Global Ingaas Camera Market

Market Size in USD Million

CAGR :

%

USD

179.50 Million

USD

372.40 Million

2024

2032

USD

179.50 Million

USD

372.40 Million

2024

2032

| 2025 –2032 | |

| USD 179.50 Million | |

| USD 372.40 Million | |

|

|

|

|

InGaAs Camera Market Size

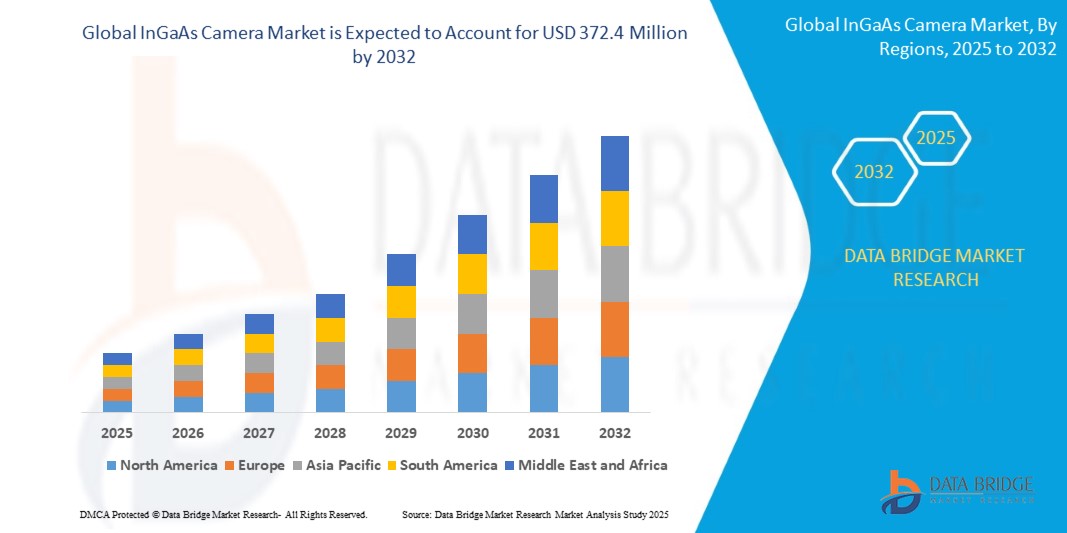

- The global InGaAs camera market size was valued at USD 179.5 million in 2024 and is expected to reach USD 372.4 million by 2032, at a CAGR of 9.55% during the forecast period

- This growth is driven by factors such as rising demand for short-wave infrared (SWIR) imaging across industrial, military, and scientific applications, increasing adoption in surveillance and machine vision systems, and advancements in sensor technologies enabling higher resolution and sensitivity

InGaAs Camera Market Analysis

- InGaAs cameras are specialized imaging devices used primarily for short-wave infrared (SWIR) detection, offering high sensitivity and resolution in low-light and non-visible conditions. They are essential for applications in defense, industrial inspection, spectroscopy, and scientific research

- The demand for these cameras is significantly driven by the increasing need for advanced imaging in surveillance, quality control, and semiconductor inspection, along with growing investments in infrared technology across sectors

- North America is expected to dominate the InGaAs camera market, accounting for the largest regional share of 36.15% in 2025, due to strong defense spending, advanced industrial automation, and the presence of key technology players

- Asia-Pacific is projected to hold a market share of 29.48% in the global InGaAs camera market in 2025, making it the second-largest region after North America. This growth is driven by rapid industrialization, expanding electronics and semiconductor sectors, and increased adoption of SWIR imaging in countries such as China, Japan, South Korea, and India

- The industrial automation segment is expected to dominate the market with a market share of 38.15% in 2025, increasing demand for high-precision inspection and quality control in manufacturing processes

Report Scope and InGaAs Camera Market Segmentation

|

Attributes |

InGaAs Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

InGaAs Camera Market Trends

“Rising Adoption of SWIR Imaging in Industrial and Defense Applications”

- One prominent trend in the InGaAs camera market is the growing integration of short-wave infrared (SWIR) imaging in industrial inspection and defense surveillance systems due to its ability to detect details invisible to the naked eye or standard cameras

- These cameras provide enhanced imaging through materials such as silicon and plastics and are highly effective in low-light or nighttime conditions, making them ideal for high-precision inspection and tactical military applications

- For instance, InGaAs cameras are increasingly being used in semiconductor wafer inspection to detect micro-defects and in defense for border surveillance and covert operations under low visibility

- This trend is transforming imaging standards across sectors, boosting demand for advanced InGaAs sensors with improved resolution, compact form factors, and broader spectral sensitivity

InGaAs Camera Market Dynamics

Driver

“Increasing Demand for InGaAs Cameras in Industrial and Defense Applications”

- The rising demand for high-precision imaging in industrial inspection, defense, and scientific research is significantly contributing to the increased demand for InGaAs cameras

- Industries such as semiconductor manufacturing, solar energy, and pharmaceuticals require accurate defect detection and material analysis, which is driving the adoption of InGaAs cameras that offer superior sensitivity in short-wave infrared (SWIR) wavelengths

- In addition, defense applications, including surveillance, border security, and night-time operations, are increasing the need for advanced infrared imaging systems that can function effectively in low-light or obscured environments

For instance,

- In June 2022, the U.S. Department of Defense awarded contracts to enhance infrared imaging systems for tactical surveillance, recognizing the need for superior performance in SWIR wavelengths for security and reconnaissance missions

- As a result of these advancements and the increasing demand for precision in industries and defense, the InGaAs camera market is experiencing significant growth across various sectors

Opportunity

“Expanding Applications of InGaAs Cameras in AI and Automation”

- InGaAs cameras are increasingly being integrated into artificial intelligence (AI) and automation systems, offering high-quality imaging for applications in industrial inspection, autonomous vehicles, and medical diagnostics

- AI algorithms can leverage the superior imaging capabilities of InGaAs cameras to improve defect detection in semiconductor manufacturing, enable more accurate surveillance in security systems, and enhance diagnostic precision in medical imaging applications

- In addition, InGaAs cameras are playing a crucial role in the development of AI-powered systems for predictive maintenance and autonomous decision-making, driving growth in industries such as manufacturing, automotive, and aerospace

For instance,

- In November 2023, a leading semiconductor manufacturer announced its partnership with an AI technology firm to incorporate InGaAs cameras into their automated inspection systems, enhancing the accuracy and speed of defect detection in microchips

- The continued development of AI and automation systems using InGaAs cameras can lead to increased efficiency, higher precision, and cost savings, opening up new opportunities across various industries

Restraint/Challenge

“High Equipment Costs Hindering Market Adoption”

- The high cost of InGaAs cameras poses a significant challenge for market penetration, particularly in industries with tight budgets, such as small to medium-sized manufacturers and research labs

- These cameras, known for their superior performance in SWIR imaging, can often range from several thousand to tens of thousands of dollars, making them expensive for many smaller organizations or those in emerging markets

- The substantial upfront investment required for these advanced imaging systems can deter companies from upgrading their equipment or adopting the technology, leading to reliance on less effective or outdated imaging systems

For instance,

- In October 2024, according to an article published by a leading industrial automation provider, the high costs of InGaAs cameras are a key factor preventing widespread adoption in sectors like manufacturing, where smaller companies may struggle to justify the investment in high-end infrared systems for quality control

- As a result, these financial barriers can limit the expansion of InGaAs camera technology, particularly in cost-sensitive markets, and hinder the overall growth potential of the market

InGaAs Camera Market Scope

The market is segmented on the basis camera cooling technology, scanning type, application and technology.

|

Segmentation |

Sub-Segmentation |

|

By Camera Cooling Technology |

|

|

By Scanning Type |

|

|

By Application |

|

|

By Technology |

|

In 2025, the industrial automation is projected to dominate the market with a largest share in application segment

In 2025, the industrial automation segment is projected to lead the market with a 38.15% share, driven by the rising demand for high-precision inspection and quality control in manufacturing processes. This growth is fueled by advancements in robotics, IoT, and AI technologies, enhancing efficiency and productivity. The Asia-Pacific region is expected to dominate with a 39% market share, reflecting its rapid industrialization and adoption of smart manufacturing solutions. Within this region, China is anticipated to hold the largest share at 18%, supported by its robust manufacturing sector and government initiatives promoting automation

The industrial automation is expected to account for the largest share during the forecast period in camera cooling technology segment

In 2025, the uncooled camera segment is expected to dominate the InGaAs camera market, accounting for the largest share due to its cost-effectiveness and versatility, making it ideal for applications in industrial automation, security, and scientific research. Uncooled cameras are easier to operate and more affordable than cooled cameras, driving their adoption across various sectors. North America, led by the U.S., is anticipated to be the dominant region, fueled by strong demand in industrial automation and defense applications. The Asia-Pacific region, particularly China, is expected to experience rapid growth, driven by industrial advancements and increasing adoption of InGaAs cameras in manufacturing processes. In terms of scanning type, the area scan camera segment is projected to hold the largest market share, offering superior imaging capabilities for high-resolution, full-frame images in industrial automation, scientific research, and security. The line scan camera segment is also expected to grow significantly, particularly for high-speed imaging in applications like semiconductor manufacturing and defect detection in continuous production lines

InGaAs Camera Market Regional Analysis

“North America Holds the Largest Share in the InGaAs Camera Market”

- North America dominates the InGaAs camera market with a market share of 38.15%, driven by the region's advanced industrial automation, defense, and scientific research sectors, along with a strong presence of key technology players

- The U.S. holds a significant share due to increasing demand for high-precision imaging systems in semiconductor manufacturing, solar energy, and military applications, as well as the adoption of advanced InGaAs cameras in these industries

- The region benefits from high investments in research and development, particularly in the defense and industrial automation sectors, as well as well-established infrastructure for technological innovation

- In addition, the demand for uncooled InGaAs cameras in industrial applications, coupled with growing automation needs and advancements in imaging technologies, is further boosting market expansion in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the InGaAs Camera Market”

- Asia-Pacific is projected to hold a market share of 29.48% in the global InGaAs camera market in 2025, making it the second-largest region after North America. This growth is driven by rapid industrialization, expanding electronics and semiconductor sectors, and increased adoption of SWIR imaging in countries such as China, Japan, South Korea, and India

- Countries like China, India, and Japan are emerging as key markets due to their large populations, strong manufacturing base, and rising investments in high-tech industries requiring advanced imaging systems

- China is expected to hold the largest market share in Asia-Pacific, estimated at 42.6% in 2025, driven by its booming semiconductor industry and growing demand for automation in various industrial sectors

- India follows with a market share of 26.5% in 2025, where the adoption of InGaAs cameras in industrial automation and scientific research is rapidly expanding. Japan, with its advanced technological infrastructure and significant focus on R&D, is projected to contribute 18.2% to the region’s market share in 2025

InGaAs Camera Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Photon Interactive UK Limited. (U.K.)

- Hamamatsu Photonics K.K. (Japan)

- First Sensor AG (Germany)

- Jenoptik AG (Germany)

- Teledyne Technologies Incorporated. (U.S.)

- Luna (U.S.)

- Lumentum Operations LLC (U.S.)

- Albis Optoelectronics AG (Switzerland)

- Thorlabs, Inc. (U.S.)

- Xenics (Belgium)

- New Imaging Technologies (France)

- Allied Vision Technologies GmbH (Germany)

- Raptor Photonics Limited (U.K.)

- Teledyne Princeton Instruments (U.S.)

- AC Photonics, Inc. (U.S.)

- New England Photoconductor (U.S.)

- Qphotonics (U.S.)

- Episensors, Inc. (U.S.)

- Roithner Lasertechnik GmbH (Austria)

- KYOTO SEMICONDUCTOR Co., Ltd. (Japan)

- Cosemi Technologies, Inc. (U.S.)

- Voxtel, Inc. (U.S.)

- Edmund Optics Inc. (U.S.)

- Precision Micro-Optics Inc. (U.S.)

Latest Developments in Global InGaAs Camera Market

- In March 2024, SVS-Vistek expanded its FXO Series of machine vision cameras with the introduction of two new short wave infrared (SWIR) models: the fxo992 and fxo993. These cameras feature Sony's advanced InGaAs SWIR sensors, IMX992 and IMX993. The fxo992 delivers a resolution of 5.2 MPixels with a frame rate of 132.6 fps, while the fxo993 offers 3.1 MPixels and a frame rate of 173.4 fps. Designed for high-speed and high-resolution imaging, these cameras are ideal for industrial applications

- In February 2024, Hamamatsu Photonics unveiled the C16741-40U, an advanced InGaAs camera with sensitivity spanning the visible to near-infrared range (400 nm to 1700 nm). Featuring an SXGA resolution of 1280 x 1024 pixels and 5 μm pixel size, this camera excels in capturing high-resolution images with exceptional signal-to-noise ratios, thanks to its minimized readout noise. Designed for precision imaging, it supports applications across various industries, including silicon wafer inspection and solar cell evaluation

- In September 2024, New Imaging Technologies (NIT) launched the SenS 1280 and SenS 1920, cutting-edge short-wave infrared (SWIR) InGaAs cameras. These high-resolution cameras are tailored for semiconductor and solar panel inspection, delivering exceptional performance with advanced pixel counts and impressive frame rates. Designed to boost efficiency in modern semiconductor fabs, the SenS 1280 and SenS 1920 set new standards in precision imaging. Their innovative features cater to the growing demand for high-throughput inspection solutions

- In February 2024, Hamamatsu Photonics launched the C16741-40U InGaAs camera, offering sensitivity across a wide spectral range from 400 nm to 1700 nm. This advanced imaging device is designed for diverse applications, including industrial inspection and scientific research, where capturing a broad spectrum of light is crucial. With SXGA resolution of 1280 x 1024 pixels and 5 μm pixel size, the camera delivers high-resolution images with exceptional signal-to-noise ratios. Its minimized readout noise ensures precision imaging, making it ideal for tasks like silicon wafer inspection and solar cell evaluation

- In August 2024, 1stVision introduced Alvium cameras featuring Sony SenSWIR InGaAs sensors, enabling advanced short-wave infrared (SWIR) imaging. These cameras are designed to capture a segment of the electromagnetic spectrum invisible to the human eye and traditional CMOS sensors, significantly broadening imaging possibilities. With applications in industrial and scientific fields, Alvium cameras offer enhanced precision and versatility for tasks requiring SWIR imaging. Their innovative design supports diverse use cases, from semiconductor inspection to environmental monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ingaas Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ingaas Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ingaas Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.