Global Injection Molding Polyamide 6 Market

Market Size in USD Billion

CAGR :

%

USD

9.88 Billion

USD

16.97 Billion

2024

2032

USD

9.88 Billion

USD

16.97 Billion

2024

2032

| 2025 –2032 | |

| USD 9.88 Billion | |

| USD 16.97 Billion | |

|

|

|

|

Injection Molding Polyamide 6 Market Size

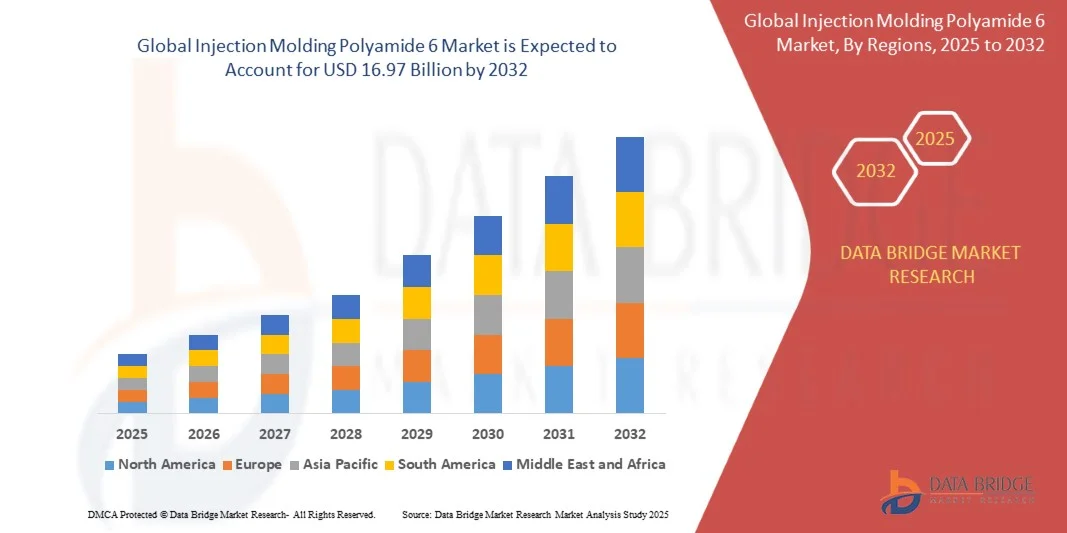

- The global injection molding polyamide 6 market size was valued at USD 9.88 billion in 2024 and is expected to reach USD 16.97 billion by 2032, at a CAGR of 7.0% during the forecast period

- The market growth is largely fuelled by increasing demand for lightweight, durable, and high-performance materials in automotive, electrical, and consumer goods applications

- Rising adoption of polyamide 6 in engineering plastics and industrial components is driving product utilization due to its excellent mechanical strength, chemical resistance, and thermal stability

Injection Molding Polyamide 6 Market Analysis

- The market is witnessing significant growth due to the rising demand for lightweight, high-strength, and durable engineering plastics

- Increasing applications in automotive, electrical & electronics, consumer goods, and medical devices are driving adoption

- North America dominated the injection molding polyamide 6 market with the largest revenue share of 40.1% in 2024, driven by high demand for lightweight and high-performance materials in automotive, electrical & electronics, and industrial machinery applications

- Asia-Pacific region is expected to witness the highest growth rate in the global injection molding polyamide 6 market, driven by large-scale production capacities, growing demand from automotive and packaging industries, and supportive government policies promoting advanced polymer adoption

- The automotive segment held the largest market revenue share in 2024, driven by the growing demand for lightweight and fuel-efficient components. Polyamide 6 is increasingly used in engine covers, brackets, and housings, offering superior strength, thermal resistance, and durability compared with conventional materials

Report Scope and Injection Molding Polyamide 6 Market Segmentation

|

Attributes |

Injection Molding Polyamide 6 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Injection Molding Polyamide 6 Market Trends

Rising Adoption of Lightweight and High-Performance Engineering Plastics

- The increasing demand for lightweight, durable, and high-performance materials is reshaping the injection molding polyamide 6 (PA6) market. Manufacturers are leveraging PA6 for automotive, electrical, and industrial applications to improve fuel efficiency, reduce component weight, and enhance mechanical performance. This trend is driving the integration of polyamide 6 into both high-volume and specialized production lines, while also enabling environmentally conscious manufacturing by lowering energy consumption during production

- The push for rapid prototyping and flexible manufacturing is accelerating the adoption of advanced injection molding technologies. The ability to produce complex geometries with shorter cycle times enables manufacturers to reduce material waste and optimize operational efficiency, supporting faster time-to-market for PA6 components. In addition, these technologies allow for iterative design improvements, helping companies respond to dynamic market requirements and regulatory changes

- The cost-effectiveness, thermal resistance, and chemical stability of modern PA6 grades are increasing their attractiveness for end-use industries. Manufacturers are increasingly using reinforced and blended polyamide 6 to achieve superior performance in lightweight structural components, housings, and connectors without significantly raising production costs. Reinforced and bio-based variants further expand possibilities in high-load and environmentally sustainable applications, making PA6 an increasingly versatile material

- For instance, in 2023, several European automotive suppliers reported a reduction in vehicle component weight and improved fuel economy after incorporating glass-fiber reinforced PA6 parts in engine covers and structural brackets. These changes enhanced product durability while lowering overall material consumption. Moreover, companies observed fewer defects during assembly and extended product lifespans, translating into lower warranty claims and operational savings

- While PA6 adoption is accelerating in multiple industries, ongoing innovation, process optimization, and material customization are essential. Companies must focus on developing high-performance grades, cost-efficient molding processes, and sustainable formulations to fully capture growing market demand. Collaborative R&D efforts and partnerships between resin producers and end-users are further expected to drive adoption in emerging applications, such as electric vehicle components and advanced consumer electronics

Injection Molding Polyamide 6 Market Dynamics

Driver

Increasing Demand in Automotive, Electrical & Electronics, and Industrial Applications

- The rising demand for lightweight and high-strength components is driving widespread adoption of polyamide 6. Automotive manufacturers, in particular, are using PA6 to meet stringent fuel efficiency and emission standards without compromising structural integrity. In addition, the shift toward electric and hybrid vehicles is boosting the use of PA6 for battery housings, thermal management systems, and other lightweight, high-performance components

- End-use industries are prioritizing durability, thermal resistance, and chemical stability, pushing the uptake of reinforced and modified PA6 grades. Electrical & electronics sectors are using PA6 for connectors, housings, and insulating components, supporting miniaturization and reliability of devices. This is especially important in high-demand sectors such as consumer electronics, telecommunications, and industrial automation, where performance under thermal and mechanical stress is critical

- Public and private sector investments in advanced manufacturing facilities and material research are further stimulating PA6 adoption. R&D in reinforced, blended, and bio-based PA6 variants is enabling broader applications in high-performance industrial components. Moreover, government incentives promoting lightweight materials and sustainable manufacturing are encouraging companies to adopt PA6 solutions more rapidly

- For instance, in 2022, a leading automotive OEM in Germany integrated PA6-based components in over 30 vehicle models, reducing weight by up to 15% and achieving better fuel efficiency while maintaining safety and durability standards. The company also reported lower production costs due to reduced material usage and streamlined assembly processes, highlighting the financial and operational benefits of PA6 adoption

- While industrial demand and technological advancements are driving the market, companies must continue investing in innovative grades, process automation, and lightweight design solutions to sustain growth. Focus on developing recyclable PA6 grades and enhancing supply chain resilience will also be key to maintaining competitiveness in a rapidly evolving market

Restraint/Challenge

High Raw Material Costs and Processing Complexities

- The cost of high-performance polyamide 6 resins, especially reinforced or specialty grades, can be a barrier for small and medium-scale manufacturers. High material prices impact adoption in cost-sensitive applications, limiting market penetration in emerging economies. Price volatility in raw materials, driven by fluctuations in nylon precursors and energy costs, further complicates budgeting for production planning

- Complex processing requirements, such as precise temperature control, mold design, and cycle optimization, require skilled personnel and advanced machinery. Lack of technical expertise or inadequate infrastructure can result in production inefficiencies and reduced product quality. These challenges are compounded for reinforced or fiber-filled PA6 grades, where improper handling can lead to warping, voids, or inconsistent mechanical performance

- Supply chain disruptions for polyamide 6 granules, additives, and reinforcing agents can restrict timely production, particularly in regions reliant on imports. These logistical challenges can increase lead times and production costs. Companies in regions with inconsistent supply networks often face inventory shortages, production delays, and potential contractual penalties, which can negatively affect market credibility

- For instance, in 2023, several Southeast Asian manufacturers reported delays in automotive component production due to a shortage of high-quality PA6 resins, affecting delivery schedules and profitability. Some firms were forced to source alternative materials at higher costs, leading to temporary design compromises and additional quality control measure

- While material innovation and processing advancements continue, overcoming cost pressures and technical challenges is critical. Market stakeholders need to focus on optimized molding techniques, local sourcing, and scalable production solutions to maintain competitiveness and expand market reach. Investments in workforce training, automated processing, and supply chain diversification will also play a crucial role in mitigating risks

Injection Molding Polyamide 6 Market Scope

The market is segmented on the basis of application, resin type, end-use industry, molding process, and distribution channel.

• By Application

On the basis of application, the injection molding polyamide 6 market is segmented into Automotive, Electrical and Electronics, Consumer Goods, Medical, and Packaging. The automotive segment held the largest market revenue share in 2024, driven by the growing demand for lightweight and fuel-efficient components. Polyamide 6 is increasingly used in engine covers, brackets, and housings, offering superior strength, thermal resistance, and durability compared with conventional materials.

The electrical and electronics segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing use of PA6 in connectors, insulating components, and housings. The material’s excellent thermal stability, chemical resistance, and mechanical properties make it ideal for high-performance electronic devices, supporting miniaturization and long-term reliability.

• By Resin Type

On the basis of resin type, the market is segmented into Glass Fiber Reinforced Polyamide 6, Mineral Reinforced Polyamide 6, and Unreinforced Polyamide 6. Glass fiber reinforced PA6 dominated the market in 2024 due to its superior mechanical strength, dimensional stability, and suitability for high-load applications in automotive and industrial sectors.

Unreinforced PA6 is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and wide usability in consumer goods, packaging, and light-duty industrial components. Its ease of processing and adaptability to various molding techniques make it increasingly attractive for versatile applications.

• By End-Use Industry

On the basis of end-use industry, the market is categorized into Aerospace, Construction, Industrial Machinery, Medical, and Automotive. The automotive sector accounted for the largest share in 2024, owing to stringent fuel efficiency regulations and the increasing adoption of lightweight components to reduce vehicle weight.

The medical industry is expected to witness the fastest growth rate from 2025 to 2032 due to the rising demand for sterilizable, durable, and biocompatible PA6 components in surgical instruments, diagnostic equipment, and medical device housings.

• By Molding Process

On the basis of molding process, the market is segmented into Injection Molding, Blow Molding, Extrusion Molding, and Compression Molding. Injection molding dominated the market in 2024 due to its versatility, precision, and efficiency in producing complex PA6 components for automotive, electronics, and industrial applications.

Blow molding and extrusion molding is expected to witness the fastest growth rate from 2025 to 2032, particularly in packaging and consumer goods, as manufacturers increasingly adopt these techniques to achieve cost-effective, high-volume production with minimal material waste.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Sales, Distributors, Online Marketplaces, and Retail Stores. Direct sales accounted for the largest share in 2024, driven by long-term supply agreements and collaborations between PA6 resin manufacturers and end-use companies, ensuring reliable product availability and technical support.

Online marketplaces is expected to witness the fastest growth rate from 2025 to 2032, as small and medium-scale manufacturers increasingly adopt digital procurement platforms for ease of sourcing, competitive pricing, and faster delivery of PA6 resins and compounds.

Injection Molding Polyamide 6 Market Regional Analysis

- North America dominated the injection molding polyamide 6 market with the largest revenue share of 40.1% in 2024, driven by high demand for lightweight and high-performance materials in automotive, electrical & electronics, and industrial machinery applications

- Manufacturers in the region are leveraging PA6 for structural components, housings, and connectors, benefiting from advanced manufacturing infrastructure and a skilled workforce

- This widespread adoption is further supported by stringent automotive fuel efficiency regulations, rising industrial automation, and increasing awareness of energy-efficient and durable polymer solutions across end-use industries

U.S. Injection Molding Polyamide 6 Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by the growing automotive and electronics sectors and the adoption of reinforced and blended PA6 grades. High demand for lightweight, durable, and thermally stable components in vehicles, industrial machinery, and consumer products is driving market growth. Increasing R&D investments and adoption of advanced injection molding technologies further support the market expansion.

Europe Injection Molding Polyamide 6 Market Insight

Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for lightweight automotive and industrial components. Countries such as Germany, France, and Italy are leading markets, with stringent safety, emission, and energy efficiency standards promoting PA6 adoption. Advanced manufacturing capabilities and the push toward sustainable and recyclable materials further support market growth.

Germany Injection Molding Polyamide 6 Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, fueled by automotive production, industrial automation, and high demand for lightweight and chemically resistant PA6 components. The integration of reinforced and blended PA6 in engine covers, housings, connectors, and industrial parts is increasing, supported by Germany’s strong focus on innovation, sustainability, and precision manufacturing.

Asia-Pacific Injection Molding Polyamide 6 Market Insight

Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrialization, rising automotive and electronics production, and expanding consumer goods manufacturing in China, India, and Japan. The region’s growing adoption of reinforced and cost-effective PA6 grades for lightweight and high-performance applications is fueling demand. Government initiatives supporting industrial modernization and smart manufacturing are also accelerating market growth.

China Injection Molding Polyamide 6 Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the expanding automotive, electronics, and industrial machinery sectors. Rising urbanization, technological adoption, and government initiatives supporting advanced manufacturing are encouraging PA6 adoption for high-strength, lightweight, and durable components. The presence of local PA6 manufacturers ensures cost-effective and accessible material supply.

Japan Injection Molding Polyamide 6 Market Insight

Japan’s market is expected to witness the fastest growth rate from 2025 to 2032 due to high demand for lightweight, thermally stable, and durable components in automotive and electronics applications. The focus on fuel efficiency, energy savings, and industrial automation encourages the use of reinforced PA6. Integration with advanced manufacturing systems and strong R&D capabilities supports innovation and expanded market adoption.

Injection Molding Polyamide 6 Market Share

The Injection Molding Polyamide 6 industry is primarily led by well-established companies, including:

- DSM Engineering Plastics (Netherlands)

- BASF SE (Germany)

- LANXESS AG (Germany)

- INEOS Group (U.K.)

- Celanese Corporation (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Toray Industries, Inc. (Japan)

- Solvay SA (Belgium)

- Mitsui Chemicals, Inc. (Japan)

- Covestro AG (Germany)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- SABIC (Saudi Arabia)

- ExxonMobil Chemical Company (U.S.)

- Evonik Industries AG (Germany)

- Asahi Kasei Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Injection Molding Polyamide 6 Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Injection Molding Polyamide 6 Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Injection Molding Polyamide 6 Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.