Global Inorganic Scintillators Market

Market Size in USD million

CAGR :

%

USD

349.62 million

USD

569.98 million

2024

2032

USD

349.62 million

USD

569.98 million

2024

2032

| 2025 –2032 | |

| USD 349.62 million | |

| USD 569.98 million | |

|

|

|

|

Inorganic Scintillators Market Size

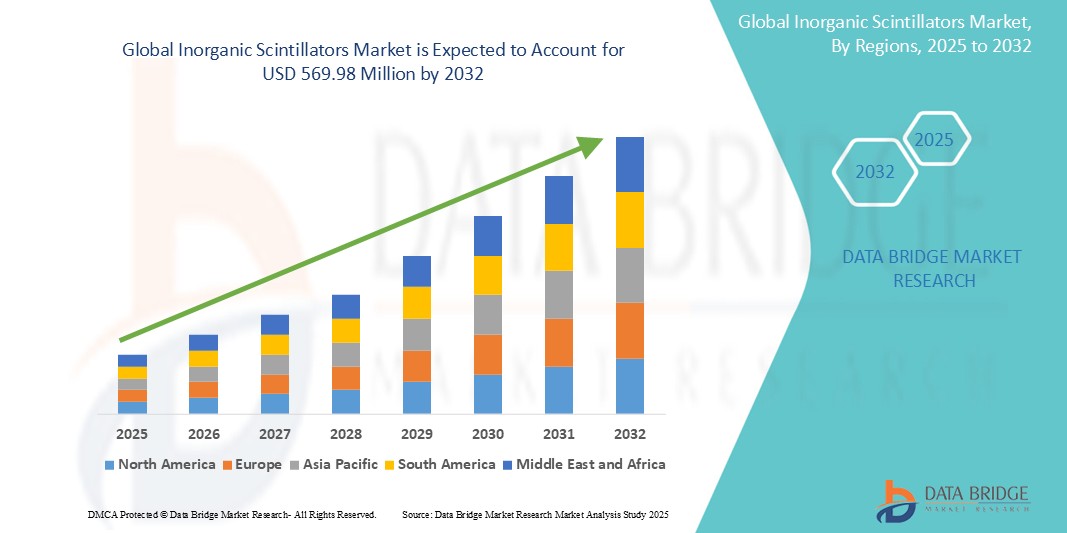

- The global inorganic scintillators market size was valued at USD 349.62 million in 2024 and is expected to reach USD 569.98 million by 2032, at a CAGR of 6.30% during the forecast period

- This growth is driven by factors such as the Increasing Demand for High-Speed Dental Handpieces and Increasing Demand for High-Speed Dental Handpieces

Inorganic Scintillators Market Analysis

- Inorganic scintillators are crucial components used in radiation detection systems, converting high-energy radiation into visible light for precise measurement and imaging. They are widely used in medical imaging, security scanning, and scientific research

- The demand for these scintillators is significantly driven by increasing security concerns, advancements in medical imaging technologies, and the rising need for accurate radiation detection in nuclear power plants and high-energy physics research

- North America is expected to dominate the inorganic scintillators market, with 42.7% market share, driven by advanced healthcare infrastructure, strong demand for radiation detection systems, and significant investments in nuclear power and medical imaging technologies

- Asia-Pacific is expected to be the fastest growing region in inorganic scintillators market with 21.9% market share, driven by expanding nuclear power capacity, increasing healthcare spending, and rising awareness about radiation safety

- The gadolinium orthosilicate (GSO) is expected to dominate the market with a market share of 43.3%. This dominance is attributed to GSO's high density and effective atomic number, which enhance its efficiency in stopping gamma rays and ionizing radiation

Report Scope and Inorganic Scintillators Market Segmentation

|

Attributes |

Inorganic Scintillators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Inorganic Scintillators Market Trends

“Advancements in Inorganic Scintillators for Radiation Detection and Imaging”

- One prominent trend in the development of inorganic scintillators is the ongoing improvement in material composition and performance characteristics to enhance radiation detection and imaging precision

- These advancements focus on achieving faster response times, higher light output, and superior energy resolution, which are critical for accurate radiation measurement in medical imaging, security, and nuclear science

- For instance, the use of advanced crystal growth techniques and doping methods has enabled the production of scintillators such as LYSO (Lutetium Yttrium Orthosilicate) and LaBr3 (Lanthanum Bromide) with significantly improved light yield and timing resolution, making them ideal for high-resolution PET (Positron Emission Tomography) systems and gamma cameras

- These innovations are transforming the field of radiation detection, supporting more precise diagnostic imaging, better radiation therapy planning, and enhanced security screening, thereby driving the demand for next-generation inorganic scintillators

Inorganic Scintillators Market Dynamics

Driver

“Increasing Demand for Radiation Detection in Healthcare and Security”

- The growing need for precise radiation detection in medical imaging, nuclear power plants, homeland security, and industrial applications is significantly driving the demand for inorganic scintillators

- With the rising prevalence of cancer and the increasing use of diagnostic imaging technologies such as PET, CT, and SPECT, the demand for high-performance scintillators continues to grow

- In addition, the global focus on safety and radiation protection in nuclear power plants and border security further supports market growth, as these sectors rely heavily on high-sensitivity radiation detection systems

For instance,

- In March 2024, according to a report by the International Atomic Energy Agency (IAEA), the global number of nuclear reactors is expected to increase by nearly 20% by 2040, driven by the need for low-carbon energy sources. This expansion significantly boosts the demand for high-performance radiation detectors and inorganic scintillators

- As a result, the growing need for accurate radiation detection in healthcare, power generation, and security is creating substantial opportunities for the inorganic scintillators market

Opportunity

“Emerging Applications in Space Exploration and High-Energy Physics”

- Inorganic scintillators are finding new applications in space exploration and high-energy physics, where accurate radiation detection is crucial for both scientific research and astronaut safety

- Scintillators such as LYSO and BGO are increasingly used in space missions for cosmic radiation detection, particle physics experiments, and planetary exploration, where precise measurement of high-energy particles is essential

- These materials also support advanced experiments in particle accelerators and colliders, where they are used to track high-speed particles and study fundamental physics

For instance,

- In June 2024, according to a study published by the European Space Agency (ESA), advanced scintillators were used in the JUICE (JUpiter ICy moons Explorer) mission to detect cosmic radiation and measure the magnetic fields of Jupiter’s moons. These scintillators played a critical role in the mission’s scientific objectives, providing high-resolution data for space scientists

- The expanding role of inorganic scintillators in space research and high-energy physics presents significant growth opportunities for manufacturers, driven by increased investment in scientific exploration

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The production of high-quality inorganic scintillators is complex and expensive, often involving costly raw materials and precise manufacturing processes

- Many high-performance scintillators, such as LYSO and LaBr3, require rare earth elements or specialized crystal growth techniques, leading to higher costs and supply chain challenges

- This substantial financial investment can deter potential buyers, especially in developing regions with budget constraints, limiting the widespread adoption of advanced scintillator technologies

For instance,

- In February 2025, according to an industry report by Saint-Gobain Crystals, the high cost of rare earth elements such as lutetium and lanthanum significantly impacts the pricing of LYSO and LaBr3 scintillators, creating challenges for manufacturers in maintaining competitive pricing without compromising quality

- Consequently, the high cost of manufacturing and limited availability of critical raw materials can restrict market growth, especially in price-sensitive regions

Inorganic Scintillators Market Scope

The market is segmented on the basis of scintillation material, type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Scintillation Material |

|

|

By Type |

|

|

By Application |

|

|

By End User

|

|

In 2025, the gadolinium orthosilicate is projected to dominate the market with a largest share in scintillation material segment

The gadolinium orthosilicate segment is expected to dominate the inorganic scintillators market with the largest share of 43.3%, driven due to its high density and effective atomic number, which enhance its efficiency in stopping gamma rays and ionizing radiation. These properties result in better detection sensitivity and brighter light emissions.

The medical imaging is expected to account for the largest share during the forecast period in application market

The medical imaging segment is expected to dominate the medical imaging market with the largest share of 42.70%, driven due to the increasing demand for advanced diagnostic technologies such as PET, SPECT, and gamma cameras. Scintillators are essential components in these systems, enabling precise detection and visualization of radioactive tracers used in diagnosing conditions such as cancer and cardiovascular diseases.

Inorganic Scintillators Market Regional Analysis

“North America Holds the Largest Share in the Inorganic Scintillators Market”

- North America dominates the inorganic scintillators market, accounting for 42.7% of the global market share, driven by advanced healthcare infrastructure, strong demand for radiation detection systems, and significant investments in nuclear power and medical imaging technologies

- U.S. holds a substantial share within this region, contributing around 37.3% to the global market, supported by its well-established medical imaging industry, extensive research and development activities, and a growing focus on radiation safety and homeland security

- The dominance of North America is further reinforced by the presence of major scintillator manufacturers, favorable government funding for scientific research, and a strong focus on cancer diagnostics, boosting the market's expansion.

- In addition, the increasing number of nuclear power plants and the rising demand for advanced medical imaging systems continue to drive growth in the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Inorganic Scintillators Market”

- Asia-Pacific accounted for approximately 21.9% of the global inorganic scintillators market, driven by expanding nuclear power capacity, increasing healthcare spending, and rising awareness about radiation safety

- Countries such as China, India, and Japan are emerging as key markets, driven by rapid industrialization, increasing healthcare investments, and growing demand for nuclear power as a clean energy source

- Japan remains a crucial market for high-precision scintillators, supported by its advanced medical technology, extensive cancer screening programs, and a well-established research infrastructure

- India is projected to register the highest CAGR of 7.6% within the region, driven by the rapid expansion of its healthcare sector, increasing nuclear power capacity, and a growing focus on radiation safety, making it a key player in the global market.

Inorganic Scintillators Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- RamSoft, Inc. (Canada)

- InHealth Group (U.K)

- Siemens Healthineers AG (Germany)

- Sonic Healthcare Limited (Australia)

- GE HealthCare (U.S.)

- Akumin Inc. (U.S.)

- Hologic Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Carl Zeiss AG (Germany)

- FUJIFILM Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Carestream Health (U.S.)

- UNILABS (Switzerland)

- ONRAD, Inc. (U.S.)

- Narang Medical Limited (India)

- Johnson & Johnson Services, Inc. (U.S.)

- BD (U.S.)

Latest Developments in Global Inorganic Scintillators Market

- In November 2024, a study presented a method to extend nanoplasmonic scintillators to the bulk regime. By integrating plasmonic nanoparticles with perovskite scintillator nanocrystals, the research demonstrated significant enhancements in power and decay rate, paving the way for advanced radiation detection technologies

- In June 2024, researchers published a study on the development of plastic scintillators incorporating perovskite nanocrystals (PNCs). This innovative class of scintillators combines the superior luminescent properties of PNCs with the flexibility and processability of polymers, potentially revolutionizing radiation detection applications

- In November 2023, Tibidabo Scientific Industries, a leading provider of advanced scientific solutions, announced the acquisition of LLA Instruments. This strategic move expands Tibidabo's portfolio to include innovative products for material detection and identification, catering to a diverse range of applications

- In October 2023, Hitachi Group announced that its Healthcare Business Division would be transferred to Hitachi High-Tech, a wholly owned subsidiary. This strategic move aims to enhance the group's healthcare capabilities and drive innovation in diagnostic, treatment, and digital solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.