Global Infrared Vision Systems Market

Market Size in USD Billion

CAGR :

%

USD

7.32 Billion

USD

11.09 Billion

2024

2032

USD

7.32 Billion

USD

11.09 Billion

2024

2032

| 2025 –2032 | |

| USD 7.32 Billion | |

| USD 11.09 Billion | |

|

|

|

|

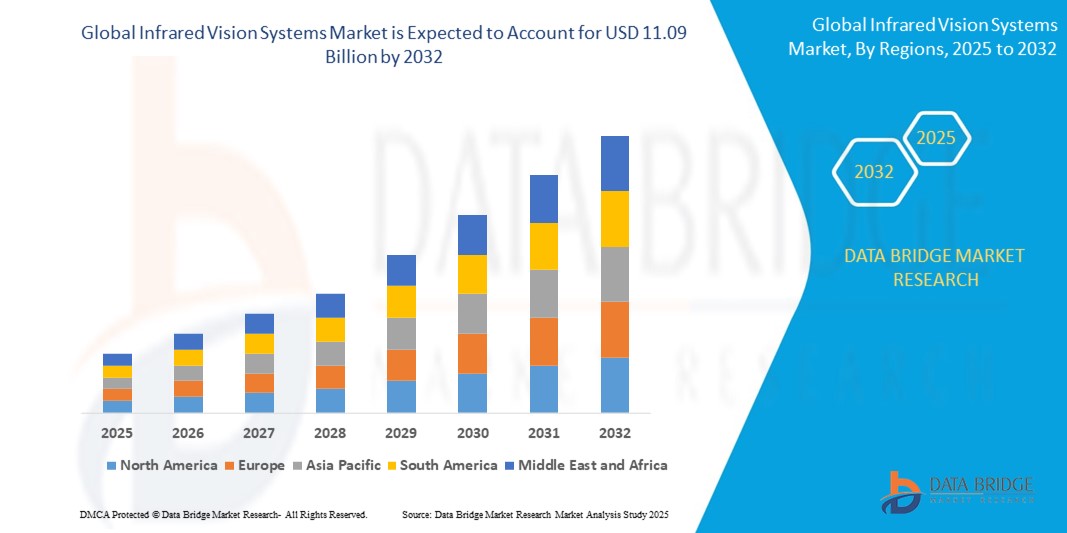

What is the Global Infrared Vision Systems Market Size and Growth Rate?

- The global infrared vision systems market size was valued at USD 7.32 billion in 2024 and is expected to reach USD 11.09 billion by 2032, at a CAGR of 5.30% during the forecast period

- The infrared vision systems market is witnessing advancements such as AI-driven thermal imaging, improving accuracy in various applications. The integration of infrared sensors in the automotive and defense sectors is growing due to enhanced safety features

- Portable and wearable infrared devices are also gaining traction, driving market expansion. These technologies enable precise detection in low-visibility environments, fueling broader adoption and market growth

What are the Major Takeaways of Infrared Vision Systems Market?

- The rising demand for space exploration is driving the infrared vision systems market. These systems are essential for detecting celestial objects and monitoring spacecraft in harsh environments

- For instance, NASA's James Webb Space Telescope relies on infrared vision to observe distant galaxies, stars, and planetary systems, enabling groundbreaking discoveries. As space missions expand, the need for advanced infrared technology grows, fueling market growth in this sector

- North America held the largest revenue share of 35.87% in the infrared vision systems market in 2024, propelled by increasing adoption of smart surveillance, thermal imaging, and night vision applications across defense, automotive, and industrial sectors

- Asia-Pacific market is projected to record the fastest CAGR of 11.58% between 2025 and 2032, fueled by urbanization, smart infrastructure development, and growing defense modernization efforts

- The Camera segment dominated the market with the largest revenue share of 36.4% in 2024, owing to the rising demand for thermal imaging and night vision applications across defense, surveillance, and automotive industries

Report Scope and Infrared Vision Systems Market Segmentation

|

Attributes |

Infrared Vision Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Infrared Vision Systems Market?

“Integration of AI and Advanced Analytics for Smart Detection”

- A prominent trend shaping the infrared vision systems market is the integration of artificial intelligence (AI) and advanced analytics to enhance detection accuracy, reduce false alarms, and improve situational awareness across various applications including military, surveillance, and automotive

- AI-enabled infrared systems now feature real-time object recognition, thermal anomaly detection, and automated threat classification, transforming conventional passive imaging into intelligent, proactive monitoring solutions

- For instance, FLIR Systems has launched AI-powered thermal cameras that automatically identify intruders, vehicles, or fire hazards, even in complete darkness or adverse weather conditions—dramatically improving response times and decision-making

- These systems are also increasingly compatible with edge computing platforms, allowing faster data processing directly on the device for improved operational efficiency and reduced network latency

- As industries demand smarter, more adaptive vision technologies, this AI-driven transformation is expected to significantly raise the standard for accuracy, automation, and usability in infrared-based surveillance and monitoring systems

What are the Key Drivers of Infrared Vision Systems Market?

- Rising global security concerns, especially in defense, border surveillance, and critical infrastructure protection, are a major factor driving demand for advanced infrared vision systems with 24/7 monitoring capabilities

- In May 2024, Thales Group announced a major upgrade in its Sophie Optima thermal imaging systems, featuring multi-spectrum sensors designed to assist soldiers with enhanced night vision and real-time threat detection indicating rising defense investments

- Automotive safety regulations and the increasing inclusion of thermal cameras in ADAS (Advanced Driver Assistance Systems) are further propelling market expansion, with infrared solutions being vital for night-time pedestrian and animal detection

- In addition, the use of infrared imaging in healthcare, for non-invasive diagnostics such as fever screening and blood flow analysis, is expanding due to post-pandemic healthcare digitization and aging population demographics

- With growing industrial automation, infrared systems are also witnessing greater adoption in predictive maintenance, enabling early detection of equipment failure through thermal anomalies

Which Factor is challenging the Growth of the Infrared Vision Systems Market?

- A significant hurdle for market expansion lies in the high cost and complexity of infrared imaging systems, especially for small and mid-sized enterprises or developing nations

- Advanced infrared sensors require specialized materials (such as vanadium oxide or indium antimonide), making them costlier than visible light cameras, which often restricts large-scale adoption in price-sensitive applications

- Furthermore, limited resolution and image clarity in budget infrared systems can hinder their effectiveness in fast-paced or highly dynamic environments, affecting user confidence

- Cybersecurity is another growing concern as networked IR systems, particularly in surveillance and smart city infrastructure, become more vulnerable to hacking and data breaches

- To overcome these challenges, companies are investing in R&D for cost-effective uncooled sensors, promoting modular and scalable systems, and integrating robust cybersecurity protocols. Educating end-users on ROI and operational benefits is also crucial for long-term adoption and trust-building

How is the Infrared Vision Systems Market Segmented?

The market is segmented on the basis of component, technology, platform, and application.

• By Component

On the basis of component, the infrared vision systems market is segmented into Sensors, Camera, Display, Processing Unit, and Control Electronics. The Camera segment dominated the market with the largest revenue share of 36.4% in 2024, owing to the rising demand for thermal imaging and night vision applications across defense, surveillance, and automotive industries. Infrared cameras are widely adopted due to their ability to capture heat signatures in low or no-light environments, enhancing operational visibility and safety

The Sensors segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for miniaturized, high-precision IR sensors in smart home devices, healthcare diagnostics, and predictive maintenance in industrial settings.

• By Technology

On the basis of technology, the infrared vision systems market is segmented into Infrared, Synthetic Vision, Millimeter Wave Radar, and GPS. The Infrared segment held the dominant market share of 48.9% in 2024, fueled by its extensive adoption in night vision, temperature monitoring, and heat detection applications. Infrared technology remains the core of thermal vision systems and is increasingly used in both military-grade and consumer-grade devices.

The Synthetic Vision segment is projected to grow at the highest CAGR during 2025–2032, thanks to its growing role in aviation and automotive sectors for providing real-time 3D visualization under low visibility conditions.

• By Platform

On the basis of platform, the market is segmented into Fixed Wing and Rotary Wing. The Fixed Wing segment accounted for the largest market share of 57.6% in 2024, attributed to its dominant usage in defense surveillance, long-range border patrol, and civil aviation operations. These platforms extensively rely on infrared systems for night-time reconnaissance and terrain mapping.

The Rotary Wing segment, comprising helicopters and UAVs, is expected to witness rapid growth through 2032, driven by increased deployment of drones and aerial platforms in urban surveillance, disaster response, and smart city applications.

• By Application

On the basis of application, the infrared vision systems market is segmented into Automotive, BFSI, Commercial, Government and Defense, Healthcare, Industrial, and Residential. The Government and Defense segment held the largest market revenue share of 39.3% in 2024, propelled by continuous investments in night vision, battlefield surveillance, and border security systems. Infrared vision technology is indispensable in mission-critical scenarios, offering visibility where traditional optics fail.

The Automotive segment is anticipated to exhibit the fastest CAGR from 2025 to 2032, driven by increasing integration of IR cameras in ADAS (Advanced Driver Assistance Systems) and autonomous vehicle platforms for pedestrian detection, lane recognition, and enhanced driver safety during nighttime driving.

Which Region Holds the Largest Share of the Infrared Vision Systems Market?

- North America held the largest revenue share of 35.87% in the infrared vision systems market in 2024, propelled by increasing adoption of smart surveillance, thermal imaging, and night vision applications across defense, automotive, and industrial sectors

- The region's strong investments in military-grade technologies, early adoption of advanced driver assistance systems (ADAS), and robust healthcare infrastructure are further accelerating demand for infrared-based solutions

- High R&D capabilities, technological leadership in sensor design, and growing integration of IR systems in commercial and residential security frameworks have cemented North America’s dominance in the global market

U.S. Infrared Vision Systems Market Insight

U.S. market accounted for 81% of the North American share in 2024, backed by large-scale defense budgets, adoption of AI-integrated surveillance systems, and the growing popularity of IR-enabled smart homes. The automotive industry’s push for safety features such as pedestrian detection and lane assist is also driving the demand for IR cameras. In addition, strong government initiatives supporting border security and thermal screening technologies continue to boost the U.S. market growth across multiple sectors.

Europe Infrared Vision Systems Market Insight

Europe infrared vision systems market is anticipated to grow at a steady CAGR, led by rising applications in defense, aviation, and industrial safety. Stringent regulations around occupational health and workplace safety, along with government-funded smart city initiatives, are fostering the adoption of thermal and infrared solutions. The presence of leading automotive and aerospace manufacturers in countries such as Germany and France is further propelling innovation and deployment of IR systems across multiple end-user industries.

U.K. Infrared Vision Systems Market Insight

U.K. market is poised for substantial growth through the forecast period, owing to the increasing incorporation of thermal imaging in public surveillance, transportation, and healthcare. Smart city projects, coupled with rising demand for energy-efficient infrastructure, are driving investment in smart sensors, including IR vision technologies. Furthermore, national security concerns and growing adoption of smart home automation systems are adding momentum to the country’s IR systems demand.

Germany Infrared Vision Systems Market Insight

German infrared vision systems market is expected to expand rapidly due to its strong industrial base and focus on advanced manufacturing technologies. With rising interest in Industry 4.0, thermal monitoring tools and predictive maintenance solutions are gaining popularity in manufacturing plants. Germany's well-established automotive sector is also deploying infrared cameras in safety systems, making it one of the key adopters in the European market.

Which Region is the Fastest Growing Region in the Infrared Vision Systems Market?

Asia-Pacific market is projected to record the fastest CAGR of 11.58% between 2025 and 2032, fueled by urbanization, smart infrastructure development, and growing defense modernization efforts. Countries such as China, Japan, and India are driving adoption through significant investments in surveillance technologies, border security, smart transportation, and consumer electronics. Government initiatives to promote digitalization, AI, and robotics are also contributing to the increased integration of infrared systems.

Japan Infrared Vision Systems Market Insight

Japan’s market is accelerating due to high-tech manufacturing, strong defense readiness, and a focus on elderly care technologies. The adoption of thermal vision systems in healthcare facilities, public transport, and smart homes is rising rapidly. Moreover, Japan’s push toward autonomous vehicles and disaster-response technologies is stimulating innovation and demand for integrated infrared systems.

China Infrared Vision Systems Market Insight

China accounted for the largest share in the Asia-Pacific region in 2024, driven by massive urban expansion, increasing smart city initiatives, and a flourishing electronics manufacturing ecosystem. Local companies are rapidly producing low-cost, high-quality IR sensors and thermal cameras, making infrared technology more accessible. In sectors such as defense, retail, and construction, IR systems are becoming indispensable for real-time surveillance, equipment monitoring, and energy efficiency.

Which are the Top Companies in Infrared Vision Systems Market?

The infrared vision systems industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Raytheon Technologies Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Autoliv Inc. (Sweden)

- DENSO CORPORATION (Japan)

- FLIR Systems, Inc. (U.S.)

- ZF Friedrichshafen AG (Germany)

- Magna International Inc. (Canada)

- OmniVision Technologies, Inc. (U.S.)

- Continental AG (Germany)

- Delphi Technologies (U.S.)

- OMRON Corporation (Japan)

- Meopta (Czech Republic)

- Newcon International Ltd (Canada)

- HELLA GmbH & Co. KGaA (Germany)

- Bendix Commercial Vehicle Systems LLC (U.S.)

- Thales Group (France)

- Elbit Systems Ltd. (Israel)

What are the Recent Developments in Global Infrared Vision Systems Market?

- In February 2024, Prama India entered into a Transfer of Technology (ToT) agreement with the Centre for Development of Advanced Computing (C-DAC), aiming to boost domestic innovation and production in thermal camera technology. This strategic collaboration is set to enhance research and development efforts for next-generation thermal imaging solutions. The partnership marks a pivotal step towards self-reliance and technological advancement in India's thermal imaging sector

- In January 2024, Teledyne FLIR, a subsidiary of Teledyne Technologies, introduced an upgraded version of its K-Series thermal imaging cameras, specially designed for firefighting and search and rescue missions. These enhanced models offer superior clarity and sharpness, particularly under low-contrast conditions, thereby improving user safety and operational effectiveness. This release underlines the company’s commitment to enhancing emergency response tools with high-performance thermal imaging

- In May 2023, Leonardo DRS, Inc. announced the deployment of its advanced high-precision radiometer, the Multiband Uncooled SmallSat Imaging Radiometer (MUSIR), aboard a NASA demonstration mission. Designed to measure Earth's surface temperature from space, this uncooled thermal imaging radiometer is a breakthrough in small, cost-effective satellite constellation technologies. This innovation highlights the potential of compact thermal imaging systems in space-based environmental monitoring

- In November 2022, Teledyne FLIR collaborated with RealWear, a pioneer in wearable-assisted reality, under its Thermal by FLIR partnership to launch the world’s first fully hands-free, voice-controlled thermal imaging module. In addition, fellow Thermal by FLIR partner Ulefone introduced the Power Armor 18T 5G, the first smartphone equipped with a Lepton 3.5 thermal imaging camera. These advancements signify a leap forward in integrating thermal imaging with consumer and industrial wearable tech

- In May 2021, Lynred, a France-based infrared detector specialist, was awarded a contract by Thales Alenia Space to supply its large-format SWIR detector, NGP (Next-Generation Panchromatic), for the CO2M mission under the Copernicus program. This initiative plays a vital role in Europe’s satellite-based Earth observation and carbon monitoring efforts. The contract underscores Lynred’s role in supporting climate-focused space initiatives through advanced IR technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Infrared Vision Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Infrared Vision Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Infrared Vision Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.