Global Inhaled Nitric Oxide Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

2.21 Billion

2025

2033

USD

1.19 Billion

USD

2.21 Billion

2025

2033

| 2026 –2033 | |

| USD 1.19 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Inhaled Nitric Oxide Market Size

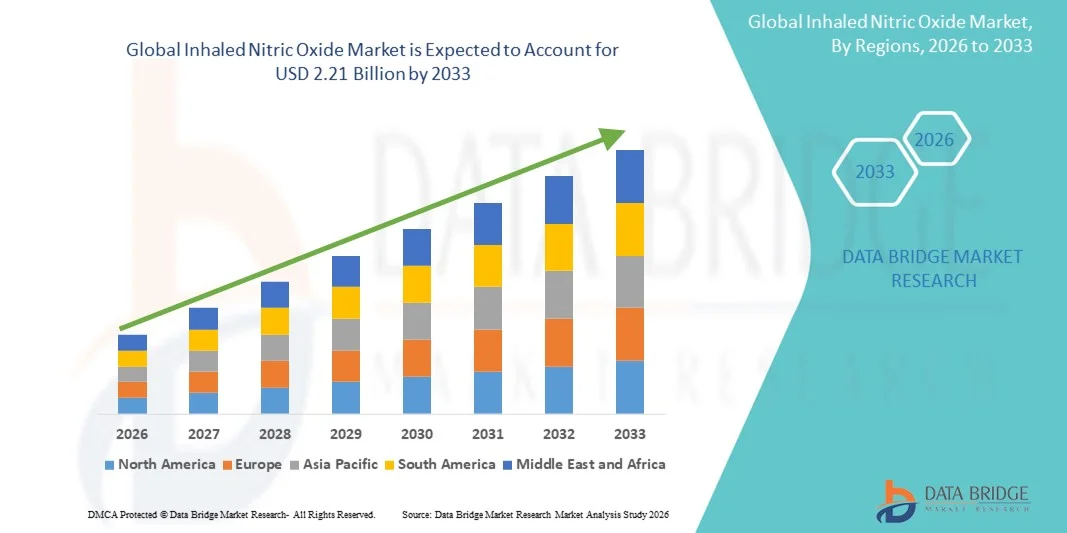

- The global inhaled nitric oxide market size was valued at USD 1.19 billion in 2025 and is expected to reach USD 2.21 billion by 2033, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by increasing prevalence of respiratory disorders, rising adoption of advanced pulmonary therapies, and growing awareness of non-invasive treatment options in critical care settings

- Furthermore, expanding hospital infrastructure, increasing investments in neonatal and adult intensive care units, and rising research activities in pulmonary hypertension and other respiratory conditions are driving the uptake of Inhaled Nitric Oxide solutions, thereby significantly boosting the industry's growth

Inhaled Nitric Oxide Market Analysis

- Inhaled Nitric Oxide, a critical therapy used primarily in neonatal and adult respiratory care, is increasingly vital in treating conditions such as pulmonary hypertension, acute respiratory distress syndrome (ARDS), and other life-threatening respiratory disorders due to its vasodilatory effects and non-invasive administration

- The escalating demand for inhaled nitric oxide is primarily fueled by rising prevalence of respiratory disorders, expanding ICU and neonatal care infrastructure, increasing awareness of advanced pulmonary therapies, and growing research in critical care treatment options

- North America dominated the inhaled nitric oxide market with the largest revenue share of 39.5% in 2025, supported by advanced healthcare infrastructure, high adoption of pulmonary therapies, strong presence of key market players, and growing clinical research in respiratory care, with the U.S. contributing the majority share due to widespread availability in hospitals and specialized care centers

- Asia-Pacific is expected to be the fastest-growing region in the inhaled nitric oxide market during the forecast period, registering a CAGR of 10.8%, driven by increasing incidence of respiratory disorders, improving healthcare access, rising healthcare expenditure, and expanding neonatal and critical care facilities in countries such as China, India, and Japan

- The 99.99% purity segment dominated with a market share of 57.2% in 2025, owing to strict regulatory standards and clinical requirements for inhaled therapeutics

Report Scope and Inhaled Nitric Oxide Market Segmentation

|

Attributes |

Inhaled Nitric Oxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Inhaled Nitric Oxide Market Trends

Rising Prevalence of Respiratory Conditions and Critical Care Needs

- The increasing prevalence of respiratory disorders such as pulmonary hypertension, acute respiratory distress syndrome (ARDS), and neonatal hypoxic respiratory failure is a primary driver for the Inhaled Nitric Oxide (iNO) market. The therapy offers selective pulmonary vasodilation, helping improve oxygenation without causing systemic hypotension

- For instance, in March 2024, a major hospital network in the U.S. adopted an advanced iNO delivery system in their neonatal intensive care units, enabling more precise dosing and improved patient outcomes. Such adoptions are expected to drive market expansion in the forecast period

- The rising incidence of COVID-19-related ARDS and other acute lung injuries has further underscored the clinical utility of iNO as an adjunct therapy, reinforcing its demand in critical care settings. Healthcare providers are increasingly recognizing iNO’s role in improving ventilation-perfusion matching in severe respiratory conditions, supporting its integration into standard treatment protocols

- Technological advancements in delivery devices, including portable and automated systems, enhance dosing precision, reduce waste, and improve safety, further fueling adoption in hospitals and specialty care centers. Continuous education and clinical awareness programs are facilitating the early adoption of iNO therapy, emphasizing its benefits in both pediatric and adult critical care populations

- The growing number of clinical trials exploring iNO for off-label applications, such as in COVID-19 patients and lung transplant candidates, also contributes to the market’s momentum. Increasing government and private hospital investments in advanced respiratory support infrastructure are creating opportunities for wider integration of iNO therapy in intensive care units

- Ease of administration and compatibility with existing ventilator systems make iNO therapy a convenient option for clinicians managing complex respiratory cases. The combination of clinical efficacy, emerging applications, and improved delivery mechanisms is expected to sustain robust market growth during the forecast period

Inhaled Nitric Oxide Market Dynamics

Driver

Shift Toward Precise and Versatile iNO Therapy

- A key trend in the global Inhaled Nitric Oxide (iNO) market is the expansion of clinical applications beyond traditional pulmonary hypertension, including ARDS, neonatal hypoxic respiratory failure, and off-label use in COVID-19-induced respiratory distress

- Healthcare providers are increasingly adopting advanced iNO delivery systems with improved dosing precision, reduced gas wastage, and integration with mechanical ventilators, which enhances clinical outcomes

- Portable iNO delivery devices are gaining popularity, enabling bedside therapy and potential use in emergency transport or smaller healthcare facilities. Continuous R&D is focused on optimizing iNO administration to minimize adverse effects such as methemoglobinemia, improving patient safety

- The growing number of clinical trials exploring new indications for iNO supports its broader adoption and long-term market growth. Integration with monitoring systems that provide real-time feedback on oxygenation and nitric oxide concentration is making therapy more efficient and user-friendly

- Hospitals and specialty clinics are increasingly investing in automated and user-friendly systems, which are reducing human error and improving treatment consistency

- For instance, in February 2024, a major U.S. hospital implemented a portable iNO delivery system for neonatal ICUs, improving treatment accessibility and precision in critical care settings

- Regional expansion in emerging markets is facilitated by awareness campaigns highlighting the benefits of iNO in critical care, particularly in neonatal and pediatric ICUs

- Strategic partnerships between medical device manufacturers and hospital networks are driving adoption by demonstrating improved patient outcomes. Overall, this trend reflects a shift towards more precise, accessible, and versatile iNO therapy, creating long-term growth opportunities for the market

Restraint/Challenge

High Cost of Therapy and Limited Accessibility in Developing Regions

- The relatively high cost of iNO therapy, including the gas cylinders, delivery devices, and monitoring systems, poses a challenge for adoption, particularly in resource-limited settings

- For instance, in June 2023, several smaller hospitals in Southeast Asia reported delayed adoption of iNO therapy due to budget constraints, highlighting regional disparities in access

- The need for trained personnel and careful monitoring during therapy adds to operational challenges, limiting the ability of smaller clinics to implement iNO effectively

- Short shelf-life and specialized storage requirements for nitric oxide gas cylinders further complicate logistics and increase the overall cost of treatment. While newer delivery technologies are improving efficiency, upfront investment remains high, making hospitals cautious about large-scale implementation

- Potential adverse effects such as methemoglobinemia and rebound pulmonary hypertension necessitate vigilant monitoring, which can strain limited clinical resources. Insurance coverage limitations and varying reimbursement policies across regions can restrict patient access, affecting market penetration

- Educating clinicians and healthcare administrators about cost-effective utilization strategies is vital for overcoming these barriers. Addressing affordability through regional partnerships, leasing models for delivery systems, and government subsidies could enhance adoption in emerging markets

Inhaled Nitric Oxide Market Scope

The market is segmented on the basis of type, strength, purity, application, end-users, and distribution channel.

- By Type

On the basis of type, the Inhaled Nitric Oxide market is segmented into gas, delivery systems, and others. The gas segment dominated the largest market revenue share of 48.6% in 2025, driven by its extensive application in critical care and neonatal intensive care units (NICUs). Hospitals and specialized clinics prefer pre-filled gas cylinders due to their reliability, standardized dosing, and compliance with medical regulations. Gas forms provide ease of storage, longer shelf life, and compatibility with existing ventilator systems. The segment benefits from established supply chains and is supported by global regulatory approvals. Its prevalence in ARDS, COPD, and neonatal respiratory treatments ensures steady revenue generation. Additionally, gas delivery allows precise control of dosage in emergency situations and critical care interventions. The segment is further bolstered by the growing demand in emerging markets and increasing awareness of respiratory disorders. Clinicians also favor this form due to its simplicity and proven clinical outcomes.

The delivery systems segment is anticipated to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by technological advancements in portable and integrated delivery devices. These systems enable precise dosing, reduce nitric oxide wastage, and allow bedside administration, supporting usage in emergency care, home healthcare, and patient transport. Innovations such as ventilator-integrated delivery devices and portable cylinders are increasing adoption in adult ICU and neonatal care settings. Hospitals and clinics increasingly prefer devices that provide real-time monitoring and safety alarms. The growing prevalence of respiratory disorders, expansion of home healthcare services, and rising investments in healthcare infrastructure contribute to rapid segment growth. Delivery systems are becoming more compact, cost-effective, and user-friendly, allowing for better management of critical respiratory therapies outside traditional hospital environments. Improved patient compliance and reduced clinical errors are key advantages driving adoption.

- By Strength

On the basis of strength, the market is segmented into 100 ppm, 800 ppm, and others. The 100 ppm segment dominated with a market share of 53.4% in 2025, largely due to its standard use in neonatal respiratory treatments and ARDS management. It offers a safe therapeutic profile, regulatory approval in major markets, and easy integration with existing ICU ventilator setups. Hospitals prefer this dosage for controlled administration, minimizing risks of nitric oxide toxicity. Clinical guidelines recommend 100 ppm for effective management of hypoxic respiratory failure in newborns and critical adults. The segment’s dominance is reinforced by consistent demand across NICUs globally, as well as rising awareness of iNO therapy among clinicians. It is also supported by hospital protocols ensuring proper monitoring of oxygenation and patient safety. Stable procurement channels, well-established dosing protocols, and extensive clinical evidence further strengthen market leadership.

The 800 ppm segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by emerging research exploring high-dose nitric oxide for severe adult respiratory disorders. High-concentration iNO administration is increasingly adopted in acute care scenarios, including ARDS and COVID-19-related respiratory failure. Hospitals and specialized respiratory clinics are integrating advanced ventilator delivery systems capable of supporting higher concentrations safely. The rise of portable high-dose systems also enables use in emergency care and transport. Clinical trials and studies demonstrating efficacy in severe cases are encouraging adoption. Improved dosing precision and safety monitoring features contribute to confidence in this segment. Rising awareness and adoption in emerging economies further support rapid growth.

- By Purity

On the basis of purity, the market is segmented into 99.92% purity, 99.99% purity, and others. The 99.99% purity segment dominated with a market share of 57.2% in 2025, owing to strict regulatory standards and clinical requirements for inhaled therapeutics. High-purity iNO reduces the formation of nitrogen dioxide and other harmful by-products, ensuring safety in sensitive neonatal and critical care patients. Hospitals, NICUs, and specialized clinics widely adopt this standard. Strong supply chain networks, adherence to international quality standards, and established clinical outcomes strengthen dominance. Increasing adoption in ARDS, COPD, and neonatal hypoxic respiratory failure treatments supports revenue growth. Regulatory approvals in the US, EU, and Asia-Pacific further reinforce the segment’s leadership. High-purity iNO ensures reliable and consistent therapeutic performance across patient populations.

The 99.92% purity segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by increasing adoption in emerging markets where cost-effectiveness is critical. Hospitals and clinics prefer slightly lower-purity options for non-critical respiratory care, providing patient safety while reducing costs. Expansion in home healthcare settings and outpatient care is supporting segment growth. The segment benefits from increasing production capabilities and growing awareness of safe administration protocols. Its relatively lower cost compared to ultra-high-purity variants makes it more accessible in budget-sensitive regions.

- By Application

On the basis of application, the market is segmented into COPD, neonatal respiratory treatment, tuberculosis treatment, ARDS, malaria treatment, and others. The neonatal respiratory treatment segment dominated with a market share of 42.5% in 2025, driven by the prevalence of hypoxic respiratory failure in newborns and NICU demand worldwide. Hospitals prioritize iNO therapy in neonates due to its proven efficacy, safety profile, and standardized dosing. Guidelines from pediatric and neonatal associations recommend iNO for early intervention in critical respiratory conditions. Established protocols in developed markets ensure steady adoption, while expanding NICU capacity in emerging economies fuels growth. Rising births, improved neonatal care infrastructure, and awareness of iNO therapy further reinforce market dominance.

The ARDS segment is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, fueled by increased adult ICU admissions and severe respiratory conditions. Hospitals and specialty clinics are adopting iNO therapy to manage acute lung injuries and COVID-19 complications effectively. Portable delivery systems and research demonstrating enhanced patient outcomes support rapid growth. Rising prevalence of ARDS in adult populations, especially in critical care units, drives segment expansion. Adoption is further encouraged by increasing healthcare investments, growing awareness of iNO therapy benefits, and availability of advanced ventilator-compatible devices.

- By End-Users

On the basis of end-users, the Inhaled Nitric Oxide market is segmented into clinics, hospitals, and others. The hospital segment dominated with a revenue share of 65.3% in 2025, primarily due to the need for continuous monitoring, specialized staff, and advanced critical care infrastructure. Hospitals are the main adoption sites for both neonatal and adult intensive care applications, including ARDS, neonatal hypoxic respiratory failure, and severe COPD cases. Large-scale procurement, high-volume utilization, and integration with ventilator systems strengthen the segment’s leadership. The hospital segment benefits from established clinical guidelines, strict regulatory compliance, and the availability of trained respiratory therapists. High awareness among clinicians and adoption of standardized iNO administration protocols also drive consistent revenue. Furthermore, hospitals have the capability to safely store and handle high-purity iNO gases, reducing risks associated with dosage and delivery. Government-funded programs and hospital partnerships with iNO manufacturers reinforce market dominance. In addition, hospitals frequently participate in clinical trials and research programs, further consolidating their position as primary end-users. The segment’s robust supply chain and infrastructure make it less susceptible to market fluctuations. Advanced monitoring equipment and established safety protocols ensure safe and effective patient outcomes, adding to its preference over other end-user segments.

The clinic segment is expected to witness the fastest CAGR of 16.7% from 2026 to 2033, driven by the increasing adoption of iNO therapy in outpatient care, home healthcare, and smaller specialty healthcare facilities. Clinics are integrating portable delivery systems for emergency and less intensive care scenarios, making therapy more accessible to patients outside hospital settings. The rise in home healthcare programs, particularly in developed countries, supports this growth trajectory. Clinics are increasingly providing critical respiratory care for ARDS, COPD, and neonatal patients in collaboration with hospitals, ensuring continuity of care. Technological advancements in portable and compact iNO delivery devices are enabling clinics to offer high-quality care at lower costs. Training and awareness programs for clinicians in smaller facilities are contributing to faster adoption. Clinics also benefit from simplified logistics, easy procurement of consumables, and less dependency on complex hospital infrastructure. The segment is supported by reimbursement policies and insurance coverage for home-based care. Integration with telemedicine platforms allows remote monitoring of patients receiving iNO therapy. Emerging markets are witnessing a surge in outpatient care centers, further driving segment growth. Expansion of public-private partnerships to extend respiratory care into local communities also plays a key role. Enhanced accessibility and cost-effective delivery make clinics a rapidly growing segment in the global iNO market.

- By Distribution Channel

On the basis of distribution channel, the Inhaled Nitric Oxide market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with a market share of 59.1% in 2025, as hospitals directly procure iNO gas and delivery systems for critical care, NICU, and ICU applications. Centralized procurement ensures cost efficiency and compliance with safety standards. Hospital pharmacies maintain strict storage and handling protocols to guarantee product safety and dosage accuracy. High-volume consumption and established supply chains reinforce leadership in the market. Hospitals also rely on long-term contracts with iNO manufacturers to secure consistent supply, supporting uninterrupted critical care. The segment benefits from regulatory approvals, clinician trust, and integration with hospital ventilator systems. Additionally, hospital pharmacies provide technical support for administration and device maintenance. Collaboration with respiratory therapists and medical staff ensures optimal patient outcomes, strengthening adoption. Hospitals continue to expand their NICU and ICU capacities, increasing demand for iNO. Government regulations often favor hospital-based procurement, adding to segment dominance. Established partnerships with suppliers and consistent product availability reinforce this leadership.

The online pharmacy segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, fueled by digitalization in healthcare supply chains and rising adoption of home healthcare programs. Online platforms enable convenient procurement of consumables, delivery devices, and iNO canisters, reaching smaller hospitals, clinics, and home healthcare providers. Digital marketplaces provide real-time inventory updates, secure payment options, and doorstep delivery, making iNO therapy more accessible in remote or underserved areas. The expansion of e-commerce infrastructure, particularly in emerging markets, supports rapid growth. Online pharmacies also allow for bulk procurement with flexible shipping schedules, benefiting smaller healthcare providers. Telemedicine integration further facilitates remote prescription and monitoring of iNO therapy, driving adoption. Increasing trust in online medical supply platforms and improvements in cold chain logistics contribute to segment expansion. The convenience, cost-efficiency, and reduced administrative burden for healthcare providers are key factors. Online pharmacies also provide educational resources and customer support to ensure safe administration. Enhanced access in geographically isolated regions is boosting demand. The segment is further supported by government initiatives to streamline digital healthcare procurement and expand home care programs.

Inhaled Nitric Oxide Market Regional Analysis

- North America dominated the inhaled nitric oxide market with the largest revenue share of 39.5% in 2025

- Supported by advanced healthcare infrastructure, high adoption of pulmonary therapies, strong presence of key market players, and growing clinical research in respiratory care

- The market contributing the majority share due to widespread availability in hospitals and specialized care centers

U.S. Inhaled Nitric Oxide Market Insight

The U.S. inhaled nitric oxide market captured the largest revenue share within North America, driven by increasing incidence of pulmonary hypertension, neonatal hypoxic respiratory failure, and acute respiratory distress syndrome (ARDS). The growing adoption of iNO in NICUs, ICUs, and surgical care settings, coupled with ongoing clinical trials for expanded indications, is propelling market growth.

Europe Inhaled Nitric Oxide Market Insight

The Europe inhaled nitric oxide market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing prevalence of respiratory disorders, adoption of advanced respiratory care therapies, and improvements in healthcare infrastructure. Countries such as the U.K. and Germany are witnessing rising hospital investments in neonatal and critical care facilities, supporting iNO adoption.

U.K. Inhaled Nitric Oxide Market Insight

The U.K. inhaled nitric oxide market is anticipated to grow at a noteworthy CAGR, fueled by the growing prevalence of neonatal respiratory complications, pulmonary hypertension, and increasing adoption of advanced inhaled therapies. Enhanced healthcare access and strong government support for neonatal care are also expected to stimulate market growth.

Germany Inhaled Nitric Oxide Market Insight

Germany’s inhaled nitric oxide market is expected to expand at a considerable CAGR during the forecast period, supported by rising awareness of respiratory disorders, strong clinical research, and increasing use of inhaled nitric oxide in hospitals and specialized care centers. The country’s robust healthcare system and emphasis on neonatal and critical care infrastructure further accelerate adoption.

Asia-Pacific Inhaled Nitric Oxide Market Insight

The Asia-Pacific inhaled nitric oxide market is expected to be the fastest-growing region, registering a CAGR of 10.8% during the forecast period, driven by the increasing incidence of respiratory disorders, rising healthcare expenditure, expanding neonatal and critical care facilities, and improving healthcare access in countries such as China, India, and Japan.

Japan Inhaled Nitric Oxide Market Insight

The Japanese inhaled nitric oxide market is gaining momentum due to increasing neonatal respiratory cases, adult pulmonary complications, and the country’s focus on high-quality healthcare services. Rising adoption of inhaled nitric oxide in NICUs and ICUs, along with clinical research in respiratory care, is boosting market growth.

China Inhaled Nitric Oxide Market Insight

China inhaled nitric oxide market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to increasing prevalence of pulmonary hypertension, ARDS, and neonatal respiratory failure, coupled with growing healthcare infrastructure, rising number of hospitals and specialized care centers, and strong government initiatives promoting advanced respiratory therapies.

Inhaled Nitric Oxide Market Share

The Inhaled Nitric Oxide industry is primarily led by well-established companies, including:

• Linde plc (Germany)

• Air Liquide S.A. (France)

• Vyaire Medical (U.S.)

• INO Therapeutics (U.S.)

• Praxair, Inc. (U.S.)

• BOC Healthcare (U.K.)

• Xi’an Tianxin Pharmaceutical Co., Ltd. (China)

• WhiteSwell Medical (U.S.)

• Ikaria, Inc. (U.S.)

• Minaris Regenerative Medicine GmbH (Germany)

• BTG International (U.K.)

• Sandoz (Switzerland)

• Terumo Corporation (Japan)

• Sigma-Aldrich (U.S.)

Latest Developments in Global Inhaled Nitric Oxide Market

- In January 2023, VERO Biotech Inc. raised USD 30 million to accelerate the development and commercialization of its GENOSYL Delivery System (DS), a tankless iNO generator. This system was designed to improve portability and reduce reliance on bulky high-pressure gas cylinders, enabling easier bedside delivery of nitric oxide for patients

- In June 2022, VERO Biotech received FDA clearance for the GENOSYL DS, marking a significant milestone in making nitric oxide therapy more accessible. The device allows precise dosing without the need for large cylinders, which is particularly beneficial for neonatal and critical care patients

- In December 2023, Mallinckrodt plc secured FDA clearance for its INOmax EVOLVE Delivery System, a next-generation iNO device that incorporates mini-cylinders, automated control, and synchronized dose delivery. This system enhanced patient safety and efficiency in ventilated settings, particularly in NICUs and adult ICUs

- In October 2024, Mallinckrodt began expanded deployment of the INOmax EVOLVE DS across hospitals in the United States. The rollout focused on improving automation, portability, and safety for patients requiring inhaled nitric oxide therapy, addressing the growing demand for advanced respiratory care

- In May 2024, the FDA confirmed the clearance of the INOmax EVOLVE system for NICU and transport applications, reinforcing its clinical utility in neonatal respiratory therapy and emergency care situations

- In May 2025, the FDA granted 510(k) clearance for the NOxBOXi Nitric Oxide Delivery System, which provides a constant, user-set NO concentration and includes integrated NO₂/O₂ monitoring, enhancing safety and treatment precision for patients under iNO therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.