Global Infectious Diseases Small Molecule Api Market

Market Size in USD Billion

CAGR :

%

USD

27.79 Billion

USD

44.29 Billion

2024

2032

USD

27.79 Billion

USD

44.29 Billion

2024

2032

| 2025 –2032 | |

| USD 27.79 Billion | |

| USD 44.29 Billion | |

|

|

|

Infectious Diseases Small Molecule API Market Analysis

The infectious diseases small molecule API market is experiencing robust growth, fueled by the escalating global prevalence of infectious diseases, the rise in antimicrobial resistance (AMR), and ongoing breakthroughs in drug discovery and development. As AMR continues to be a growing concern, there is a pressing need for new small molecule APIs that can effectively combat resistant pathogens, including antibiotic-resistant bacteria and viral infections. The global healthcare community is focused on developing new classes of antibiotics, antivirals, and antifungals to address this critical issue. In particular, the development of novel small molecules is essential in tackling multi-drug-resistant strains of diseases like HIV, tuberculosis (TB), malaria, hepatitis, and COVID-19.

Recent advancements in genomics, high-throughput screening, CRISPR technology, and artificial intelligence (AI) are facilitating the discovery of targeted small molecule therapies, allowing for more precise and effective treatments for a wide range of infectious diseases. For example, technologies like genomic sequencing are enabling pharmaceutical companies to design drugs that target specific strains of pathogens, enhancing efficacy and reducing the potential for resistance.

Infectious Diseases Small Molecule API Market Size

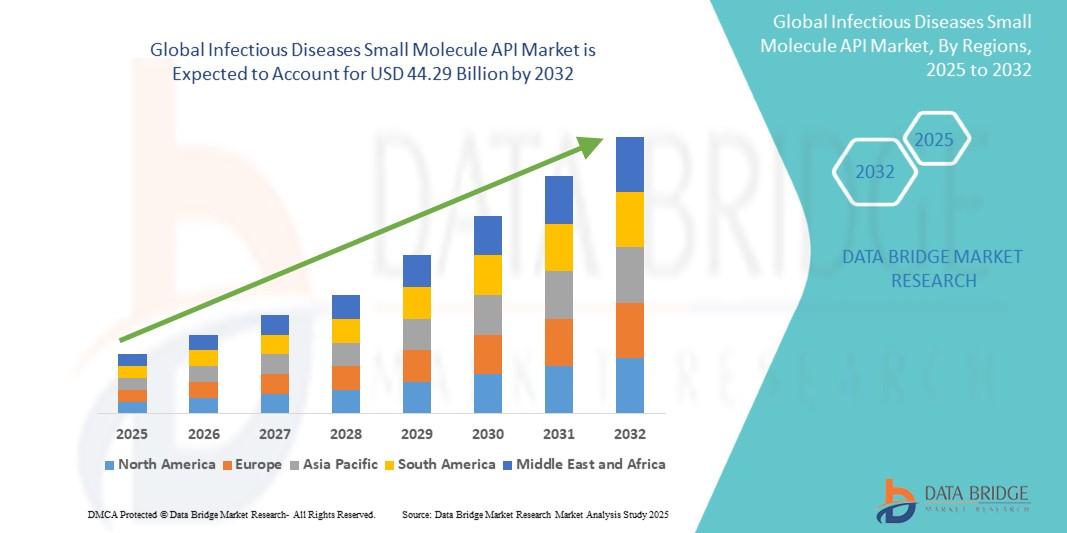

The global infectious diseases small molecule API market size was valued at USD 27.79 billion in 2024 and is projected to reach USD 44.29 billion by 2032, with a CAGR of 6.00% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Infectious Diseases Small Molecule API Market Trends

“Growing Antibiotic Resistance and the Demand for Novel Drugs”

A key trend driving the infectious diseases small molecule API market is the escalating issue of antimicrobial resistance (AMR), which has created an urgent need for novel, effective antibiotics. As bacteria develop resistance to current treatments, there is a growing demand for new small molecules capable of targeting these resistant strains. Governments and global health organizations are actively supporting research into new antibiotics, with initiatives such as the Antimicrobial Resistance Innovation Fund promoting investment in AMR-focused drug development. For instance, the introduction of new antibiotic classes like ceftolozane-tazobactam and meropenem-vaborbactam is specifically aimed at combating multi-drug-resistant bacterial infections.

Report Scope and Infectious Diseases Small Molecule API Market Segmentation

|

Attributes |

Infectious Diseases Small Molecule API Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Italy, Spain, Russia, Denmark, Norway, Sweden, Rest of Europe in Europe, China, Japan, India, Indonesia, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Kuwait, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott (U.S.), AstraZeneca (United Kingdom), B. Braun SE (Germany), BioCryst Pharmaceuticals, Inc. (U.S.), Boehringer Ingelheim International GmbH (Germany), Bristol-Myers Squibb Company (U.S.), Cardinal Health (U.S.), DAIICHI SANKYO COMPANY, LIMITED (Japan), F. Hoffmann-La Roche Ltd (Switzerland), GE HealthCare (U.S.), Gilead Sciences, Inc. (U.S.), GSK plc. (UK), Johnson & Johnson Services, Inc. (U.S.), Merck & Co., Inc. (U.S.), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Sanofi (France), Shionogi & Co., Ltd. (Japan), Takeda Pharmaceutical Company Limited (Japan), Teva Pharmaceutical Industries Ltd. (Israel), and Vir Biotechnology, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Infectious Diseases Small Molecule API Market Definition

An infectious diseases small molecule active pharmaceutical ingredient (API) refers to the chemically synthesized, low molecular weight compounds that serve as the biologically active core of medications used to treat infectious diseases. These APIs are designed to target specific pathogens, including bacteria, viruses, fungi, or parasites, to inhibit their growth, replication, or survival within the host.

Infectious Diseases Small Molecule API Market Dynamics

Drivers

- Rising Prevalence of Infectious Diseases

Technological advancements in drug discovery and pharmacogenomics are significantly driving the growth of the infectious diseases small molecule API market. Techniques like high-throughput screening, CRISPR technology, and artificial intelligence (AI) are accelerating the development of novel small molecule APIs by enabling faster, more precise identification of potential drug candidates. In addition, improved understanding of the genetic makeup of pathogens has facilitated the creation of more targeted therapies, increased efficacy and reducing the risk of resistance. This trend is particularly important in combating antimicrobial resistance (AMR). For instance, Sofosbuvir, a direct-acting antiviral for hepatitis C, was developed using advanced drug discovery methods, showcasing the potential for more effective treatments against resistant infectious diseases. These technological advancements are pivotal in accelerating the market growth.

- Increasing Investment in Antiviral Research

The growing emphasis on antiviral treatments, particularly after the outbreaks of COVID-19, Zika, and Ebola, has led to a surge in investments aimed at developing new small molecule antiviral APIs. As viral infections remain a critical global health challenge, the demand for innovative antiviral drugs has become a key focus for both pharmaceutical companies and research institutions. For instance, the approval of Paxlovid (Nirmatrelvir + Ritonavir) for COVID-19 represents a significant advancement in antiviral drug development, highlighting the increasing demand for effective small molecule therapies. This trend is driving substantial growth in the Infectious Diseases Small Molecule API Market, as the global need for antiviral solutions continues to grow.

Opportunities

- Increasing Global Focus on Health and Pandemic Preparedness

The COVID-19 pandemic has highlighted the critical need for faster drug development and improved preparedness for future pandemics. In response, governments and international bodies are significantly boosting investments in infectious disease research, accelerating the development of both vaccines and therapeutics. This intensified focus has led to a sharp rise in demand for small molecule APIs, especially for emerging viral infections. For instance, the emergency use authorization (EUA) of Remdesivir for the treatment of COVID-19 demonstrates how global health crises can quickly drive the development and deployment of essential APIs. This increased emphasis on rapid drug development and preparedness for infectious diseases presents significant market opportunities for small molecule APIs.

- Personalized Medicine in Infectious Disease Treatment

Advances in genomics and personalized medicine are creating significant opportunities for the development of targeted small molecule therapies. These treatments can be customized to address specific strains of viruses or bacteria, or to suit individual patient profiles, improving both efficacy and minimizing side effects. As our understanding of infectious diseases at the molecular level grows, developing personalized treatments will become essential for optimizing therapeutic outcomes. The creation of APIs for personalized treatment regimens, particularly for diseases such as hepatitis, HIV, and malaria, where the genetic profile of the pathogen plays a crucial role in determining treatment success.

Restraints/Challenges

- Antimicrobial Resistance (AMR)

Antimicrobial resistance represents a major challenge as bacteria and other pathogens evolve resistance to current antibiotics and antivirals, identifying new small molecules that can effectively target these resistant strains becomes more difficult. The development of new antibiotics, antivirals, and antifungals capable of combating resistant pathogens is a complex, expensive, and time-intensive process. Developing novel antibiotics and antivirals that can overcome AMR is challenging due to the limited pipeline of new drugs, high research costs, and regulatory hurdles. For reference, the slow development and approval of new antibiotics to fight multi-drug-resistant tuberculosis (MDR-TB) and MRSA reflect the difficulty in addressing AMR effectively. This creates a hurdle to the market.

- High Development and Manufacturing Costs

The development of small molecule drugs for infectious diseases can be exceedingly expensive, often totaling billions of dollars for research, clinical trials, and regulatory approvals. This financial burden can limit the ability of smaller companies and biotech firms to invest in the development of infectious disease treatments. In addition, the production costs of small molecule APIs, especially for more complex drugs, can be substantial, creating challenges in regions with limited healthcare budgets, particularly in developing countries. The high costs associated with R&D, clinical trials, and regulatory compliance further discourage smaller firms from entering the market, ultimately slowing overall market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Infectious Diseases Small Molecule API Market Scope

The market is segmented on the basis of mode of treatment, infection type, formulation, API type application, distribution channel, and distribution type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Mode of Treatment

- Vaccines

- Drugs

Infection Type

- Viral

- Parasitic

- Fungal

- Bacterial

- Others

Formulation

- Oral

- Injectable

- Topical

API Type

- Antibiotics

- Antivirals

- Antifungals

- Antiprotozoals

- Anthelmintics

- Combination Therapies

Application

- HIV/AIDS

- Influenza

- Hepatitis

- Malaria

- Tuberculosis

- Others

Distribution Channel

- Clinic

- Hospitals

- Others

Distribution Type

- Direct Sales

- Wholesale Distribution

- Online Pharmacies

Infectious Diseases Small Molecule API Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, mode of treatment, infection type, formulation, API type application, distribution channel, and distribution type as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Italy, Spain, Russia, Denmark, Norway, Sweden, Rest of Europe in Europe, China, Japan, India, Indonesia, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Kuwait, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America leads the market, generating the highest revenue. The rising prevalence of infectious diseases and favorable reimbursement policies are key drivers expected to boost demand for infectious disease therapeutics in the region. In addition, the presence of numerous manufacturers in the U.S. and the growing number of clinical trials focused on developing new treatment options are anticipated to further strengthen the region's dominant market share.

The Asia Pacific region is projected to experience the fastest growth during the forecast period. Key factors driving this growth include the high prevalence of diseases like HIV, malaria, TB, and other infections, along with the rising incidence of these conditions. In addition, increasing investments in the prevention and diagnosis of infectious diseases are expected to further boost market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Infectious Diseases Small Molecule API Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Infectious Diseases Small Molecule API Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- AstraZeneca (United Kingdom)

- B. Braun SE (Germany)

- BioCryst Pharmaceuticals, Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Cardinal Health (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GE HealthCare (U.S.)

- Gilead Sciences, Inc. (U.S.)

- GSK plc. (UK)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Shionogi & Co., Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Vir Biotechnology, Inc. (U.S.)

Latest Developments in Infectious Diseases Small Molecule API Market

- In September 2024, BioCryst Pharmaceuticals, Inc. announced that it has been awarded a contract by the U.S. Department of Health and Human Services (HHS) valued at up to $69 million. This contract will cover the procurement of up to 95,625 doses of RAPIVAB (peramivir injection) over a five-year period for the treatment of influenza

- In October 2023, Vir Biotechnology, Inc. announced that the Biomedical Advanced Research and Development Authority (BARDA), part of the U.S. Department of Health and Human Services (HHS) Administration for Strategic Preparedness and Response (ASPR), awarded Vir approximately $50 million in new funding. The funding will support the advancement of novel monoclonal antibody (mAb) candidates and delivery solutions to enhance the use of mAbs in the treatment of COVID-19 and bolster pandemic preparedness and response

- In July 2023, Roche Diagnostics India announced the launch of Elecsys HCV Duo, India’s first fully automated immunoassay that enables the simultaneous and independent detection of both hepatitis C virus (HCV) antigen and antibody status from a single plasma or serum sample. The Elecsys HCV Duo assay enables significantly earlier (~3 weeks earlier) diagnosis of active hepatitis C virus infection compared to using antibody-only tests

- In January 2023, Thermo Fisher Scientific announced the launch of its CE-IVD-marked Applied Biosystems TaqPath Seq HIV-1 Genotyping Kit, a Sanger sequencing-based assay designed to analyze positive HIV samples and identify genetic variants that could confer resistance to commonly used antiretroviral therapies

- In December 2021, Roche completed the acquisition of TIB Molbiol to expand its PCR-test portfolio in the fight against emerging infectious diseases. Roche and TIB Molbiol built upon their capabilities for the rapid development of assays to detect emerging pathogens and potential health threats, including infectious diseases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.