Global Inoculants Market

Market Size in USD Billion

CAGR :

%

USD

1.24 Billion

USD

2.27 Billion

2024

2032

USD

1.24 Billion

USD

2.27 Billion

2024

2032

| 2025 –2032 | |

| USD 1.24 Billion | |

| USD 2.27 Billion | |

|

|

|

|

Global Inoculants Market Size

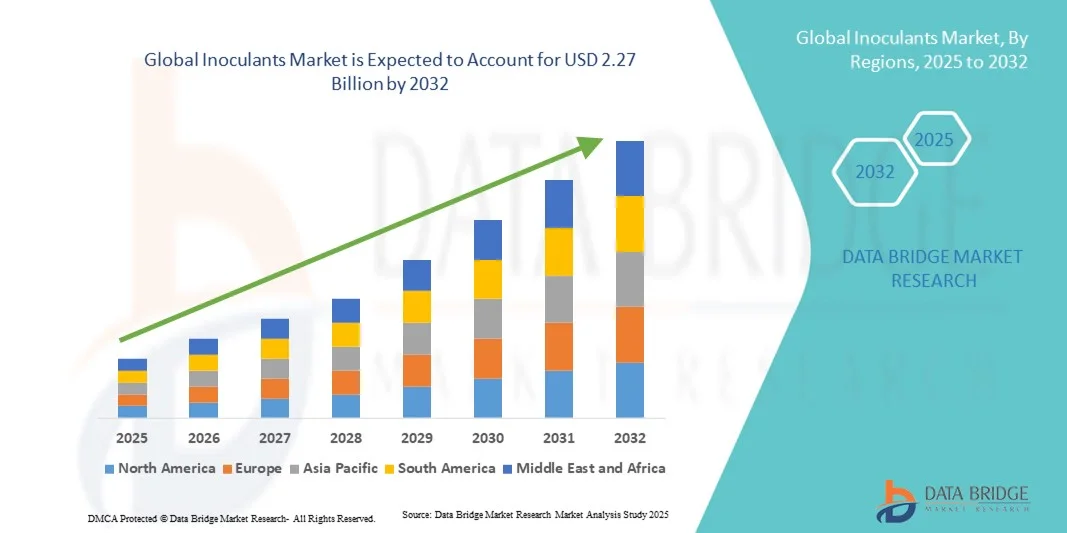

- The global Inoculants Market size was valued at USD 1.24 billion in 2024 and is projected to reach USD 2.27 billion by 2032, growing at a CAGR of 7.78% during the forecast period.

- The market growth is primarily driven by increasing awareness of sustainable agricultural practices and the rising need to enhance crop yield and soil fertility through eco-friendly solutions.

- Additionally, advancements in microbial formulations, coupled with government initiatives promoting biofertilizers and environmentally safe crop inputs, are boosting the adoption of inoculant products. These factors are collectively driving the market expansion and strengthening the role of inoculants in modern agriculture.

Global Inoculants Market Analysis

- Inoculants, used to enhance soil fertility and crop productivity through beneficial microorganisms, are increasingly essential in modern agriculture and sustainable farming practices due to their ability to improve nutrient availability, promote plant growth, and reduce dependency on chemical fertilizers.

- The growing adoption of inoculants is primarily driven by rising awareness of eco-friendly agricultural solutions, the need to boost crop yields, and increasing government support for biofertilizers.

- Asia-Pacific North America dominated the Global Inoculants Market with the largest revenue share of 31.5% in 2024, characterized by well-established agricultural practices, high awareness of sustainable farming, and a strong presence of key industry players, with the U.S. witnessing substantial growth in inoculant adoption across major crops, supported by research innovations and advanced microbial formulations.

- North America Asia-Pacific is expected to be the fastest-growing region in the Global Inoculants Market during the forecast period due to expanding agricultural activities, rising awareness of sustainable farming, and increasing government initiatives promoting biofertilizers.

- The agricultural inoculants segment dominated the market with the largest revenue share of 62.5% in 2024, driven by their extensive use across staple crops such as cereals, oilseeds, and pulses to enhance nitrogen fixation, improve nutrient uptake, and boost overall yield.

Report Scope and Global Inoculants Market Segmentation

|

Attributes |

Inoculants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Inoculants Market Trends

Enhanced Efficiency Through Microbial Innovation and Precision Agriculture

- A significant and accelerating trend in the Global Inoculants Market is the increasing integration of advanced microbial formulations with precision agriculture technologies. This fusion of innovations is significantly enhancing crop productivity, soil health, and overall farm efficiency.

- For instance, rhizobium-based inoculants combined with precision nutrient management allow farmers to optimize nitrogen fixation in legume crops, improving yield while reducing chemical fertilizer dependency. Similarly, biofertilizer formulations enriched with phosphate-solubilizing bacteria can be applied in targeted doses for maximum nutrient uptake.

- Advanced inoculants are enabling features such as stress tolerance enhancement, disease resistance, and improved root development. For example, some microbial consortia are formulated to adapt to varying soil conditions, increasing crop resilience against drought or salinity. Furthermore, precision application techniques, such as seed coating and foliar sprays, offer farmers easier and more efficient use of inoculants.

- The integration of inoculants with smart farming platforms facilitates centralized monitoring of crop health, soil conditions, and nutrient requirements. Through these systems, farmers can manage microbial applications alongside irrigation, fertilization, and pest control strategies, creating a unified and optimized farm management approach.

- This trend towards more efficient, targeted, and scientifically engineered inoculant solutions is fundamentally reshaping agricultural practices. Consequently, companies such as Novozymes and BASF are developing next-generation microbial products that enhance nutrient efficiency, boost crop resilience, and support sustainable farming practices.

- The demand for high-performance inoculants integrated with precision agriculture technologies is growing rapidly across both large-scale and smallholder farms, as farmers increasingly prioritize yield optimization, sustainability, and resource efficiency.

Global Inoculants Market Dynamics

Driver

Growing Need Due to Increasing Demand for Sustainable Agriculture and Crop Productivity

-

The rising focus on sustainable farming practices and the need to enhance crop yields and soil health is a significant driver for the heightened demand for inoculants.

- For instance, in 2024, BASF launched advanced microbial solutions aimed at improving nitrogen fixation and crop resilience, supporting farmers in reducing chemical fertilizer usage while maintaining high productivity. Such initiatives by leading companies are expected to accelerate the Global Inoculants Market growth during the forecast period.

- As farmers become more aware of the long-term benefits of eco-friendly agricultural inputs, inoculants offer advantages such as improved nutrient uptake, disease resistance, and enhanced soil microbiome health, providing a compelling alternative to conventional chemical fertilizers.

- Furthermore, the increasing adoption of precision farming, combined with digital agriculture platforms, is making inoculants an integral component of modern crop management strategies, enabling optimized application, monitoring, and yield prediction.

- The ease of application through seed coating, granular formulations, or liquid sprays, along with the ability to integrate with other biofertilizers and crop management solutions, is propelling inoculant adoption in both large-scale commercial farms and smallholder agricultural setups.

Restraint/Challenge

Concerns Regarding Storage Stability, Efficacy, and High Initial Costs

- Challenges surrounding the stability and consistent performance of microbial inoculants pose a significant barrier to broader market penetration. Since inoculants rely on live microorganisms, improper storage, transport, or application can reduce efficacy, creating hesitation among potential users.

- For instance, studies highlighting reduced viability of certain rhizobium or phosphate-solubilizing inoculants under extreme temperatures have made some farmers cautious about adopting microbial solutions, especially in regions with limited cold chain infrastructure.

- Addressing these concerns through improved formulation technologies, shelf-stable products, and farmer education on proper storage and application techniques is crucial for building trust and ensuring adoption. Companies such as Novozymes and Rizobacter emphasize robust product performance and training programs to mitigate these issues. Additionally, the relatively higher cost of some advanced microbial inoculants compared to conventional fertilizers can be a barrier for price-sensitive farmers, particularly in developing regions. While basic inoculants have become more affordable, premium multi-strain or tailored formulations often come at a higher price.

- While costs are gradually decreasing with technological advancements and economies of scale, the perceived premium for high-performance inoculants can still hinder widespread adoption, especially for farmers who prioritize immediate cost savings over long-term soil health benefits.

- Overcoming these challenges through innovative, stable formulations, cost-effective production, and farmer awareness initiatives will be vital for sustained growth in the Global Inoculants Market.

Global Inoculants Market Scope

The inoculants market is segmented on the basis of type, microbe, and crop type.

- By Type

On the basis of type, the Global Inoculants Market is segmented into Agricultural Inoculants and Silage Inoculants. The agricultural inoculants segment dominated the market with the largest revenue share of 62.5% in 2024, driven by their extensive use across staple crops such as cereals, oilseeds, and pulses to enhance nitrogen fixation, improve nutrient uptake, and boost overall yield. Farmers prioritize agricultural inoculants for their proven efficacy, ease of application through seed coating or soil incorporation, and compatibility with precision agriculture techniques.

Silage inoculants, on the other hand, are expected to witness the fastest growth rate of 20.8% CAGR from 2025 to 2032, fueled by rising livestock production, the need for higher quality forage, and increasing adoption of advanced silage preservation technologies. The growth is particularly strong in regions with intensive dairy and meat production, where improved fermentation and feed efficiency are critical.

- By Microbe

On the basis of microbe, the Global Inoculants Market is segmented into Bacterial, Fungal, and Other Sources. The bacterial segment held the largest market revenue share of 57.4% in 2024, largely due to the widespread use of rhizobium, Azospirillum, and phosphate-solubilizing bacteria for legume crops, cereals, and oilseeds, offering cost-effective nutrient management and enhanced crop performance. Bacterial inoculants are preferred for their high efficacy in nitrogen fixation, soil health improvement, and adaptability to different environmental conditions.

The fungal segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, supported by growing adoption of mycorrhizal fungi to improve nutrient absorption, drought tolerance, and soil structure. Increasing R&D in beneficial fungi applications for horticulture, vegetables, and high-value crops is driving demand for this segment.

- By Crop Type

On the basis of crop type, the Global Inoculants Market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Forage, and Others. The cereals and grains segment dominated the market with the largest revenue share of 45.6% in 2024, attributed to the extensive global cultivation of wheat, rice, and maize and the proven benefits of inoculants in improving nitrogen fixation and overall yield. Oilseeds and pulses also see strong demand due to inoculants’ role in supporting protein-rich crops and soil fertility.

The forage segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by the increasing livestock population and rising demand for high-quality fodder. Advanced silage inoculants and microbial consortia are gaining popularity among dairy and meat producers for enhancing forage digestibility and fermentation efficiency.

Global Inoculants Market Regional Analysis

- Asia-Pacific dominated the Global Inoculants Market with the largest revenue share of 31.5% in 2024, driven by high adoption of sustainable farming practices, advanced agricultural technologies, and favorable government initiatives promoting biofertilizers and microbial solutions.

- Farmers in the region increasingly prioritize environmentally friendly crop inputs that enhance soil fertility, improve nutrient uptake, and reduce dependency on chemical fertilizers. The adoption of precision agriculture, coupled with awareness of long-term soil health benefits, is further supporting inoculant usage across cereals, oilseeds, and forage crops.

- This widespread adoption is also fueled by strong research and development infrastructure, high investment capacity among agribusinesses, and the presence of major global inoculant manufacturers in the region, establishing North America as a leading market for both agricultural and silage inoculants.

U.S. Inoculants Market Insight

The U.S. inoculants market captured the largest revenue share of 35% in 2024 within North America, fueled by the widespread adoption of sustainable farming practices and precision agriculture technologies. Farmers are increasingly prioritizing microbial solutions to improve soil fertility, enhance nutrient uptake, and boost crop yields while reducing chemical fertilizer usage. The growing demand for high-value crops and forage production, combined with advanced distribution networks and strong R&D presence of key inoculant manufacturers, is further propelling market growth. Additionally, government support for biofertilizers and eco-friendly agricultural inputs is encouraging adoption across both large-scale commercial farms and smallholder operations.

Europe Inoculants Market Insight

The Europe inoculants market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations promoting sustainable agriculture and reduced chemical fertilizer use. Increased awareness of soil health, crop productivity, and environmental impact is encouraging farmers to adopt microbial inoculants. Key growth is observed across cereals, oilseeds, and horticulture crops, with demand supported by government initiatives and subsidies for biofertilizer adoption. The region is witnessing significant growth in both conventional farms and organic farming setups, where inoculants are considered essential for maintaining soil fertility.

U.K. Inoculants Market Insight

The U.K. inoculants market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of sustainable crop management practices and increasing awareness of eco-friendly farming solutions. Concerns regarding soil degradation, nutrient depletion, and the environmental impact of chemical fertilizers are encouraging farmers to use microbial inoculants. Moreover, the country’s advanced agricultural infrastructure, robust supply chains, and government-backed incentives for sustainable farming are expected to continue stimulating market growth across cereals, pulses, and forage crops.

Germany Inoculants Market Insight

The Germany inoculants market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sustainable agriculture and advanced farming technologies. The country’s emphasis on innovation, research, and environmentally friendly solutions supports the adoption of inoculants in cereals, oilseeds, and vegetables. Strong focus on reducing chemical fertilizer use, coupled with the integration of precision agriculture techniques and smart farming solutions, is driving inoculant demand. Germany’s developed agricultural sector and government programs promoting biofertilizers reinforce growth in both commercial and organic farming segments.

Asia-Pacific Inoculants Market Insight

The Asia-Pacific inoculants market is poised to grow at the fastest CAGR of 22% from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and rising awareness of sustainable agriculture in countries such as China, India, and Japan. The growing adoption of high-value crops, expansion of livestock farming, and government initiatives promoting biofertilizers are boosting market demand. Furthermore, the region’s role as a manufacturing hub for microbial inoculants, combined with increasing accessibility and affordability, is expanding usage among smallholder farmers and large-scale commercial farms alike.

Japan Inoculants Market Insight

The Japan inoculants market is gaining momentum due to the country’s focus on high-tech, sustainable agriculture and precision farming practices. Farmers are increasingly adopting microbial inoculants to enhance crop yields, improve soil fertility, and reduce chemical fertilizer dependency. Government initiatives supporting eco-friendly agriculture, coupled with the integration of inoculants in horticulture and high-value crop production, are fueling growth. Additionally, Japan’s aging farmer population is driving demand for easy-to-apply and effective biofertilizer solutions that reduce labor and optimize crop management.

China Inoculants Market Insight

The China inoculants market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, government support for sustainable agriculture, and high adoption of modern farming practices. The expanding middle class and increasing demand for high-quality agricultural produce are encouraging farmers to use microbial solutions for cereals, oilseeds, vegetables, and forage crops. Strong domestic manufacturing capabilities, affordable product offerings, and the push towards environmentally sustainable farming practices are key factors propelling market growth in China.

Global Inoculants Market Share

The Inoculants industry is primarily led by well-established companies, including:

- Novozymes (Denmark)

- BASF SE (Germany)

- Bayer CropScience (Germany)

- Syngenta AG (Switzerland)

- Koppert Biological Systems (Netherlands)

- Rizobacter (Argentina)

- Biofertilizers India Pvt. Ltd. (India)

- Chr. Hansen Holding A/S (Denmark)

- Sumitomo Chemical Co., Ltd. (Japan)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India)

- AgBiome (U.S.)

- Lallemand Inc. (Canada)

- Verdesian Life Sciences (U.S.)

- Alltech Inc. (U.S.)

- Biocrop (Brazil)

- WinField Solutions (U.S.)

- International Fertilizer Development Center (IFDC) (U.S.)

- Novagro Agri Inputs Pvt. Ltd. (India)

- Global Bio-Chem Technology Group (China)

- Huapont Life Sciences (China)

What are the Recent Developments in Global Inoculants Market?

- In April 2023, Novozymes A/S, a global leader in microbial solutions, launched a strategic initiative in Brazil to enhance soil fertility and crop productivity through its advanced agricultural inoculant formulations. This initiative underscores the company’s dedication to delivering innovative, sustainable solutions tailored to the specific soil and climate conditions of the region. By leveraging its global expertise and cutting-edge microbial products, Novozymes is addressing local agricultural challenges while reinforcing its position in the rapidly growing Global Inoculants Market.

- In March 2023, BASF SE, a leading chemical and agricultural solutions provider based in Germany, introduced its next-generation BioNematicide and Rhizobium-based inoculants for soybeans and cereals in India. These products are engineered to improve nitrogen fixation, enhance crop resilience, and boost yields. The launch highlights BASF’s commitment to advancing sustainable farming technologies and supporting farmers in optimizing productivity while reducing chemical inputs.

- In March 2023, Syngenta AG successfully deployed a field trial program across multiple regions in China to evaluate the performance of its microbial inoculants for maize and vegetables. The project leverages advanced biotechnologies to improve plant health and soil microbiome efficiency, underscoring Syngenta’s dedication to sustainable crop production. This initiative highlights the growing role of biofertilizers in enhancing food security and farm profitability.

- In February 2023, Lallemand Plant Care, a leader in microbial inoculants for global agriculture, announced a partnership with smallholder farmer cooperatives in Sub-Saharan Africa to expand access to cost-effective biofertilizers. The collaboration aims to improve crop yields, soil health, and farmer livelihoods by providing tailored microbial solutions. This initiative emphasizes Lallemand’s commitment to driving adoption of sustainable agricultural practices in developing regions.

- In January 2023, Novagro BioTech, an emerging provider of crop-specific inoculants in the U.S., unveiled its new SoyRhizo Plus product at the National AgriTech Expo 2023. The microbial formulation enhances nitrogen fixation and improves plant vigor in soybean crops. The launch highlights the company’s focus on integrating advanced microbial technologies into practical farming applications, offering farmers a combination of yield improvement and environmental sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.