Global Inflammatory Bowel Diseases Market

Market Size in USD Billion

CAGR :

%

USD

23.60 Billion

USD

35.68 Billion

2024

2032

USD

23.60 Billion

USD

35.68 Billion

2024

2032

| 2025 –2032 | |

| USD 23.60 Billion | |

| USD 35.68 Billion | |

|

|

|

|

Inflammatory Bowel Diseases Market Size

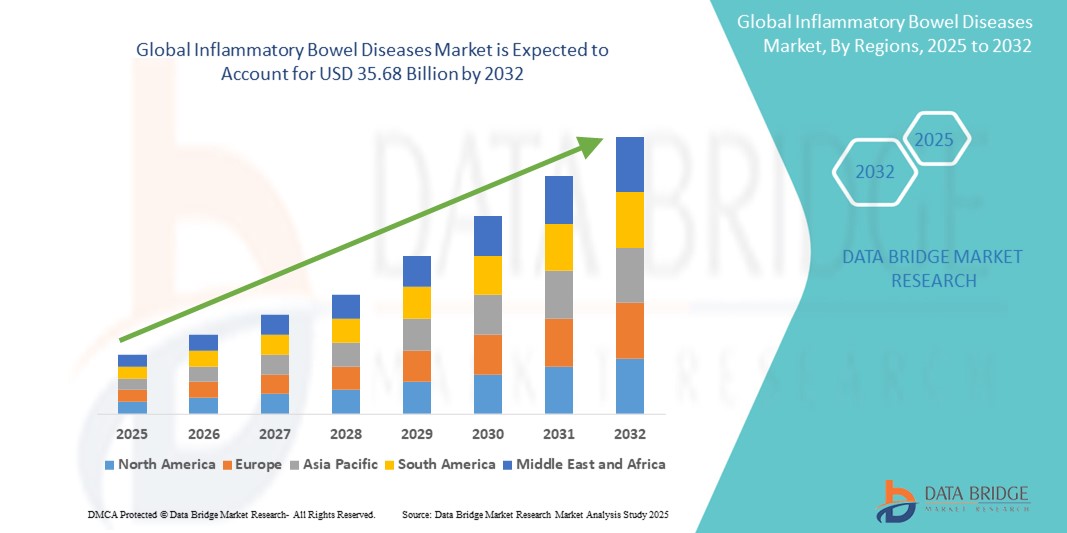

- The global inflammatory bowel diseases market size was valued at USD 23.60 billion in 2024 and is expected to reach USD 35.68 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely driven by the rising prevalence of Crohn’s disease and ulcerative colitis, coupled with growing awareness and advancements in biologic therapies and personalized medicine, which are transforming treatment paradigms globally

- Furthermore, increasing investment in R&D, favorable regulatory support, and the expanding adoption of targeted immunotherapies are reinforcing the market. These converging factors are accelerating the shift towards innovative and long-term disease management solutions in the global IBD treatment landscape

Inflammatory Bowel Diseases Market Analysis

- Inflammatory bowel diseases, encompassing Crohn’s disease and ulcerative colitis, are chronic gastrointestinal disorders that require long-term management, making them a significant focus within the global healthcare landscape due to their growing prevalence and burden on patient quality of life

- The rising demand for effective IBD treatment is primarily driven by increasing incidence rates worldwide, greater awareness of gastrointestinal health, and the expanding utilization of biologics and small molecule therapies offering targeted and sustained remission

- North America dominated the inflammatory bowel diseases market with the largest revenue share of over 40.5% in 2024, attributed to advanced healthcare infrastructure, high diagnosis rates, significant R&D investments, and a strong pipeline of novel IBD treatments from leading pharmaceutical players in the U.S.

- Asia-Pacific is projected to be the fastest growing region in the IBD market during the forecast period, driven by increasing patient population, improving healthcare access, and heightened awareness and diagnosis of IBD across developing economies

- Ulcerative colitis segment dominated the inflammatory bowel diseases market with a market share of 53.5% in 2024, driven by its higher global prevalence, earlier diagnosis rates, and availability of a wide range of effective treatment options

Report Scope and Inflammatory Bowel Diseases Market Segmentation

|

Attributes |

Inflammatory Bowel Diseases Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Inflammatory Bowel Diseases Market Trends

“Precision Medicine and Biologic Innovation Reshaping Treatment Landscape”

- A significant and accelerating trend in the global inflammatory bowel diseases market is the rise of precision medicine and biologic-based therapies, which are transforming traditional treatment models through more targeted and effective interventions for both Crohn’s disease and ulcerative colitis

- For instance, therapies such as anti-TNF biologics, anti-integrin agents, and JAK inhibitors are gaining prominence due to their ability to induce and maintain long-term remission in moderate to severe IBD patients. Similarly, biosimilars are increasingly adopted across several regions, offering cost-effective alternatives without compromising efficacy

- Precision medicine, aided by biomarker-driven diagnostics and companion testing, enables clinicians to tailor treatment strategies based on individual genetic and immunological profiles, improving clinical outcomes and reducing adverse effects

- The integration of digital health solutions—including remote patient monitoring, telehealth, and mobile apps for symptom tracking—is further enhancing patient engagement, treatment adherence, and disease management

- This trend toward targeted biologics, personalized approaches, and technology-driven care is fundamentally transforming how IBD is diagnosed, monitored, and treated across diverse healthcare environments. Consequently, companies such as AbbVie, Takeda, and Pfizer are expanding their R&D efforts to develop next-generation IBD treatments that align with this evolving therapeutic landscape

- The demand for advanced, patient-centric, and precision-based IBD treatments is growing rapidly across both developed and emerging markets, as healthcare systems prioritize improved disease control and long-term patient outcomes

Inflammatory Bowel Diseases Market Dynamics

Driver

“Rising IBD Incidence and Advancements in Biologic Therapies”

- The increasing global prevalence of inflammatory bowel diseases, driven by changing lifestyles, urbanization, and growing awareness of gastrointestinal health, is a major factor contributing to the expanding market size

- For instance, a rising number of newly diagnosed IBD cases in Asia-Pacific and Latin America is highlighting the shift of IBD from a predominantly Western condition to a global health challenge, thereby broadening the demand for therapeutic solutions

- The widespread adoption of biologics, including anti-TNFs and emerging JAK inhibitors, is revolutionizing the IBD treatment paradigm, offering more effective and long-term disease management compared to traditional therapies

- Furthermore, strong clinical pipelines, favorable regulatory approvals, and increasing investment in innovative drug development by key players such as Janssen, Takeda, and Eli Lilly are accelerating the availability of novel treatment options

- The growing emphasis on early diagnosis, supported by advanced imaging and endoscopic technologies, and improved patient access to specialty care, especially in developed healthcare systems, are also contributing to the increased uptake of IBD therapies

- These factors collectively support the sustained expansion of the IBD market, particularly as healthcare providers and patients seek more personalized and durable treatment solutions

Restraint/Challenge

“High Cost of Biologic Therapies and Access Limitations in Low-Income Regions”

- Despite notable therapeutic progress, the high cost of biologic and targeted therapies continues to be a key barrier to adoption, especially in low- and middle-income countries where access to advanced care remains limited

- For instance, the annual cost of biologic treatment can exceed thousands of dollars per patient, posing significant financial challenges for both patients and healthcare systems without adequate insurance or reimbursement coverage

- Concerns over healthcare equity, combined with limited local manufacturing, slow biosimilar adoption, and delays in regulatory approvals, further hinder access to innovative IBD treatments in resource-constrained settings

- In addition, late diagnosis due to a lack of specialized gastroenterology services and insufficient awareness in rural regions often leads to delayed intervention and poorer outcomes

Inflammatory Bowel Diseases Market Scope

The market is segmented on the basis of type, treatment, dosage form, route of administration, diagnosis, end-users, and distribution channel.

- By Type

On the basis of type, the inflammatory bowel diseases market is segmented into microscopic colitis, ulcerative colitis, and Crohn’s disease. The ulcerative colitis segment dominated the market with the largest market revenue share of 53.5% in 2024, owing to its high prevalence and chronic relapsing nature that necessitates long-term pharmacological management. Increased awareness, early diagnosis, and the availability of targeted therapies such as aminosalicylates and biologics are further driving segment growth.

The crohn’s disease segment is projected to witness the fastest growth rate from 2025 to 2032, supported by expanding research into novel treatment pathways, rising incidence in developed and emerging markets, and favorable reimbursement frameworks for advanced therapies such as JAK inhibitors and monoclonal antibodies. Ongoing clinical trials and approval of new drugs are also contributing to its rapid expansion.

- By Treatment

On the basis of treatment, the inflammatory bowel diseases market is segmented into medication, surgery, and others. The medication segment held the largest share in 2024, as pharmaceutical interventions—including corticosteroids, immunosuppressants, and biologics—remain the primary line of management in both acute and maintenance phases of IBD. The rise in prescription of targeted therapies with fewer side effects is further bolstering this segment.

The surgery segment, is projected to grow steadily during forecast period from 2025 to 2032, due to increased accessibility to minimally invasive surgical procedures and better postoperative outcomes with enhanced recovery protocols.

- By Dosage Form

On the basis of dosage form, the inflammatory bowel diseases market is categorized into tablet, capsule, injections, and others. The injections segment led the market in 2024, attributed to the widespread use of biologics and biosimilars that are typically administered via subcutaneous or intravenous routes. These include anti-TNF agents and interleukin inhibitors that require injection-based delivery for optimal bioavailability.

The tablet segment is anticipated to see significant growth from 2025 to 2032, particularly for aminosalicylates and small molecule oral drugs such as JAK inhibitors, which offer ease of use, better patient compliance, and long-term maintenance therapy options.

- By Route Of Administration

On the basis of route of administration, the inflammatory bowel diseases market is segmented into oral, parenteral, and others. The oral route accounted for the largest market share in 2024 due to its non-invasive nature and preference in chronic disease management. Many first-line drugs for ulcerative colitis and Crohn’s disease, such as mesalamine and azathioprine, are administered orally.

The parenteral route, which includes subcutaneous and intravenous administration, is expected to grow rapidly during forecast period, owing to the increasing adoption of biologics, patient assistance programs for injectable therapies, and the rise of specialty clinics offering infusion services.

- By Diagnosis

On the basis of diagnosis, the inflammatory bowel diseases market is segmented into imaging procedures, endoscopic procedures, and lab tests. The endoscopic procedures segment led the market in 2024, as colonoscopy and sigmoidoscopy are standard diagnostic tools for IBD, allowing direct visualization, tissue biopsy, and disease monitoring.

The lab tests segment is projected to grow rapidly during forecast period, driven by increasing reliance on biomarkers such as fecal calprotectin and C-reactive protein (CRP) for early detection, disease monitoring, and treatment response assessment.

- By End User

On the basis of end-users, the inflammatory bowel diseases market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment held the highest market share in 2024, owing to the availability of multidisciplinary care, access to advanced diagnostics, and treatment of severe IBD cases requiring hospitalization or surgical intervention.

The homecare segment is expected to witness the fastest growth from 2025 to 2032 due to the growing preference for subcutaneous self-injection therapies, remote monitoring, and improved patient education enabling home-based chronic care management.

- By Distribution Channel

On the basis of distribution channel, the inflammatory bowel diseases market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated in 2024 due to the high usage of biologics and specialty drugs that require cold-chain handling and are administered within clinical settings.

The online pharmacy segment is expected to grow at the fastest pace during forecast period, supported by increased digital adoption, convenience in ordering refills for chronic medications, and the growing availability of specialty drugs through accredited e-pharmacy platforms.

Inflammatory Bowel Diseases Market Regional Analysis

- North America dominated the inflammatory bowel diseases market with the largest revenue share of over 40.5% in 2024, attributed to advanced healthcare infrastructure, high diagnosis rates, significant R&D investments, and a strong pipeline of novel IBD treatments from leading pharmaceutical players in the U.S.

- The region benefits from strong awareness among patients and physicians, established reimbursement frameworks, and continued innovation in targeted drug development and diagnostics for IBD

- This dominance is further supported by rising clinical trials, well-funded research initiatives, and a higher rate of early diagnosis, positioning North America as a global leader in both treatment access and therapeutic advancements for IBD management

U.S. Inflammatory Bowel Diseases Market Insight

The U.S. inflammatory bowel diseases market captured the largest revenue share of 78.3% in 2024 within North America, fueled by the country’s advanced healthcare infrastructure and a high prevalence of Crohn’s disease and ulcerative colitis. The presence of leading pharmaceutical companies, strong patient awareness, and robust research funding supports the early adoption of biologics and personalized treatments. In addition, the increasing availability of advanced diagnostic tools and a growing preference for minimally invasive procedures are further driving market growth across the nation.

Europe Inflammatory Bowel Diseases Market Insight

The Europe inflammatory bowel diseases market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing incidence rates, rising healthcare expenditure, and increasing patient access to biologic therapies. Countries across the region are witnessing heightened awareness around early diagnosis and treatment adherence. Ongoing research collaborations and regulatory support for innovative therapies are also fostering market expansion, with significant growth seen in both urban and rural healthcare settings.

U.K. Inflammatory Bowel Diseases Market Insight

The U.K. inflammatory bowel diseases market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising disease burden, increasing focus on preventive healthcare, and the adoption of novel therapeutic approaches. The National Health Service (NHS) initiatives to enhance early screening and manage chronic conditions are significantly contributing to the market. In addition, the expanding use of biosimilars and digital health monitoring solutions supports more effective disease management and cost efficiency.

Germany Inflammatory Bowel Diseases Market Insight

The Germany inflammatory bowel diseases market is expected to expand at a considerable CAGR during the forecast period, driven by a growing demand for advanced biologics, an aging population, and strong clinical research activity. The country’s robust health insurance framework and emphasis on precision medicine are enhancing access to cutting-edge therapies. Furthermore, collaborative efforts between research institutions and pharma companies continue to boost innovation in IBD treatment modalities.

Asia-Pacific Inflammatory Bowel Diseases Market Insight

The Asia-Pacific inflammatory bowel diseases market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising awareness, improving healthcare access, and increasing incidence of IBD across emerging economies such as China, India, and South Korea. Government healthcare reforms, growing investments in life sciences, and increasing availability of diagnostics and biologic treatments are contributing to the region’s rapid expansion. The market is also benefiting from lifestyle changes and urban dietary patterns linked to gastrointestinal disorders.

Japan Inflammatory Bowel Diseases Market Insight

The Japan inflammatory bowel diseases market is gaining momentum due to the country’s aging population, strong healthcare system, and increasing adoption of biologic and biosimilar treatments. High disease awareness, coupled with early diagnosis and regular patient follow-ups, enhances treatment outcomes. Japan’s focus on personalized medicine and integration of AI-based diagnostic tools in healthcare settings is also supporting market growth, particularly in urban centers.

India Inflammatory Bowel Diseases Market Insight

The India inflammatory bowel diseases market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing IBD incidence, improved healthcare infrastructure, and growing use of advanced therapeutics. Rising medical tourism, enhanced affordability of biosimilars, and expanding gastroenterology specialty services across both private and public sectors are accelerating the market. Furthermore, digital health initiatives and educational outreach programs are improving early diagnosis and long-term disease management across diverse patient populations.

Inflammatory Bowel Diseases Market Share

The inflammatory bowel diseases industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Baxter (U.S.)

- Bayer AG (Germany)

- Lilly (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma Limited (India)

- Lupin (India)

- AbbVie Inc. (U.S.)

- Abbott (U.S.)

- Bausch Health Companies Inc. (Canada)

What are the Recent Developments in Global Inflammatory Bowel Diseases Market?

- In April 2023, AbbVie Inc. announced promising real-world data for RINVOQ (upadacitinib), showcasing its effectiveness in maintaining clinical remission in patients with moderately to severely active ulcerative colitis. The findings, presented at the ECCO Congress, emphasized upadacitinib’s sustained benefits across diverse patient populations. This development highlights AbbVie's ongoing commitment to innovation in immunology and its strategic focus on expanding targeted therapies within the inflammatory bowel diseases market

- In March 2023, Takeda Pharmaceutical Company Limited launched an expanded access program for Entyvio subcutaneous (vedolizumab) in select countries, aimed at offering early access to patients with Crohn’s disease and ulcerative colitis ahead of broader commercial availability. This move reflects Takeda’s proactive approach to bridging therapeutic gaps and underscores its leadership in biologic treatments for IBD

- In March 2023, Eli Lilly and Company announced the Phase 3 trial initiation for mirikizumab in Crohn’s disease after receiving positive results from its ulcerative colitis studies. Mirikizumab is a monoclonal antibody targeting the IL-23 pathway, and its clinical progression signals Lilly’s growing presence in the IBD treatment landscape. This advancement represents the company's strategic effort to diversify its immunology portfolio

- In February 2023, Janssen Pharmaceuticals, a Johnson & Johnson company, secured regulatory approvals for STELARA (ustekinumab) label expansion in Europe, allowing its use in pediatric patients aged six and above with moderately to severely active ulcerative colitis. This development broadens treatment options for younger populations and reinforces Janssen’s role in delivering comprehensive IBD care solutions across all age groups

- In January 2023, Arena Pharmaceuticals, acquired by Pfizer, reported new findings from the Phase 2 CULTIVATE study evaluating etrasimod, an S1P receptor modulator, in patients with Crohn’s disease. The results demonstrated favorable safety and efficacy profiles, building anticipation for Phase 3 outcomes. This research milestone illustrates Pfizer's ambition to redefine oral treatment options and further solidify its footprint in the global IBD therapeutics market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.