi-specialty operations necessitate robust infection surveillance platforms. Vendors offer tailored software solutions and service packages to meet hospitals’ scale and complexity requirements. Automated dashboards provide centralized monitoring, audit trails, and compliance reporting. Hospital administrators increasingly prioritize infection surveillance to reduce HAIs, minimize penalties, and improve accreditation ratings. The segment’s dominance is reinforced by global health initiatives and increased funding for patient safety and infection control.

The Long-Term Care Facilities segment is expected to witness the fastest CAGR of 22.0% from 2026 to 2033, fueled by the rising aging population and the high susceptibility of residents to HAIs, including UTIs, CAUTI, and bloodstream infections. Infection surveillance adoption in long-term care facilities helps prevent outbreaks, monitor chronic conditions, and reduce hospitalization rates. Predictive analytics and automated alert systems are increasingly implemented to manage infection risks in elderly care settings. Modular, cloud-based solutions allow smaller facilities to deploy scalable monitoring without significant infrastructure investments. Regulatory pressures and quality reporting requirements for elder care drive adoption further. Training and support services for staff enhance compliance and operational efficiency. Remote monitoring capabilities enable oversight across multiple facilities, improving infection management outcomes. Partnerships with software vendors and service providers facilitate continuous surveillance and timely intervention. Growth in government-funded programs to improve long-term care quality supports rapid adoption of advanced infection monitoring solutions.

Infection Surveillance Solutions Systems Market Regional Analysis

- North America dominated the infection surveillance solutions systems market with the largest revenue share of 45% in 2025

- Supported by a well-established healthcare infrastructure, strong adoption of digital health solutions, and the presence of leading market players

- The market is witnessing substantial growth in infection surveillance system implementations due to technological advancements, increasing patient safety initiatives, and robust R&D investments aimed at improving hospital infection control protocols

U.S. Infection Surveillance Solutions Systems Market Insight

The U.S. infection surveillance solutions systems market captured the largest revenue share within North America in 2025. Growth is primarily driven by widespread adoption of AI- and analytics-based infection monitoring platforms, rising investments in hospital IT infrastructure, and a focus on improving patient safety and compliance with regulatory standards. The implementation of real-time monitoring and predictive analytics solutions further accelerates market expansion across hospitals, long-term care facilities, and clinics.

Europe Infection Surveillance Solutions Systems Market Insight

The Europe infection surveillance solutions systems market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent infection control regulations and the rising need for advanced digital surveillance in hospitals and clinics. Adoption is further encouraged by increasing healthcare IT investments and a growing focus on minimizing hospital-acquired infections across both public and private healthcare settings.

U.K. Infection Surveillance Solutions Systems Market Insight

The U.K. infection surveillance solutions systems market is expected to grow at a noteworthy CAGR during the forecast period, driven by government initiatives promoting digital health adoption, rising demand for infection prevention solutions, and a focus on enhancing patient safety in hospitals and care facilities.

Germany Infection Surveillance Solutions Systems Market Insight

The Germany infection surveillance solutions systems market is anticipated to expand at a considerable CAGR, supported by strong healthcare infrastructure, increasing awareness of infection control, and high adoption of advanced digital monitoring systems. Germany’s emphasis on innovation and quality healthcare services further stimulates market growth in hospitals and long-term care facilities.

Asia-Pacific Infection Surveillance Solutions Systems Market Insight

The Asia-Pacific infection surveillance solutions systems market is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare digitization, rising awareness of infection prevention, and growing investments in hospitals, clinics, and long-term care facilities across countries such as China, India, and Japan.

Japan Infection Surveillance Solutions Systems Market Insight

The infection surveillance solutions systems market is witnessing steady growth due to rapid adoption of digital health solutions, an aging population, and increasing focus on patient safety. Hospitals and clinics are implementing advanced infection monitoring systems to improve clinical outcomes and comply with stringent health regulations.

China Infection Surveillance Solutions Systems Market Insight

The China infection surveillance solutions systems market accounted for the largest revenue share in Asia-Pacific in 2025, supported by increasing healthcare digitization, expanding hospital networks, and high adoption of AI- and analytics-based infection surveillance platforms. Government initiatives promoting infection prevention and investments in hospital infrastructure further drive market growth.

Infection Surveillance Solutions Systems Market Share

The Infection Surveillance Solutions Systems industry is primarily led by well-established companies, including:

• VigiLanz (U.S.)

• BD (U.S.)

• Sentinel Healthcare (U.S.)

• Streamline Health (U.S.)

• Spok, Inc. (U.S.)

• ICNet (U.S.)

• Mediware Information Systems (U.S.)

• Accuity, Inc. (U.S.)

• Cerner Corporation (U.S.)

• Epic Systems Corporation (U.S.)

• Oracle Health Sciences (U.S.)

• Allscripts Healthcare Solutions (U.S.)

• SAS Institute (U.S.)

Latest Developments in Global Infection Surveillance Solutions Systems Market

- In February 2023, the U.S.‑based company Becton, Dickinson and Company (BD) announced an expanded commitment to antimicrobial‑resistance surveillance, pledging to enhance infection prevention programmes and deploy new digital surveillance tools across its global healthcare network

- In April 2023, the national health authorities of Bangladesh launched a rule‑based AI‑driven digital surveillance system for COVID‑19 in cooperation with local health agencies, enabling automated triage, symptom tracking and case‑management workflows for community and hospital settings

- In December 2024, a market‑release announcement stated that the global infection surveillance solutions market is forecast to reach USD 2.01 billion by 2032, driven by heightened demand for hospital‑acquired‑infection monitoring and regulatory compliance solutions

- In January 2025, the UK Health Security Agency (UKHSA) launched a metagenomics‑based surveillance programme (VetCLIN‑AMR) to monitor antimicrobial resistance in companion animals and map zoonotic transmission risk, thereby extending infection‑surveillance tools beyond human acute care settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.