Global Infrastructure As A Service Market

Market Size in USD Billion

CAGR :

%

USD

49.46 Billion

USD

305.92 Billion

2024

2032

USD

49.46 Billion

USD

305.92 Billion

2024

2032

| 2025 –2032 | |

| USD 49.46 Billion | |

| USD 305.92 Billion | |

|

|

|

|

Infrastructure as a Service Market Size

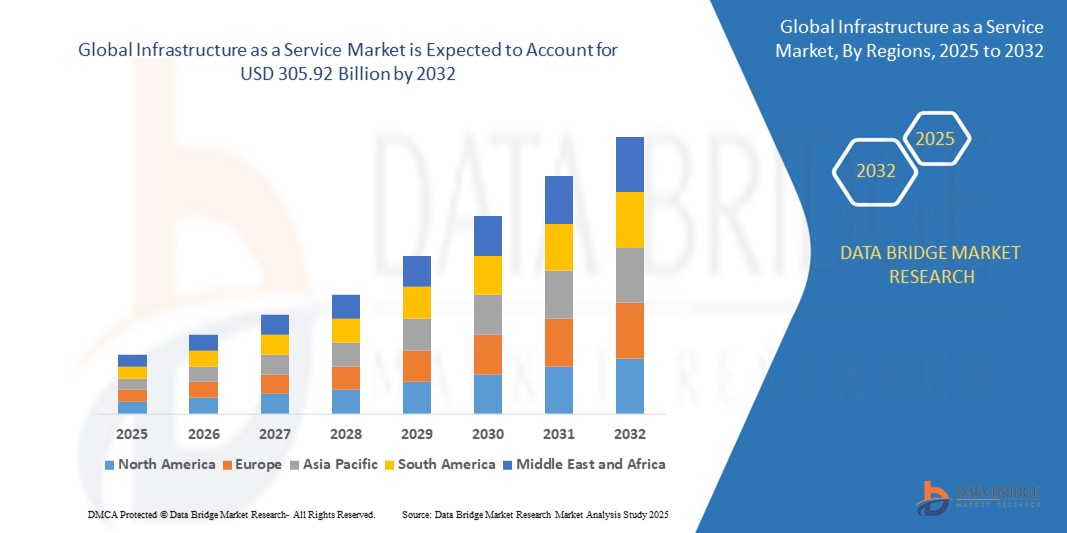

- The global infrastructure as a service market size was valued at USD 49.46 billion in 2024 and is expected to reach USD 305.92 billion by 2032, at a CAGR of 25.58% during the forecast period

- The market growth is largely fueled by the accelerating adoption of cloud computing and the need for scalable, flexible, and cost-effective IT infrastructure solutions across industries, enabling businesses to rapidly deploy and manage computing resources without heavy upfront investments

- Furthermore, increasing digital transformation initiatives, the rise of remote work, and demand for seamless access to data and applications are driving enterprises to adopt Infrastructure as a service platforms that offer enhanced agility, security, and integration capabilities, significantly boosting demand for Infrastructure as a service solutions and propelling market expansion globally

Infrastructure as a Service Market Analysis

- Infrastructure as a Service provides virtualized computing resources over the internet. It offers scalable and cost-effective solutions for computing power, storage, and networking without requiring physical hardware. Businesses use Infrastructure as a service for flexible resource management, reducing capital expenses, and enhancing operational efficiency. It supports diverse applications, from web hosting to complex data processing

- The rising demand for Infrastructure as a service is primarily driven by the need for flexible, cost-effective cloud solutions that support remote work, big data analytics, and application hosting, alongside increasing emphasis on business continuity, disaster recovery, and rapid scalability to meet fluctuating workloads

- North America dominated the infrastructure as a service market with a share 45% in 2024, due to widespread cloud adoption across enterprises, advanced IT infrastructure, and strong investments in digital transformation initiatives

- Asia-Pacific is expected to be the fastest growing region in the infrastructure as a service market during the forecast period due to rapid digitalization, urbanization, and expanding internet penetration in emerging economies such as China, India, Japan, and Australia

- Storage segment dominated the market with a market share of 38.5% in 2024, due to the exponential increase in data generation and the need for scalable, secure, and high-performance storage solutions. Organizations rely heavily on cloud storage for backup, disaster recovery, and seamless access to critical data, which has made storage the backbone of Infrastructure as a service offerings

Report Scope and Infrastructure as a Service Market Segmentation

|

Attributes |

Infrastructure as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Infrastructure as a Service Market Trends

“Rising Expansion of Multi-Cloud Strategies”

- A significant and accelerating trend in the global Infrastructure as a Service market is the rising expansion of multi-cloud strategies, where organizations leverage multiple cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) to optimize workload distribution, enhance resilience, and avoid vendor lock-in

- For instance, major enterprises like Netflix utilize AWS for their primary workloads while integrating Google Cloud for data analytics and Azure for enterprise applications, ensuring flexibility and cost optimization across diverse business needs

- Multi-cloud adoption enables organizations to tailor infrastructure solutions based on specific application requirements, compliance mandates, and geographic considerations, providing enhanced control and risk mitigation; companies such as IBM Cloud and VMware are offering advanced multi-cloud management tools that simplify integration and orchestration across clouds

- The growing complexity of IT environments demands seamless interoperability and unified management across multiple cloud platforms, allowing enterprises to dynamically allocate resources, improve disaster recovery, and maintain continuous service availability

- This trend is driving Infrastructure as a Service providers to develop more sophisticated APIs, security frameworks, and hybrid cloud capabilities, enabling businesses to build resilient, scalable, and agile IT infrastructures that adapt to evolving market demands

- The increasing emphasis on multi-cloud strategies is transforming enterprise cloud adoption models, with companies prioritizing agility, cost efficiency, and compliance, thereby accelerating demand for robust Infrastructure as a service solutions that support seamless multi-cloud operations

Infrastructure as a Service Market Dynamics

Driver

“Rising Focus on Core Business”

- The increasing demand for organizations to focus on their core business activities while outsourcing IT infrastructure management is a significant driver for the growing adoption of Infrastructure as a Service solutions

- For instance, in March 2025, IBM launched enhanced managed Infrastructure as a service offerings aimed at enabling enterprises to offload complex infrastructure operations and concentrate resources on innovation and business growth, positioning itself as a key enabler in the market

- As businesses face rising IT complexity and costs, Infrastructure as a service provides scalable, on-demand computing resources, allowing companies to reduce capital expenditures and operational burdens associated with maintaining physical data centers

- Furthermore, the shift towards digital transformation and agile development models is pushing organizations to adopt Infrastructure as a service platforms that facilitate faster deployment of applications and services, improving time-to-market and operational efficiency

- The ability to leverage expert cloud service providers for infrastructure management, security, and compliance enables enterprises to streamline IT operations and direct focus towards strategic initiatives, thereby driving the increased uptake of Infrastructure as a service across diverse industry sectors

Restraint/Challenge

“Complexity in Migration and Integration”

- The complexity involved in migrating existing IT workloads and integrating diverse legacy systems with Infrastructure as a Service platforms poses a significant challenge to market adoption, as organizations often face compatibility issues and operational disruptions

- For instance, enterprises transitioning to Infrastructure as a service environments such as AWS, Microsoft Azure, or Google Cloud frequently encounter difficulties in ensuring seamless data migration and interoperability with on-premises applications, causing delays and increased costs

- Addressing these challenges requires comprehensive planning, robust migration tools, and expert support; companies like VMware and IBM provide specialized hybrid cloud solutions and migration services designed to simplify integration and minimize downtime during transitions

- In addition, concerns over data security, compliance, and potential performance degradation during migration further complicate adoption, especially for highly regulated industries such as banking and healthcare

- Overcoming these obstacles through improved migration frameworks, standardized APIs, and stronger collaboration between cloud providers and enterprise IT teams will be critical for accelerating Infrastructure as a service market growth and broader enterprise acceptance

Infrastructure as a Service Market Scope

The market is segmented on the basis of component type, user type, industry vertical, services, and deployment.

- By Component Type

On the basis of component type, the Infrastructure as a Service market is segmented into storage, network, computer, and others. The storage segment dominated the market with the largest market revenue share of 38.5% in 2024, driven by the exponential increase in data generation and the need for scalable, secure, and high-performance storage solutions. Organizations rely heavily on cloud storage for backup, disaster recovery, and seamless access to critical data, which has made storage the backbone of Infrastructure as a service offerings.

The network segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for high-speed connectivity, low latency, and secure data transmission to support cloud-native applications, IoT deployments, and edge computing. Innovations such as 5G and software-defined networking further enhance network capabilities, attracting enterprises to upgrade their cloud infrastructure.

- By User Type

On the basis of user type, the Infrastructure as a Service market is segmented into small and medium scale enterprises and large enterprises. The large enterprises segment accounted for the largest market revenue share in 2024, driven by their extensive IT infrastructure needs, multi-location operations, and the demand for scalable computing resources. These enterprises benefit from cost efficiency, flexible resource allocation, and enhanced disaster recovery capabilities offered by Infrastructure as a service solutions.

The small and medium scale enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing digital transformation efforts, cloud adoption to reduce upfront capital expenditure, and access to enterprise-grade infrastructure without the need for large IT teams.

- By Industry Vertical

On the basis of industry vertical, the Infrastructure as a Service market is segmented into banking, financial services and insurance, government and education, healthcare, telecom and IT, retail, manufacturing, media and entertainment, and others. The banking, financial services and insurance segment held the largest market revenue share in 2024, driven by strict regulatory compliance, the need for secure infrastructure, and adoption of cloud-powered analytics and fraud detection solutions.

The government and education segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by government modernization initiatives, increased investment in digital learning platforms, and demand for efficient public service delivery through cloud infrastructure. In addition, public sector organizations seek to enhance citizen services, data transparency, and inter-agency collaboration through cloud-based solutions. Growing emphasis on data security, compliance with regulatory frameworks, and the need for cost-effective IT resource management further accelerate cloud adoption in government and education sectors.

- By Services

On the basis of services, the Infrastructure as a Service market is segmented into managed hosting services, storage as a service, high performance computing as a service, disaster recovery as a service, data centre as a service, desktop as a service, application hosting as a service, and others. The managed hosting services segment held the largest market revenue share in 2024, supported by growing IT complexity and the need for expert management, monitoring, and maintenance of cloud infrastructure.

The disaster recovery as a service segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rising cybersecurity threats and the critical need for business continuity solutions that reduce downtime and data loss risk through automated failover systems. Growing regulatory requirements for data protection and the high cost of manual disaster recovery processes further accelerate the adoption of scalable, cost-effective, and reliable DRaaS offerings across industries.

- By Deployment

On the basis of deployment, the Infrastructure as a Service market is segmented into public cloud, private cloud, and hybrid cloud. The public cloud segment dominated the market with the largest revenue share in 2024, driven by cost efficiency, scalability, and ease of access for businesses of all sizes.

The hybrid cloud segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by enterprises’ preference for flexible cloud environments that combine on-premises infrastructure with cloud resources to optimize security, control, and workload placement according to business and regulatory needs.

Infrastructure as a Service Market Regional Analysis

- North America dominated the infrastructure as a service market with the largest revenue share of 45% in 2024, driven by widespread cloud adoption across enterprises, advanced IT infrastructure, and strong investments in digital transformation initiatives

- Businesses and government agencies in the region prioritize scalability, security, and compliance, fueling demand for Infrastructure as a service solutions that enable flexible computing resources and disaster recovery

- This dominance is further supported by high cloud maturity, presence of leading cloud service providers, and the growing shift to hybrid and multi-cloud deployments, establishing North America as a key market for Infrastructure as a service in both commercial and public sectors

U.S. Infrastructure as a Service Market Insight

U.S. Infrastructure as a service market captured the largest revenue share within North America in 2024, propelled by rapid digital transformation efforts and increasing cloud-native application development. Enterprises are investing heavily in scalable, on-demand infrastructure to support remote work, big data analytics, and AI workloads. The strong presence of global cloud giants and early adoption of innovative cloud services, combined with regulatory focus on data security and privacy, further accelerate the growth of the U.S. Infrastructure as a service market.

Europe Infrastructure as a Service Market Insight

The Europe Infrastructure as a service market is expected to grow at a steady CAGR during the forecast period, driven by stringent data protection regulations such as GDPR, rising cloud awareness, and increased public sector investments in digital infrastructure. The region’s focus on cloud sovereignty and data residency encourages adoption of private and hybrid cloud models. Growth is also supported by digital transformation across banking, manufacturing, and public services sectors, as organizations seek secure and compliant cloud infrastructure solutions.

U.K. Infrastructure as a Service Market Insight

The U.K. Infrastructure as a service market is projected to grow robustly, driven by strong government initiatives promoting cloud-first policies and expanding use of cloud infrastructure in financial services and healthcare sectors. Increased demand for cost-effective, scalable IT resources and cloud-enabled business continuity strategies is also fueling market expansion. The U.K.’s advanced telecom infrastructure and increasing acceptance of hybrid cloud deployments further contribute to market momentum.

Germany Infrastructure as a Service Market Insight

Germany’s Infrastructure as a service market is expected to witness significant growth, underpinned by strong manufacturing and industrial sectors adopting Industry 4.0 initiatives. The emphasis on data privacy, security, and compliance aligns with demand for private and hybrid cloud services. Growing cloud adoption in automotive, healthcare, and government institutions is further accelerating Infrastructure as a service deployments. The country’s focus on green IT and sustainable cloud infrastructure solutions also supports market development.

Asia-Pacific Infrastructure as a Service Market Insight

The Asia-Pacific Infrastructure as a service market is anticipated to register the fastest CAGR from 2025 to 2032, driven by rapid digitalization, urbanization, and expanding internet penetration in emerging economies such as China, India, Japan, and Australia. Government cloud initiatives, increasing investments in smart cities, and growth of SMEs adopting cloud infrastructure to reduce IT costs are key growth factors. Additionally, the region’s growing role as a manufacturing and innovation hub for cloud technologies enhances the accessibility and affordability of Infrastructure as a service solutions.

Japan Infrastructure as a Service Market Insight

Japan’s Infrastructure as a service market growth is supported by its advanced technology ecosystem, strong focus on automation, and rising adoption of cloud services in manufacturing, finance, and healthcare sectors. The aging population and labor shortages are driving automation and cloud migration for operational efficiency. Integration of Infrastructure as a service with IoT and AI technologies in smart factories and urban infrastructure further propel market expansion.

China Infrastructure as a Service Market Insight

China accounted for the largest revenue share in the Asia-Pacific Infrastructure as a service market in 2024, fueled by government policies supporting cloud infrastructure development and digital economy growth. Rapid urbanization, growing cloud literacy, and the increasing number of data centers enhance demand across industries such as retail, telecom, and manufacturing. China’s strong domestic cloud service providers and investments in cloud security and AI further boost the Infrastructure as a service market’s growth trajectory.

Infrastructure as a Service Market Share

The infrastructure as a service industry is primarily led by well-established companies, including:

- SLB (U.S.)

- Adtran (U.S.)

- Fujikura Ltd. (Japan)

- EXFO Inc. (Canada)

- Sumitomo Electric Industries, Ltd. (Japan)

- Lumentum Operations LLC (U.S.)

- DSIT Solutions Ltd. (Israel)

- Bandweaver (U.K.)

- Qualitrol Company LLC (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Omnisens (Switzerland)

- NBG Holding GmbH (Austria)

- Zayo Group, LLC (U.S.)

- CommVerge Solutions (China)

- Halliburton (U.A.E.)

- LANCIER Monitoring GmbH (Germany)

- M2Optics, Inc. (U.S.)

- FURUKAWA ELECTRIC CO., LTD. (Japan)

What are the Recent Developments in Global Infrastructure as a Service Market?

- In December 2023, ZKTeco partnered with Amazon Web Services (AWS) to launch the innovative Minerva IoT platform, leveraging AWS’s robust cloud infrastructure to enhance its cloud capabilities. This collaboration is expected to strengthen ZKTeco’s position in the Infrastructure as a service market by offering a secure and scalable IoT platform with advanced features, driving greater adoption of cloud-based IoT solutions

- In November 2023, Leaseweb Global introduced a new channel partner program in the U.K. designed specifically for managed service providers (MSPs). This initiative aims to expand Leaseweb’s market reach by fostering long-term sales partnerships, enabling MSPs to deliver strategic cloud services and advice, thereby boosting demand for Infrastructure as a service offerings in the region

- In August 2023, Cisco and Kyndryl have expanded their partnership to enhance enterprise cyber risk management. Kyndryl's cyber resilience solution will now integrate with Cisco's Security Cloud platform, which includes Multicloud Defense for unified security, Duo for access control, and extended detection and response features

- In May 2023, Kyndryl and Cloudflare announced a partnership to modernize corporate networks. This collaboration combines Cloudflare’s Zero Trust technology and Kyndryl’s WAN-as-a-Service to offer businesses scalable, efficient cloud connectivity. The integration aims to streamline network management and enhance security for diverse cloud environments

- In December 2022, F5 launched its Distributed Cloud App infrastructure protection solution, enhancing application observability and security for cloud-native infrastructures. This development strengthens F5’s market competitiveness by addressing critical security and performance needs, encouraging wider adoption of secure cloud applications within the Infrastructure as a service sector

- In October 2022, Lenovo enhanced its TruScale Infrastructure-as-a-Service technology solution through extended partnerships with Nutanix, Veeam, and Red Hat. This improvement has increased customer acceptance by offering enhanced safety, on-premises control, and hybrid cloud flexibility, positioning Lenovo strongly in the hybrid Infrastructure as a service market segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INFRASTRUCTURE AS A SERVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INFRASTRUCTURE AS A SERVICE MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL INFRASTRUCTURE AS A SERVICE MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 CASE STUDY

5.6 COMPANY COMPARITIVE ANALYSIS

6. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, BY SOLUTIONS

6.1 OVERVIEW

6.2 MANAGED HOSTING

6.3 STORAGE AS A SERVICE

6.3.1 STORGAE AREA NETWORK (SAN) BASED STORAGE

6.3.2 NETWORK ATTACHED STORAGE (NAS)

6.4 DISASTER RECOVERY AS A SERVICE (DRAAS)

6.5 COLOCATION

6.6 NETWORK MANAGEMENT

6.7 CONTENT DELIVERY

6.8 HIGH PERFORMANCE COMPUTING AS A SERVICE

6.9 OTHERS

7. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 PUBLIC CLOUD

7.3 PRIVATE CLOUD

7.4 HYBRID CLOUD

8. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 SMALL & MEDIUM SIZE ENTERPRISES

8.3 LARGE ENTERPRISES

9. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, BY VERTICAL

9.1 OVERVIEW SIZE

9.2 IT & TELECOM

9.2.1 SOLUTION

9.2.1.1. MANAGED HOSTING

9.2.1.2. STORAGE AS A SERVICE

9.2.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.2.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.2.1.5. COLOCATION

9.2.1.6. NETWORK MANAGEMENT

9.2.1.7. CONTENT DELIVERY

9.2.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.2.1.9. OTHERS

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.3.1 SOLUTION

9.3.1.1. MANAGED HOSTING

9.3.1.2. STORAGE AS A SERVICE

9.3.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.3.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.3.1.5. COLOCATION

9.3.1.6. NETWORK MANAGEMENT

9.3.1.7. CONTENT DELIVERY

9.3.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.3.1.9. OTHERS

9.4 HEALTHCARE

9.4.1 SOLUTION

9.4.1.1. MANAGED HOSTING

9.4.1.2. STORAGE AS A SERVICE

9.4.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.4.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.4.1.5. COLOCATION

9.4.1.6. NETWORK MANAGEMENT

9.4.1.7. CONTENT DELIVERY

9.4.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.4.1.9. OTHERS

9.5 RETAIL AND E-COMMERCE

9.5.1 SOLUTION

9.5.1.1. MANAGED HOSTING

9.5.1.2. STORAGE AS A SERVICE

9.5.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.5.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.5.1.5. COLOCATION

9.5.1.6. NETWORK MANAGEMENT

9.5.1.7. CONTENT DELIVERY

9.5.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.5.1.9. OTHERS

9.6 GOVERNMENT & DEFENSE

9.6.1 SOLUTION

9.6.1.1. MANAGED HOSTING

9.6.1.2. STORAGE AS A SERVICE

9.6.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.6.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.6.1.5. COLOCATION

9.6.1.6. NETWORK MANAGEMENT

9.6.1.7. CONTENT DELIVERY

9.6.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.6.1.9. OTHERS

9.7 ENERGY & UTILITIES

9.7.1 SOLUTION

9.7.1.1. MANAGED HOSTING

9.7.1.2. STORAGE AS A SERVICE

9.7.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.7.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.7.1.5. COLOCATION

9.7.1.6. NETWORK MANAGEMENT

9.7.1.7. CONTENT DELIVERY

9.7.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.7.1.9. OTHERS

9.8 MANUFACTURING

9.8.1 SOLUTION

9.8.1.1. MANAGED HOSTING

9.8.1.2. STORAGE AS A SERVICE

9.8.1.3. STORGAE AREA NETWORK (SAN) BASED STORAGE

9.8.1.4. DISASTER RECOVERY AS A SERVICE (DRAAS)

9.8.1.5. COLOCATION

9.8.1.6. NETWORK MANAGEMENT

9.8.1.7. CONTENT DELIVERY

9.8.1.8. HIGH PERFORMANCE COMPUTING AS A SERVICE

9.8.1.9. OTHERS

9.9 OTHERS

10. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, BY REGION

10.1 GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 NORTH AMERICA

10.1.1.1. U.S.

10.1.1.2. CANADA

10.1.1.3. MEXICO

10.1.2 EUROPE

10.1.2.1. GERMANY

10.1.2.2. FRANCE

10.1.2.3. U.K.

10.1.2.4. ITALY

10.1.2.5. SPAIN

10.1.2.6. RUSSIA

10.1.2.7. TURKEY

10.1.2.8. BELGIUM

10.1.2.9. NETHERLANDS

10.1.2.10. SWITZERLAND

10.1.2.11. NORWAY

10.1.2.12. FINLAND

10.1.2.13. DENMARK

10.1.2.14. SWEDEN

10.1.2.15. POLAND

10.1.2.16. REST OF EUROPE

10.1.3 ASIA PACIFIC

10.1.3.1. JAPAN

10.1.3.2. CHINA

10.1.3.3. SOUTH KOREA

10.1.3.4. INDIA

10.1.3.5. AUSTRALIA

10.1.3.6. SINGAPORE

10.1.3.7. THAILAND

10.1.3.8. MALAYSIA

10.1.3.9. INDONESIA

10.1.3.10. PHILIPPINES

10.1.3.11. NEW ZEALAND

10.1.3.12. TAIWAN

10.1.3.13. VIETNAM

10.1.3.14. REST OF ASIA PACIFIC

10.1.4 SOUTH AMERICA

10.1.4.1. BRAZIL

10.1.4.2. ARGENTINA

10.1.4.3. REST OF SOUTH AMERICA

10.1.5 MIDDLE EAST AND AFRICA

10.1.5.1. SOUTH AFRICA

10.1.5.2. EGYPT

10.1.5.3. SAUDI ARABIA

10.1.5.4. U.A.E

10.1.5.5. ISRAEL

10.1.5.6. OMAN

10.1.5.7. BAHRAIN

10.1.5.8. KUWAIT

10.1.5.9. QATAR

10.1.5.10. REST OF MIDDLE EAST AND AFRICA

10.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT & APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, SWOT ANALYSIS

13. GLOBAL INFRASTRUCTURE AS A SERVICE MARKET, COMPANY PROFILE

13.1 AMAZON WEB SERVICES (AWS)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 MICROSOFT CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 INTERNATIONAL BUSINESS MACHINES (IBM) CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 GOOGLE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 ALIBABA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 RACKSPACE TECHNOLOGY

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 VMWARE

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 KYNDRYL INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 CISCO SYSTEMS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.10 FUJITSU

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 ORACLE

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 ACCENTURE

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 HCL TECHNOLOGIES LIMITED

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 ATOS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 ATLASSIAN

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 RED HAT, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 DELL INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 HUAWEI

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 REDCENTRIC PLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.20 NETMAGIC SOLUTIONS PVT. LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 NTT LIMITED

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 RELIANCE COMMUNICATIONS

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 TATA COMMUNICATIONS

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 SIFY TECHNOLOGIES

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

13.25 CITRIX SYSTEMS, INC.

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 GEOGRAPHIC PRESENCE

13.25.4 PRODUCT PORTFOLIO

13.25.5 RECENT DEVELOPMENTS

13.26 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

13.26.1 COMPANY SNAPSHOT

13.26.2 REVENUE ANALYSIS

13.26.3 GEOGRAPHIC PRESENCE

13.26.4 PRODUCT PORTFOLIO

13.26.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14. RELATED REPORTS

15. QUESTIONNAIRE

16. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.