Global Infectious Testing Market

Market Size in USD Billion

CAGR :

%

USD

6.36 Billion

USD

10.43 Billion

2024

2032

USD

6.36 Billion

USD

10.43 Billion

2024

2032

| 2025 –2032 | |

| USD 6.36 Billion | |

| USD 10.43 Billion | |

|

|

|

|

Infectious Testing Market Analysis

The global infectious testing market is experiencing robust growth due to advancements in diagnostic technologies and increased emphasis on early disease detection. Innovations such as next-generation sequencing and advanced molecular diagnostics are revolutionizing the field by offering more precise and rapid results. The market is also being driven by the rising incidence of infectious diseases and supportive healthcare policies that promote widespread testing. Additionally, the expansion of point-of-care testing solutions is improving accessibility and convenience for both patients and healthcare providers. The integration of digital technologies and AI in diagnostic tools is further enhancing the accuracy and efficiency of infectious testing, fueling continued market expansion. With ongoing research and development efforts, the market is set to benefit from more sophisticated testing methods and increased adoption across various healthcare settings.

Infectious Testing Market Size

The global infectious testing market size was valued at USD 6.36 billion in 2024 and is projected to reach USD 10.43 billion by 2032, with a CAGR of 6.38% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Infectious Testing Market Trends

“Integration of Advanced Molecular Diagnostics”

A contemporary market trend in the global infectious testing sector is the integration of advanced molecular diagnostics, particularly Polymerase Chain Reaction (PCR) and next-generation sequencing (NGS). Molecular diagnostics technologies are markedly enhancing the precision and speed of diagnostic results. PCR, for instance, has become a cornerstone of infectious disease testing, especially highlighted by its crucial role in the rapid detection of COVID-19. Its ability to amplify small quantities of viral RNA has enabled quick and accurate identification of the virus, even in early stages of infection. Meanwhile, NGS offers comprehensive genomic analysis, allowing for the detection of genetic variations and mutations that are critical for understanding and tracking pathogen evolution. Such rising trend towards more sophisticated molecular diagnostics not only improves diagnostic accuracy but also accelerates the response to emerging infectious diseases, positioning these technologies as central to the future of global infectious testing.

Report Scope and Infectious Testing Market Segmentation

|

Attributes |

Infectious Testing Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), BIOMÉRIEUX (France), BD (U.S.), Siemens Healthineers AG (Germany), Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc (U.S.), Sysmex Corporation (Japan), Beckman Coulter, Inc. (U.S.), Danaher Corporation (U.S.), Chembio Diagnostics, Inc. (U.S.), Cepheid (U.S.), Trinity Biotech (Ireland), Sekisui Diagnostics (Japan), QuidelOrtho Corporation (U.S.), MedMira Inc. (Canada), Quest Diagnostics Incorporated (U.S.), Bayer AG (Germany), Rapid Test Methods Ltd. (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Infectious Testing Market Definition

Infectious testing encompasses a variety of diagnostic procedures designed to identify infections caused by pathogens such as bacteria, viruses, fungi, and parasites. These tests include molecular techniques such as polymerase chain reaction (PCR) that detect pathogen genetic material, serological tests that measure antibodies or antigens in the blood, microbiological cultures that grow and identify microorganisms, and immunoassays that use antibodies to detect specific pathogens or their components. Such testing is essential for accurate diagnosis, effective treatment, and managing the spread of infectious diseases.

Infectious Testing Market Dynamics

Drivers

- Rising Prevalence of Infectious Diseases

Rising prevalence of infectious diseases is a significant driver of the infectious testing market, as the increasing incidences of diseases such as COVID-19, influenza, tuberculosis, and sexually transmitted infections elevate the demand for effective diagnostic solutions. For instance, the COVID-19 pandemic has dramatically underscored the need for rapid and accurate testing, with widespread use of PCR and antigen tests to identify and manage the virus. According to a report from the World Health Organization (WHO), since 2021, more than 13 billion COVID-19 vaccine doses have been administered globally, illustrating the surge in testing demand driven by the pandemic. Such heightened need for testing has spurred innovation and expansion in diagnostic technologies, highlighting the crucial role of diagnostic tests in controlling and understanding infectious disease outbreaks.

- Expansion of Healthcare Infrastructure

Expansion of healthcare infrastructure significantly impacts the infectious testing market by improving the availability and accessibility of diagnostic services, especially in emerging markets. In regions like Asia-Pacific and Latin America, substantial investments in healthcare facilities and diagnostic laboratories are driving market growth. For instance, the Indian government’s National Health Mission, which includes initiatives to upgrade medical infrastructure and expand diagnostic capabilities, has led to the establishment of numerous new diagnostic centers across the country. Similarly, Brazil's investment in healthcare infrastructure, such as the expansion of public health laboratories and integration of advanced diagnostic technologies, enhances the availability of testing services. Such developments not only increase access to diagnostic tests but also contribute to improved disease management and early detection, fueling overall market growth.

Opportunities

- Growth of Point-of-Care Testing (POCT)

The growth of point-of-care testing (POCT) is significantly expanding opportunities in the infectious testing market, driven by the demand for rapid and convenient diagnostic solutions. POCT devices are increasingly favored for their ability to provide immediate results at or near the patient’s location, reducing the wait time for diagnosis and enabling prompt treatment decisions. For instance, handheld diagnostic devices for influenza and strep throat, such as the Abbott ID NOW and Cepheid Xpert Xpress, offer rapid testing with results available within minutes. Such quick turnaround is particularly valuable in both clinical settings, such as emergency rooms, and remote or underserved areas where access to centralized laboratories may be limited. The convenience and efficiency of POCT not only improve patient outcomes by enabling timely treatment but also streamline healthcare workflows, driving further adoption and growth in the market.

- Development of Multiplex Testing Platforms

The development of multiplex testing platforms, which allow for the simultaneous detection of multiple pathogens in a single test, is gaining significant traction in the infectious testing market. These platforms streamline diagnostics by reducing testing time, costs, and the need for multiple separate tests. For instance, BioFire's FilmArray system can identify up to 22 respiratory pathogens, including viruses and bacteria, in one go, providing a comprehensive diagnostic solution within an hour. Such efficiency is particularly beneficial in managing outbreaks or in clinical settings where rapid, accurate results are crucial for effective patient management. By offering a broad-spectrum diagnostic tool, multiplex testing platforms improve laboratory efficiency and enhance the ability to detect co-infections, making them invaluable for comprehensive infectious disease control and driving their adoption across healthcare systems.

Restraints/Challenges

- Rapid Emergence of New Infectious Agents

The rapid emergence of new infectious agents often outpaces the development of diagnostic tests. For instance, during the COVID-19 pandemic, the appearance of new variants like Delta and Omicron demonstrated this issue. Such variants featured mutations that affected the virus's transmissibility and, in some cases, compromised the accuracy of existing diagnostic tests. Consequently, diagnostic companies had to swiftly adapt their assays to detect these new strains effectively. Such ongoing need for innovation highlights the difficulty of keeping diagnostic tests current with the constantly shifting landscape of infectious diseases. Significantly restricting the infectious testing market growth.

- Navigating Regulatory Approval Hurdles

In the infectious testing market, regulatory challenges are highlighted by specific requirements and timelines for diagnostic devices. For instance, the U.S. FDA’s 510(k) premarket notification process demands that manufacturers demonstrate their device is substantially equivalent to an existing, legally marketed device. In contrast, the European Union’s In Vitro Diagnostic Regulation (IVDR), effective from May 2022, requires a more stringent evaluation process compared to the previous In Vitro Diagnostic Directive (IVDD). The IVDR mandates comprehensive clinical evidence and a rigorous review by a notified body, Such increased complexity and duration of regulatory approval can limit the speed at which new infectious testing devices reach the market, acting as a substantial restraint on market growth and innovation.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Infectious Testing Market Scope

The market is segmented on the basis of product and service, technology, disease type, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product and Service

- Assays

- Kits and Reagents

- Instruments and Services

- Software

Technology

- Immunodiagnostics

- Clinical Microbiology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- DNA Sequencing and Next-Generation Sequencing (NGS)

- DNA Microarray

- Other Technologies

Disease Type

- Hepatitis

- Human Immunodeficiency Virus (HIV)

- Chlamydia Trachomatis Genital Infection and Gonorrhoea (CT/NG)

- Hospital-Acquired Infections (HAIS)

- Human Papillomavirus (HPV)

- Tuberculosis (TB)

- Influenza

- Other Infectious Diseases

End User

- Hospital/Clinical Laboratories

- Reference Laboratories

- Physician Offices

- Academic/Research Institutes

- Other End Users

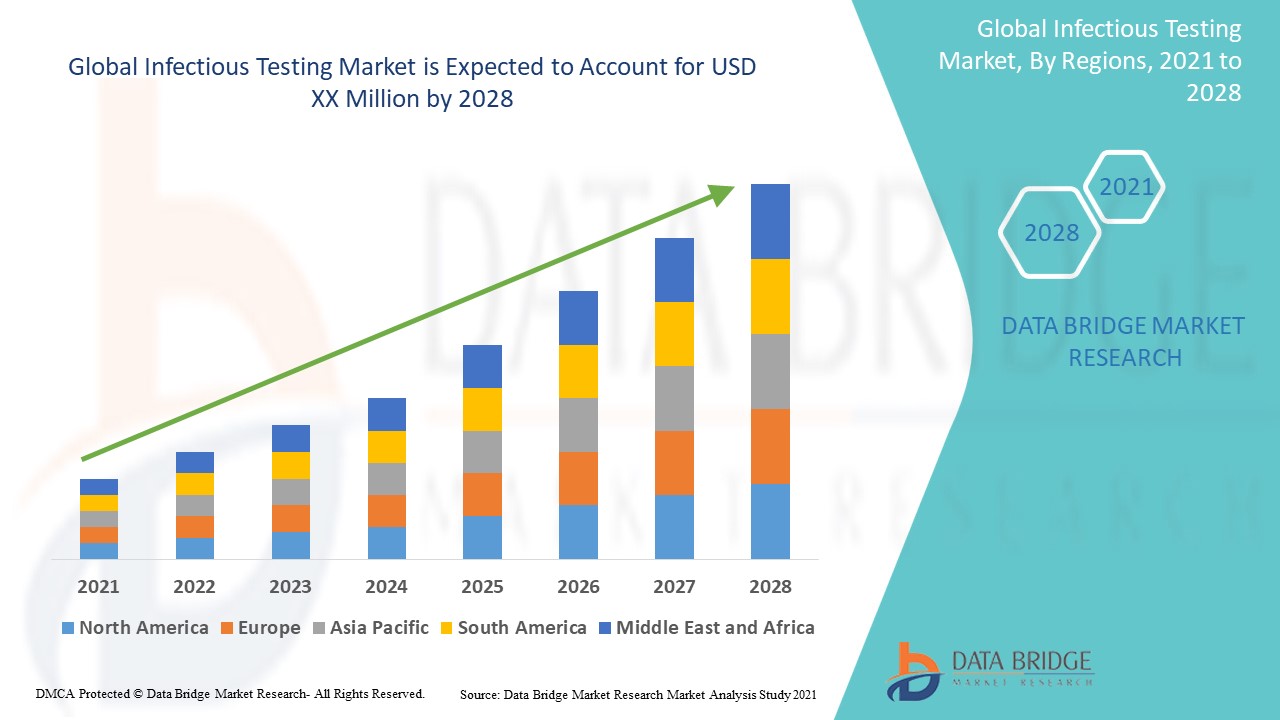

Infectious Testing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product and service, technology, disease type, and end user.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the infectious testing market due to several key factors, including a high prevalence of infectious diseases and a significant presence of major healthcare providers. The region's advanced healthcare infrastructure and widespread access to diagnostic technologies contribute to its dominant position. Additionally, the favorable reimbursement policies in North America support the adoption of innovative testing solutions by reducing financial barriers for patients and healthcare facilities.

Asia-Pacific is expected to experience the highest growth rate during the forecast period, driven by significant advancements in healthcare infrastructure and a rising incidence of infectious diseases. The rapid development of medical facilities and technology in countries such as China and India is enhancing the region's healthcare capabilities. Additionally, increasing efforts to address the growing burden of infectious diseases are fueling demand for advanced diagnostic and treatment solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Infectious Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Infectious Testing Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- BIOMÉRIEUX (France)

- BD (Becton, Dickinson and Company) (U.S.)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sysmex Corporation (Japan)

- Beckman Coulter, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- Cepheid (U.S.)

- Trinity Biotech (Ireland)

- Sekisui Diagnostics (Japan)

- QuidelOrtho Corporation (U.S.)

- MedMira Inc. (Canada)

- Quest Diagnostics Incorporated (U.S.)

- Bayer AG (Germany)

- Rapid Test Methods Ltd. (U.K.)

Latest Developments in Infectious Testing Market

- In January 2023, Cipla Limited has introduced Cippoint, an advanced point-of-care testing device that provides a broad spectrum of tests, including cardiac markers, diabetes, infectious diseases, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers. This device, which has received CE IVD approval, meets the standards set by the European In-Vitro Diagnostic Device Directive, ensuring its reliability and accuracy in testing

- In September 2021, F. Hoffmann-La Roche AG has announced a definitive agreement to acquire all outstanding shares of the TIB Molbiol Group. This acquisition will strengthen Roche's extensive portfolio of molecular diagnostics by adding a diverse array of assays, including those for detecting SARS-CoV-2 variants and other infectious diseases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.