Global Injector Pen Polymers Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.82 Billion

2024

2032

USD

1.16 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Injector Pen Polymers Market Size

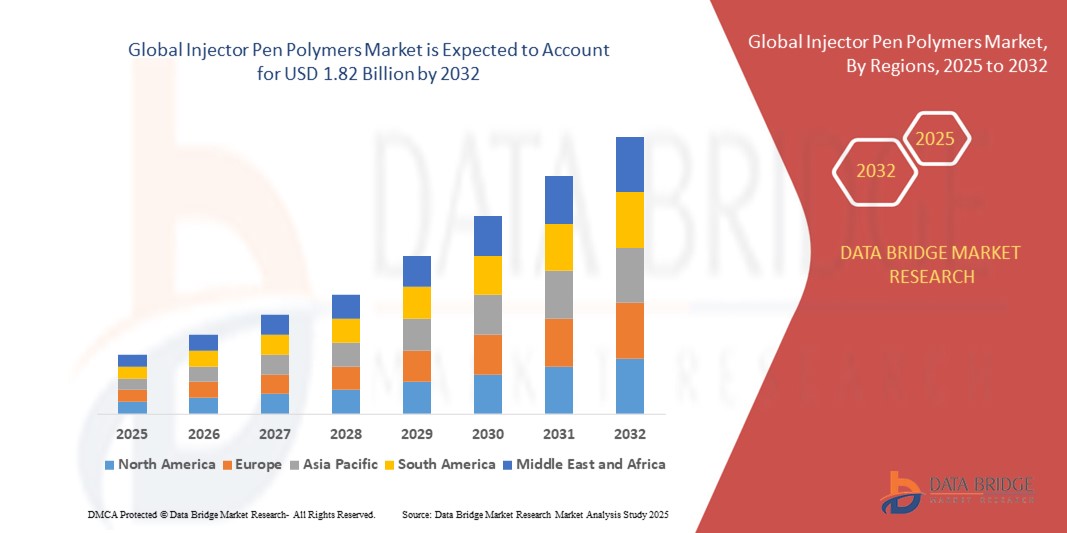

- The global injector pen polymers market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases such as diabetes and autoimmune disorders, which is driving demand for injector pens as a convenient and reliable drug delivery method. The rising shift toward self-administration therapies is further boosting the consumption of polymers that ensure safety, durability, and patient comfort in injector pen design

- Furthermore, the growing preference for user-friendly, ergonomic, and disposable devices is accelerating the use of advanced polymers such as polycarbonate (PC) and thermoplastic elastomers (TPE). These factors are converging to strengthen the uptake of injector pen polymers, thereby significantly boosting the industry’s growth

Injector Pen Polymers Market Analysis

- Injector pen polymers are specialized medical-grade materials such as PC, PP, PE, TPE, and PMMA, used in the manufacturing of injector pens that enable precise, safe, and patient-friendly drug delivery. These polymers provide strength, biocompatibility, and design flexibility, supporting innovations in reusable and disposable injector systems across therapeutic areas

- The escalating demand for injector pen polymers is primarily fueled by the growing incidence of diabetes, the rising adoption of biologics and biosimilars, and the global trend toward self-care and at-home treatment. The ability of polymers to deliver durability, light weight, and cost efficiency continues to make them indispensable in the evolution of modern drug delivery devices

- North America dominated the injector pen polymers market with a share of 45.2% in 2024, due to the rising prevalence of chronic diseases such as diabetes and the growing adoption of self-administration drug delivery systems

- Asia-Pacific is expected to be the fastest growing region in the injector pen polymers market during the forecast period due to rapid urbanization, growing middle-class populations, and rising healthcare spending in countries such as China, Japan, and India

- Injectable pens for insulin segment dominated the market with a market share of 52.8% in 2024, due to the high prevalence of diabetes globally and the increasing reliance on insulin therapy for effective disease management. Insulin injector pens made with reliable polymers such as PC and PP ensure dosage accuracy, safety, and portability, which are critical for diabetic patients managing daily injections. The rising preference for injector pens over traditional syringes, owing to their convenience, reduced pain, and precise delivery, has significantly reinforced the dominance of this segment. In addition, the integration of smart features into insulin pens, combined with the need for user-friendly designs, further supports the heavy usage of polymers in this application

Report Scope and Injector Pen Polymers Market Segmentation

|

Attributes |

Injector Pen Polymers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Injector Pen Polymers Market Trends

Rising Prevalence of Chronic Diseases

- The global injector pen polymers market is witnessing strong growth due to the rising prevalence of chronic diseases such as diabetes, arthritis, and multiple sclerosis. Increased use of self-administered injectable therapies has expanded the role of polymers in improving device safety, usability, and patient adherence

- For instance, Schott and Becton Dickinson have invested in advanced polymer-based injector pen designs that are lightweight, break-resistant, and patient-friendly. These innovations support the growing demand for safe, durable, and ergonomic injector pens in long-term chronic disease management

- The rising emphasis on patient-centric solutions strengthens the demand for polymer-based injector pens, as they offer greater design flexibility and customizable features. Polymers also allow reduced weight compared to glass or metal, improving handling and convenience for patients who require daily use

- In addition, the pharmaceutical industry’s focus on biologics has increased demand for advanced pen injectors that maintain drug integrity. Polymers with high barrier properties and chemical resistance are particularly relevant for protecting next-generation injectable formulations

- Sustainability is also beginning to shape the market, with growing research into recyclable and bio-based polymers for injector pens. This aligns with broader healthcare trends toward sustainable packaging and low-carbon medical device materials

- Altogether, the surge in chronic conditions requiring frequent self-administration, coupled with demand for durable and patient-friendly devices, is reinforcing strong growth prospects for polymers in injector pen applications

Injector Pen Polymers Market Dynamics

Driver

Technological Advancements in Drug Delivery Systems

- Technological advancements in drug delivery systems are driving demand for specialized polymers that enhance injector pen design and performance. Modern devices are expected to deliver high precision, ease of use, and patient safety, all of which depend on advanced polymer innovations

- For instance, Gerresheimer AG has developed polymer-based injector components optimized for biologics delivery, focusing on strength, chemical resistance, and user-friendly ergonomics. Their solutions support the pharmaceutical industry’s transition toward complex self-administered medicines

- Innovations in auto-injectors and smart injector pens with connectivity features are also increasing consumer reliance. Polymers enable intricate designs and micro-component integration while ensuring durability under repeated use conditions, supporting both therapeutic and digital healthcare needs

- In addition, the push for reliable drug stability is strengthening demand for high-performance polymers. Materials such as cyclic olefin polymers (COP) and cyclic olefin copolymers (COC) are gaining prominence due to their barrier properties, transparency, and compatibility with sensitive formulations

- These advancements underscore the growing collaboration between medical device and polymer manufacturers. By enabling innovation in injector designs, polymers are becoming indispensable to the evolution of next-generation drug delivery solutions globally

Restraint/Challenge

Material Compatibility and Drug Interaction

- A key challenge in the injector pen polymers market is ensuring compatibility between polymer materials and the injectable drugs they contain. Certain polymers can interact with sensitive biologics, leading to reduced drug efficacy, contamination, or device failure

- For instance, manufacturers such as BD and West Pharmaceutical Services report challenges related to extractables and leachables from polymers, which can compromise drug quality. This issue becomes more critical for biologics and protein-based drugs that are highly sensitive to material interactions

- Maintaining regulatory compliance also adds complexity. Ensuring thorough material testing and validation for each drug-device combination requires significant investment and extends development timelines for pharmaceutical companies

- In addition, not all polymers provide stable long-term containment for moisture- or oxygen-sensitive drugs. The need for specialized coatings or multi-layer barrier designs further increases costs and complicates injector pen manufacturing processes

- Addressing these material compatibility challenges requires continuous R&D, use of advanced high-performance polymers, and close collaboration between pharma companies and device makers. Overcoming these hurdles is essential for ensuring the safety, performance, and widespread adoption of polymer-based injector pens

Injector Pen Polymers Market Scope

The market is segmented on the basis of material type and application.

- By Material Type

On the basis of material type, the injector pen polymers market is segmented into polycarbonate (PC), polypropylene (PP), polyethylene (PE), thermoplastic elastomers (TPE), and acrylic (PMMA). The polycarbonate (PC) segment dominated the largest market revenue share in 2024, primarily due to its superior strength, transparency, and excellent dimensional stability, which make it highly suitable for medical-grade injector pens. PC offers resistance to impact and heat, ensuring durability and consistent performance, which is critical for frequent-use devices such as insulin pens. Its compatibility with sterilization processes and ability to integrate with precision molding technologies further strengthens its dominance in high-quality injector pen manufacturing. In addition, PC supports complex designs and clear housings, enabling healthcare providers and patients to monitor dosage levels with ease, thereby enhancing safety and trust in PC-based injector pens.

The thermoplastic elastomers (TPE) segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for ergonomic, user-friendly injector pens that offer enhanced grip and flexibility. TPE materials are increasingly favored in the medical device industry for their rubber-such as elasticity combined with the ease of processing offered by thermoplastics, making them suitable for customizable pen components. Their biocompatibility and ability to improve patient comfort in repeated use settings further accelerate adoption. Moreover, the growing trend toward self-administration of therapies is increasing the need for injector pens that are safe, comfortable, and convenient to handle, positioning TPE as a preferred material in next-generation injector pens.

- By Application

On the basis of application, the injector pen polymers market is segmented into injectable pens for insulin, injectable pens for growth hormones, injectable pens for other pharmaceuticals, and veterinary injector pens. The injectable pens for insulin segment dominated the largest market revenue share of 52.8% in 2024, driven by the high prevalence of diabetes globally and the increasing reliance on insulin therapy for effective disease management. Insulin injector pens made with reliable polymers such as PC and PP ensure dosage accuracy, safety, and portability, which are critical for diabetic patients managing daily injections. The rising preference for injector pens over traditional syringes, owing to their convenience, reduced pain, and precise delivery, has significantly reinforced the dominance of this segment. In addition, the integration of smart features into insulin pens, combined with the need for user-friendly designs, further supports the heavy usage of polymers in this application.

The injectable pens for other pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing adoption of biologics, biosimilars, and personalized medicines that require regular at-home administration. Chronic conditions such as rheumatoid arthritis, multiple sclerosis, and osteoporosis are fueling demand for polymer-based injector pens designed for safe and effective self-administration. The versatility of polymers allows manufacturers to create lightweight, durable, and patient-centric devices tailored for a wide range of therapies. Growing R&D investments in drug delivery technologies and the expansion of polymer applications in novel pharmaceutical injector pens are further propelling growth. Moreover, the shift toward enhancing patient adherence through easy-to-use injector devices is reinforcing the rapid expansion of this segment.

Injector Pen Polymers Market Regional Analysis

- North America dominated the injector pen polymers market with the largest revenue share of 45.2% in 2024, driven by the rising prevalence of chronic diseases such as diabetes and the growing adoption of self-administration drug delivery systems

- The region’s advanced healthcare infrastructure and strong emphasis on patient-centric solutions have reinforced the demand for high-quality polymers used in injector pens

- Increasing preference for convenient, safe, and reliable alternatives to traditional syringes has supported strong market penetration. The presence of leading pharmaceutical companies and robust R&D investments further strengthen North America’s leadership in this segment

U.S. Injector Pen Polymers Market Insight

The U.S. injector pen polymers market captured the largest revenue share in 2024 within North America, fueled by the rising incidence of diabetes and autoimmune disorders that require regular injectable treatments. Patients are increasingly adopting injector pens for their accuracy, safety, and ease of use compared to conventional methods. Strong demand is also supported by favorable reimbursement policies and rapid adoption of advanced drug delivery technologies. Furthermore, the presence of domestic polymer suppliers and innovation-driven healthcare practices are accelerating the growth of injector pen polymers in the U.S.

Europe Injector Pen Polymers Market Insight

The Europe injector pen polymers market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict medical device regulations and the increasing emphasis on drug safety and patient compliance. The region’s rapidly aging population and high prevalence of diabetes and osteoporosis are key drivers of injector pen adoption. European patients are increasingly favoring ergonomic, polymer-based injector pens due to their reliability and precision. The use of polymers is also expanding in the production of sustainable, recyclable devices, aligning with Europe’s strong environmental policies.

U.K. Injector Pen Polymers Market Insight

The U.K. injector pen polymers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of chronic disease management and government initiatives promoting self-care solutions. The increasing trend toward at-home therapies is strengthening demand for lightweight, durable, and patient-friendly injector pens. In addition, advancements in polymer technologies that allow for safe, compliant medical devices are contributing to growth across the U.K. healthcare landscape.

Germany Injector Pen Polymers Market Insight

The Germany injector pen polymers market is expected to expand at a considerable CAGR during the forecast period, fueled by its strong pharmaceutical manufacturing base and the increasing shift toward advanced drug delivery devices. The country’s focus on sustainability and innovation has led to growing adoption of eco-conscious polymers in medical devices. Furthermore, patient demand for high-quality, precision-engineered injector pens is driving the use of robust and biocompatible polymers across residential and clinical applications.

Asia-Pacific Injector Pen Polymers Market Insight

The Asia-Pacific injector pen polymers market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, growing middle-class populations, and rising healthcare spending in countries such as China, Japan, and India. Increasing incidence of diabetes and other chronic diseases has created significant demand for polymer-based injector pens, particularly in self-administration therapies. Government support for healthcare modernization and the presence of low-cost polymer manufacturing hubs are further enhancing affordability and accessibility across the region.

Japan Injector Pen Polymers Market Insight

The Japan injector pen polymers market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and strong demand for innovative, easy-to-use drug delivery devices. Japanese patients are highly receptive to self-administration systems that offer safety, comfort, and reliability, fueling demand for polymer-based injector pens. The integration of advanced polymers with ergonomic designs is further supporting market growth.

China Injector Pen Polymers Market Insight

The China injector pen polymers market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly expanding diabetic population, rising urbanization, and strong government initiatives promoting healthcare innovation. The country’s role as a leading hub for polymer manufacturing provides cost advantages, enabling large-scale production of injector pen components. The increasing presence of domestic pharmaceutical players and the growing adoption of affordable injector pens across urban and rural populations continue to drive market expansion in China.

Injector Pen Polymers Market Share

The injector pen polymers industry is primarily led by well-established companies, including:

- Novo Nordisk (Denmark)

- Eli Lilly and Company. (U.S.)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- Ypsomed (Switzerland)

- AstraZeneca (U.K.)

- Hoffmann-La Roche (Roche) (Switzerland)

- Becton, Dickinson and Company (BD) (U.S.)

- Owen Mumford (U.K.)

- Novartis (Switzerland)

Latest Developments in Global Injector Pen Polymers Market

- In January 2024, Mounjaro, a medication pre-filled in an injection pen, received approval from the Medicines & Healthcare Products Regulatory Agency (MHRA) in the U.K., making it the first major market to offer the drug in a convenient multi-shot Kwikpen. Eli Lilly announced rapid availability of doses for British patients to combat diabetes and obesity. This regulatory milestone significantly accelerates demand for high-quality polymers used in injector pens, as manufacturers must ensure safety, durability, and compliance in large-scale production for mass-market adoption

- In April 2023, Mitsubishi Tanabe Pharma Corporation (MTPC) and Eli Lilly Japan launched Mounjaro subcutaneous injectable 2.5 mg/5 mg ATEOS in Japan, administered once a week via a single-use autoinjector device. The device automatically inserts the needle and delivers the dose with minimal patient handling. This innovation underscores the growing role of polymer-based injector pens in advancing patient-friendly drug delivery, boosting demand for materials that enable ergonomic design, biocompatibility, and safe single-use functionality

- In September 2022, Sanofi introduced its next-generation SoloStar insulin pen in select European markets, designed with enhanced ergonomics and reduced injection force to improve patient comfort. The redesign required advanced polymers with superior durability and precision molding capabilities. This development reflects the market’s increasing reliance on innovative polymer solutions to improve usability and adherence, thereby strengthening the role of polymers in competitive injector pen product launches

- In June 2022, Novo Nordisk expanded its FlexTouch insulin pen availability across Asia-Pacific, with a focus on India and Southeast Asia, where diabetes prevalence is surging. The device, made with lightweight and durable polymers, offers consistent dosing and portability. This expansion highlights how rising diabetes cases in emerging economies are driving demand for polymer-based injector pens, positioning Asia-Pacific as a key growth hub for the market

- In March 2021, Ypsomed announced the commercial rollout of its YpsoMate autoinjector platform in collaboration with several pharmaceutical partners in Europe and North America. The platform, manufactured with high-performance polymers, allows flexible customization for various biologics. This launch emphasizes the importance of polymers in enabling scalable, versatile, and patient-centric injector devices, pushing the market toward broader therapeutic applications beyond diabetes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Injector Pen Polymers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Injector Pen Polymers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Injector Pen Polymers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.