Global Inorganic Color Pigments Market

Market Size in USD Billion

CAGR :

%

USD

3.77 Billion

USD

5.16 Billion

2024

2032

USD

3.77 Billion

USD

5.16 Billion

2024

2032

| 2025 –2032 | |

| USD 3.77 Billion | |

| USD 5.16 Billion | |

|

|

|

|

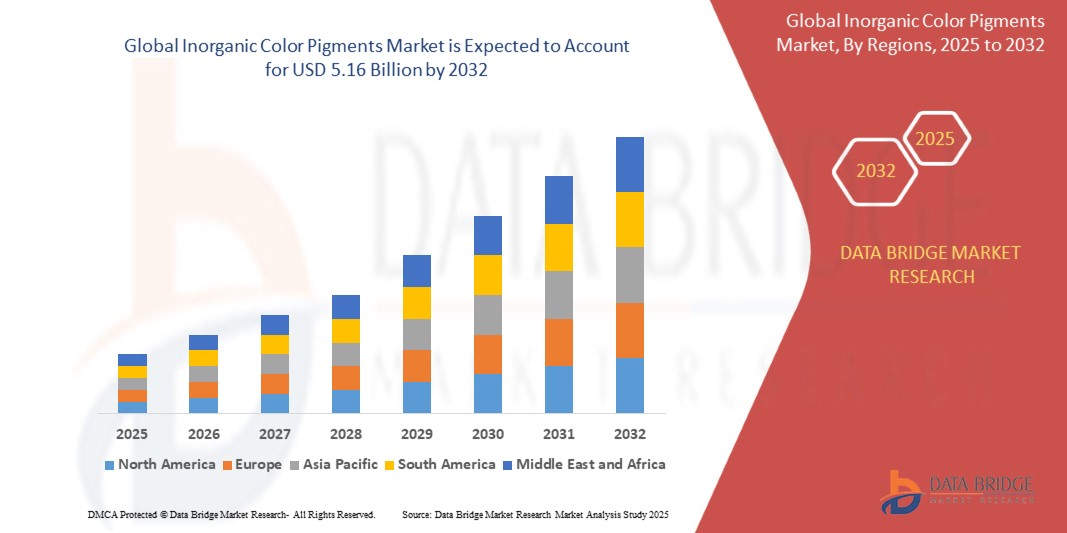

What is the Global Inorganic Color Pigments Market Size and Growth Rate?

- The global inorganic color pigments market size was valued at USD 3.77 billion in 2024 and is expected to reach USD 5.16 billion by 2032, at a CAGR of 4.00% during the forecast period

- The inorganic color pigments market has demonstrated robust growth driven by their widespread application across multiple industries, including paints and coatings, plastics, construction materials, and textiles

- These pigments, known for their superior lightfastness, chemical stability, and durability, are crucial in sectors requiring long-lasting color performance. The demand is particularly strong in regions with expanding manufacturing bases, such as Asia-Pacific, where rapid industrialization and infrastructure development drive the need for high-quality colorants

- In addition, the less stringent regulatory environment regarding VOC emissions in emerging markets compared to North America and Europe has further accelerated market growth

What are the Major Takeaways of Inorganic Color Pigments Market?

- Inorganic color pigments are highly valued for their exceptional properties, including outstanding lightfastness, chemical resistance, and durability. These attributes make them ideal for applications where long-lasting color stability is crucial, such as in outdoor coatings, automotive finishes, and industrial applications

- Unsuch as organic pigments, inorganic pigments maintain their color integrity and resist degradation from UV light, weathering, and chemical exposure. Their robustness ensures that they perform reliably in demanding environments, contributing to their widespread use in products requiring enduring color performance and resilience, driving the market growth

- Asia-Pacific dominated the inorganic color pigments market with the largest revenue share of 32.58% in 2024, fueled by rapid industrialization, robust demand from automotive, construction, packaging, and electronics sectors, and strong regional manufacturing capabilities

- North America is projected to grow at the fastest CAGR of 11.56% from 2025 to 2032, driven by high demand for UV-stable, heat-resistant, and corrosion-resistant pigments in construction, industrial coatings, automotive refinish, and aerospace sectors

- The Iron and Iron Oxide Pigments segment dominated the market with the largest revenue share of 38.9% in 2024, driven by their cost-effectiveness, non-toxicity, UV stability, and excellent dispersibility

Report Scope and Inorganic Color Pigments Market Segmentation

|

Attributes |

Inorganic Color Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Inorganic Color Pigments Market?

“Shift Toward Eco-Friendly and High-Performance Pigments”

- A major emerging trend in the inorganic color pigments market is the growing shift toward eco-friendly, heavy metal-free, and high-performance pigments, especially in architectural coatings, plastics, and automotive sectors. Increasing environmental regulations and customer preference for non-toxic, sustainable solutions are driving innovation in pigment formulations

- For instance, in October 2023, Venator Materials PLC launched its Ecopure™ range, a sustainable iron oxide pigment line tailored for green building certifications and low-VOC coatings. Similarly, LANXESS expanded its Bayferrox® portfolio with new eco-conscious pigments for global markets

- These pigments offer enhanced UV resistance, chemical stability, and thermal durability, making them suitable for long-lasting applications under extreme conditions without environmental trade-off

- The trend aligns with circular economy initiatives, as industries aim to minimize carbon footprint through recyclable and energy-efficient raw materials

- Companies such as Cathay Industries and BASF are developing next-gen synthetic iron oxides and mixed metal oxide pigments to meet stringent global compliance standards

- As environmental scrutiny tightens worldwide, the adoption of green and sustainable inorganic pigments is expected to redefine market leadership and pigment innovation in the coming years

What are the Key Drivers of Inorganic Color Pigments Market?

- The increasing demand for durable, heat-resistant, and fade-resistant colorants in applications such as construction materials, industrial coatings, plastics, and ceramics is propelling the inorganic color pigments market forward

- For instance, in June 2024, Shepard Color Company introduced a new line of high-performance mixed metal oxide pigments for high-heat and chemically aggressive environments, supporting growing demand in aerospace and electronics

- These pigments provide exceptional weather resistance, chemical inertness, and thermal stability, ensuring color longevity in both interior and exterior use case

- Moreover, urbanization and infrastructure growth, especially in Asia-Pacific and the Middle East, are accelerating the consumption of colored concrete, bricks, and tiles, where inorganic pigments are widely used

- The rise of aesthetic architecture, along with the demand for vibrant yet stable pigments in packaging and automotive coatings, further boosts market penetration

- In addition, technological advancements in nano-pigment production and automation in dispersion techniques are improving performance and cost-efficiency, driving higher adoption across end-use industries

Which Factor is challenging the Growth of the Inorganic Color Pigments Market?

- A notable challenge facing the inorganic color pigments market is the price volatility of raw materials such as titanium dioxide, cobalt, and chromium compounds. This volatility directly affects manufacturing costs and narrows profit margins for pigment producers

- For instance, cobalt-based pigments have witnessed significant cost hikes due to supply constraints and growing battery demand in electric vehicles, affecting downstream applications in paints and plastics

- Another challenge lies in compliance with stringent environmental and health regulations, particularly in Europe and North America, where pigments containing heavy metals such as lead, cadmium, or hexavalent chromium are being phased out

- This necessitates costly reformulation and R&D investments to develop safe alternatives without compromising performance, which can be burdensome for small to mid-tier manufacturers

- Furthermore, limited color intensity and opacity in some eco-friendly alternatives present challenges in replicating deep shades or glossy finishes desired in certain premium applications

- Overcoming these hurdles requires supply chain diversification, sustainable mining practices, and the development of cost-effective, high-performing pigment alternatives, ensuring compliance without sacrificing market competitiveness

How is the Inorganic Color Pigments Market Segmented?

The market is segmented on the basis of product type, form, and application.

• By Product Type

On the basis of product type, the inorganic color pigments market is segmented into Cobalt Pigments, Ultramarine Pigments, Bismuth Pigments, Iron and Iron Oxide Pigments, Cadmium Pigments, Chromium Pigments, Carbon and Vegetable Black, and Others. The Iron and Iron Oxide Pigments segment dominated the market with the largest revenue share of 38.9% in 2024, driven by their cost-effectiveness, non-toxicity, UV stability, and excellent dispersibility. These pigments are widely used across construction materials, paints, and plastics for their strong coloring strength and environmental compliance.

The Bismuth Pigments segment is projected to witness the fastest growth rate from 2025 to 2032, as they are increasingly adopted as eco-friendly and heavy-metal-free alternatives, especially in cosmetics, medical devices, and food packaging. Their non-toxic profile and compliance with global safety standards are driving demand across regulated applications.

• By Form

On the basis of form, the market is segmented into Aqueous and Powder. The Powder segment held the largest market revenue share of 63.4% in 2024, due to its long shelf life, easy handling, and wide compatibility with coatings, plastics, and cement applications. Powder pigments provide vibrant coloration and are ideal for dry blending, contributing to their dominance.

The Aqueous segment is expected to register the fastest CAGR during the forecast period, supported by the growing adoption of water-based formulations in coatings and printing inks for environmental compliance and low VOC emissions. Aqueous dispersions also offer improved application ease in digital and textile printing, accelerating market penetration.

• By Application

On the basis of application, the inorganic color pigments market is segmented into Paints and Coatings, Printing Inks, Polymers, Construction Materials, Cosmetics, Textile Printing, and Others. The Paints and Coatings segment dominated the market with the largest revenue share of 36.8% in 2024, driven by high consumption in protective, decorative, and industrial coatings. The demand for durable, UV-resistant pigments with strong opacity and weather stability is bolstering usage across automotive, architectural, and marine coatings.

The Polymers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising use of colored plastics in consumer goods, packaging, and electronics. Inorganic pigments provide heat stability and non-migratory properties, making them suitable for extrusion, injection molding, and thermoforming processes.

Which Region Holds the Largest Share of the Inorganic Color Pigments Market?

- Asia-Pacific dominated the inorganic color pigments market with the largest revenue share of 32.58% in 2024, fueled by rapid industrialization, robust demand from automotive, construction, packaging, and electronics sectors, and strong regional manufacturing capabilities

- The presence of major pigment producers and extensive use in applications such as paints, coatings, plastics, and inks across China, India, Japan, and South Korea is supporting market expansion. Government initiatives promoting sustainable infrastructure and green buildings are also accelerating the use of eco-friendly inorganic pigments

- In addition, rising exports, growing middle-class consumerism, and an expanding domestic construction sector are enabling Asia-Pacific to maintain its leadership in global pigment production and consumption

China Inorganic Color Pigments Market Insight

China held the largest market share in Asia-Pacific in 2024, driven by its dominant pigment manufacturing base, high construction activity, and increasing use of iron oxide and chromium pigments in road surfacing, tiles, plastics, and coatings. Government support for green construction materials and energy-efficient buildings is driving demand, while local players continue to scale low-cost, high-quality pigment production for both domestic and export markets.

Japan Inorganic Color Pigments Market Insight

Japan is witnessing steady growth in the inorganic color pigments market, supported by its technological advancements, precision coatings in electronics, and increasing demand for architectural finishes. The country’s focus on durability, environmental safety, and performance aesthetics makes inorganic pigments preferred in robotics, automotive coatings, and smart city infrastructure. In addition, strong emphasis on recyclable and non-toxic colorants aligns with evolving sustainability goals.

Which Region is the Fastest Growing Region in the Inorganic Color Pigments Market?

North America is projected to grow at the fastest CAGR of 11.56% from 2025 to 2032, driven by high demand for UV-stable, heat-resistant, and corrosion-resistant pigments in construction, industrial coatings, automotive refinish, and aerospace sectors. Increasing use of eco-friendly pigment alternatives and rising investment in low-VOC and lead-free formulations are contributing to growth. Strong regulatory support, coupled with high R&D activity in advanced surface coatings, continues to push innovation and adoption of high-performance inorganic pigments.

U.S. Inorganic Color Pigments Market Insight

The U.S. leads the North American market in 2024, backed by a mature coatings industry, ongoing infrastructure renewal, and growing usage in packaging and consumer goods. Strategic partnerships and mergers between coating manufacturers and pigment producers are also helping to expand market penetration. Demand for solar-reflective, fade-resistant pigments in architectural and automotive applications continues to rise.

Canada Inorganic Color Pigments Market Insight

Canada is witnessing rising adoption of Inorganic Color Pigments in green building, energy-efficient construction, and public infrastructure upgrades. Government initiatives supporting environmentally friendly materials and a surge in residential housing development are driving demand. The expansion of local pigment distributors and import channels is also helping smaller manufacturers access a broader customer base.

Which are the Top Companies in Inorganic Color Pigments Market?

The inorganic color pigments industry is primarily led by well-established companies, including:

- Huntsman International LLC (U.S.)

- BASF SE (Germany)

- Lanxess (Germany)

- Venator Materials PLC (U.K.)

- Applied Minerals, Inc. (U.S.)

- Cathay Industries (China)

- Hunan Sanhuan Pigment Co., Ltd. (China)

- KRONOS Worldwide, Inc. (U.S.)

- Ferro Corporation GmbH (Germany)

- Shepard Color Company (U.S.)

- Bayer AG (Germany)

- Rockwood (U.S.)

- Atlanta AG (Germany)

- Apollo Colors (U.S.)

- Honeywell International (U.S.)

- Todo Kogyo (Japan)

What are the Recent Developments in Global Inorganic Color Pigments Market?

- In February 2024, LANXESS, a leading specialty chemicals company, showcased its comprehensive range of products for the paints and coatings sector at the Paint India exhibition, held at the Bombay Exhibition Centre in Goregaon, Mumbai. The company emphasized its innovative formulations designed to enhance performance and sustainability across coatings applications. This participation reaffirmed LANXESS’s position as a key contributor to innovation in the global inorganic color pigments market

- In May 2023, U.S. Silica Holdings, Inc. launched EverWhite Pigment, a newly engineered high-whiteness pigment designed for use in coatings, construction materials, and various industrial applications. This advanced product serves as a partial substitute or complementary material for common inorganic white pigments such as titanium dioxide (TiO₂) and aluminum trihydrate (ATH). This launch marked a strategic expansion of U.S. Silica’s pigment solutions portfolio for the specialty coatings market

- In February 2023, PRECHEZA introduced a new range of iron oxide red pigments under the brand names FEPREN TP303M and FEPREN TP200M, representing micronized grades tailored for paints and coatings. These pigments are also compatible with plastics manufacturing processes including rolling and casting techniques. This product expansion reflects PRECHEZA’s commitment to diversifying its pigment offerings for multi-industry applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inorganic Color Pigments Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inorganic Color Pigments Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inorganic Color Pigments Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.